Originally Posted by Tanay Ved

Original translation: Saoirse, Foresight News

Key Takeaways

- Digital asset reserves focused on Ethereum are expanding rapidly, with a cumulative increase of 2.2 million ETH (1.8% of the total supply) in just two months, creating an imbalance between supply and demand.

- These funds adopt an active on-chain strategy and plan to allocate funds through staking and DeFi to provide support for network security and liquidity while increasing returns.

- While still in the accumulation phase, higher on-chain participation could enhance Ethereum’s liquidity and security while increasing its exposure to corporate funding risks.

The rise of digital asset reserves

Digital asset reserves (DATs)—publicly listed companies that hold crypto assets like Bitcoin or Ethereum on their balance sheets—have emerged as a new channel for market access. The launch of spot ETFs in 2024 unlocked demand from investors who previously couldn't hold BTC and ETH through direct custody. Similarly, digital asset reserves offer investors exposure to these assets and their ecosystems through publicly traded shares, while also providing the ability to strategically raise and deploy capital.

We previously analyzed in depth Michael Saylor's " Strategy Playbook ," which raised funds through the issuance of shares and convertible bonds, accumulating over 628,000 Bitcoin (2.9% of the total Bitcoin supply). Companies around the world, from Marathon Digital to Japan's Metaplanet, have followed suit, offering shareholders amplified or "leveraged" Bitcoin exposure. Now, this model is expanding to other ecosystems, with numerous entities competing to increase their holdings of ETH in their corporate treasury reserves.

While the goal of increasing shareholder exposure to the underlying asset remains unchanged, the Ethereum Reserve differs fundamentally from the Bitcoin Reserve in that it can leverage Ethereum's staking and DeFi ecosystem. This creates the potential for increased returns through Ethereum's native yields and efficient allocation of on-chain capital. In this article, we will analyze the dynamic impact of the Ethereum Reserve on the ETH supply and explore the potential impact of these large institutional investors entering the network.

