Original title: "Recalling the platform currency war 4 years ago, is there still room for 10 times the growth now?"

Only those who dare to burn money have the opportunity to print new money.

This afternoon, OKX announced a massive, one-time burn of 65.25 million OKB tokens, worth hundreds of millions of dollars at current prices. Following the announcement, OKB's price surged, increasing by over 100% in a short period of time, instantly becoming a focal point amidst the relatively sluggish market. This volatility struck many investors as familiar.

The market's thoughts quickly returned to the sensational "platform coin destruction war" four years ago—in 2021. Back then, exchanges used real money to buy back and destroy their own platform coins. This not only reduced market circulation and created scarcity, but also signaled profitability and business growth. It was a silent, yet intense, arms race: repeated destruction announcements drove coin prices higher and reshuffled market capitalization rankings.

Now, as OKB embarks on another large-scale burn, market sentiment and memories are simultaneously ignited. However, the industry landscape in 2025 is vastly different—global regulation is stricter, and the competitive landscape and ecosystem layout among exchanges have undergone significant changes.

However, this does not prevent us from asking the same question - is it possible for a tenfold market like in 2021 to appear in today's platform coin track?

Revisiting the 2021 Platform Coin Destruction Campaign

Let’s rewind the timeline to four years ago.

From the end of 2020 to the beginning of 2021, the crypto market experienced an epic bull run. Bitcoin broke through the $20,000 mark and continued to climb, while Ethereum returned to the $1,000 range, driving a surge in the altcoin sector. A large amount of speculative capital initially poured into low-priced, volatile altcoins, driving short-term gains and rapidly igniting market sentiment.

Subsequently, with the cashing out and return of profits from altcoins, the exchange's trading volume and profits were significantly pushed up.

At this time, the platform currency has the conditions for "follow-up growth": the high profits brought by the bull market enable exchanges to repurchase and destroy tokens on a large scale, reduce circulation and create scarcity; and the need for market value management makes exchanges happy to use destruction to demonstrate their strength to the market.

The leading platforms keenly captured this opportunity and used destruction as a weapon in the game of brand competition and investor confidence.

A "destruction muscle show" catalyzed by the altcoin craze and supported by exchange profits has begun, and the platform currency has completed the position transformation from "making up for the rise" to "leading the rise" in the market.

In that war of destruction, no one wanted to be a silent bystander.

The frequency, scale, and variety of the major exchanges' actions are almost as exciting as the price charts. To secure a higher position on the market capitalization charts, they employ various methods to demonstrate their strength to the market—some launch a single, shocking attack, others opt for a steady pace to build trust, some directly compete in the secondary market, and still others rely on high-frequency trading to create a strong presence.

Ultimately, four distinct factions, each representing a unique approach, gradually emerged: BNB, HT, OKB, and FTT. These not only shaped the platform coin landscape in 2021 but also provided models for later entrants to emulate and even improve upon.

In that smoke-filled destruction war, BNB was the first cannon to fire.

In April 2021, Binance burned 1,099,888 BNB in a single transaction, a staggering $595 million at the time, setting a new record for a single burn in crypto history. This not only caused a sharp drop in the circulating supply but also demonstrated to the market the speed of profit realization. CZ then issued an even more radical signal—completing the 100 million coin burn target ahead of schedule and introducing an automatic burn mechanism to make this move sustainable and predictable. This large-scale, steady pace of activity helped BNB's price climb from $37 to $690 during that year's bull market, catapulting it into the top three globally by market capitalization.

Similar to BNB, HT's rise wasn't driven by a first wave of gains, but rather by a pattern of "altcoins rising first, followed by platform coins." In January and February 2021, funds primarily flowed into popular altcoins. Once these funds flowed back into exchange profits and platform coins, HT experienced a significant surge. From approximately 4 yuan in early January 2021, it peaked near 39 yuan in May, a nearly tenfold increase.

