Original source: Animal Observation

On August 12, following Coinbase, the second crypto exchange will officially land on the New York Stock Exchange - Bullish plans to raise approximately $990 million through its initial public offering.

On the surface, this is just another routine crypto debut. The impressive IPO performance of companies like Circle and Figma over the past six months, along with Coinbase's inclusion in the S&P 500, has whetted the US stock market's appetite for crypto companies.

The debut of Bullish seems to be a continuation of this trend, and may even be the most ostentatious one. This exchange, with $3 billion in assets on its books , has not only received strong support from top investors such as Peter Thiel, Alan Howard, and SoftBank, but has also acquired the crypto media giant CoinDesk, firmly holding the industry's most influential "microphone". Its CEO, Tom Farley, was once the chairman of the New York Stock Exchange.

The strong background and halo made investors' demand for Bullish's IPO "particularly strong", causing Bullish to increase its fundraising scale from US$629 million to US$990 million on the eve of its IPO.

But beneath Bullish's impressive resume lies a past that is enough to stir up memories in the crypto world: the whereabouts of huge financing, the split between the community and capital, and an abandoned public chain - EOS.

Li Xiaolai, the "evangelist" of EOS, wrote on his WeChat Moments on August 10, 2018, "I'll look back at EOS in seven years." Ironically, seven years later, what the community saw was not the growth of EOS, but the glorious bell ringing of Bullish - a company that has nothing to do with EOS.

$4.2 billion betrayal

If I were to describe the relationship between Bullish and EOS in one sentence, it would probably be this: the former and the current, they understand each other tacitly, but it is difficult for them to sit at the same table anymore.

After news of Bullish's secret IPO filing broke, the price of the EOS token surged 17%, creating the illusion of a rekindled relationship. However, in the eyes of the EOS community, this slight increase was more like irony. Block.one, the former operator, had long since turned to Bullish, leaving EOS in its current state—and at the expense of its decline.

The story begins in 2017. Back then, the public blockchain industry was enjoying its golden age. White papers served as entry points, and visions were the ultimate fundraising tool. Block.one launched EOS with the promise of "millions of TPS and zero fees," instantly attracting a global influx of investors.

In 2018, it raised $4.2 billion through ICO, setting a new record for financing in the crypto industry, and EOS was dubbed the "Ethereum Terminator."

However, the myth crumbled faster than expected. Shortly after the mainnet launched, users discovered an insurmountable gap between reality and the white paper: transfers required staking CPU and RAM, resulting in a cumbersome process and high barriers to entry. Node elections, far from the anticipated "decentralized democracy," quickly devolved into a voting game for large investors and exchanges.

Technological defects are only superficial; the deeper cracks come from the uneven distribution of resources.

Although Block.one promised to invest $1 billion to support the EOS ecosystem, $2.2 billion of the $4.2 billion in financing was ultimately used to purchase U.S. Treasury bonds. It was also used to purchase BTC, speculate in stocks, acquire Silvergate (which went bankrupt in 2023), and purchase the Voice domain name, among other investment attempts.

The amount of funds actually flowing into the EOS developer ecosystem is embarrassingly small.

The final straw that broke the EOS community’s patience was the launch of Bullish in 2021. Block.one announced the launch of this new crypto trading platform, raising $1 billion in funding, yet it had no connection to the EOS technology ecosystem. It did not use the EOS chain, did not support EOS tokens, and did not acknowledge any relationship with EOS, not even a token of thanks.

In the eyes of the EOS community, this was a blatant betrayal: Block.one raised a huge amount of money through EOS, only to launch a new venture and make a stunning pivot. EOS was left behind, deprived of its original resources and spotlight.

Bullish raises $1 billion in financing, marking a new beginning

Bullish, which was born out of the shattered EOS dream, initially received support from Block.one with a $100 million cash injection.