Supply Dynamics: The Race for 5% of Supply

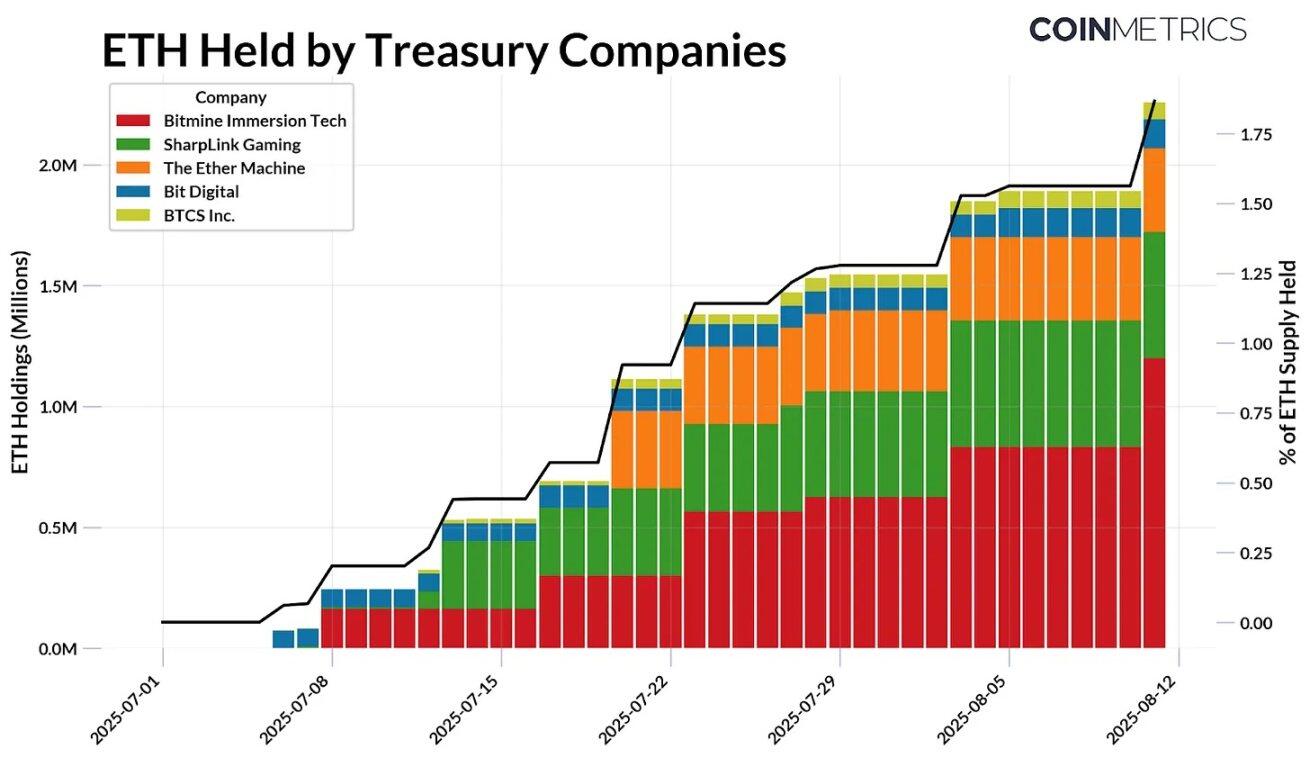

Since July of this year, Ethereum digital asset reserves have accumulated 2.2 million ETH, representing nearly 1.8% of the current total ETH supply. There are currently five major players in this space, raising funds through equity financing methods such as public offerings or private equity offerings (PIPEs) to deploy capital and increase the value of their holdings. As of August 11th, these entities held the following:

- Bitmine Immersion Technologies: 1.15 million ETH, worth approximately $4.8 billion

- SharpLink Gaming: 521,000 ETH, worth approximately $2.2 billion

- The Ether Machine: 345,000 ETH, worth approximately $1.4 billion

- Bit Digital: 120,000 ETH, worth approximately $503 million

- BTCS Inc.: 70,000 ETH, worth approximately $293 million

Bitmine Immersion Technologies is currently the largest corporate holder of ETH, holding 0.95% of the total ETH supply and is rapidly progressing toward its goal of accumulating 5% of the circulating ETH supply. As market conditions shift, these companies are able to build reserves at favorable costs, and competition for a larger share of ETH is intensifying.

Source: Coin Metrics Network Data Pro and public documents (as of August 11, 2025)

