Original author: Coinbase

Original translation: Luffy, Foresight News

Web 1.0 and Web 2.0 transformed global data communications and social media, but finance lagged behind. Now, "Web 3.0" is revolutionizing money and finance using blockchain protocols. These protocols are rapidly evolving, and businesses are adopting them to stay competitive.

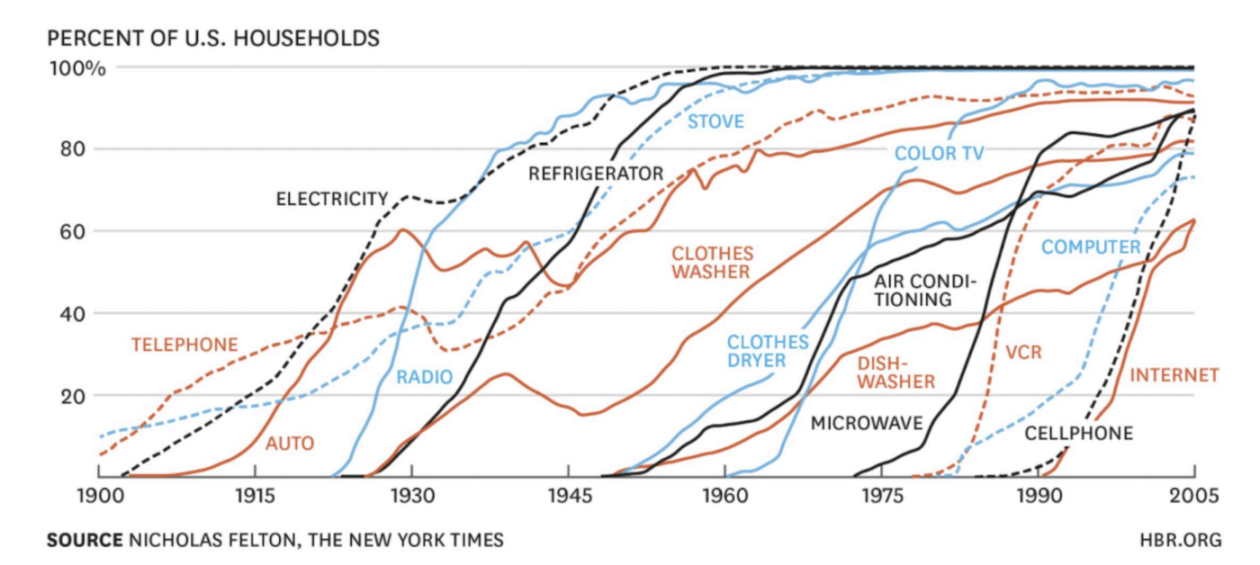

The development of disruptive technologies follows a predictable trajectory, but the time to adoption is rapidly shrinking. It took 75 years for the telephone to reach 100 million users, 30 years for the internet, and 16 years for mobile phones, but today's mobile apps achieve mass adoption in just months. For example, ChatGPT reached 100 million users in less than two months! Web 2.0 platforms reduced transaction friction but centralized control, capturing the majority of economic value and user data. Blockchain protocols address these shortcomings, enabling the free flow of money across the internet, empowering users with ownership rights, and operating without intermediaries.

Currently, institutional blockchain adoption is accelerating, laying the groundwork for disrupting traditional Web 2.0 platforms at the consumer level, and policymakers are taking notice. The GENIUS Act, which regulates the issuance of stablecoins and holds strategic significance for the dollar's global strength, has now become law. The CLARITY Act, which has passed the House of Representatives, aims to clarify how the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) regulate cryptocurrencies. Importantly, both bills have bipartisan support. Finally, the SEC just announced Project Crypto, a Commission-wide initiative to modernize securities rules and regulations and fully integrate blockchain technology into U.S. financial markets. Crypto is rewriting history.

