Original author: ChandlerZ, Foresight News

Binance recently launched a new USDC current account investment product. Running from August 11th to September 10th, users can enjoy an annualized return of up to 12% on the first 100,000 USDC they deposit. This figure, significantly higher than the average interest rate for USD stablecoins, quickly sparked discussion within the community.

Binance also announced a zero-fee promotion for select USDC trading pairs. This promotion is open to VIP 2-9 users and spot liquidity providers. Participating trading pairs include BNB/USDC, ADA/USDC, TRX/USDC, and XRP/USDC. During the promotional period, both maker and taker fees will be waived for these trading pairs.

Circle, the issuer of USDC, has been increasing its marketing budget over the past year, particularly investing heavily in Coinbase's high-interest deposit program. Market speculation quickly arose that Binance's subsidy also came from Circle, rather than solely from Binance.

This high-yield, short-term strategy is not uncommon in the stablecoin competition. However, by targeting a platform like Binance, which uses USDT as its core settlement currency, Circle has begun to directly attack its competitors' core positions.

USDC’s Business Model and Vulnerabilities

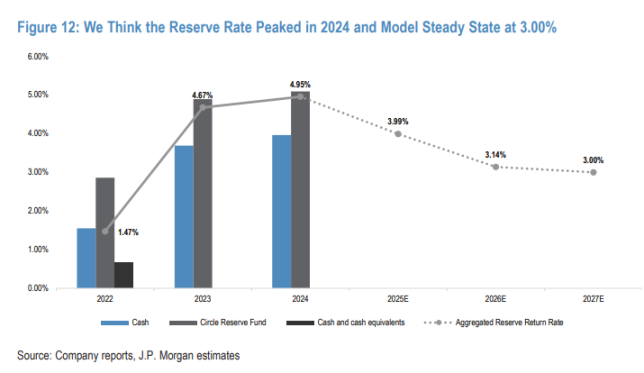

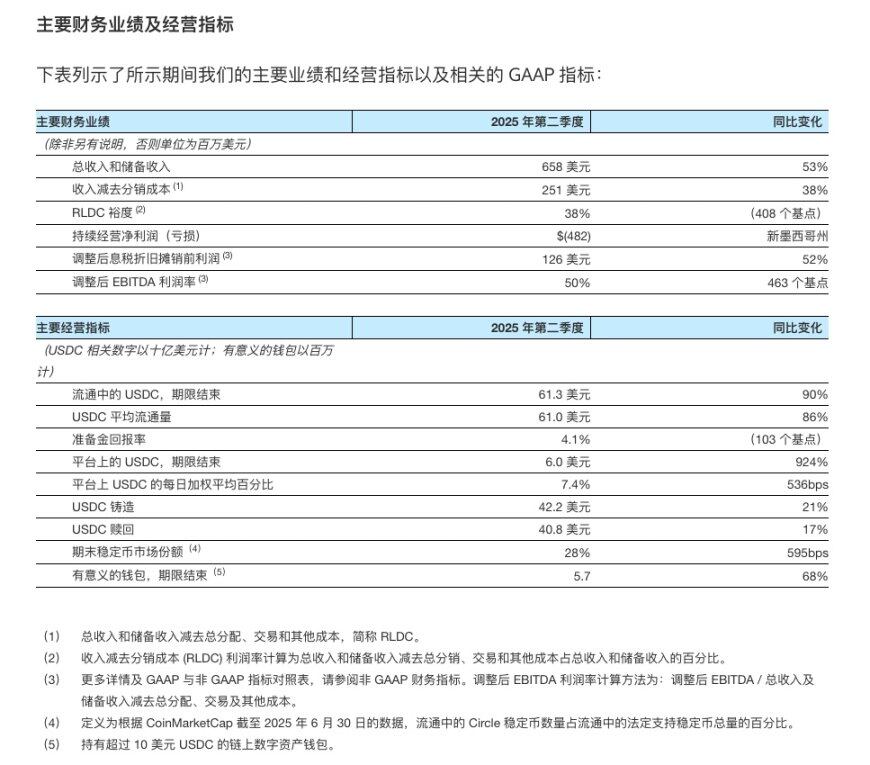

Circle's revenue streams are highly concentrated. In 2024, 97% of its revenue came from interest earned on its USDC reserves. These reserves are invested in US Treasury bonds maturing within 93 days, repurchase agreements within 7 days, and demand deposits at major banks, yielding an average yield of nearly 4%. This model performs well during rising interest rate cycles but is quickly impacted by falling rates.