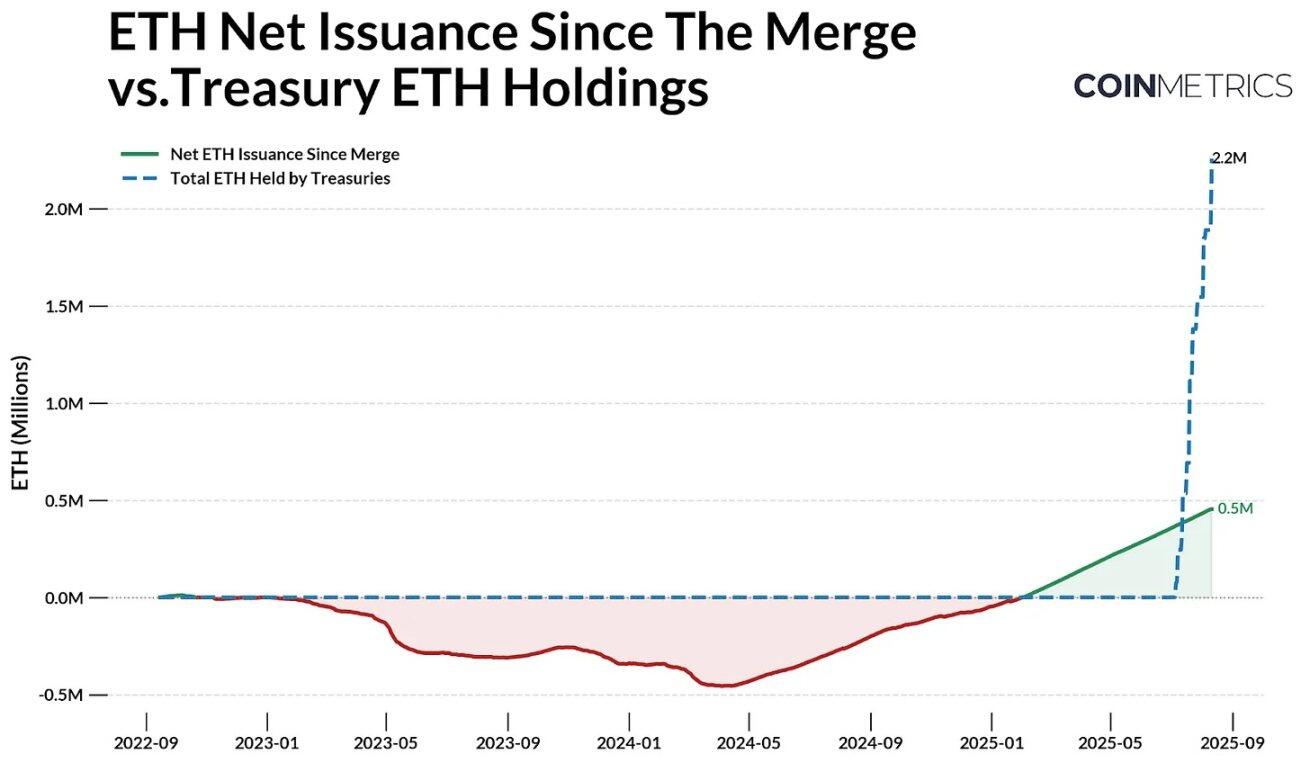

This trend is even more pronounced when considering Ethereum's issuance dynamics. Ethereum's supply is regulated by the PoS mechanism, where newly issued ETH is distributed to validators and a portion of transaction fees is destroyed. Therefore, net issuance can fluctuate between negative (deflationary) and positive (inflationary) values.

Since the September 2022 "merger," Ethereum has issued 2.44 million ETH and destroyed 1.98 million, for a net increase of 454,300 ETH. Since July of this year, the Ethereum Treasury has accumulated 2.2 million ETH, far exceeding the net increase in issuance during the same period. While Bitcoin's supply cap and halving mechanism directly reduce its new issuance, Ethereum's supply is dynamic and currently inflationary. Given that Ethereum's market capitalization is approximately one-quarter of Bitcoin's, the scale and speed of recent demand are even more noteworthy.

Source: Coin Metrics Network Data Pro and public documents

This supply-demand imbalance is even more pronounced given the increasing inflows into Ethereum ETFs in recent months. Overall, these instruments are absorbing ETH's 107.2 million free float (market available supply), in addition to the 29% of ETH staked in the consensus layer and the 8.9% held in other smart contracts. Therefore, the continued accumulation of reserves and ETFs is likely to amplify price sensitivity to this new demand.

Ecosystem Impact: Staking, DeFi, and On-Chain Activity

While most ETH treasuries are still in the accumulation phase, some of their funds may eventually move on-chain. Unlike Bitcoin treasuries, which tend to be relatively passive, these companies plan to leverage Ethereum's staking and DeFi infrastructure to improve risk-adjusted returns and effectively utilize their holdings. This shift is already underway: SharpLink Gaming has staked a significant portion of its holdings, BTCS Inc. is generating returns through Rocket Pool, and other companies like The Ether Machine and ETHZilla are preparing for more active on-chain management.

