Original | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

This column aims to cover the current low-risk return strategies based on stablecoins (and their derivative tokens) in the market (Odaily Note: code risks can never be ruled out), to help users who hope to gradually expand their capital scale through U-based financial management to find more ideal interest-earning opportunities.

Previous records

New opportunities

Binance launches USDC subsidy program

On August 11, Binance officially announced that it will launch a one-month (8.11 - 9.10) USDC subsidy campaign.

During the event, users who subscribe to USDC current account investment through Binance with a balance of up to 100,000 USDC can enjoy a 10% tiered yield subsidy and a real-time annualized yield of approximately 2%.

This is almost the simplest, most secure and relatively profitable mining opportunity on the market. Users with idle funds in the exchange must not miss it.

Kamino launches its fourth season incentive campaign

On August 7, Kamino, the leading lending protocol on Solana, announced the launch of its fourth season activities.

This season's activities have changed the points airdrop to token incentives. The incentives will be directly reflected in the specific pool's apparent yield. In addition, by staking KMNO, users can obtain a certain multiplier yield increase.

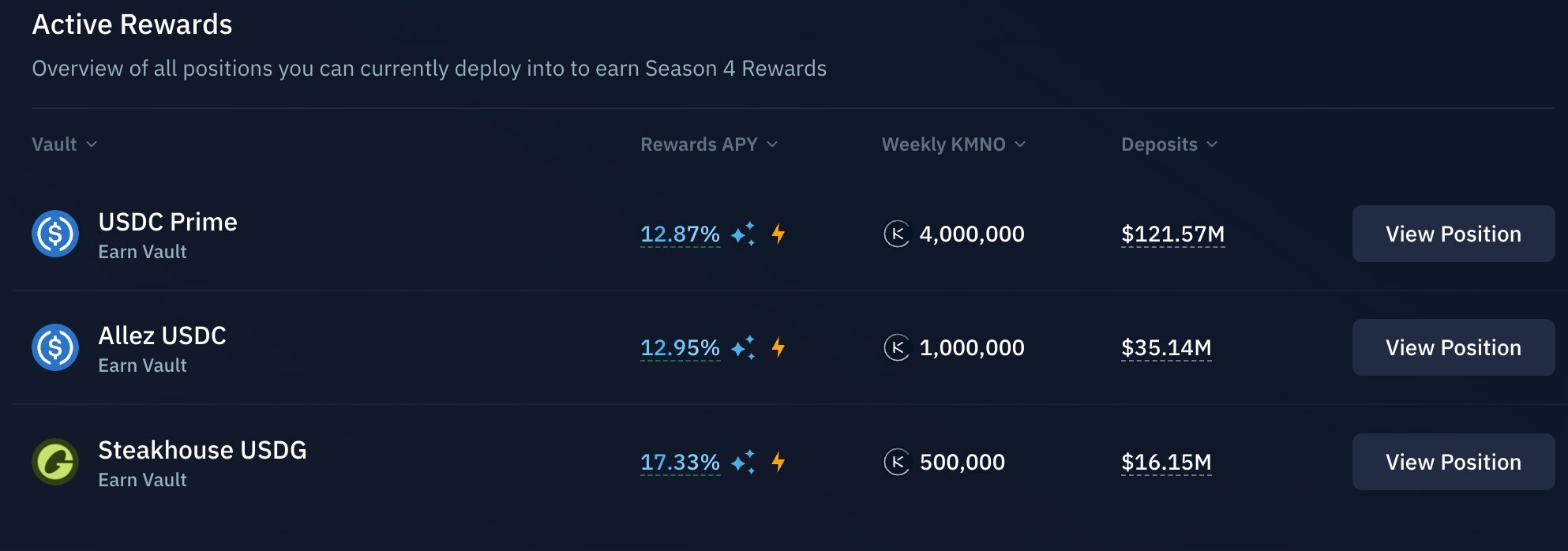

As shown in the chart below, there are currently three dedicated pools for the Season 4 event: USDC Prime (APY 12.87%), Allez USDC (APY 12.95%), and Steakhouse USDG (APY 17.33%). It's also important to note that the APY composition of these pools primarily consists of additional incentives in the form of KMNO.

Huma partners with Kamino to activate PST revolving loan

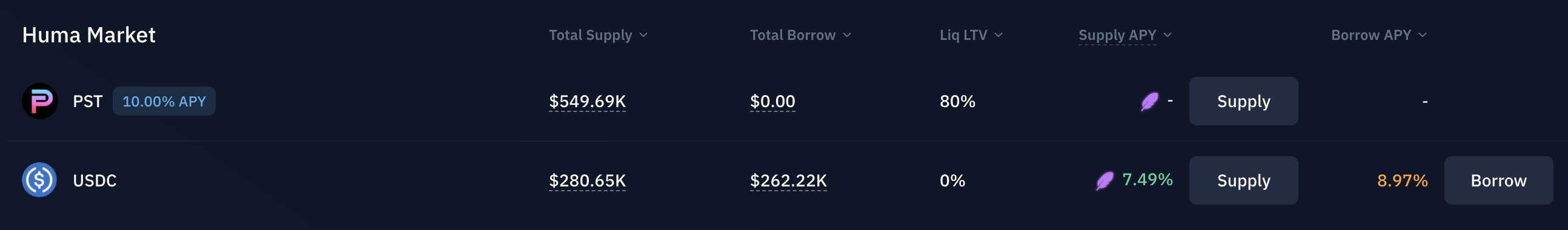

On August 8, Huma announced a partnership with Kamino, and PST (Huma’s interest-bearing deposit certificate) will be available on the latter’s V2 lending market.