Three major trends: Platforms face disruption

Web 2.0 platforms rely on centralization, limiting interoperability between different ecosystems. Blockchain protocols will disrupt this, creating open, permissionless, and interoperable marketplaces. Three major trends are driving this shift:

Bitcoin Protocol

Bitcoin, with a fixed supply of 21 million, is a cryptographically secure, decentralized network with a market capitalization exceeding $2 trillion and hundreds of millions of users. Originally conceived as peer-to-peer cash, Bitcoin has evolved into a store of value favored by institutions like Coinbase (with 105 million users) and BlackRock (whose Bitcoin ETF is rapidly reaching $80 billion), as well as multiple governments. Bitcoin's daily trading volume in spot and derivatives markets reaches $70-100 billion, ensuring ample global liquidity. Interoperability initiatives like "wrapped Bitcoin" on Ethereum strengthen network effects, enabling Bitcoin's adoption across thousands of third-party applications and networks. As a result, the Bitcoin economy is rapidly growing, driving demand for this scarce asset.

Stablecoin applications

Stablecoins are fiat currencies tokenized on-chain, holding over $270 billion in assets across over 175 million wallets. While still relatively small compared to traditional fiat currencies, stablecoin transactions are projected to reach nearly $50 trillion annually by 2025, making them a veritable killer app for crypto.

Stablecoins are among the top 20 holders of U.S. Treasury bonds. Stablecoins are so efficient, allowing for faster and lower-fee transfers than fiat currencies, that the U.S. government has prioritized regulatory clarity for their use. Consequently, impacted platforms like PayPal and Visa must adapt and actively embrace these technologies; they can no longer rely on their oligopoly with the banking system.

The US Treasury Secretary predicts that stablecoin assets could exceed $2 trillion and process 30% of global remittances by 2028. One can expect the stablecoin economy to generate billions of dollars in fee revenue for on-chain platforms like Coinbase.

Decentralized Finance (DeFi) Protocols

DeFi offers programmable asset management services, with approximately $140 billion locked in hundreds of protocols, providing 24/7 trading, lending, and tokenization services. DeFi applications like AAVE and Morpho enable permissionless lending, while perpetual contracts on decentralized exchanges (DEXs) offer complex strategies like funding rate arbitrage.

BlackRock's BUIDL (BlackRock USD Institutional Digital Liquidity Fund) will disrupt and transform the asset management model, shifting power to on-chain distributors. A new wave of asset managers is emerging in these areas, while existing traditional platforms face survival challenges. If they fail to adapt, they will be eliminated.

Bitcoin and stablecoins are nearing full regulatory clarity and mass adoption. DeFi is expected to achieve greater regulatory clarity and improved scalability in the coming years. Businesses operating on-chain today will lead the next wave of innovation. These three trends will bring about a dramatic shift in business growth and portfolio returns. Investors currently without crypto exposure should take note.

Moving away from zero allocation: a portfolio approach

Cryptocurrency is still young. Bitcoin is only 16 years old, Ethereum 10, and it wasn't until recently that Ethereum upgraded to a proof-of-stake consensus mechanism that it became a robust network. Stablecoins, just over seven years old, have gained regulatory clarity with the passage of the GENIUS Act.

But these technologies are entering their prime, maturing rapidly as stablecoins become integrated into industries like banking, payments, automation, and AI-powered agents.

Just as governments are bringing cryptocurrencies mainstream through careful policy adjustments, institutional investors are also evaluating frameworks for incorporating crypto into their portfolios. This process has just begun, and the first step is always the same: moving away from zero crypto asset allocation.