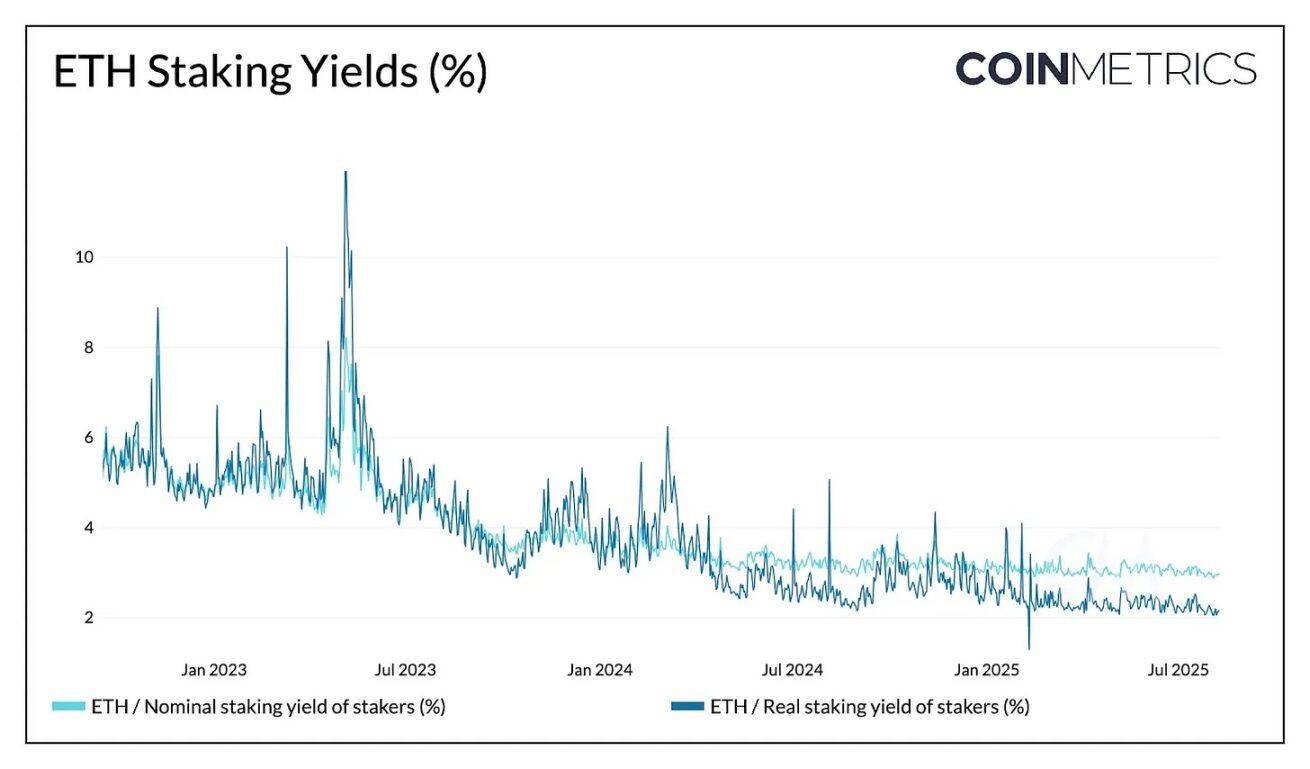

Source: Coin Metrics Network Data Pro

Currently, Ethereum offers a nominal yield of 2.95% and a real (inflation-adjusted) yield of 2.15% by providing staking rewards for network security. This not only generates price appreciation for the underlying asset, but also provides a stable income stream for the Treasury. For example, if 30% of the 2.2 million ETH currently held by the Treasury were staked at the current nominal yield of approximately 3%, and the ETH price were $4,000, this would generate approximately $79 million in annual revenue. While a large influx of funds into staking could depress yields, this impact is relatively mild because Ethereum's reward rate gradually decreases as the total amount staked increases.

There are two primary ways for corporate treasuries to participate: running their own validator nodes or leveraging liquidity staking protocols. The US SEC has clarified that liquidity staking protocols are not considered securities. Companies can stake through third-party institutions like Lido, Coinbase, or RocketPool and receive a "liquidity" token in return.

