Original author: Wajahat Mughal

Original translation: Alex Liu, Foresight News

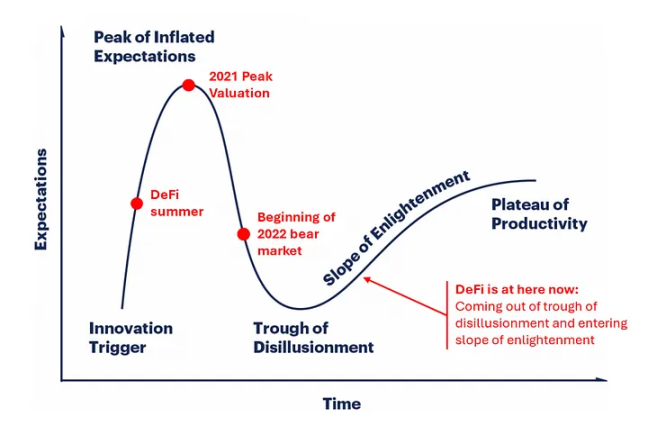

Last year, calls for a “DeFi Renaissance” became widespread, and the DeFi space experienced a period of recovery and renewed interest.

This growth is led by protocols like AAVE, Uniswap, Lido, Maker, Ethena, Morpho, and Pendle, which continue to scale and contribute the vast majority of the total value locked (TVL) in the crypto space. This comes after DeFi was recently going through its most challenging phase: the collapse of UST, one of the largest stablecoins, the closure of FTX, a leading centralized exchange, and numerous other setbacks, including hacks, exploits, and depegging incidents, which plagued the DeFi space during the previous bear market. Over the past few years, the landscape has shifted dramatically, giving rise to a narrative often referred to as the "DeFi Renaissance."

DeFi's Years of Development - Quoted from Arthur 0x's article "DeFi Renaissance: Making DeFi Great Again"

These protocols have survived brutal bear markets and continue to develop, improve, and innovate on the decentralized exchanges (DEX), money markets, and staking sectors they were originally built for.

There are many reasons for the DeFi resurgence, some of which are as follows:

- Mainstream protocols are battle-tested : applications have withstood the multiple disasters of the last cycle, including USDC depegging, stETH depegging, a complete boom-bust cycle, and the high-yield/high-interest environment of traditional finance.

- Stronger product offerings : whether it’s high-yield stablecoins (Ethena), more capital-efficient DEXs (Fluid/Uniswap V 4), or money market innovations (Euler, Morpho, AAVE, etc.).

- Shift towards sustainability : Reducing reliance on token emissions by generating revenue while optimizing the token economics of DeFi native tokens.

- Stablecoins are growing : The current total volume has reached $267 billion, far exceeding the peak of the previous cycle and setting a new record high. Despite the dominance of Tether and Circle, interest-bearing stablecoins are still growing.

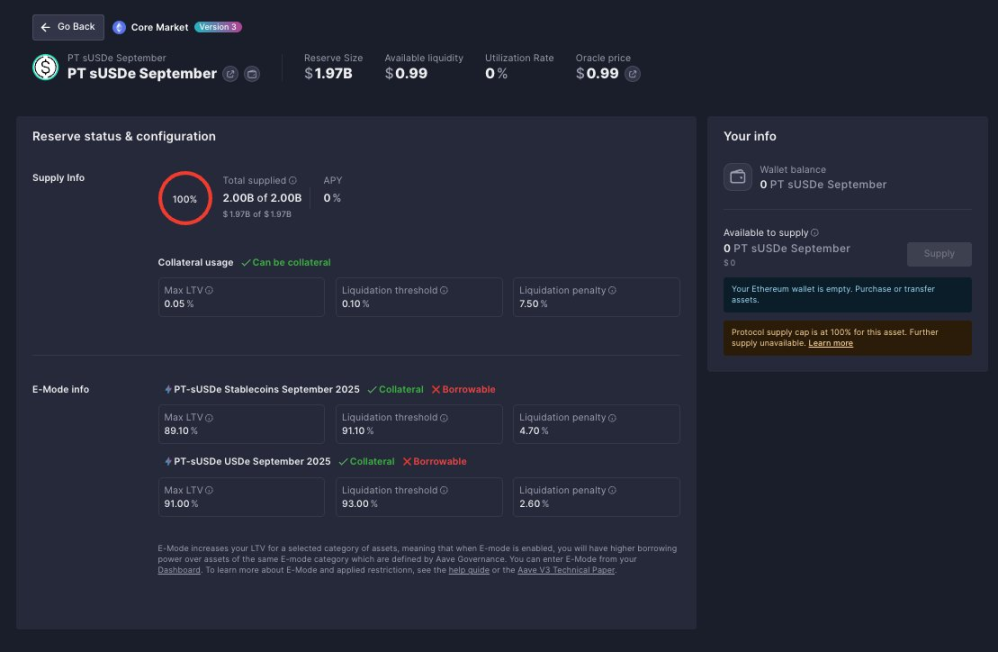

One reason for the DeFi resurgence is the ability of these protocols to work together to create unique DeFi tools, highlighting the advantages of tokenization and the "Lego-like" nature of currencies. A prime example is the collaboration between Ethena, Pendle, and AAVE to create the PT-USDe collateral asset type.

Only 1 of 3 Ethena PT markets on AAVE has reached its $2 billion cap

In June of this year, the portfolio had $1.3 billion in assets, and a few months later, it has soared to over $3.3 billion - accounting for more than 2% of the total TVL of existing DeFi, and achieved through only a single tool. And this is just the tip of the iceberg of DeFi's achievements in the past few years.

