Original title: The Rise of Pendle PT: From DeFi Experiment to Fixed Income Empire

Over the past three or four years, the crypto world's hot topics have shifted like a revolving door: the Ethereum merger ignited the LSD market, airdrop points fueled a chart-topping frenzy, and now, stablecoin returns are taking center stage. Bustling activity is the norm, but after each hue fades, Pendle always stands center stage—unobtrusive, yet steadily and responsibly laying the groundwork for a wider and deeper pipeline behind the scenes.

If the LSD craze of 2023 relied primarily on Lido for liquidity and Rocket Pool for decentralization, then Pendle was the only one supporting yield splitting and pricing. If the airdrop crowd of 2024 relied on Excel to track points and Twitter to compare hand speed, then Pendle was the one directly pricing "future yield" on YT. By 2025, the market capitalization of stablecoins will continue to climb, the yield-based dollar will dominate the narrative, and Pendle will remain the largest secondary trading platform. Three market trends, one thread—whoever masters the "disassembly and assembly" of on-chain interest rates will secure a position in the next round of narratives.

From USDT to PT: Stablecoin + Fixed Income Dual Engine

When discussing stablecoins in the industry, it's not just the "old money" like USDT and USDC that comes to mind, but also the new, high-yielding names like USDe and cUSD 0. The data is stark: Over the past month, Pendle's TVL has accelerated, reaching a record high of $8.2 billion on August 9th and approaching $9 billion on August 13th. More crucial is the momentum of capital inflows—Aave quietly raised the position limit for PT-USDe (Sep 2025) by $600 million this week, and it was fully filled in less than an hour, demonstrating that demand for PT from institutions and whales has not only not been diverted, but has actually intensified.

Many people still remember Pendle as "the airdrop points paradise," but they've actually changed their focus long ago. Starting in June of this year, the PT/YT nomenclature was changed to a more understandable format. The frontend clearly states, "1 PT redeems the principal at maturity, 1 YT accumulates all profits," making it easy for new users to understand without having to consult a Telegram group. The backend also includes daily notifications, showing position movements and profits earned, in a pop-up window upon opening the website.

On the TradFi front, Citadels partnered with Edge Capital. This $400 million hedge fund packaged its mEDGE strategy library into PT and directly added it to Pendle. Currently, mEDGE's TVL has exceeded $10 million. Meanwhile, Spark's stablecoin USDS saw an inflow of over $100 million in 24 hours. The 25x Spark points alone attracted a large number of investors, pushing the TVL of USDS on Pendle to over $200 million. The supporting lending market is also booming, with the total amount of PT in circulation on Aave exceeding several billion dollars – showing that fixed income is truly becoming monetizable.

Why PT is more resilient to market fluctuations: Taking the Liquid Leverage activity as an example

On July 29th, Ethena launched Liquid Leverage on Aave: users pledge 50% USDe and 50% sUSDe as collateral, combining lending rates with promotional rewards, offering a more market-oriented return path. On launch day, the market was indeed discussing whether this would squeeze PT. The reality was that Aave's PT-USDe limit increase was immediately snapped up. Liquid Leverage's yield structure, which relies in part on rewards from the ENA ecosystem, is more sensitive to market conditions and activity levels. In contrast, PT's returns are locked in at a discount, resulting in less exposure to volatility. In other words, Liquid Leverage is like a sports drink, while PT is more like a deposit book with water—the former is highly profitable during promotional periods, while the latter is more stable after the activity subsides.

Citadels: Turning DeFi Fixed Income into an Empire

Simply put, Citadels is Pendle's "going global" initiative: attracting traditional capital while simultaneously entering new public blockchains. Compliance, KYC, RWA, Solana, TON... while it might sound confusing, the core logic is simple: to bring the PT/YT interest rate puzzle to a wider range of environments, allowing any yield-generating asset to be priced on Pendle. If Pendle used to be like a dungeon filled with side quests, Citadels aims to transform the main city into a financial empire. Anyone looking to issue a stablecoin, trade RWA, or hedge funding rates must first register here.

Institutionalized PT and cross-chain PT: What’s next?

Pendle's Citadels is not a "renamed official website," but three real distribution channels:

(1) Non-EVM PT overseas: Bring PT to high-speed ecosystems such as Solana/TON/HYPE with one click, expanding the reachable user and asset pool;

(2) KYC Compliant PT: Wallets and brokerage interfaces for institutions, packaging on-chain fixed income into assets that can be held in compliance;

(3) Direct connection with strategic parties: For example, Edge Capital's mEDGE has directly minted its strategy library into PT and distributed it on Pendle, providing a bridge for "institutional strategy × DeFi fixed income". Simply put: one PT, two legs (cross-chain & institutional), putting the "interest rate puzzle" at the forefront of more markets.