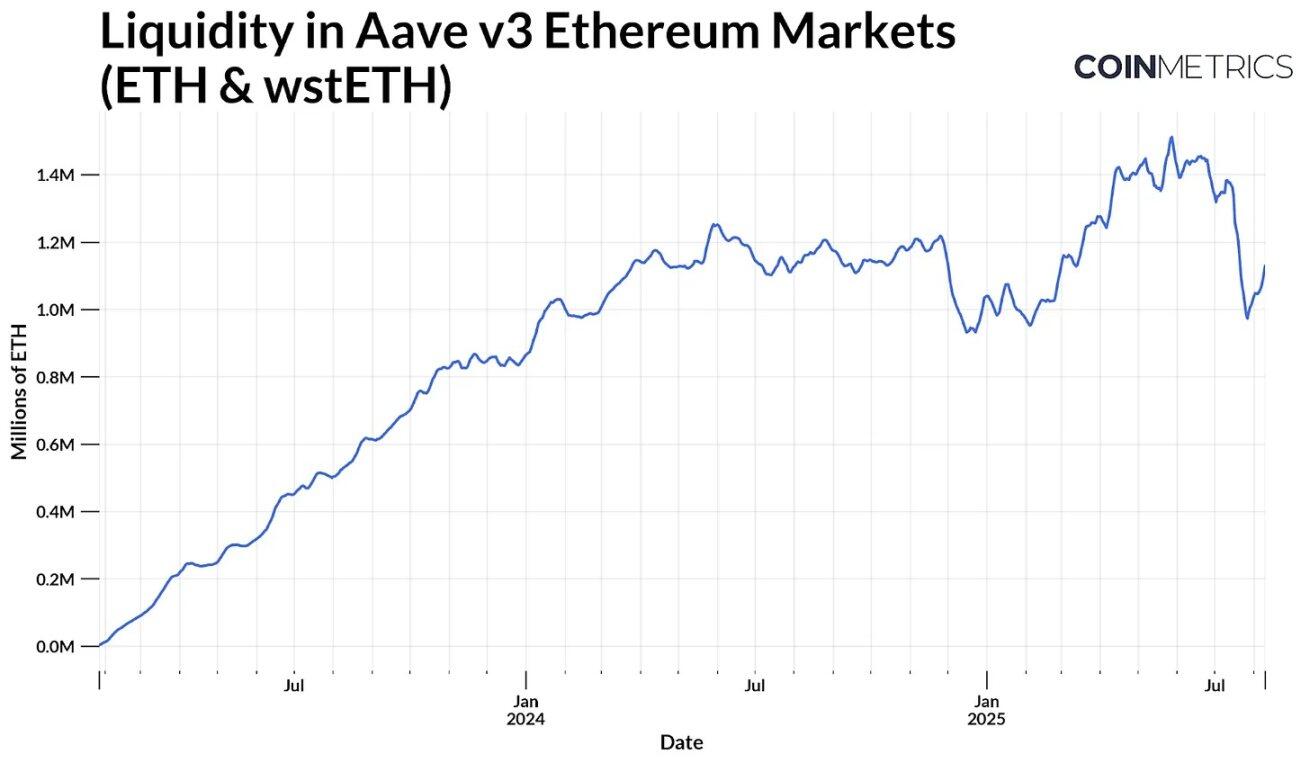

Source: Coin Metrics ATLAS

Despite the added risks, tokens like Lido's stETH are widely used in DeFi for staking and lending, or to generate additional returns on top of the benchmark annualized staking yield in a capital-efficient manner. For example, on Aave v 3, ETH and liquid staking tokens like stETH constitute a large pool of available liquidity (the supply of assets available for lending). This pool has currently grown to approximately 1.1 million ETH, and the addition of reserve funds is likely to further expand the pool, increasing returns while enhancing market liquidity.