OKB chose a more direct approach. It eliminated the intermediate buyback process and directly purchased and burned tokens in the secondary market. This strategy was like firing a bullet directly into the price curve, reducing the opportunity for speculators to ambush in advance while also creating a significant market impact at the moment of announcement. Throughout 2021, OKB destroyed nearly 30 million tokens, sending the price from the single digits to $40, firmly securing its second-tier position.

Image source: CCTV interview video

As a newcomer, FTT clearly didn't want to lose pace to its established rivals. FTX opted for a high-frequency strategy—weekly buybacks and burns, funneling all revenue from transaction fees, leveraged token redemptions, and futures funding fees into its arsenal. This dynamic kept it a focal point throughout the 2021 bull market, with its price peaking at $85, second only to BNB and OKB. However, this model relies heavily on trading volume, and any market reversal could deplete its momentum. As expected, the exchange's collapse in 2022 brought FTT's story to an abrupt end, its decline from star to ruin.

The firepower of the entire destruction war is concentrated in the first four months from the beginning of 2021 to spring.

From January to April, platforms such as BNB, OKB, HT, and FTT released record-breaking buyback and destruction data almost every now and then, with each transaction often reaching hundreds of millions of US dollars. Combined with the high trading volume in the bull market, the currency prices rose one after another, and market sentiment was continuously pushed to the peak.

From July to September, the pace of token destruction continued, but the scale was reduced compared to the first half of the year. Announcements were more focused on maintaining expectations, and the price reaction became milder, entering a period of stagnation. In the fourth quarter, as BTC and ETH entered a period of adjustment, exchange trading volume declined significantly, and the scale and frequency of token destruction decreased. The news effect no longer drove a strong upward trend for platform tokens, and the popularity quickly subsided.

Ultimately, this nearly year-long arms race not only left a precipitous peak and trough on the price curve, but also reshaped the landscape of exchange-denominated tokens. BNB, with its dual advantages of power and pace, firmly established itself as the undisputed leader; OKB, with its robust mechanisms and decisive execution, firmly held a second-tier position. While FTT, once unrivaled during the bull market, collapsed in 2022 due to its over-reliance on trading volume and external factors, becoming a cautionary tale in the history of exchange-denominated tokens.

The aftermath of this battle continues to this day, and it also provides a sober footnote for those who come after them - in the world of platform coins, you must be able to afford to burn, and more importantly, you must survive long enough.

The platform coins that will skyrocket in 2025

The rise of platform coins is often not a linear climb, but a "step-by-step" jump: it seems calm at ordinary times, but once a key event is triggered (large-scale destruction, major product launch, license issuance, ecological explosion), the price will rise steeply in a short period of time, and then build a new price center on the new step.

In the past cycles, these "super-explosive" platform coins almost all have a common script:

First, lay the groundwork – lay the foundation in ecology, products, compliance, etc. in advance; then detonate – ignite the market through a large-scale action, such as the launch of BNB’s Alpha, the massive destruction of OKB, and the dual ecological closed loop of BGB; then expand by taking advantage of the momentum – continuously release new positive news at new high prices to maintain popularity and capital inflow.

In 2025, we can see that BNB, OKB, and BGB are all interpreting this logic in their own way.

1. BNB

From approximately US$250 at the beginning of 2023 to over US$800 in 2025, BNB has more than tripled in two years.

The main trend of this round of rise was largely triggered by Binance Alpha.

Over the past six months, Binance Alpha has become the largest trading platform in the cryptocurrency world. On the Alpha page, users can participate in early-stage project IDOs by completing tasks, staking BNB, and more, with the opportunity to enter a token lottery before the project launches. The monthly returns retail investors can earn from this platform far exceed the average salary of a white-collar worker.

However, Alpha is not an isolated product. It connects the entire BNB Chain’s on-chain operation scenarios: Alpha not only provides tasks and lottery opportunities, but also serves as a traffic entrance to guide users to explore the BNB Chain in depth.