Why Pencosystem?

Pencosystem: What Happened After Unbundling Interest Rates

For protocol partners, Pendle has never been a tool for simply tokenizing returns. Rather, it's an engine that simultaneously amplifies TVL, liquidity, and market signals. Once the pool is launched, unilateral market making and zero IL (if held to maturity) directly retain LPs. The discount on PT and the premium on YT act as a 24/7 price discovery dashboard, allowing teams to read the temperature of external funding in real time. EtherFi is a prime example—less than six months after eETH launched on Pendle, the protocol's TVL skyrocketed 15-fold. The previously stagnant OpenEden also saw a 45% growth rate within a month of launching on the pool. In short: when Pendle wins, the underlying protocol wins.

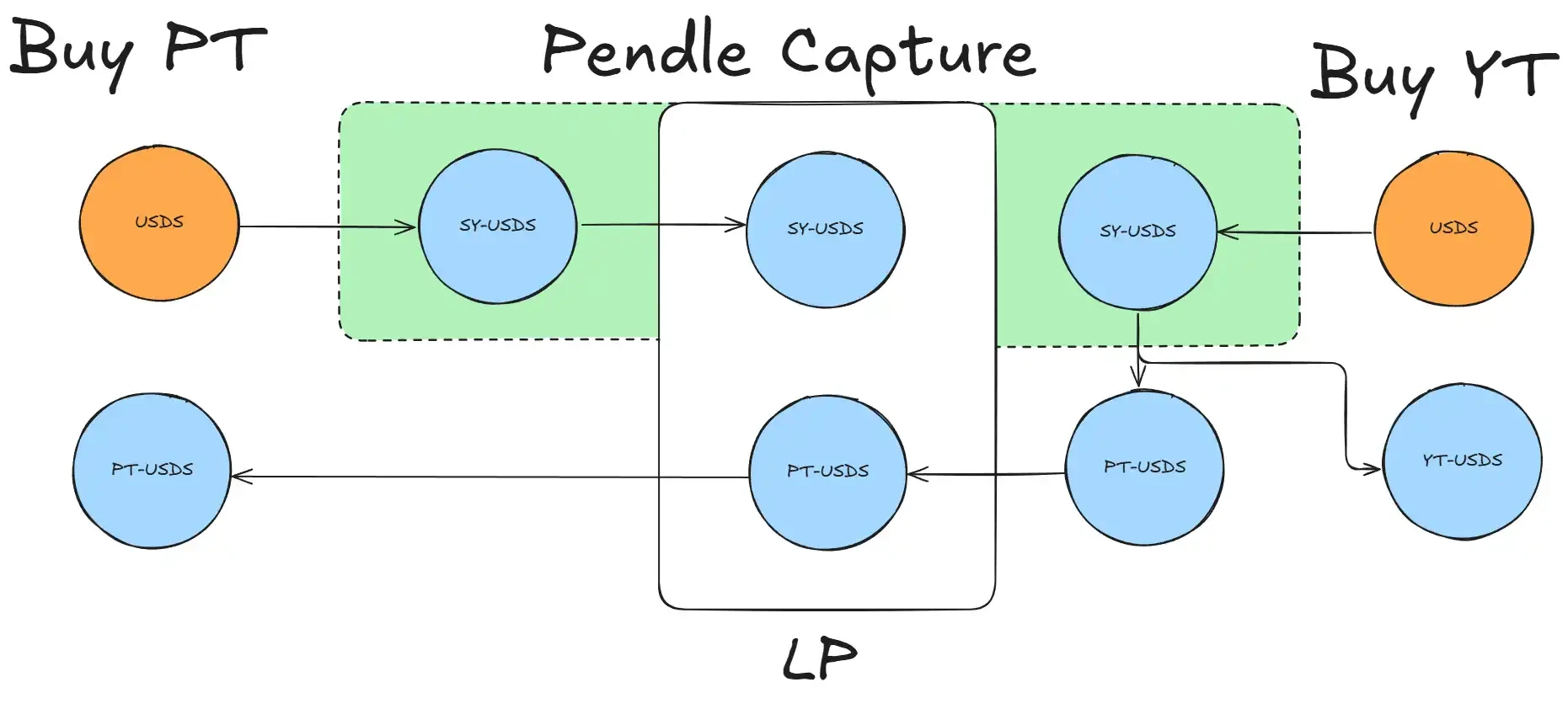

Pendle's magic is actually quite simple: it splits an interest-bearing asset into fixed-income and floating-income assets. PT is like a one-year US dollar bond, offering a guaranteed 3-12% APY upon maturity. YT is like an interest rate swap with options, allowing you to bet on airdrops, the Federal Reserve, and funding rates. After the split, the market naturally flattens the price gap—the steeper the PT discount, the more attractive the locked-in return; the higher the YT premium, the more people believe there will be more red envelopes in the future.