5 Strategies for Escape Zero Configuration

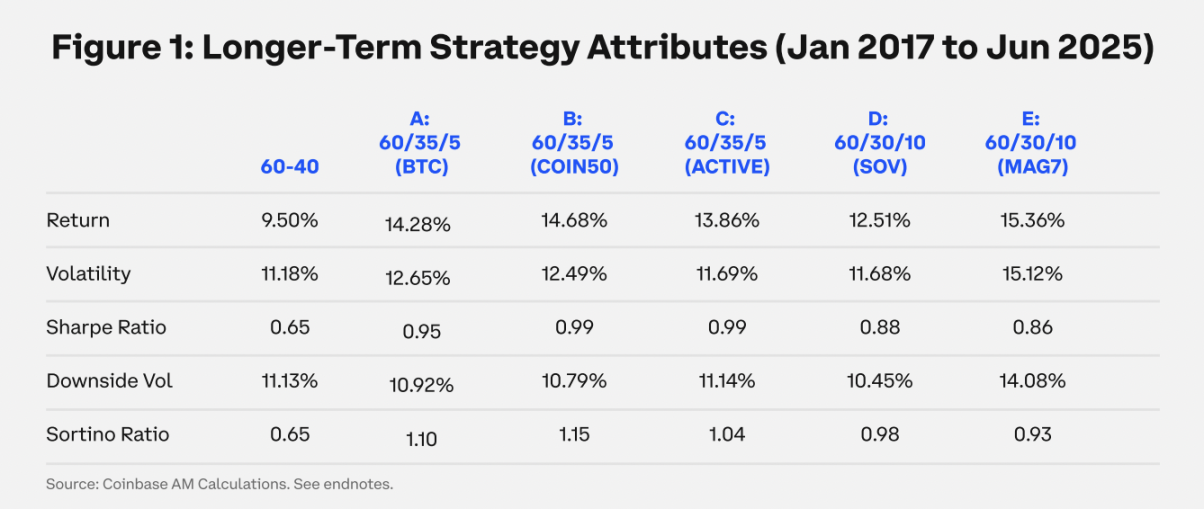

To promote the adoption of cryptocurrencies in institutional portfolios, we evaluated five strategies that leverage portfolio analysis, capital market assumptions, and index methodologies. The following three charts outline these strategies: Portfolio A) Bitcoin (BTC), B) Coinbase 50 Index (COIN 50), C) Active Asset Management (ACTIVE), D) Store of Value Index (SOV), and E) Listed Crypto Equities (MAG 7) . These strategies aim to address the diversification and risk-adjusted return issues of a traditional 60/40 stock/bond portfolio.

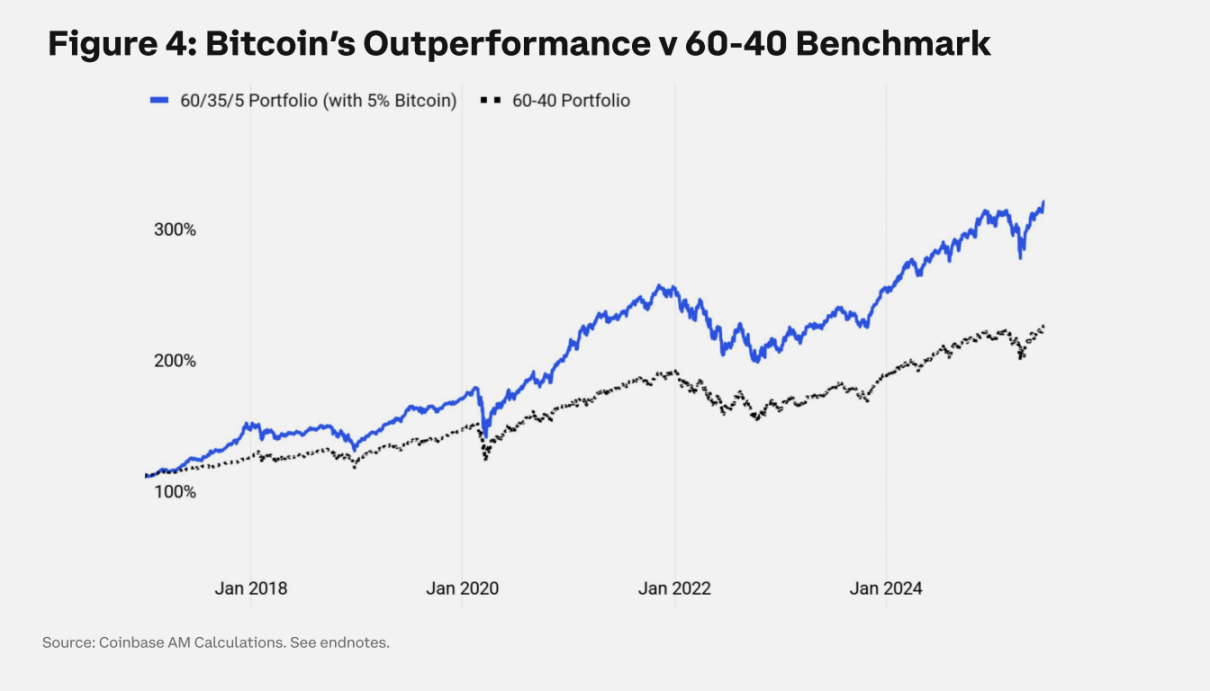

Portfolio A: Bitcoin (5% allocation)

The simplest way to escape a zero allocation is to add Bitcoin to your portfolio. To simplify risk exposure, we consider a 5% allocation to Bitcoin. From January 2017 to June 2025, a 5% allocation to Bitcoin significantly boosted portfolio returns. During this period, Bitcoin's compound annual growth rate (CAGR) was 73%, and its annualized volatility is currently 72% and trending downward. (See Figure 1 for performance data.)