Since users can currently earn 10% APY by depositing PST through Huma’s Classic mode (i.e., non-locked mode), which is higher than the borrowing cost of USDC, users can conduct a revolving loan by “depositing PST in Kamino; borrowing USDC; depositing PST in Huma again; and depositing PST in Kamino again” to maximize the yield.

It is worth mentioning that in order to stimulate the liquidity of this revolving loan model, Huma will temporarily provide 3 times the points incentive for USDC deposits in related pools. Users who want to save trouble can also choose to deposit USDC directly in Kamino.

Upshift Launches maxiUSR Vault

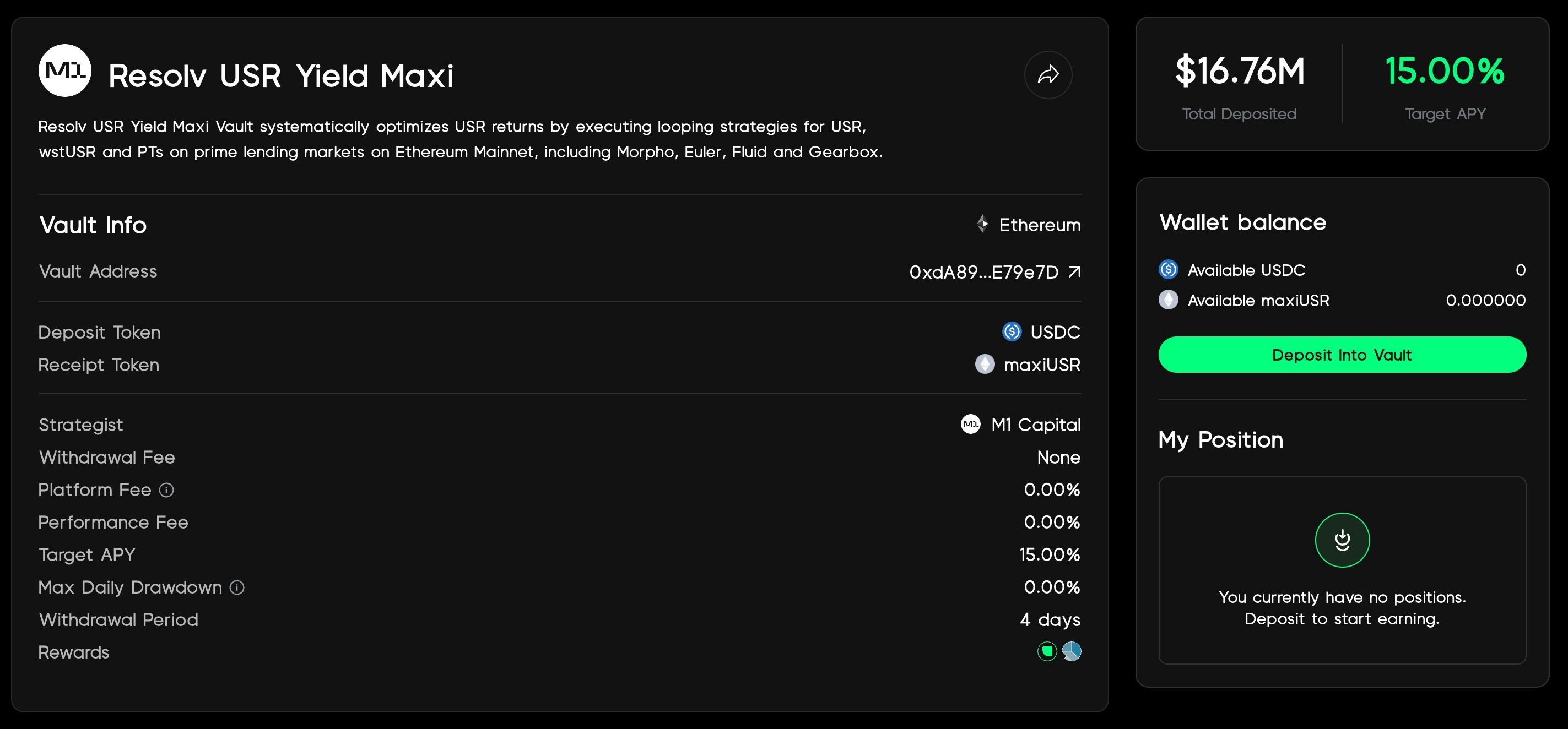

On August 8, Upshift, a stablecoin yield protocol under August, announced the launch of maxiUSR Vault. The strategy is managed by hedge fund M1 Capital and will use Resolv's stablecoin USR for revolving loans to amplify returns.

According to the disclosure, the strategy plans to achieve an annualized return of more than 20% (real-time data is 15%) , while obtaining 45 times Resolv points and 8 times Upshift points.

- 核心观点:稳定币理财收益机会涌现。

- 关键要素:

- 币安USDC活期理财补贴10%+2%收益。

- Kamino第四季激励池APY最高17.33%。

- Huma与Kamino合作推循环贷策略。

- 市场影响:吸引资金流入稳定币理财市场。

- 时效性标注:短期影响。