Don't underestimate this unbundling process. It allows LPs to earn fees by simply placing a single bet, with negligible impermanent loss. They can also leverage the unbundled PT on Aave. Large investors often use 3x to 5x leverage to boost their APY to 25-30%. This process is fully publicized on the on-chain ledger, so transparent that even investment bank analysts can replicate the Excel template.

From the end of 2023 to the present, Pendle has experienced 27 large-scale maturity events, seven of which exceeded $1 billion in single maturity. The largest redemption, $3.8 billion in June of last year, was cleared instantly on-chain. More recently, on May 29th, another $1.6 billion matured, bringing the peak TVL down from 4.79 billion to 4.23 billion, rebounding to 4.45 billion in just one week. The retention rate remains stable at 93%. The money doesn't just return—35% of the maturing funds roll directly into new Pendle pools, a historic seven-day retention rate.

Stablecoin Launchpad

Stablecoins are the most direct and profitable protagonists in the Pendle story. PT incorporates a fixed annualized return of 3–12% into on-chain contracts, while YT bundles the uncertainty of future interest rates, airdrop points, and funding rates for speculators. As a result, the new dollar debuts with two product lines: stable coupons and high-volatility betting.

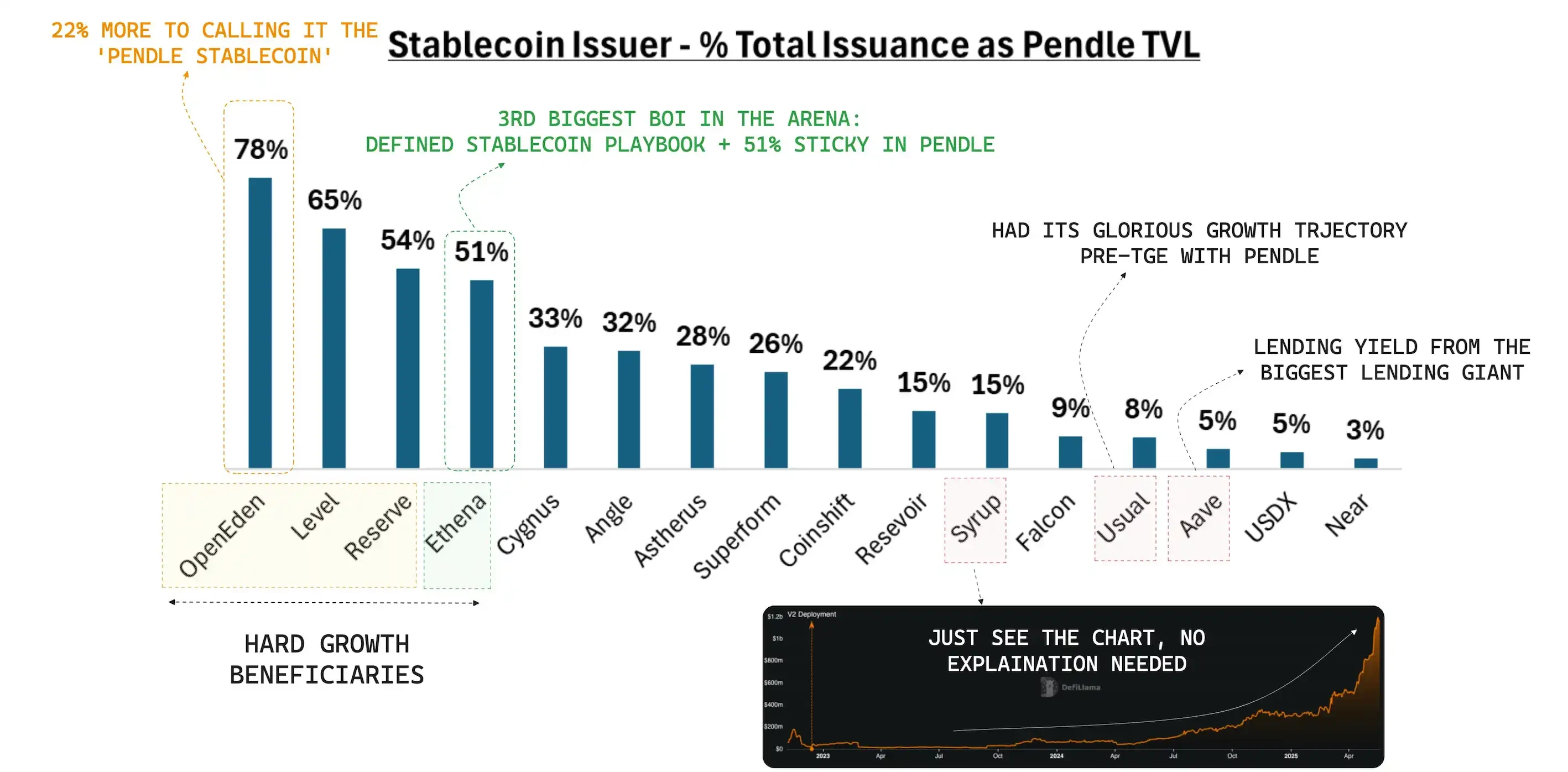

The data speaks volumes: Before reaching $1 billion in TVL, half of USDDe's value was locked in Pendle, and even at nearly $6 billion, it maintained a 40% share. cUSD, after three weeks of stagnating at zero, saw a 45% increase in one month on Pendle. The latest USDS attracted $100 million in liquidity in just 24 hours. Liquidity retention is equally impressive: during the $1.6 billion maturity surge on May 29th, USDDe's TVL only dropped 6%, recovering its loss four days later. For any stablecoin, nothing captivates institutional wallets more than the assurance that funds continue to flow back after the surge.

Over the past year, any yield-generating stablecoin looking to increase its TVL would include "Pendle Pool" in its launch section. OpenEden's cUSD 0, which had previously seen stagnant growth, saw a 45% surge in less than a month after listing on Pendle. For anyone looking to issue new USD, it's become the default scenario to hand over price discovery and early liquidity to Pendle.

Zooming out further, stablecoins themselves are also part of a broader trend of structural expansion. According to Modular Capital's " Pendle: Era of Stablecoin Expansion ," global stablecoin supply has surpassed $250 billion, while yield-generating stablecoins have surged from less than $1.5 billion to $11 billion in just eighteen months, increasing their market share from 1% to 4.5%. The same report also offers a scenario: Under the auspices of the GENIUS Act and the Federal Reserve maintaining relatively high interest rates, the stablecoin market is expected to double to $500 billion over the next 18-24 months; 15%, or $75 billion, of this will flow into yield-generating products.