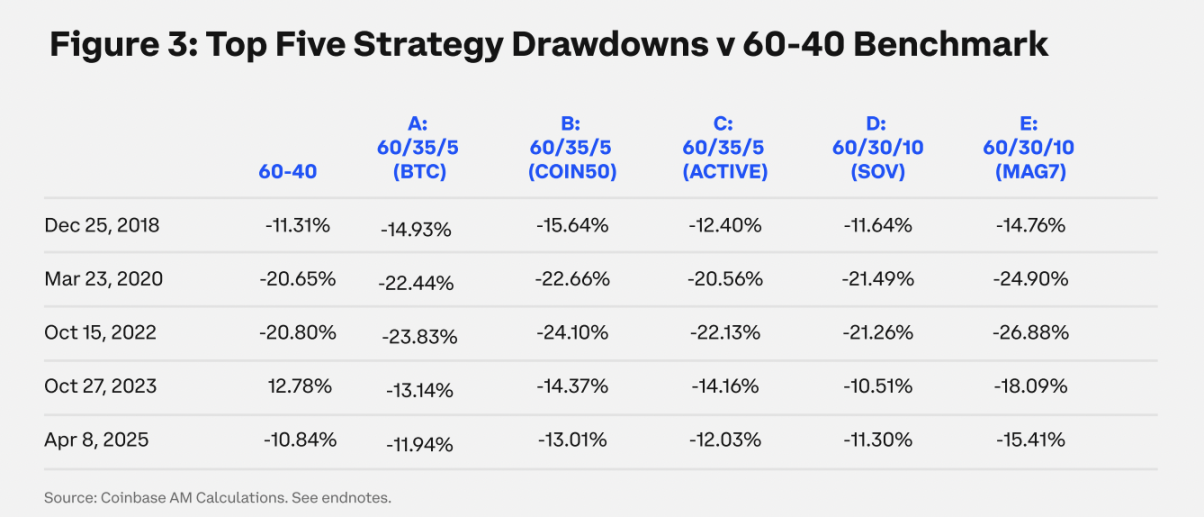

Even a modest 5% allocation to Bitcoin (as an alternative to a bond allocation) significantly improves portfolio performance compared to a 60/40 stock-bond benchmark strategy, adding nearly 500 basis points to annual portfolio performance while increasing risk-adjusted returns and reducing downside volatility.

