Original author: @viee 7227, Biteye core contributor

BNB has recently experienced a remarkable structural rally. After reaching its all-time high in July, it surpassed its all-time high of $865.68 today. With numerous US-listed companies aggressively purchasing BNB as reserve assets, and with positive news such as ETF applications, BNB, once viewed as a "trading platform coin" and "public chain ecosystem token," is now evolving into an institutional reserve asset.

This market trend may not be driven by temporary hype, but rather by a revaluation and repositioning of BNB. This article will delve into BNB's path to institutionalization and the various opportunities available to retail investors.

1. Review of BNB’s “Institutional Evolution” Path

In the past two months, three major events have occurred around BNB:

- Several US-listed companies have added BNB to their reserves: Since July, several US-listed companies have announced purchases or fundraising for BNB. For example, CEA Industries, with support from Yzi Labs, plans to raise $500 million (expandable to $1.2 billion) to build the largest BNB reserve; Liminatus Pharma plans to invest up to $500 million in BNB for a long-term investment; Windtree Therapeutics has approved up to $700 million for BNB acquisitions; and Nano Labs plans to invest $1 billion to gradually hold 5% to 10% of the circulating BNB supply, having already purchased 128,000 BNB over the counter. This series of moves indicates that BNB is being viewed by some institutions as a reserve asset comparable to Bitcoin.

- ETF Trend: In early May, renowned asset management firm VanEck formally submitted its application for a BNB ETF to the US SEC, including additional benefits such as staking. If approved, BNB is expected to become the focus of the next round of crypto ETF competition, following Bitcoin and Ethereum.

- BNB price hits all-time high: Driven by the aforementioned positive factors, BNB continued to strengthen, reaching an all-time high of $865.68 on August 14. The chart below shows that since mid-July, the BNB holding weighted funding rate has continued to rise from negative to positive, with multiple spikes between July 23 and August 14 reaching approximately 0.015%–0.03% per 8 hours, rising in tandem with the price. The fact that the rate did not remain negative for a long time during the decline suggests that bulls are dominant, with both spot and leverage prices driving up prices. The upward momentum is strong and the structure is relatively healthy.

Source: Coinglass

The above events reflect BNB's institutionalization, evolving from a platform primarily dependent on the internal value of the Binance ecosystem to a new phase of active allocation by traditional institutions. With this influx of "Wall Street-style" buying, BNB's core value has a structural upward momentum, providing a more long-term and stable source of demand. For retail investors, this is a time to re-examine BNB's long-term potential and capitalize on its upward momentum through various channels.

2. Retail Investor Opportunity 1: On-chain Gameplay on BNB Chain

For retail investors, actively participating in the BNB ecosystem on the chain is an important way to gain incremental value. They can participate in the BNB Chain dividends through various means such as DeFi, RWA, and Meme.