Source: Coin Metrics Network Data Pro

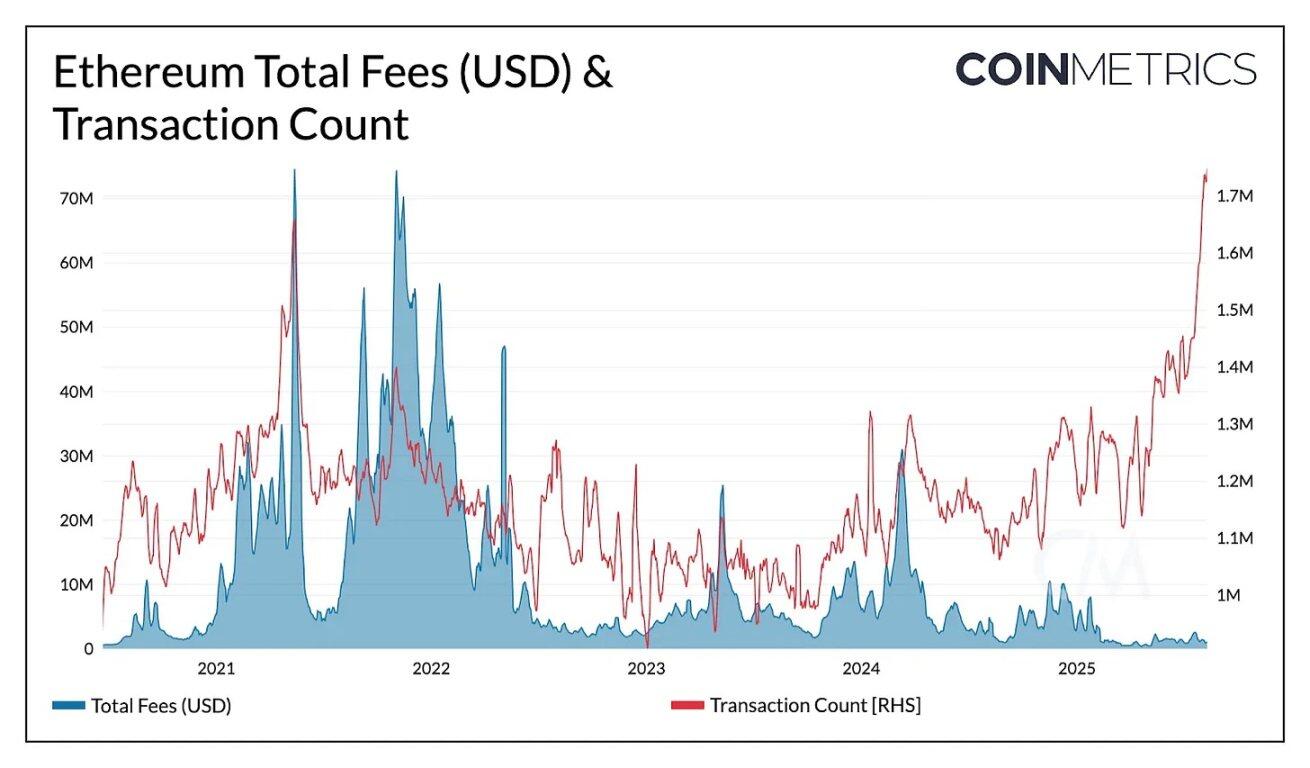

Despite Ethereum mainnet transaction volume now exceeding all-time records (1.7-1.9 million transactions per day), total fees remain at multi-year lows due to recent gas limit increases and block size expansions, which have eased network congestion and shifted some activity to L2. If treasury funds were to enter the chain on a large scale, high-value transactions on Ethereum L1 could drive growth in total blockspace demand and fee revenue, potentially creating a positive feedback loop between reserve activity, liquidity, and on-chain usage.