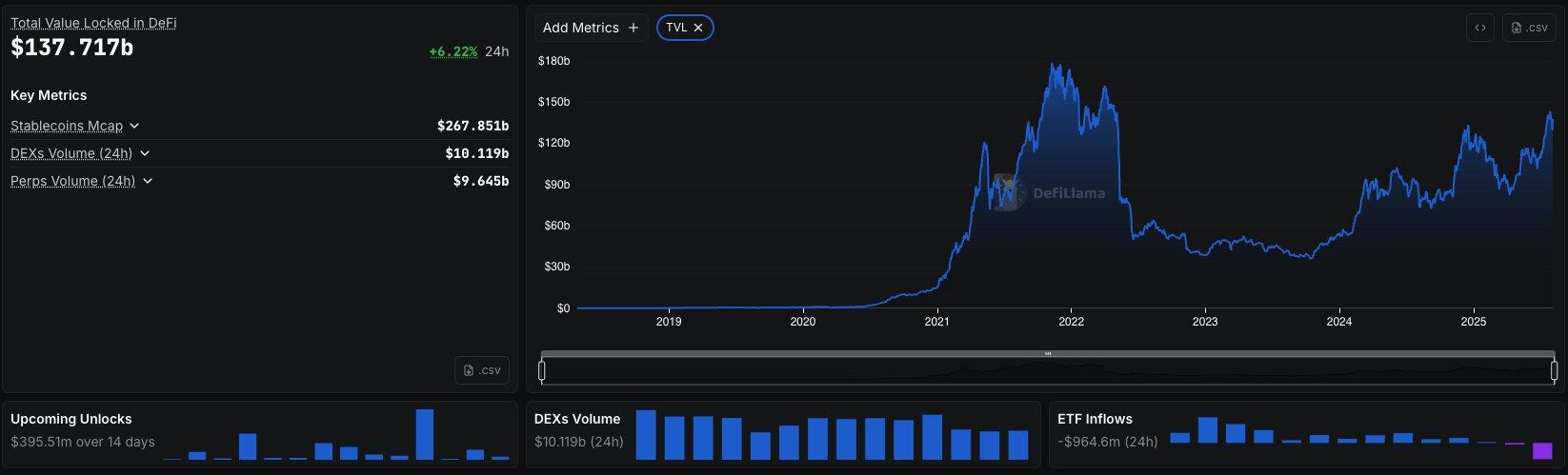

DeFi Overview as of August 2025 - DeFillama

The current TVL for DeFi has reached $150 billion, just 15% below its previous peak. While some may argue that the previous figures were inflated by ETH's peak near $4,800 and the massive growth of now-defunct stablecoins like UST, if these two variables are excluded, DeFi will undoubtedly surpass the levels of the previous cycle. With the DeFi resurgence firmly established over the past few years, I believe DeFi is entering a new chapter.

The Renaissance is over.

DeFi Baroque Era

In European history, the 15th and 16th centuries ushered in modernity through art, science, literature, and culture, often referred to as the Renaissance, a period of balance and clarity. This was followed by the Baroque period, characterized by a blend of grandeur and complexity, with artistic styles designed to evoke awe, suspense, and a sense of depth.

This is exactly where the current DeFi market is evolving: the era of simplicity is over, and a strange, grand and vibrant market is right in front of us.

"Girl with a Pearl Earring" - also known as the Mona Lisa of the North

DeFi is innovating in specific categories across all sectors, with impacts across every existing sector – derivatives .

The $600 trillion notional market size of traditional finance is only a glimpse into the scale of the derivatives sector. For DeFi, derivatives are reshaping the sector, and many are asking: how ?

The following article will introduce some of the pioneers leading the next round of iteration in the DeFi market.

Getting Started with Hyperliquid

You are all aware of Hyperliquid and its achievements, but some may not be aware of its future plans and the unique tools built on Hyperliquid.