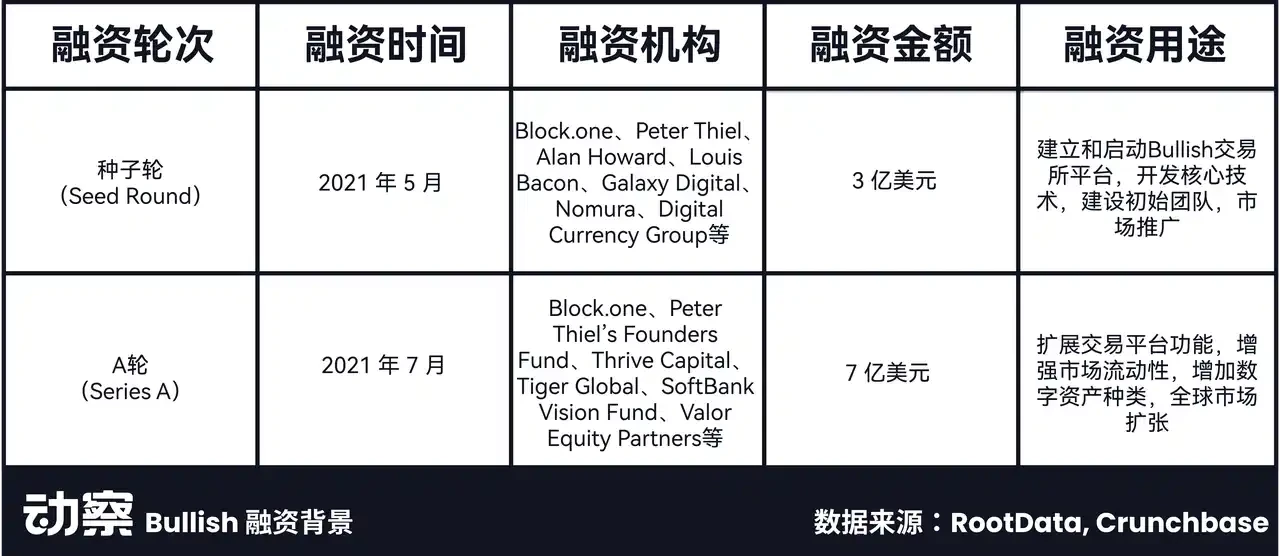

It has also attracted a number of well-known investors such as Peter Thiel and Alan Howard (investors in FTX and Polygon), as well as top venture capital firms such as Galaxy Digital, DCG and SoftBank to join the investment camp, making the lineup luxurious.

This gave Bullish an initial capital of $1 billion in its early stages, an amount far exceeding its competitor Kraken, which only had $65 million in funds in the seed and Series A rounds.

Since 2021, Bullish's core business has revolved around its exchange. Leveraging its innovative hybrid liquidity model (a combination of CLOB and AMM), Bullish is able to offer low trading spreads in high-liquidity environments while maintaining stable market depth in low-liquidity environments.

This technological innovation quickly gained favor with institutional clients, enabling Bullish to successfully become the fifth largest crypto exchange in the world.

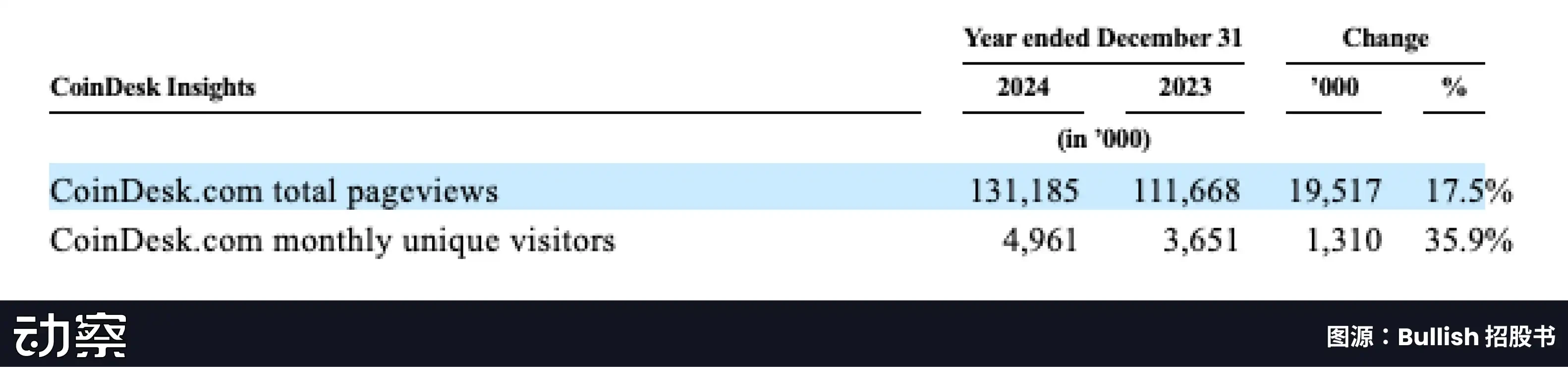

While steadily growing its exchange business, Bullish acquired CoinDesk, a leading global crypto media platform, in 2023, further consolidating its influence in the industry. CoinDesk's monthly unique visitors reached 4.96 million in 2024.