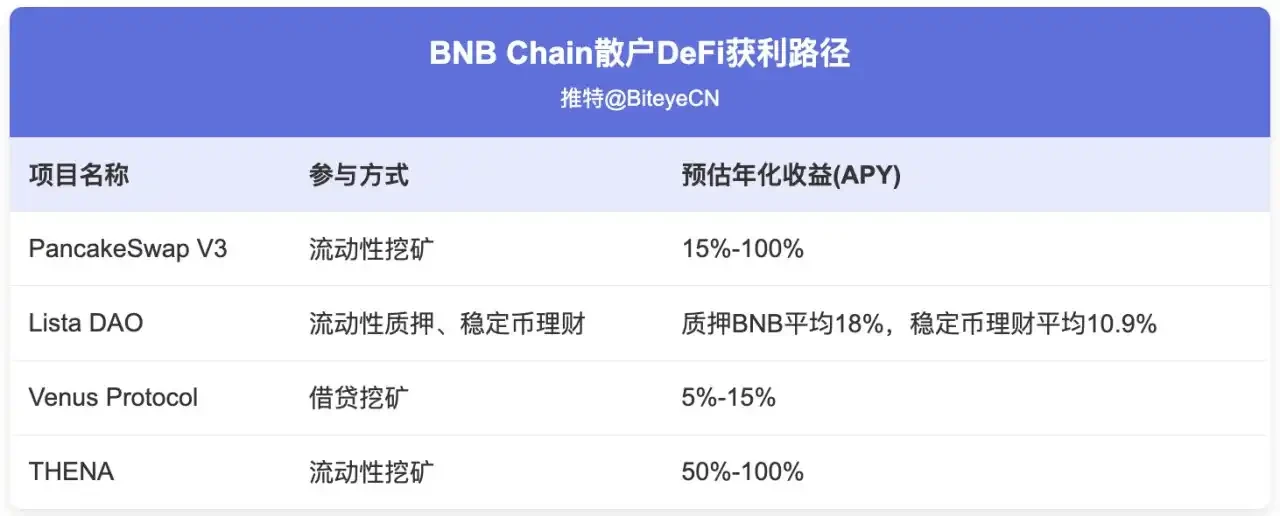

DeFi: BNB Chain's leading DEXs and lending protocols currently rank among the industry leaders in terms of TVL. For example, PancakeSwap (V3), a leading decentralized exchange, boasts a TVL of approximately $2 billion, offering liquidity pool returns across various currency pairs. Venus, a long-established lending protocol, supports lending of mainstream assets like BNB. Lista DAO also boasts a TVL of $1 billion. Retail investors can choose the right DeFi strategy based on their risk appetite (see the chart below).

RWA: BNB Chain is rapidly becoming an emerging platform for RWA on-chain. In July, Ondo Finance announced that it would integrate tokenized products representing over 100 US stocks and ETFs onto BNB Chain, enabling global users to trade selected US equity assets 24/7. Meanwhile, the xStocks program launched by Kraken and asset management company Backed will also be deployed on BNB Chain, supporting trading of over 60 US stocks and ETFs. Regarding stablecoins, the Trump family company WLFI previously chose BNB Chain to launch its first compliant stablecoin, USD 1. It has now been integrated into the BNB Chain DeFi ecosystem, establishing a USD 1 liquidity pool. Retail investors can more conveniently invest in US stocks, bonds, and other assets on BNB Chain, achieving asset diversification.

Meme: At the beginning of the year, a number of phenomenal meme tokens were launched on the BNB Chain, generating unprecedented market interest. If you're interested in meme trading, you can scan the chain on Four.meme, the BNB Chain's first fair meme issuance platform, to keep an eye on newly launched tokens. Of course, it's important to remember that meme trading is volatile, and with interest currently declining significantly, it's best to wait until it recovers before investing. From a market opportunity perspective, meme popularity can bring significant trading volume and new users to the BNB Chain, further driving demand for BNB and indirectly benefiting BNB holders.

Overall, the BNB Chain ecosystem is experiencing a surge in both traffic and value. For retail investors, this also means a surge in on-chain opportunities, allowing them to steadily earn returns from blue-chip DeFi projects, experiment with RWAs, and even discover emerging memes. As the core value carrier of BNB Chain, on-chain prosperity will ultimately translate into value support for BNB. Therefore, by deeply participating in the BNB Chain ecosystem, you are effectively growing alongside BNB.

III. Retail Investor Opportunity 2: Coin-Stock Resonance, "BNB Concept Stock" Hidden Strategy

Simply put, when a public company announces a significant purchase of BNB or incorporates BNB into its financial strategy, the performance of these stocks begins to correlate highly with BNB. When BNB soars, these stocks tend to rise in tandem or even outperform it, and vice versa. Therefore, if you have confidence in BNB's fundamentals, consider investing in related concept stocks before the market takes off. For example, MicroStrategy continues to buy Bitcoin. When retail investors buy MicroStrategy stock, they are indirectly betting on Bitcoin's performance, and MicroStrategy's stock price can sometimes even exceed Bitcoin's gains during the same period. Now, with the surge in institutional investors building positions in BNB, this kind of cryptocurrency-stock resonance effect is expected to be replicated.

We've already mentioned several companies planning to add BNB to their reserves (see the chart above). Their stocks are highly correlated with BNB. So how can retail investors navigate this and manage risk?