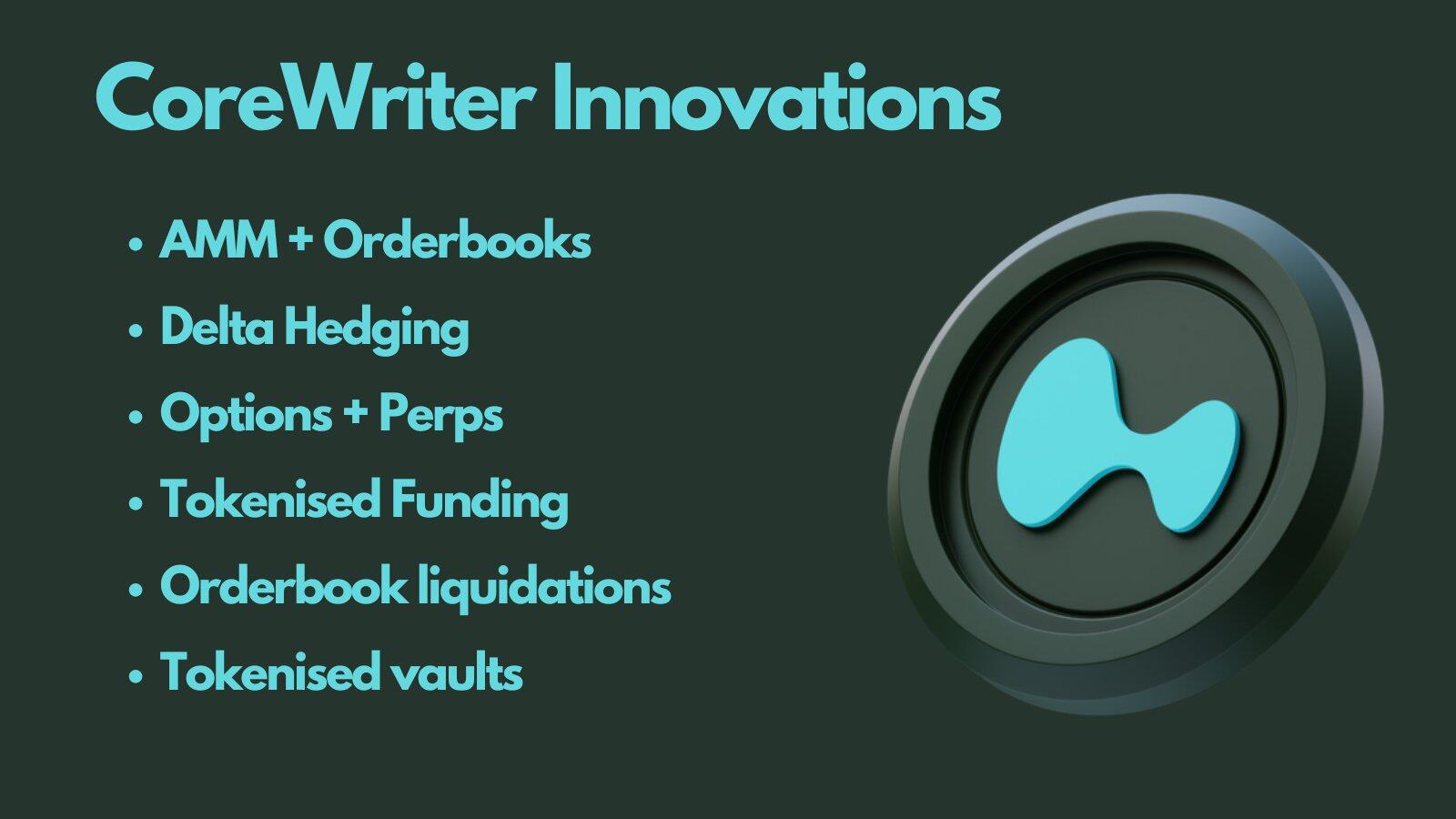

CoreWriter - Unified Execution Layer

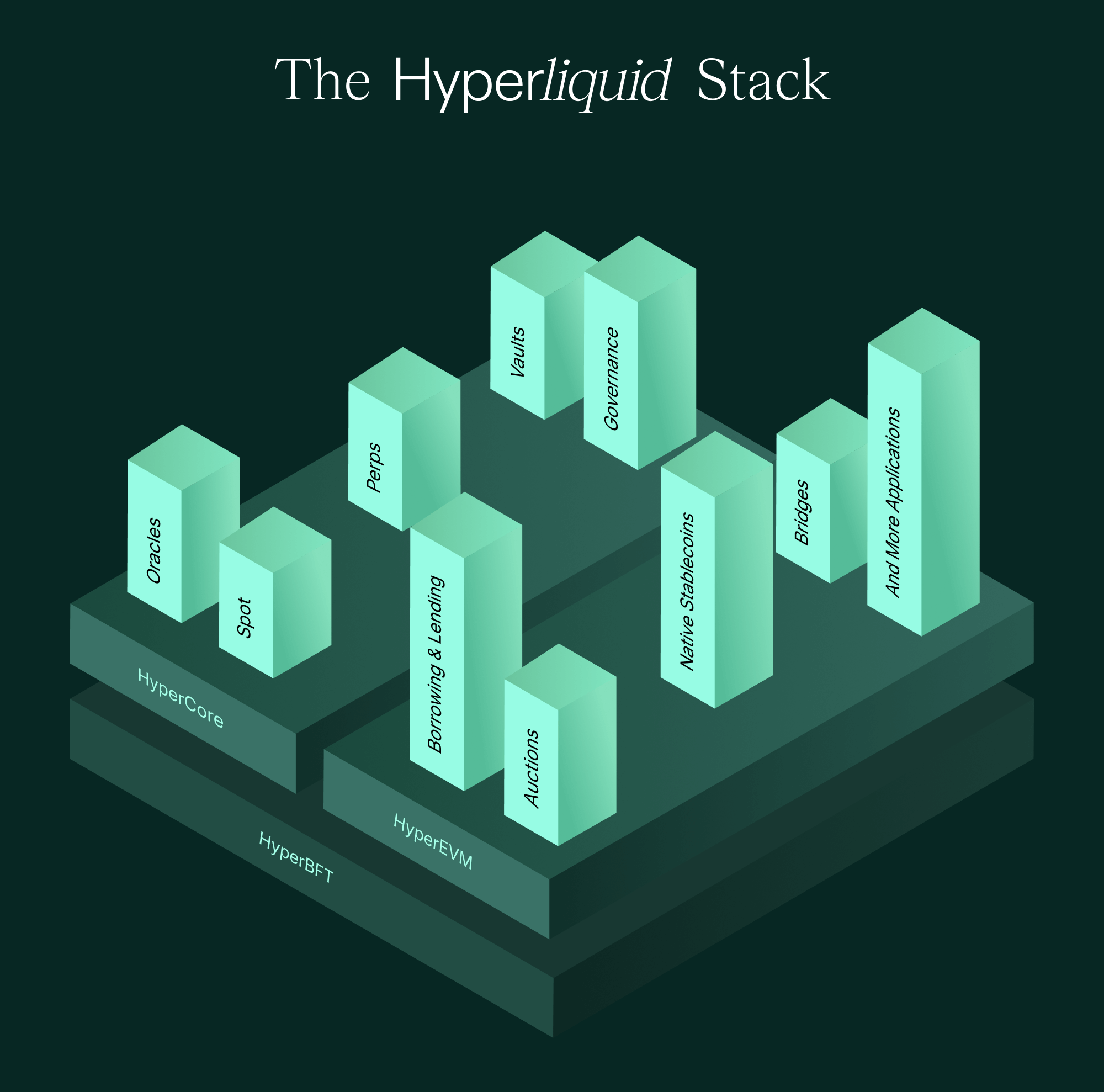

Hyperliquid utilizes a dual-state execution environment above its consensus layer: HyperCore and HyperEVM. HyperCore is the well-known high-performance engine that powers perpetual swaps and order book spot markets. HyperEVM is a completely different environment, hosting Hyperliquid's smart contract layer. While both environments share state, HyperEVM smart contracts previously could only read data from HyperCore. CoreWriter radically changes this.

Both HyperCore and HyperEVM are built on the HyperBFT consensus layer

This is the core innovation that distinguishes Hyperliquid from other chains. CoreWriter enables HyperEVM smart contracts to not only read HyperCore data but also execute transaction instructions (including trade orders, staking, transfers, and vault management).

This opens the door for the HyperEVM protocol to access the largest order book on the chain and its liquidity, creating an unprecedented and unique DeFi mechanism.

CoreWriter integration example:

- DEXs leverage AMMs and order book liquidity to improve capital efficiency

- Create complex delta hedging strategies with perpetual contracts