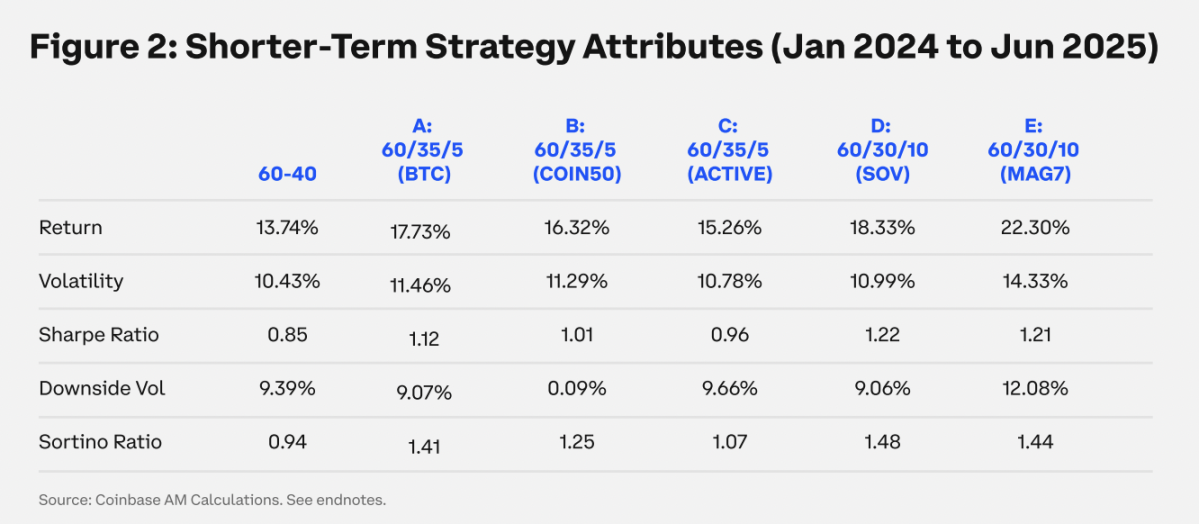

Given the rise in institutional adoption since the launch of Bitcoin exchange-traded products (ETPs) in 2024, it's worth analyzing a shorter sample period separately. Not only do the overall results hold true, but risk-adjusted returns are even stronger. The Sortino ratio (which measures excess returns relative to downside volatility) improves by 34% with increasing institutional adoption. (See Figure 2 for performance data.)

Portfolio B: Passive Coinbase 50 Index (5% allocation)

Many cryptocurrency investors seek broader exposure to adapt to evolving cryptoasset markets. Rules-based indices with systematic rebalancing mechanisms enable institutions to capture broader crypto market trends without having to focus on micro-asset selection, which is governed by rules. The Coinbase 50 Index (COIN 50) is our benchmark index.

A 5% allocation to Bitcoin yields no materially different results than a 5% allocation to the COIN 50 Index. Over a longer period, the index captured the initial surge in DeFi, as well as other market events related to NFTs, artificial intelligence, and meme coins. For investors seeking broader crypto market exposure, the index is a preferred strategy. Over the shorter sample period when Bitcoin's market share rose, it slightly outperformed in terms of return contribution and risk-adjusted performance, but also came with slightly higher downside risk. (See Figures 1-3 for performance data.)

Portfolio C: Active Asset Management (5% Allocation)

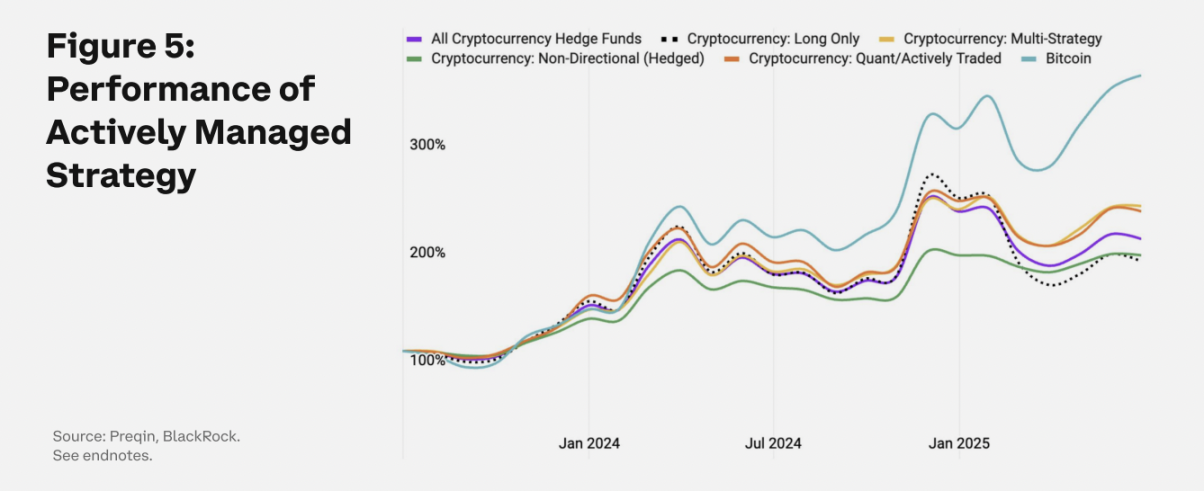

Do actively managed crypto strategies add value to investments? The answer is complex, with both positive and negative outcomes. Data from BlackRock Preqin provides a benchmark for actively managed crypto funds since 2020. Five strategies are covered: long Bitcoin, pure long cryptocurrency strategies, multi-strategy strategies, market neutral hedge strategies, and quantitative funds. Risk-adjusted returns have slightly outperformed the benchmark over longer time horizons, but have significantly lagged behind during periods of institutionalization (e.g., from 2022 to date).