Bullish also launched CoinDesk Indices and acquired CCData in 2024, leveraging the strengths of both in data services to help its institutional clients track the performance of digital assets and provide market data insights.

Bullish has also established Bullish Capital, its venture capital arm. Through this arm, Bullish is able to invest in innovative crypto projects. These investments not only generate potential returns for Bullish but also help it maintain its industry leadership and achieve diversified investment opportunities. Currently, Bullish Capital has invested in several well-known crypto projects, including Ether.fi, Babylon, and Wingbits.

In terms of financial performance, Bullish's current revenue source is still relatively single, with spot trading revenue from its exchange accounting for 70% to 80% of its total revenue.

According to the prospectus, Bullish reported a net loss of US$349 million in the first quarter of 2025, which was mainly attributed to a sharp decline in the fair value of crypto assets such as Bitcoin and Ethereum held by the company.

In terms of other income, Coindesk's revenue has achieved significant growth. In the first quarter of 2025, CoinDesk's subscription revenue reached US$20 million, an increase of more than 100% year-on-year from US$9 million in the same period of 2024.

This growth was driven in part by $9 million in sponsorship revenue from the Consensus Hong Kong 2025 conference held in Hong Kong in February 2025.

Compared to its main competitors, Coinbase and Kraken, Bullish's revenue and profits are slightly inferior. Starting in 2022, Coinbase's revenue has almost always remained more than 20 times that of Bullish. In addition, Kraken's total revenue of $1.5 billion in 2024 is also far higher than Bullish's $214 million in the same period.

In terms of business data, Bullish's spot trading volume has grown significantly. In the first quarter of 2025, Bullish's trading volume of US$79.9 billion even slightly exceeded Coinbase.

This trading volume is comparable to that of leading exchanges, but the revenue lags significantly behind, mainly because Bullish proactively lowered the trading spread.

"The strategic measure of tightening spreads has enhanced our competitive position and captured a larger market share," according to the prospectus. In 2024, Bullish's market share in global BTC and ETH spot trading volume increased by 10% and 37%, respectively, and in 2023, it increased by 31% and 189%, respectively.

However, the prospects for this strategy of expanding market share by relying on compressed spreads are not optimistic.

On the one hand, with the gradual influx of institutional investors, the market has gradually matured, and transactions have become more concentrated on leading assets such as BTC, resulting in narrowing volatility.

On the other hand, the launch of ETFs has further intensified competition among exchanges. These changes will compress market trading spreads, further affecting Bullish's profitability and competitive advantage.

Faced with increasingly fierce market competition, Bullish's competitive strategy is similar to that of leading exchanges such as Coinbase - using the derivatives market and acquisitions to develop a secondary growth curve:

"We expect to achieve growth in the future by expanding our product offerings, particularly options products, to meet the ongoing demand from stable, high-value institutional clients. We will also continue to leverage our scale, assets, and expertise to acquire companies that fit our business lines."

A valuation of 4.8 billion, is it "low-key" or is there another plan?

The reason why Bullish has the confidence to spend huge sums of money on acquisitions in the future is largely due to the financing that went down in the history of encryption - the $4.2 billion raised by Block.one through the EOS ICO in 2018.