- Keep track of the timing of BNB announcements from the aforementioned companies. Stock prices often surge immediately after an announcement, increasing the risk of buying higher afterward. For example, pay attention to key milestones such as SEC filings, secondary offerings, and purchase completions. Invest in low positions before the announcement, and take profits in batches as the news materializes.

- Watch for BNB price correlation: These stocks are highly correlated with BNB prices. For example, when BNB broke through $800 at the end of July, stocks like CEA and Windtree followed suit, while conversely, their stocks also experienced some decline. Therefore, BNB prices can be used as a leading indicator. If you believe BNB is about to embark on a new wave of growth, you can increase your holdings of related stocks and wait for the resonance. However, be aware that if BNB experiences significant fluctuations, the stock market may experience even more dramatic roller coaster fluctuations.

- Pay attention to the relationship between concept stocks and Binance: Some stocks have stronger market confidence due to the involvement of Binance or CZ. Therefore, pay attention to whether the official will provide further cooperation and support for these companies, such as providing custody and strategic guidance. These signals will strengthen the market's trust in concept stocks holding BNB, thereby driving up valuations.

It's worth noting that these opportunities carry dual risks, influenced by both crypto market volatility and stock market factors (such as financing dilution). We recommend starting small, carefully managing your positions, and monitoring fundamentals.

4. Retail Investor Opportunity 3: Trading Platform Gameplay

In recent years, Binance has launched a variety of activities, including Launchpad, Launchpool, and Megadrop, with most of these activities involving BNB. In fact, leveraging the trading platform's trading strategies transforms BNB from a simple investment into a tool for generating diversified returns, allowing users to enjoy both BNB's inherent appreciation and additional income.

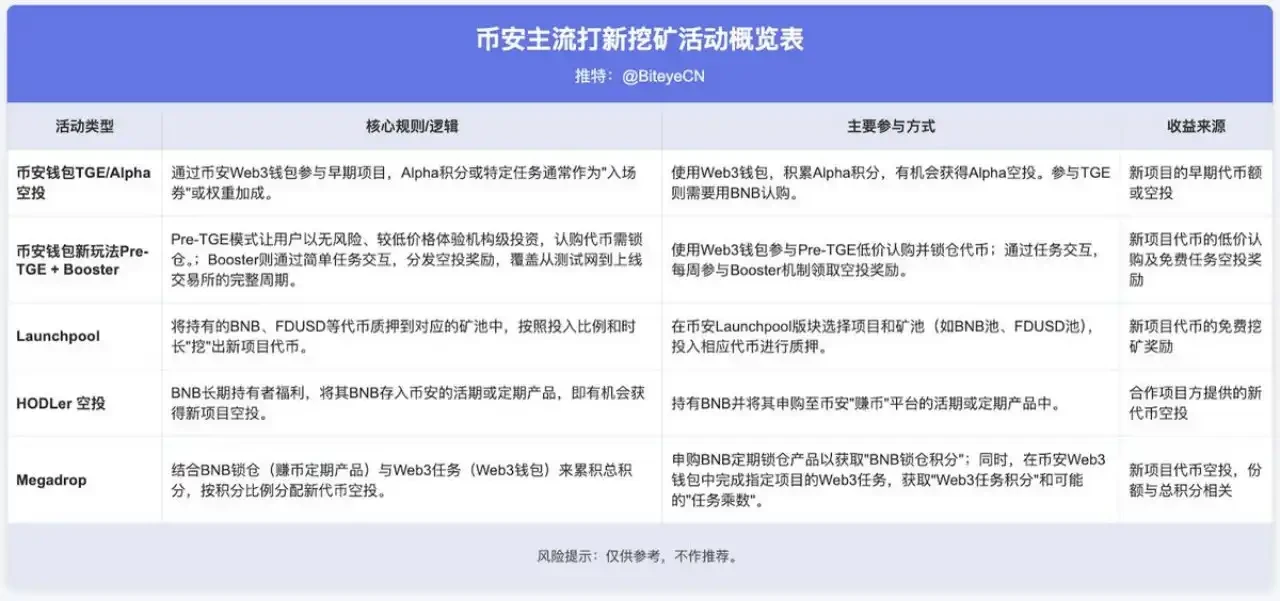

The following table summarizes several of the current mainstream Binance IPO mining activities to help you choose the appropriate way to make money based on your own situation.