The primary motivation for shifting to hedge fund strategies is to better manage downside risk. However, the hedge fund industry has yet to successfully achieve this, with drawdowns similar to those of Bitcoin and the COIN 50 Index, while also exhibiting similar downside volatility as passive strategies. This may be due to challenges in scaling, as active strategies assume more directional risk to meet asset demand.

The crypto industry is still in its early stages of development, and the current poor performance of active strategies may be a characteristic of this stage.

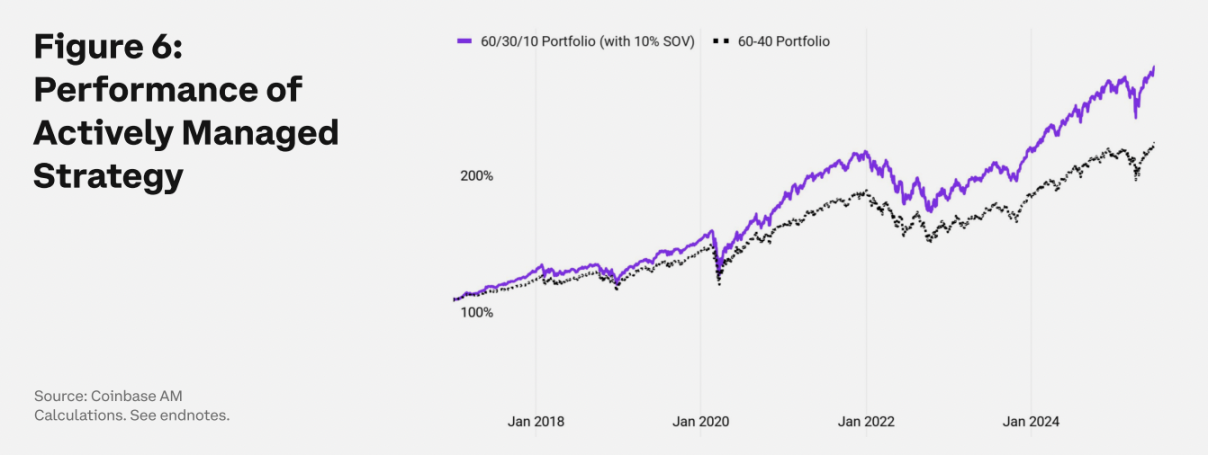

Portfolio D: Store of Value Index = Bitcoin + Gold (10% allocation)

Is Bitcoin a threat to gold, or a complement? Bitcoin has already taken on the role of a store of value. Nearly 300 entities (including state and federal governments, businesses, and others) have established Bitcoin reserve strategies, more than double the number from a year ago. However, Bitcoin is not the only store of value asset; it competes with other assets, such as gold, for this position.