In a June research report, JPMorgan Chase estimated that with approximately $60 billion in USDC in circulation, a 1 percentage point Fed rate cut would reduce Circle's annualized reserve income by $600 million and its EBITDA by $200 million. This means that a Fed policy shift would directly squeeze Circle's profit margins, a shock it lacks a business segment to mitigate.

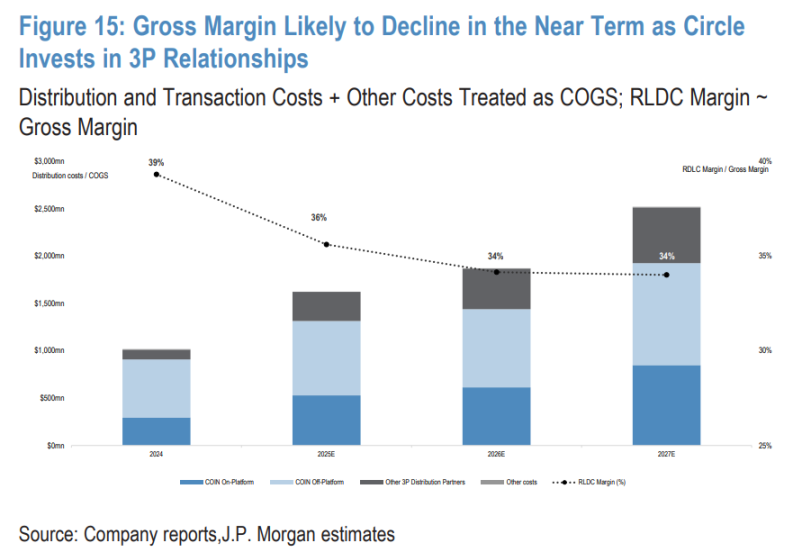

In addition to its reliance on interest rates, Circle also faces pressure from rising distribution costs. To expand USDC's market share, it has established distribution partnerships with numerous exchanges and payment companies. These channel partners receive a revenue share based on the USDC balance on their platforms, ranging from 60% to 70%. In 2024, Coinbase received $908 million in revenue from Circle, representing 55% of its reserve revenue. This high revenue share structure has resulted in Circle's gross profit margin reaching 39% in 2023, with an expected decline to 34% over time.

Stagnant market share is another challenge. As of August 12, 2025, USDT dominated the US dollar stablecoin market, holding a 60.79% market share and $164.8 billion in circulation. USDC held a 24.05% market share and $65.2 billion in circulation, a significant gap. While USDC boasts significant regulatory advantages in the European and American markets, complying with the EU's MiCA regulations and potentially meeting the US's Genius Act, its global usage, particularly in the Asia-Pacific and Latin American markets, has long lagged behind USDT.

Stablecoin users have low migration costs. Once a product with higher yields or wider coverage for a specific scenario emerges, existing users can easily migrate. At the same time, new asset classes like tokenized money market funds (TMMFs) are replacing stablecoins in settlement and collateralization functions. This trend could weaken USDC's role in on-chain finance and corporate payments.

The combination of these factors presents Circle with a stark reality: if it fails to rapidly expand USDC circulation before interest rates drop, its profit margins will continue to shrink. However, achieving this goal at a low cost is difficult under the current distribution model.

Why choose Binance to launch a high-interest offensive?

Circle's promotional strategy in the stablecoin market hinges on locking in channel partners' existing funds. Over the past two years, it has successfully driven USDC stock growth on Coinbase with high-interest deposit programs. Coinbase users can earn an annualized return of 4%-12% on their USDC holdings, with this interest subsidy primarily coming from Circle's own promotional budget. The logic behind the subsidy is straightforward: as USDC stock grows, the size of the reserve expands, and Circle's interest income from reserve investments also rises.

In the case of Coinbase, protocol binding ensures long-term stability in this partnership. Circle pays a commission based on the average daily balance of USDC on the Coinbase platform, a percentage significantly higher than Coinbase's actual market share. This high incentive ensures Coinbase's continued promotion of USDC, even offering users above-market deposit returns.