- When the funding rate is favorable, CLAMM hedges impermanent loss through perpetual contracts

- Combination strategy using options and perpetual contracts

- Tokenized Funding Rate Strategy on HyperEVM

- Currently, liquidations are usually performed by AMMs, and CoreWriter enables money markets to use order book liquidations to improve capital efficiency.

- Non-custodial tokenized vault containing HLP

Kinetiq is one example of a company that has already implemented this technology. Kinetiq utilizes a decentralized validator staking mechanism through a scoring system, with all operations automated through smart contracts between the HyperEVM and HyperCore. This enhanced trust gives Liquid Staking Tokens (LST) like kHYPE an advantage.

Kinetiq's TVL jumped to the top of HyperEVM applications within weeks of its mainnet launch.

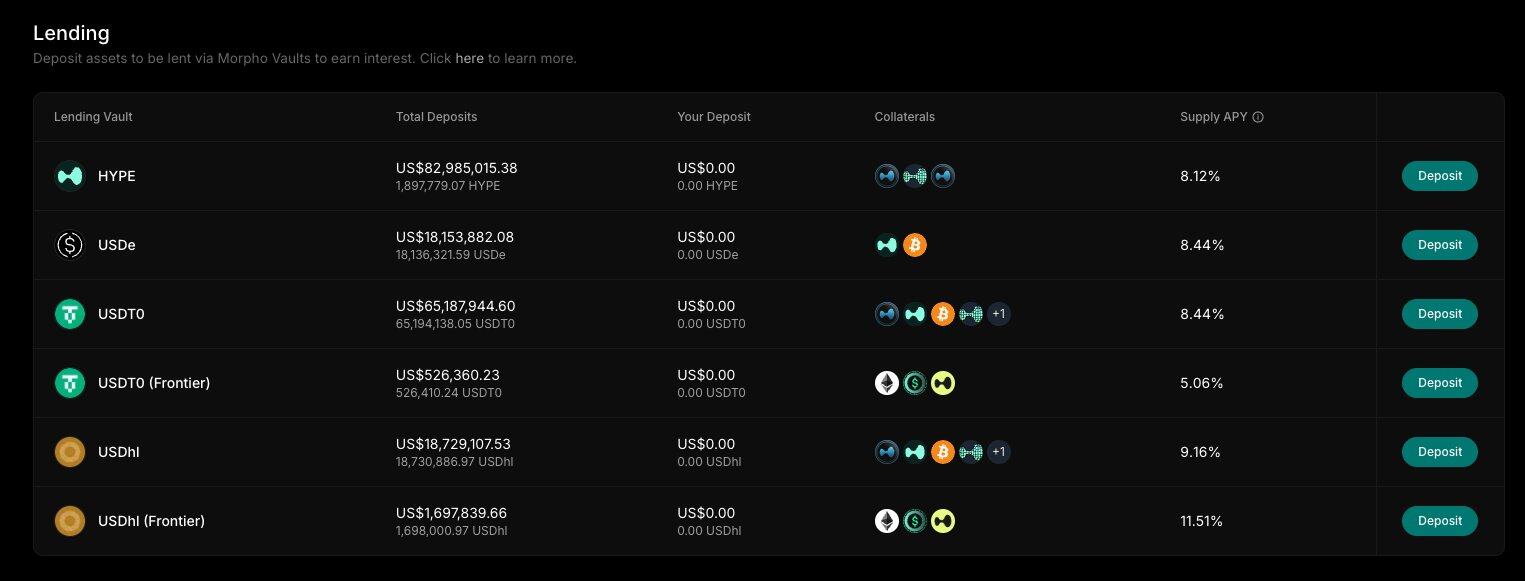

Another innovation is the introduction of new collateral assets—something the Felix Protocol team (unconfirmed) is considering. Specifically, this will allow tokenized perpetual positions to be used as collateral for lending in money markets, creating DeFi mining opportunities fully backed by derivatives.