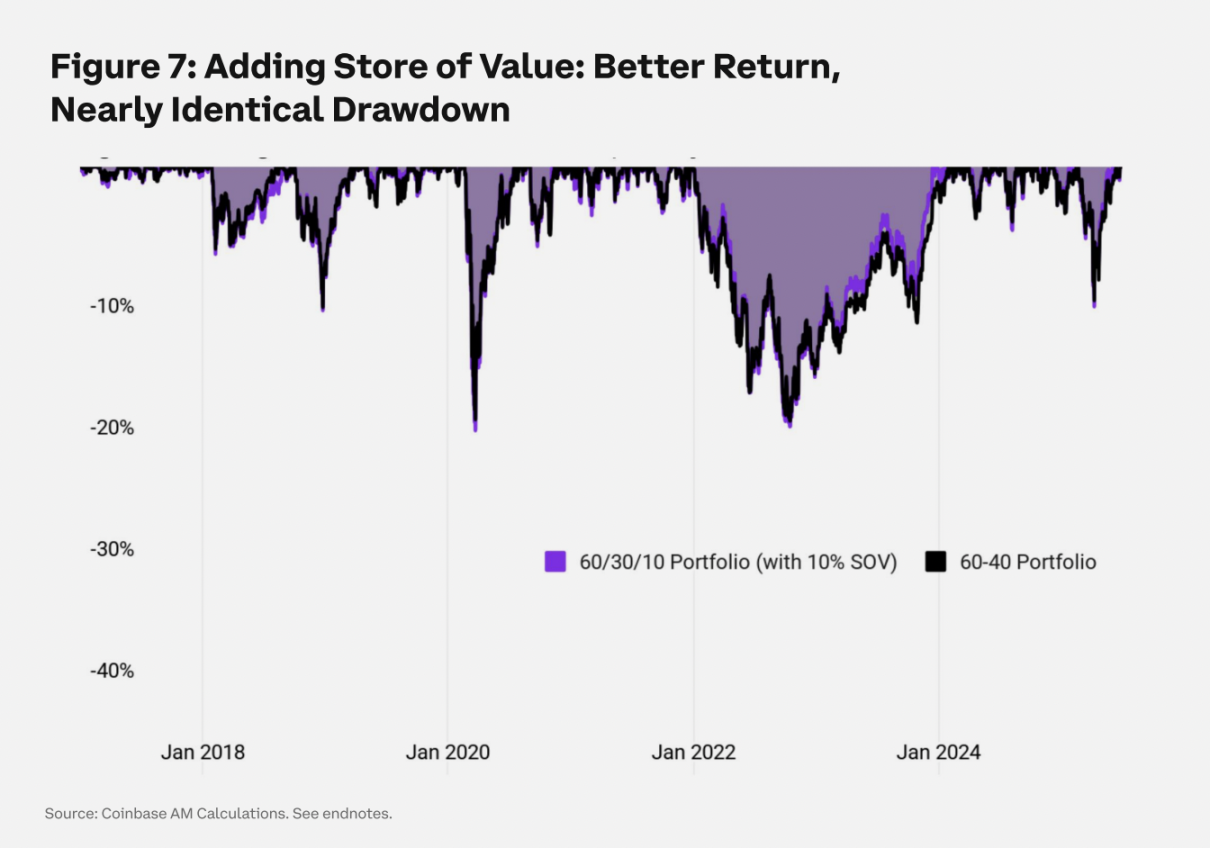

With a market capitalization of $20 trillion and Bitcoin's $2 trillion, we believe gold and Bitcoin complement each other. We have created an index based on both Bitcoin and gold, with Bitcoin's weighting inversely proportional to its volatility. In a long-term, low-volatility environment like the current one, Bitcoin's weighting in the index increases.

We view the "store of value" index as part of a process of institutionalization. This represents the creation of a new asset class, with asset allocators holding both gold and Bitcoin as a hedge against the debasement of currencies caused by rising government debt in wealthy countries. This contrasts with the current view that Bitcoin is just another commodity.

The portfolio's returns (shown below) support this view. A 10% allocation to the store of value index reflects lower volatility, thus normalizing portfolio volatility over the sample period. In the short term, as the store of value concept gains widespread institutional acceptance, adding Bitcoin to the portfolio has been highly beneficial in terms of return contribution, significantly outperforming a pure cryptocurrency strategy on a risk-adjusted basis.

However, this advantage is not evident over the long term, emphasizing the need for asset allocators to adopt a dynamic approach to store-of-value assets. A disciplined combination of gold and Bitcoin represents the right allocation at the right time.

Portfolio E: Cryptocurrency-Related Stocks (10% Allocation)

In our final assessment of our approach to transitioning away from zero-investment, we explored investing in stocks of cryptocurrency-related companies and existing platforms rapidly integrating crypto. We created the “MAG 7 Crypto Basket,” which includes publicly traded stocks of BlackRock, Blockchain Inc., Coinbase, Circle, Marathon, Strategy, and PayPal.

During periods when growth companies outperformed the broader market, we found that including a 10% MAG 7 crypto basket in the portfolio improved performance while also increasing volatility. Given the higher volatility of growth stocks, it's not surprising that replacing bonds with crypto stocks increased overall portfolio volatility. Risk-adjusted results underperformed those of a store of value index but slightly outperformed holding Bitcoin alone. The trade-off came with increased investment complexity and the highest drawdowns. (See Figures 1-3 for performance data.)