However, there is currently no public information disclosing the specific contractual arrangements between Circle and Binance for this high-interest event, but combined with the common distribution cooperation model in the industry, we can infer its capital flow logic.

Issuers typically pay a promotional fee or revenue share based on the stablecoin inventory on their platform. This fee is derived from interest earned on the issuer's reserve fund. For USDC, this reserve fund is primarily invested in short-term US Treasury bonds and repurchase agreements, yielding a yield of around 4%. Circle can distribute this portion of revenue to channel partners in exchange for more financial management access, trading pair support, and marketing resources.

In Binance's current promotion, the high interest rate only lasts for one month. Given this short period, the partnership is more likely a one-time promotional fee than a long-term distribution agreement. Circle will pay Binance a subsidy budget during the promotional period, which will be directly passed on to users in the form of high returns. For example, a user holding 100,000 USDC would earn approximately $333 in interest per month at a normal 4% yield. To achieve a 12% annualized return, the monthly interest would need to reach $1,000, with the difference covered by the subsidy.

Binance is the world's largest cryptocurrency exchange by trading volume and the core settlement hub for USDT. Circle's high-interest campaign here has a clear strategic purpose: to compete for user funds on USDT's home turf. For an issuer that has long been at a disadvantage in market share, this is a direct challenge to its biggest competitor. The choice of Binance also has a temporal context. The Federal Reserve is about to embark on a cycle of interest rate cuts, and the market generally expects lower interest rates. For Circle, which relies heavily on interest income from reserves, this presents a window of opportunity where it must act early. By expanding its reserves before interest rates fall, it can provide a buffer against overall revenue, even if yields decline.

Circle's Dilemma

High-interest subsidies can rapidly expand fund size in the short term, but they rarely translate directly into long-term retention. Stablecoins offer minimal switching costs between exchanges, making it virtually frictionless for users to adjust trading pairs or settlement currencies. Once subsidies cease, if USDC fails to establish a stable advantage in terms of trading depth, payment channels, and derivatives collateralization, funds could flow back to USDT or other high-yield stablecoins within days.

Circle’s newly released financial report shows that its “total distribution, transaction and other costs” in Q2 reached US$407 million, a year-on-year increase of 64%, mainly due to the increase in USDC circulating balance, the expansion of Coinbase’s holdings, and the increase in distribution payments with new strategic partners.

Subsidies also increase reliance on distribution channels. If Binance joins the high-interest partnership, Circle will likely adopt a revenue-sharing model with both Coinbase and Binance, two core exchanges, to maintain market share. This model carries high marginal costs, and the proportion of marketing fees to revenue is likely to rise further with each new key channel. Intensified competition gives distributors greater leverage in negotiations, allowing them to demand higher commissions or longer subsidy periods.

Unlike the long-term partnership with Coinbase, this Binance investment appears to be a concentrated, short-term tactical operation, primarily designed to test whether USDT can leverage capital migration. While its advantages include controllable investment and measurable results, its drawbacks are also significant. After the subsidy ends, capital may flow back quickly, making retention more challenging.

In the short term, the value of this move lies in expanding the reserve base ahead of interest rate cuts, creating a buffer against future declines in returns. It also verifies the effectiveness of the high-interest rate strategy implemented on core exchanges, providing a basis for replication in other markets. In the long term, Circle still faces several major challenges, including profit compression due to reliance on subsidies, a disadvantage in negotiating revenue sharing with channel partners, and the possibility of a USDT counterattack. The risk of relying solely on reserve interest income is magnified during a downward interest rate cycle. Without establishing stable demand in scenarios such as trading, payments, and cross-border settlement, sustained market share gains will be difficult to achieve.

In the coming months, Circle may initiate similar short-term subsidies on other key platforms, particularly focusing on high-liquidity trading pairs and high-frequency trading markets. However, if such tactics lack supporting long-term scenario development, their impact on the stablecoin market landscape will remain limited.

For Circle, this event is more of a market test. Whether it can create a bigger impact in the stablecoin market will depend on whether USDC can establish stronger global competitiveness beyond subsidies.

- 核心观点:Circle通过高息补贴争夺USDT市场份额。

- 关键要素:

- 币安USDC理财年化12%,远高市场均值。

- Circle收入97%依赖USDC储备金利息。

- USDC市占率24%,远低于USDT的60%。

- 市场影响:短期或引发稳定币资金迁移潮。

- 时效性标注:短期影响。