Felix's Morpho instance remains one of the most attractive money markets on HyperEVM

CoreWriter is just one of the innovations that will bring DeFi into a more exotic, complex, and composable baroque era. Another key Hyperliquid innovation is:

HIP-3: The Uniswap Moment for Perpetual Contracts

Hyperliquid's next innovation is the creation of a permissionless perpetual market through HIP-3. With 1 million HYPE (approximately $38 million at the time of writing) and an oracle, a new type of permissionless perpetual market can be deployed on Hyperliquid. This opens up a whole new market—what we might call "Perpetual Contracts as a Service" (PaaS).

The perpetual contract market has truly reached its "Uniswap moment": any perpetual market can be created, including:

- Stock Perpetual Contracts

- Index Perpetual Contract

- Perpetual Contracts in the Foreign Exchange Market

- Commodity market perpetual contracts

- Pre-IPO Market Perpetual Contract

- Real estate perpetual contracts

- Special new market

This also means that protocol-issued tokens not listed on HyperCore Perpetual or CEX can now be permissionlessly created for trading on the most popular on-chain markets. Traditional financial indices, including the S&P 500, are expected to be listed quickly after launch, forming Hyperliquid's largest market. Stocks such as $NVDA, $HOOD, and $TSLA can all be perpetualized, creating new instruments for these tech giants. Market issuers will also receive 50% of the trading fees on their instruments.

HIP-3 opens the door to new markets such as perpetual stock contracts

As a DeFi user, some niche markets are extremely attractive—especially tokenizing perpetual positions through CoreWriter for use in other HyperEVM applications. In time, we may see exotic markets like real estate perpetuals, prediction market perpetuals, and even orange juice futures. However, attracting market makers to these markets may be difficult. Therefore, mainstream markets are more likely to emerge first.

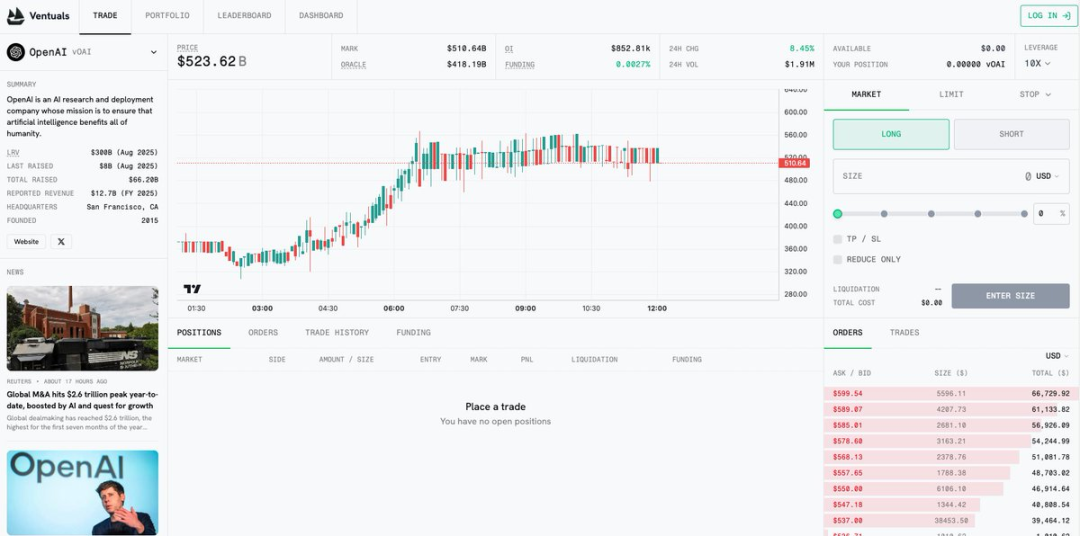

Ventuals is one of the first teams to publicly promote its Pre-IPO market built on HIP-3. It leverages industry-leading off-chain data sources to obtain accurate valuations and creates perpetual contracts around leading global private companies such as OpenAI, SpaceX, Stripe, and Anthropic.

Ventuals Testnet Marketplace

This unique market is driving DeFi innovation: one market, one oracle, and one dream.

Derivatives-backed stablecoins

Derivatives are also driving innovation in the stablecoin space—not through payment stablecoins (Tether and Circle are separate entities), but through interest-bearing stablecoins.

This space is growing rapidly, with USDe being a prime example of the development of unique, high-yield stablecoins. We are tired of the proliferation of Treasury-backed stablecoins that offer only a mediocre 5% annualized return.