Linking corporate treasury performance to chain health

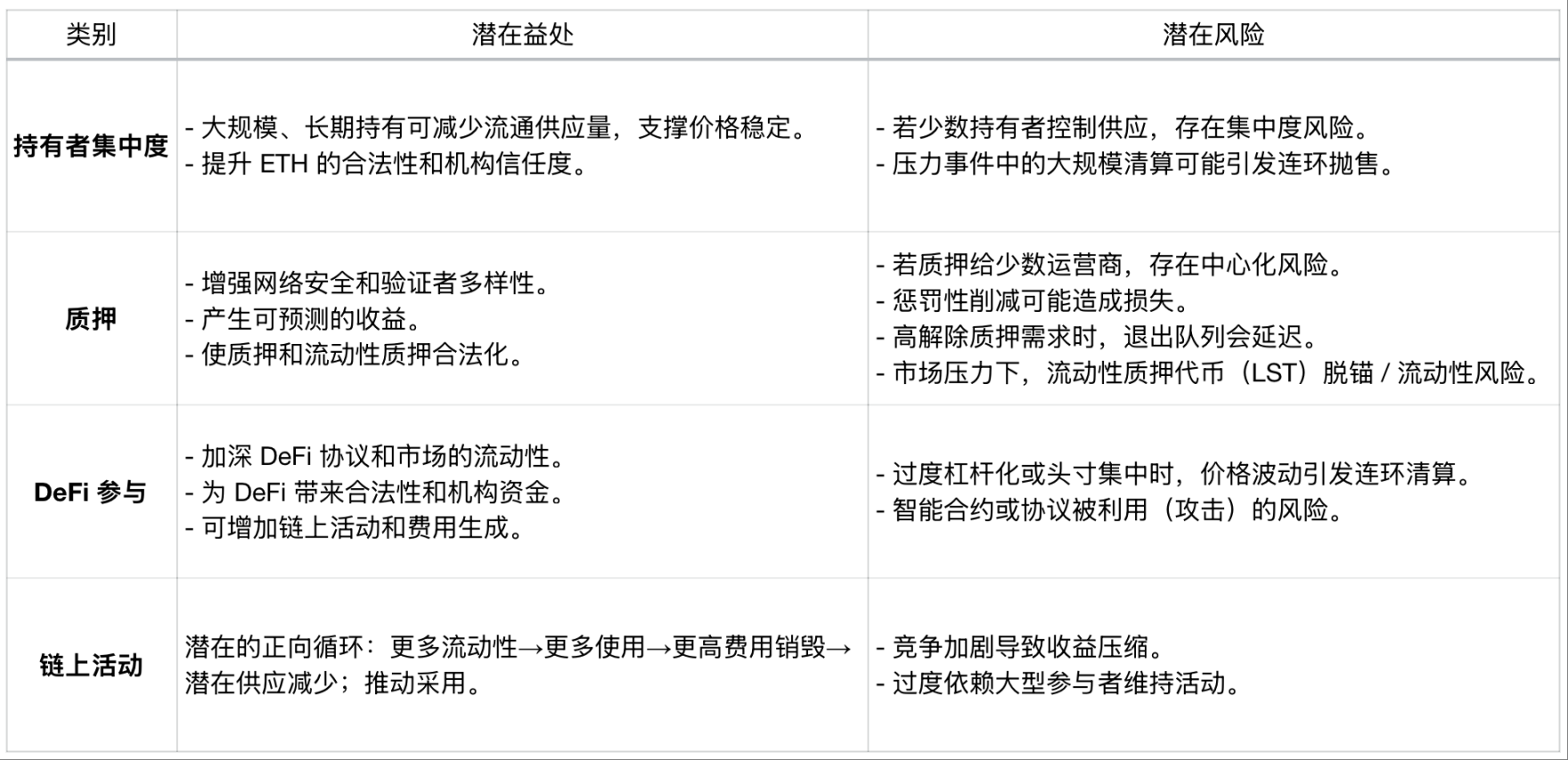

As listed Ethereum treasury companies expand their on-chain holdings, their financial performance has a growing impact on the long-term health of the Ethereum network, connecting off-chain enterprise performance with potential on-chain impacts. Large-scale, long-term holdings can reduce circulating supply, increase adoption, and boost on-chain liquidity, but centralization, leverage, and operational risks mean that issues at the enterprise level can potentially be transmitted to the network.

The on-chain impact of large ETH reserve holdings

While these are network-level considerations, corporate treasuries themselves are also influenced by market forces and investor sentiment. A strong balance sheet and continued investor confidence can lead to increased reserve holdings and participation. Conversely, a significant drop in the price of the underlying asset, tight liquidity, or excessive leverage can lead to a sell-off in ETH or a decrease in on-chain activity.