If Pendle can maintain its current market share of approximately 30% as a "stable share", it means that its TVL has the opportunity to rise to US$20 billion, and its annualized revenue could reach US$200 million based on a 100 bp fee rate - just as Modular Capital concluded: In the DeFi fixed income track, Pendle is likely to enjoy the dual valuation anchors of "U.S. Treasury bonds + Nasdaq growth stocks."

PT is growing into an economic belt

Today, over 80% of Pendle's TVL is held in US dollar assets, making it suitable for both bull and bear markets. The circulating supply of PT on the three major money markets of Aave, Morpho, and Euler has doubled in six months, exceeding 2 billion. At the same time, more and more LPs are rolling over maturing LPs to the next tranche, which is causing new TVL to surge even faster.

Taking into account market fluctuations since July 29th, PT's annualized return has significantly outperformed collateral portfolios that rely solely on lending to squeeze interest rate spreads during most periods. This is due to two reasons: First, PT's coupon is locked in by a discount, unaffected by lending liquidity and promotional activity; second, PT can be recycled as collateral in money markets like Aave, generating a compound return of "fixed coupon x leverage," resulting in capital efficiency comparable to traditional collateral. Aave's community risk management report also shows that the supply of PT as collateral has jumped to billions of dollars in just over a month, demonstrating the resilience of demand.

The interest rate era has just begun

Airdrops can give the market a temporary boost, but what truly attracts big money is guaranteed returns, ample liquidity, and a comprehensive range of derivatives. Traditional finance boasts $600 trillion in interest rate derivatives, leaving DeFi far behind, not to mention that actual returns traded within the industry are less than three percentage points. What Pendle has been doing over the past three years is slowly filling that 97% gap.

Pendle's rise proves two things: it's entirely possible to securely settle billions of principal maturing on-chain, and it can also maintain capital liquidity during market downturns. More importantly, it has shifted the interest rate value chain from closed-door pricing by project owners to open bidding on-chain, allowing the market to determine the survival of the fittest. As long as there's yield, people will invest in PT/YT, and as long as people are splitting their yield, it'll be difficult to leave Pendle. The airdrop and copycat seasons may be over, but the interest rate market has only just begun, and once it's established, the movie is only halfway through.

- 核心观点:Pendle成为链上固定收益核心平台。

- 关键要素:

- PT/YT机制简化收益拆分。

- TVL突破90亿创历史新高。

- 机构需求强劲,资金留存率高。

- 市场影响:推动DeFi固定收益市场扩张。

- 时效性标注:中期影响。