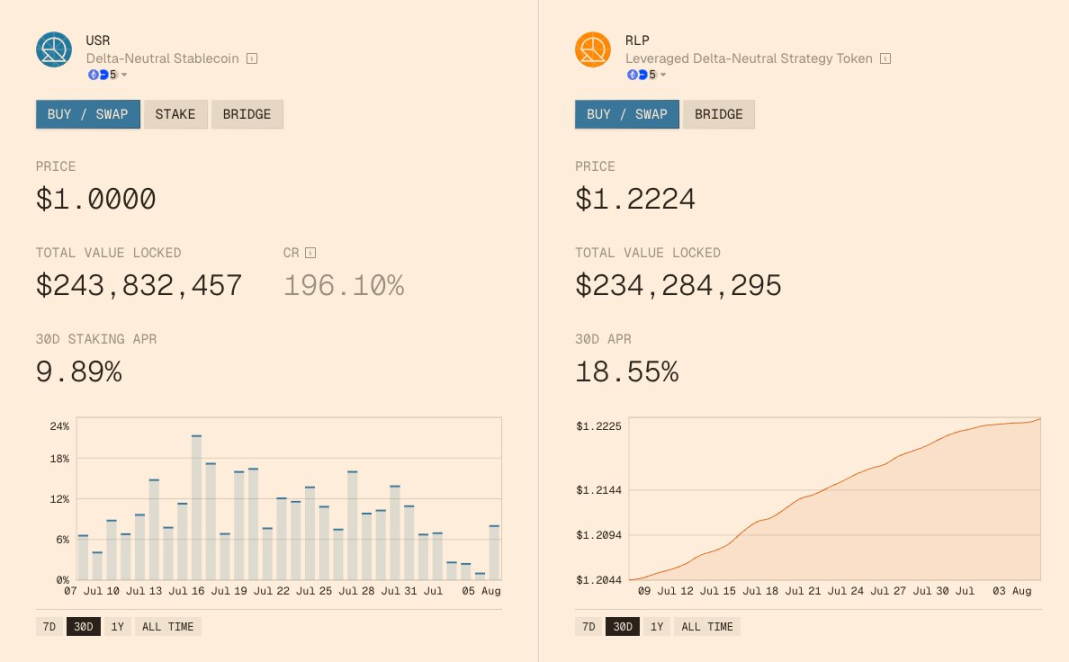

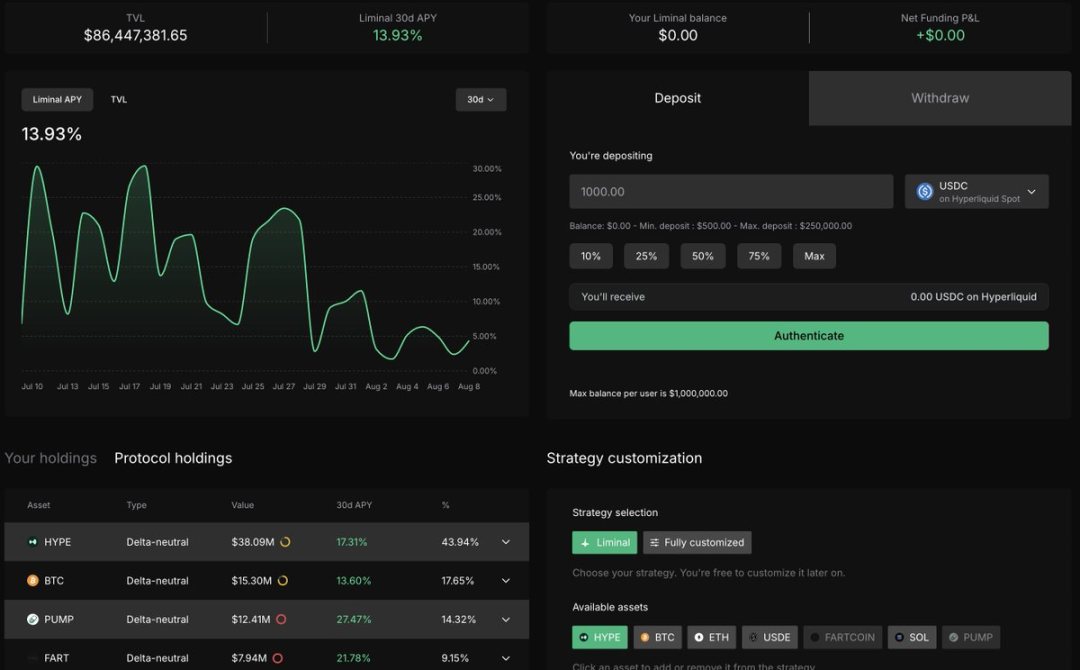

Perpetual swaps, through funding rates, have fostered the emergence of some of the best delta-neutral strategies in recent years. Resolv is another example of a high-yield delta-neutral stablecoin. Its tiered system allows users to choose a return level based on their risk appetite. Combining with protocols like Pendle can create even more complex and unique instruments. PT (Principal Token) is particularly interesting to me, as it essentially creates a fixed-rate income product backed by derivative returns.

Liminal, built on Hyperliquid, offers a funding rate strategy service within its app. Users depositing stablecoins automatically earn funding rate returns. While not stablecoins themselves, these derivative-backed products offer high returns denominated in stablecoins that surpass those of real-world assets (RWAs) like government bonds.

Stablecoins are sometimes more imaginative: for example, Neutrl creates synthetic dollar products through over-the-counter (OTC) arbitrage and perpetual hedging, with a current TVL of US$40 million and an annualized rate of over 30% (currently limited to private access).

How do they achieve this?

Neutrl sources SAFTs (Simple Agreements for Future Tokens) and token transactions from foundations and investors seeking liquidity, with the majority of transactions occurring at deep discounts to the spot price. Its advantage lies in accessing trading opportunities through its capital network and partnerships, which are then hedged through perpetual swaps. Risk management includes diversified trading, backing from other stablecoins, additional buffers, and third-party custody.

This new market allows users to earn unprecedented returns. Once the exclusive domain of a niche market, OTC trading can now benefit even ordinary on-chain users through Neutrl.

Special stablecoins come in various forms: GAIB's AI GPU derivatives, USD.AI's AI infrastructure debt-backed stablecoins, and Hyperbeat's DeFi strategy tokenized stablecoins using USDT (technically a stablecoin).