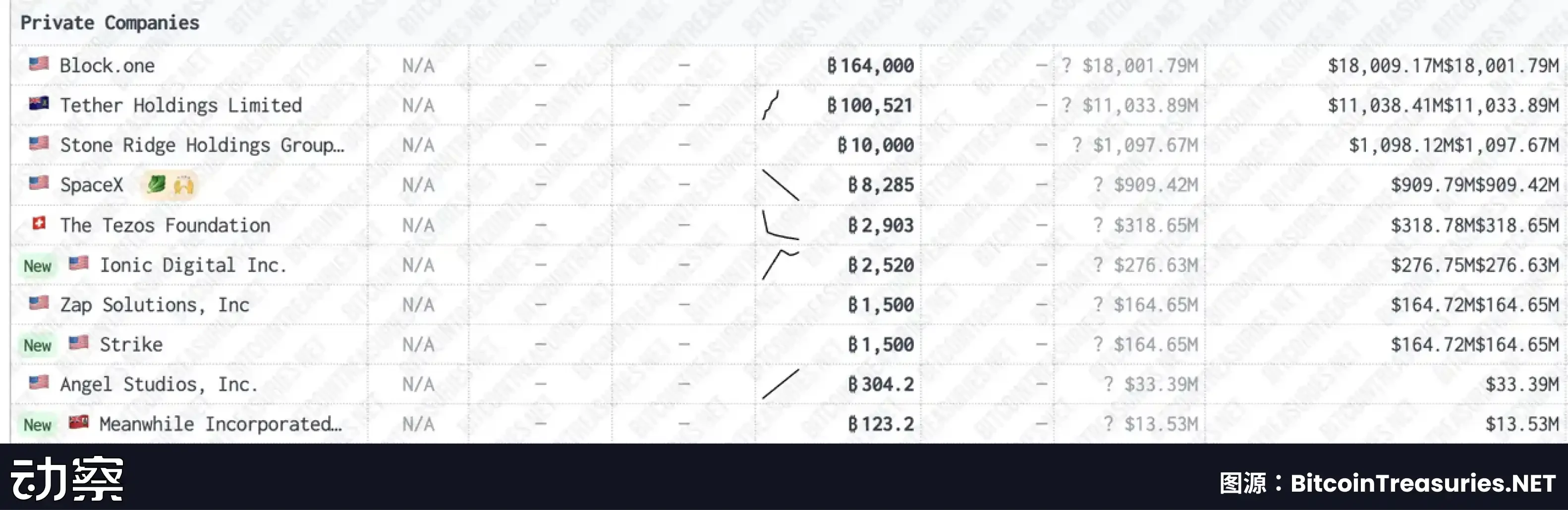

In addition to allocating a large amount of funds to stable U.S. Treasury bonds and sporadic equity investments, Block.one also purchased 160,000 bitcoins in the early days.

This move has made it the private company with the largest amount of currency in the world, holding a full 40,000 more than the stablecoin giant Tether.

Bullish's balance sheet also appears substantial: total assets exceed $3 billion, including 24,000 Bitcoin (approximately $2.8 billion), 12,600 Ethereum, and $418 million in cash and stablecoins.

In comparison, Coinbase's Bitcoin reserves in the second quarter of the same year were only 11,776, with a market value of approximately US$1.3 billion - this means that in terms of BTC holdings alone, Bullish is almost twice that of Coinbase.

This asset thickness makes Bullish somewhat "low-key" in front of its $4.8 billion IPO valuation, making it more like a digital asset reserve company rather than just an exchange.

Based on a valuation of 4.8 billion, the current premium ratio (mNAV) of this cryptocurrency stock is only 1.6. This "low-key valuation" has ignited strong investor demand for this IPO, and market sentiment is enthusiastic.

On August 11, the company significantly increased its offering plan at the last minute, raising the price range from $28-31 per share to $32-33 per share and increasing the offering size from 20.3 million shares to 30 million shares. On August 12, the offering price was raised again to $37.

Adding to the optimism, the prospectus also states that BlackRock and ARK Investment Management will subscribe for $200 million of shares at the IPO price.

But behind the enthusiasm lies another set of rules. Less than 15% of the IPO's shares are currently circulating, with the vast majority still firmly in the hands of major shareholders and early investors. Low liquidity suggests scarcity, and scarcity suggests a potential "fleet" on the first day, a highly attractive prospect for short-term investors.

As Matt Kennedy, senior strategist at Renaissance Capital, commented on the Bullish IPO: "Bankers prefer to leave some wiggle room on the valuation and raise it based on a low valuation, rather than overpricing it from the beginning and then depressing the market."

However, the flip side of low liquidity is a potential selling time bomb. Once the lock-up period ends, if major shareholders and early investors cash out, the market could easily experience a chain reaction of increased liquidity and falling stock prices.

The crypto market has seen similar scenarios too many times in this cycle.

It's also worth noting that this isn't Bullish's first attempt at capital markets. Back in 2021, at the peak of the crypto bull market, it planned to go public through a merger with the SPAC Far Peak Acquisition Corporation at a valuation of $9 billion. However, regulatory uncertainty and market volatility brought the plan to a halt in 2022.

Today, Bitcoin is once again hitting its historical high of $120,000. Crypto companies such as Circle have tested the temperature of the capital market with successful IPOs. Bullish is once again hitting the New York Stock Exchange with a valuation almost halved and a more sophisticated strategy.

Can this combination of "low valuation + tight liquidity + bull market timing" add another significant value to Block.one's already strong book assets?

However, for investors who know the story of EOS, there may be a more important revelation - don't love such a company for too long, so as to avoid the final outcome repeating the fate of the EOS community.

- 核心观点:Bullish高调IPO背后隐藏EOS资源挪用争议。

- 关键要素:

- EOS融资42亿仅少量投入生态。

- Bullish获Block.one输血10亿起家。

- IPO估值48亿但流通股不足15%。

- 市场影响:加密交易所竞争加剧,警惕资本运作风险。

- 时效性标注:中期影响。