Investors seeking to meet specific investment criteria can consider cryptocurrency-related stocks, but this is the most complex and indirect way to invest in crypto assets among the strategies discussed in this article.

Where are we going?

How do cryptocurrencies fit into the institutional investment framework? Addressing this question is crucial to unlocking institutional adoption of crypto assets. This process requires a solid asset allocation framework grounded in capital market assumptions that shape long-term price expectations and guide portfolio construction.

High equity valuations and continued government borrowing have depressed long-term return expectations. Based on rigorous capital market assumptions and forward-looking models, US stocks are projected to return 7% annually and US bonds to return 4%, which is roughly in line with cash returns. In this low-yield environment, investors are forced to explore innovative capital preservation strategies, with Bitcoin emerging as a prominent option.

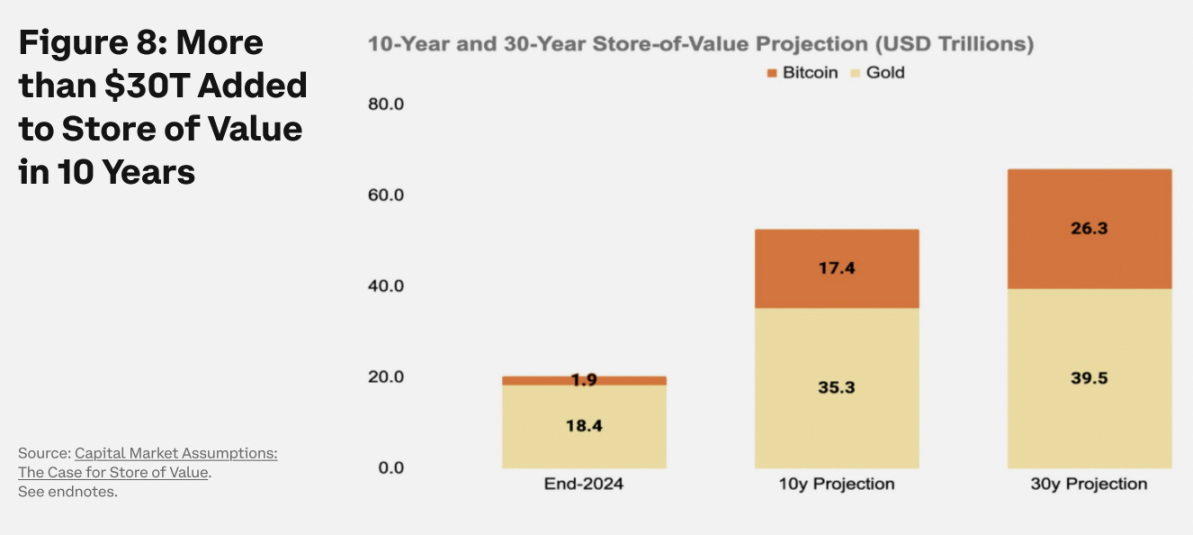

We believe that store-of-value assets, led by Bitcoin, deserve a distinct capital market category driven by macroeconomic factors such as monetary policy shifts and inflation hedging. We estimate annualized returns of 10% with minimal correlation to the bond market, which has delivered negligible real returns over a decade (Figure 8).

Bitcoin's fixed supply and decentralized nature make it a hedge against high inflation, enhancing portfolio resilience. But its store of value appeal goes beyond just a hedge; allocating to Bitcoin maximizes future capital flexibility.

in conclusion

Cryptocurrencies are reshaping the financial landscape. Institutional investors seeking cryptocurrency exposure can consider a variety of liquid market strategies, from direct passive allocations to Bitcoin or the Coinbase 50 Index to actively managed funds and strategies that blend traditional and crypto finance. The first step in moving beyond zero allocation is often the most difficult.

- 核心观点:Web3正颠覆传统金融,机构加速布局。

- 关键要素:

- 比特币市值超2万亿,机构ETF规模达800亿。

- 稳定币年转账量将达50万亿,美国立法监管。

- DeFi锁定1400亿,贝莱德推出链上基金。

- 市场影响:推动加密资产主流化,重构投资组合。

- 时效性标注:中期影响。