New derivative instruments based on options

The long-standing debate about poorly designed options products is over. On-chain options instruments offer a unique vehicle for expressing exposure, from trading-oriented products and high leverage to yield-generating strategies.

Straddles are essentially about going long on volatility

Rather than fully opening up the options world, the protocol focused on building high-quality products in niche areas before expanding. As a result, a series of options protocols emerged, offering products never before seen on the blockchain.

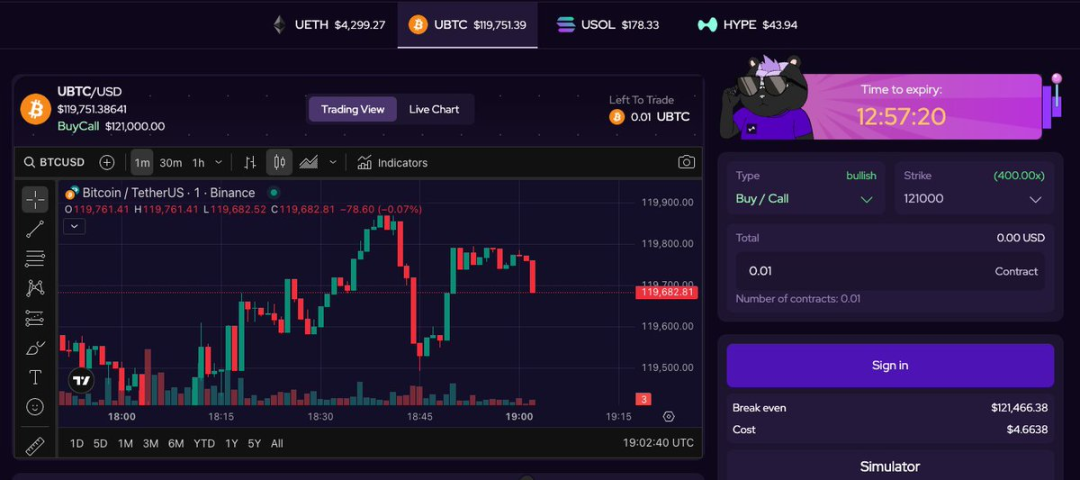

Last week, notional trading volume for instruments like 0 DTE (options expiring within 24 hours) reached a record high. Why are these instruments useful? In short: the speculative space is staggering.

- Ultra-high leverage (up to hundreds of times nominal leverage)

- Buying call/put options has no liquidation risk

The IVX protocol allows traders to access zero-day options markets on major assets such as BTC, ETH, SOL, and HYPE. These are among the best leveraged instruments available in the market today, including the highest leverage products for assets like HYPE.

BTC 400x leverage with no liquidation and no funding fees

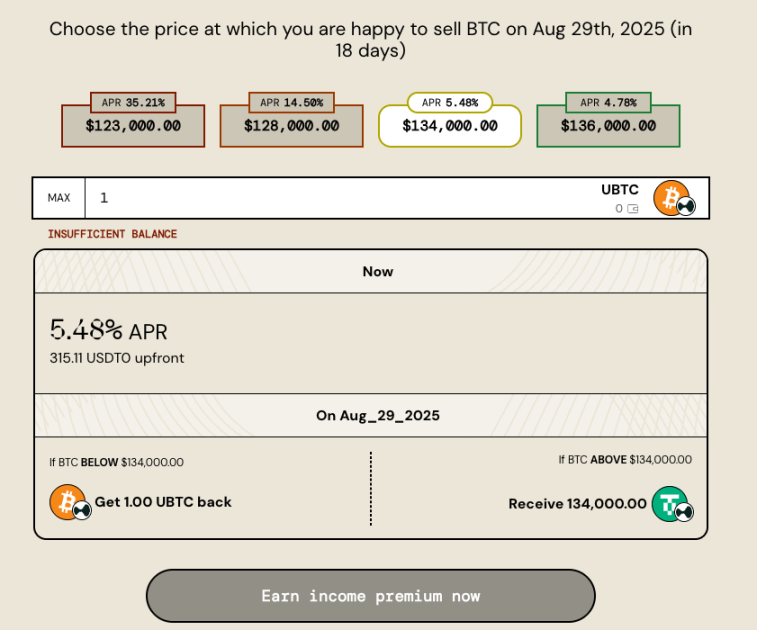

What really excites me is the focus on each protocol within its niche. Rysk Finance also focuses on options yield strategies (covered call options), once again driving DeFi innovation through derivatives. While there have been options yield products before, this application represents the first significant leap forward in user experience and sustainability.