Users have shifted from passively hoarding coins to offset transaction fees to becoming "on-chain natives"—learning to use various on-chain ecosystems like Binance Wallet and Pancakeswap for swaps, limited partnerships, lending, and even meme creation and contract trading, becoming true "BNB Chain natives." This shift in operational habits has been a key driver of BNB's growth during this cycle.

Since the beginning of 2024, BNB Chain has not only seen the explosion of core projects such as Pancake, Lista, Four.meme, and Aster at the protocol layer, but the basic indicators of the entire network have also risen simultaneously.

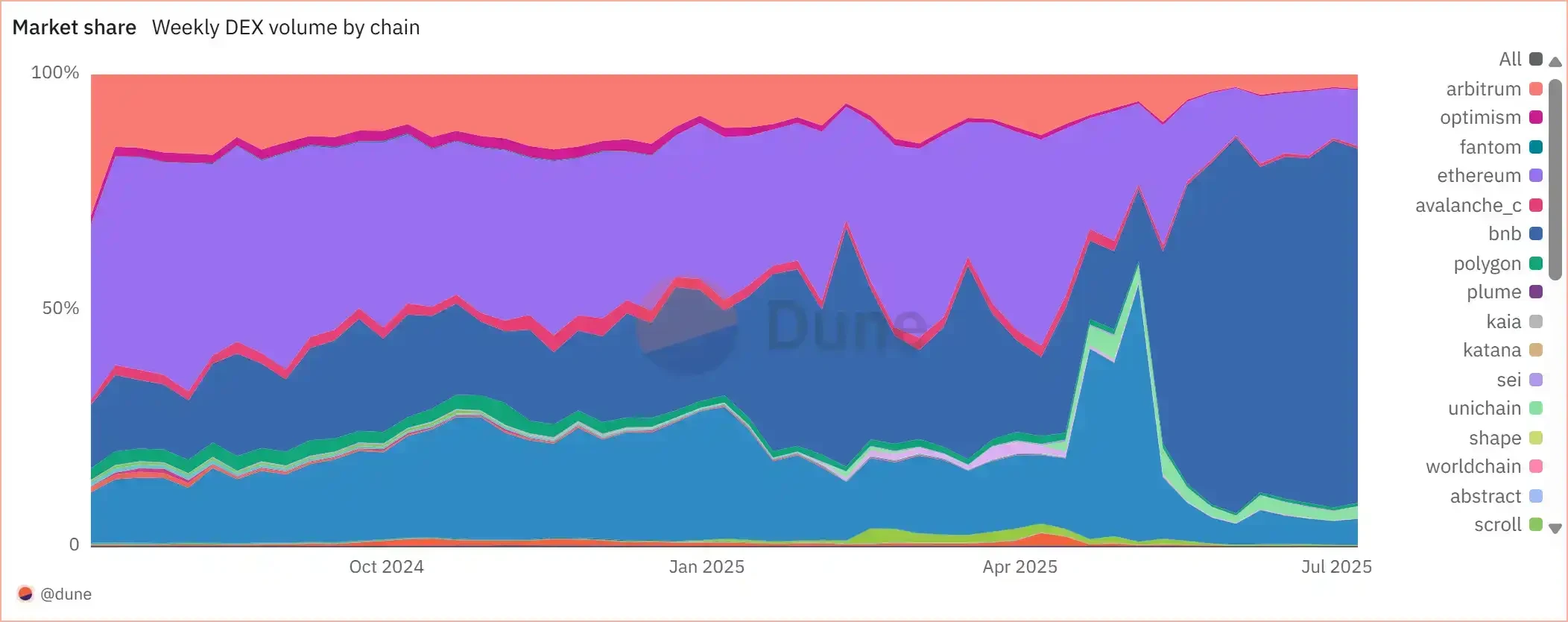

The evolution of each public chain's share of weekly DEX trading volume, with the dark blue area representing BNB Chain. Data source: Dune

This stacked area shows that BNB Chain has leapt from a "steady follower" to the public chain with the largest transaction volume over the past year. Furthermore, the Maxwell upgrade has also brought new breakthroughs. As BNB Chain's third core network upgrade this year, the block time has been further reduced from 1.5 seconds to 0.75 seconds, resulting in faster on-chain response.