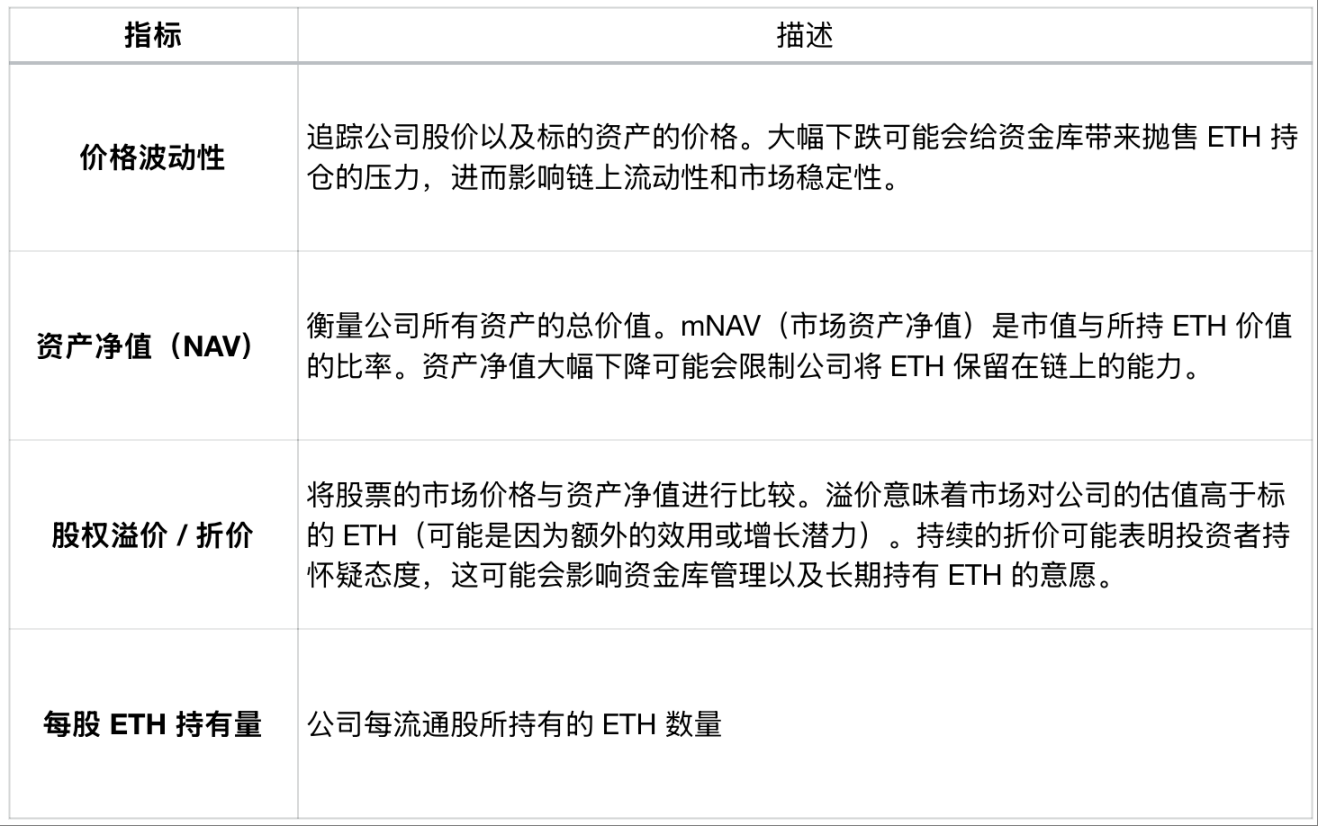

Indicators related to treasury company performance

Metric Description Price volatility tracks the company's share price as well as the price of the underlying asset. A significant drop could put pressure on the treasury to sell its ETH holdings, which could impact on-chain liquidity and market stability. Net Asset Value (NAV) measures the total value of all of a company's assets. mNAV (market net asset value) is the ratio of market capitalization to the value of ETH held. A significant drop in NAV could limit the company's ability to keep ETH on-chain. Equity Premium/Discount compares the market price of a share to the NAV. A premium means the market values the company more than the underlying ETH (perhaps due to additional utility or growth potential). A persistent discount could indicate investor skepticism, which could impact treasury management and the willingness to hold ETH long-term. ETH Holdings Per Share The amount of ETH held by the company per outstanding share.

By tracking the network-level impact and financial health of these companies, market participants can better anticipate the impact that corporate treasury actions may have on Ethereum’s supply dynamics and overall network health.

in conclusion

The rapid rise of corporate Ethereum treasuries demonstrates Ethereum's appeal as a reserve asset and source of on-chain revenue. Their growing influence is likely to increase liquidity and network activity, but it also carries risks associated with leverage, financing, and capital management. As off-chain factors (such as stock performance and debt repayments) become increasingly tied to on-chain activity, these factors can quickly impact the chain. As these institutions scale, tracking their balance sheet health and on-chain activity will be key to understanding their impact.

- 核心观点:以太坊企业储备激增导致供需失衡。

- 关键要素:

- 两月增持220万枚ETH(1.8%供应量)。

- 五大机构争夺5%流通量。

- 质押和DeFi策略提升收益。

- 市场影响:或推高ETH价格敏感性。

- 时效性标注:中期影响。