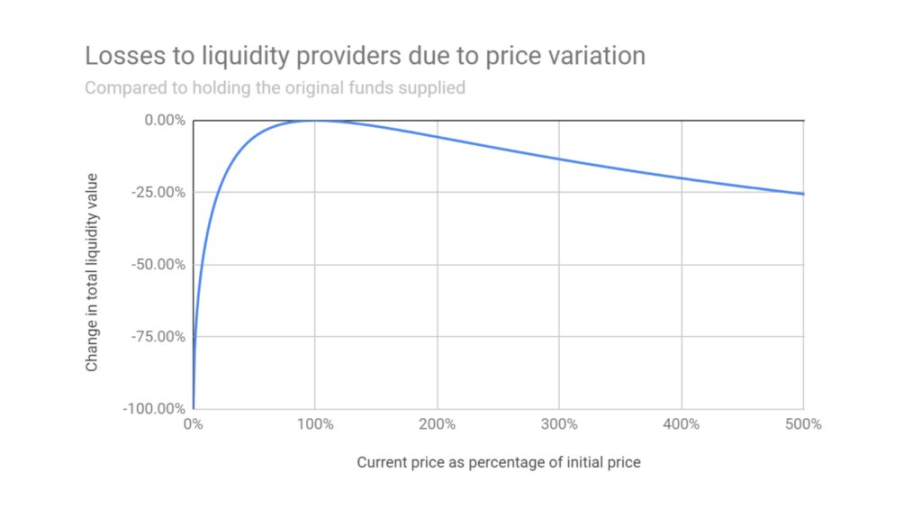

Gamma Swap's yield token is a relatively new product, creating a unique derivative on top of an AMM. Its novel yield token represents a paradigm shift in the new baroque era of DeFi: leveraging borrowed Uni V 3 positions, the yield token provides underlying spot-like exposure to a synthetic asset, unaffected by the impermanent loss of AMM LP tokens.

These tools are about to unlock composability: through cross-application integration (like listing on Euler or Morpho money markets), and the inevitable Pendle listing, we will have a fantastic and unique vehicle for expressing ETH exposure.

Fixed-Rate Single-Asset AMM V 3 Liquidity Pool with Interest-Bearing ETH Collateral — The Renaissance is Indeed Over...

Diverse options: I'm also excited about Time Swap's V3—it introduces time-bound tokens, tokenizing time periods to provide extensive functionality for YT/PT (yield tokens/principal tokens). This offers multiple advantages over current yield tokenization systems: improved capital efficiency, reduced fragmentation, and greater flexibility in yield trading.

Impermanent Loss Terminator

Regarding new tools, DeFi’s next innovation in AMM comes from Yield Basis – transforming crypto assets into productive yield-generating tools through unique leverage hedging.

Impermanent loss is an inherent characteristic of the AMM mechanism

In a traditional AMM, if you provide $10,000 in wBTC and $10,000 in USDC, your final assets won't double if the BTC price doubles (because the position grows at a ratio of √BTC price according to the xy=k formula). However, if you pledge wBTC to borrow $10,000 to form an LP position, and dynamically rebalance to ensure that the debt ($10,000) always accounts for 50% of the collateral ($20,000), and automatically adjust the debt to a 50% collateralization ratio when the BTC price fluctuates, you can ensure that the total value of the position grows in proportion to the BTC price.

Yield basis exclusively uses crvUSD to enhance its utility and, more importantly, give it control over interest rates.

The key is the rebalancing mechanism: the re-leveraged AMM provides LP tokens at a slight discount to arbitrageurs, who can add crvUSD to reduce their debt and adjust their position size. Similarly, when prices rise, the re-leveraged AMM provides crvUSD to LP token depositors at a premium, allowing arbitrageurs to add BTC to restore their 2x leveraged position.

ybBTC brings a much-needed innovative yield solution to BTC. Curve founder Michael Egorov's simulations show that ybBTC has great potential. For me, double-digit returns would be considered a success—though the dilution of returns would be questionable if deposits reached billions (which would be a huge win for Yield Basis, Curve Finance, and all on-chain BTC traders).

Funding Rate Products

Funding rates have become the most interesting tool for enhancing returns on delta-neutral positions. With funding rates soaring for altcoins (especially high-demand assets like HYPE, FARTCOIN, and PUMP), the basis trade of buying spot and shorting perpetual swaps has become one of the best opportunities of this cycle. Ethena, Resolv, and even Liminal, mentioned above, are all leveraging this to offer yield-enhancing tools.

Boros, launched by Pendle, is another innovator in this field, introducing a new derivative instrument that can trade funding rate income: those who go long on funding rate need to pay a fixed rate but receive a floating funding rate in the market, while those who go short on funding rate can pay a fixed rate.

Boros opens up new possibilities: Locking in a fixed funding rate is crucial for VCs, funds, traders, and protocols like Ethena/Resolv, allowing them to lock in returns over a period of time. This will enable more composable strategies (including fixed-rate markets).

Recommended reading: Pendle’s new product, good for ENA?

What's the future?

These are just some of the astounding innovations unfolding in the DeFi world today. Development is happening at an unprecedented pace, with teams constantly learning and evolving from industry challenges to create truly powerful products. The vast majority of these innovations are driven by derivatives, further highlighting the defining characteristics of this new era of DeFi. Derivatives will propel DeFi to new heights—first, with TVL exceeding the peak of the previous cycle and ultimately reaching $1 trillion (seven times its current size).

These protocols have only scratched the surface of their potential. Over the next 6-12 months, they will join the incumbent giants (AAVE, Uniswap, Lido, etc.) in pushing the industry to new heights.

As DeFi continues to evolve and mature, a wealth of interesting markets remain to be explored: on-chain foreign exchange markets, Sharia-compliant DeFi, fixed-rate money markets, undercollateralization, privacy solutions, and more. These areas will move from niche to mainstream, while existing areas (especially derivatives) will move from mainstream to dominant across the financial market.

We can be sure that DeFi has entered the Baroque era, and the future will only be more exciting.

- 核心观点:DeFi 进入巴洛克时代,创新加速。

- 关键要素:

- 衍生品推动 DeFi 创新。

- 稳定币规模创历史新高。

- 协议协同创造独特工具。

- 市场影响:推动 DeFi TVL 突破前高。

- 时效性标注:中期影响。