To some extent, BNB has evolved from a "platform coin endorsement" to an "ecological value carrier," and has achieved absolute dominance in the multi-chain landscape.

From a broader financial market perspective, BNB has also attracted major institutions in the traditional circle to transform billions of dollars of strategic bets into on-chain reserves and capital growth, becoming a major choice for hoarding US stocks.

This evolutionary path from platform equity to ecosystem main currency and then to institutional reserve assets is the main reason why BNB has been rising over the past two years.

2. OKB

In the two years from 2023 to 2025, OKB rose from $28 to $110.

In the past two years, OKX has had two most obvious main lines: one is to strengthen the global license layout, and the other is to accelerate the construction of Web 3 tools, such as the OKX wallet.

In 2023, OKX established a subsidiary in France and a representative office in Turkey. It also secured regulatory approvals in Dubai, actively issuing reserve certificates and enhancing transparency. From 2024 to 2025, its licensing matrix rapidly expanded, securing a Singapore MAS Payment Institution License and a Dubai VARA full operating license. It also became one of the first crypto trading platforms to receive a MiCA license.

During the same period, OKX built its wallet product into a strategic core, moving from a "platform function" to a decentralized entry point: in 2022, it launched a Web 3 wallet that supports multi-chain asset management, NFT, and DApp functions. In 2023, the wallet added the "authorization history analysis" function to improve user security and controllability. The most obvious growth was during the period of Bitcoin's ecological explosion, becoming the core channel of the Ordinals trading market: in 2023, the transaction volume exceeded US$1 billion, accounting for 91.7% of the market share. Subsequently, OKX also launched the independent OKX Wallet application, which supports 130+ blockchains, with a cumulative daily transaction volume of more than US$1 billion, 500,000 new wallets added every day, and total managed assets exceeding US$44.5 billion.

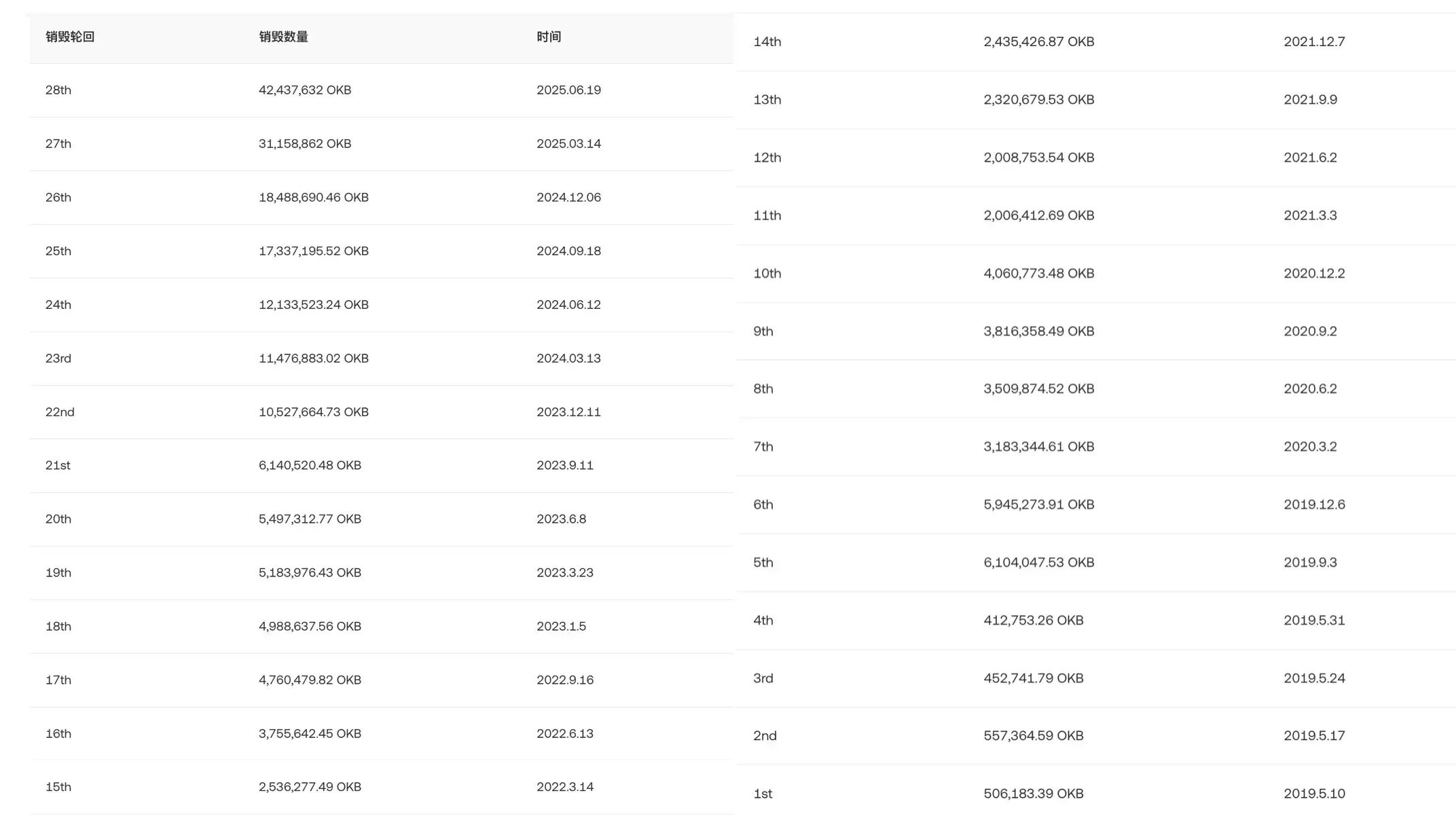

2025 was the year when OKB saw its most dramatic growth, especially with the announcement of a massive OKB burn. This was the 29th and final OKB burn in history, a massive undertaking rarely seen in the cryptocurrency world.

On August 13, OKX announced a one-time destruction of over 65 million OKBs that had been historically repurchased and reserved, and switched to using smart contracts to automatically destroy all OKBs that entered the black hole address in the future, completely stopping manual destruction.

This means that the total issuance of OKB will be permanently locked at 21 million, which is the same level of scarcity as Bitcoin.

The announcement of the "massive burn" instantly ignited the market. At 2:15 PM, OKB began its upward trend, reaching $99.27 at 2:40 PM, a 112% increase; in just 25 minutes, the price doubled. Subsequently, the bull-bear struggle intensified, and OKB continued its upward trend, reaching a high of $134 around 3:00 PM, with a maximum single-hour increase of 186%.

OKB has been burned 29 times in total

The “huge destruction” is accompanied by the X Layer upgrade, which is the “second fuse” in OKX’s public chain strategy.

X Layer is its zkEVM Layer 2 network, built on Ethereum and powered by Polygon CDK. The upgraded X Layer will increase throughput to 5,000 TPS, reduce gas costs to near zero, and enhance security and compatibility with the Ethereum mainnet.

OKB will continue to serve as the sole gas and native token of the X Layer, providing core value support for transaction fee payments, on-chain governance, and ecosystem incentives. This means that OKB's on-chain demand and external value will be further tied to the platform, transitioning from a pure CEX platform coin to a decentralized "public chain gas."

This shift can also be found in some subtle signals from the rumors of "OKX's IPO in the United States."

Trump's inauguration opened up a void for IPOs in the crypto industry, making OKX's consideration of a US IPO both unexpected and expected. On June 23rd, crypto reporter Yueqi Yang of The Information revealed that cryptocurrency trading platform OKX is considering a US initial public offering (IPO) following its return to the US market in April.

BiyaPay analysts believe this is a necessary stage in the industry's development: the past "unbridled growth" is no longer sustainable. A compliant listing is a rational choice for winning the trust of global financial institutions and users. While the involvement of regulators like the SEC will impose additional constraints, it will also drive the entire crypto industry towards transparency, stability, and capitalization.

For OKB, this will be a reshaping of its identity.

In order to reduce the restrictions imposed by US stock listing requirements on securities attributes, OKB must act as gas at the public chain level, thereby transforming into a part of the decentralized ecosystem and removing the binding relationship with CEX as much as possible.

3. BGB

From $0.20 at the beginning of 2023 to $5 in 2025, BGB has achieved an almost 25-fold increase in two years.

Bitget's strategy is closer to OKX's. BGB's rise isn't the result of a single event, but rather the continuous accumulation of platform strategies, ecosystem integration, and expansion of usage scenarios.

In 2025, Bitget's core action on platform coins will be to speed up destruction + repurchase of revenue.

In the past, BGB burns were mostly conducted quarterly, but this year they increased the frequency and used a portion of the transaction fee income to buy back BGB, which then went into the burn pool. This transparent and sustainable deflationary mechanism directly links the platform's trading activity to price expectations.

At the same time, Bitget launched a dual model: Launchpad + Staking Mining. Launchpad offers early access to early-stage projects, allowing users to stake BGB to earn quotas. Staking Mining, on the other hand, combines CEX users' asset retention with on-chain mining revenue, making BGB holdings no longer just a "hoarding coin" but a continuously generating asset.

More importantly, Bitget has also brought its own wallet into this closed loop.

After the Bitget Wallet upgrade, BGB is now interoperable with the points system. Wallet users can directly earn or spend BGB points when swapping on-chain, cross-chain, and participating in DeFi. This step extends BGB's use cases beyond exchanges, expanding the value anchor of the platform coin from a single CEX to real-world demand on-chain.

This "internal and external" approach has enabled BGB to carve out an independent path in the competition among CEX platform coins:

Internally, BGB uses Launchpad and staking to lock in liquidity, while externally, wallets and on-chain points create consumption scenarios. High-frequency burns provide value support. Judging by the price curve, BGB isn't driven by a single positive development, but rather by consistently raising market expectations through new initiatives implemented quarterly.

This seems to be the reason why among similar platform coins, BGB can maintain a high Beta in 2025 while maintaining a steady rise.

The platform currency track will not stop

Looking back at 2021, the "destruction war" used real money to create market value and shape the pattern; four years later, platform coins are still the sharpest weapon of exchanges - they can create scarcity and FOMO, and can also play a real use value in ecological expansion.

The difference is that platform tokens in 2025 are no longer simply fee discount vouchers; they are now complex assets simultaneously operating on three fronts: global licensing, on-chain ecosystems, and capital markets. The respective growth paths of BNB, OKB, and BGB are examples of this cycle of evolution.

Will this be the starting point of a new round of CEX "arms race"?

No one can give a definitive answer. But what is certain is that in this race, there is never a true truce—whoever can sustain the momentum, hold on, and run faster will be able to leave their competitors behind in the next market.

After all, in the increasingly inward-looking CEX track, what is important is not only destroying circulation to increase the price of the currency, but also the opportunities for competitors.

- 核心观点:平台币销毁或再现10倍行情。

- 关键要素:

- OKX销毁6525万枚OKB,市值数亿。

- 2021年销毁大战曾推动币价暴涨。

- BNB、OKB、BGB生态扩张支撑估值。

- 市场影响:刺激平台币板块短期炒作。

- 时效性标注:短期影响。