You can choose a suitable strategy based on your own capital size and time investment:

Conservative Holders: If you have ample funds but prefer not to invest excessive effort, you can adopt a "BNB Holder" strategy. This involves holding a certain amount of BNB over the long term and actively participating in Launchpool and occasional HODLer airdrops. This strategy prioritizes generating new tokens from new tokens, with returns derived from both BNB appreciation and new tokens airdropped.

Active Participation: If you have limited funds but ample time and hands-on skills, you can try the "Alpha Points" route. The goal is to reach the points thresholds for airdrops/TGEs, Pre-TGEs, and Booster events. Once you complete your tasks, exit promptly to lock in your gains. It's important to consider the costs of this strategy to avoid excessive transaction fees and slippage that could make the gains outweigh the gains.

In addition to the aforementioned major activities, Binance also offers BNB holders a range of benefits, including VIP tiers, fee discounts, voting for coin listings, and Binance Pay cashback. For example, using BNB to offset transaction fees on Binance spot and futures trading offers discounts. Furthermore, BNB holders can participate in exclusive Binance Earn investment products, accumulating multiple benefits.

5. Retail Investor Opportunity 4: Holding BNB, Deflationary Bonus, and Token Economic Model

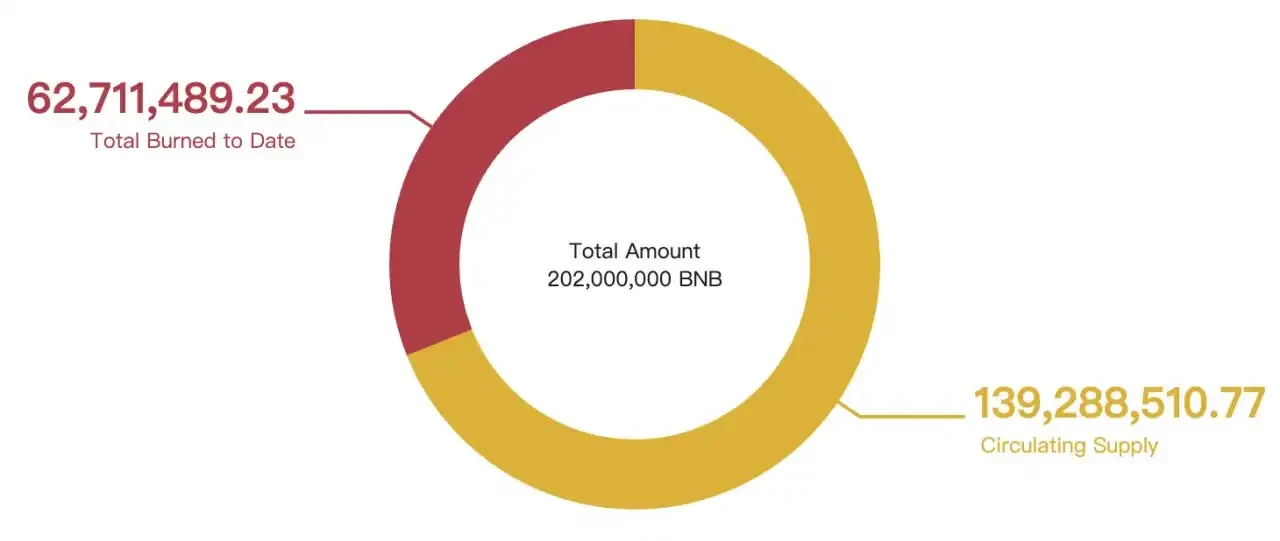

Regardless of the gameplay, most paths ultimately involve holding BNB. A key reason why many favor holding BNB is its deflationary token economics, making it the only deflationary token among the top-tier tokens by market capitalization. As of July 2025, over 60 million BNB have been destroyed (approximately 31% of the initial supply), reducing the circulating supply from 200 million to approximately 139 million. BNB is expected to reach its target constant supply of 100 million within the next few years.

Source: bnbburn.info, Binance Research

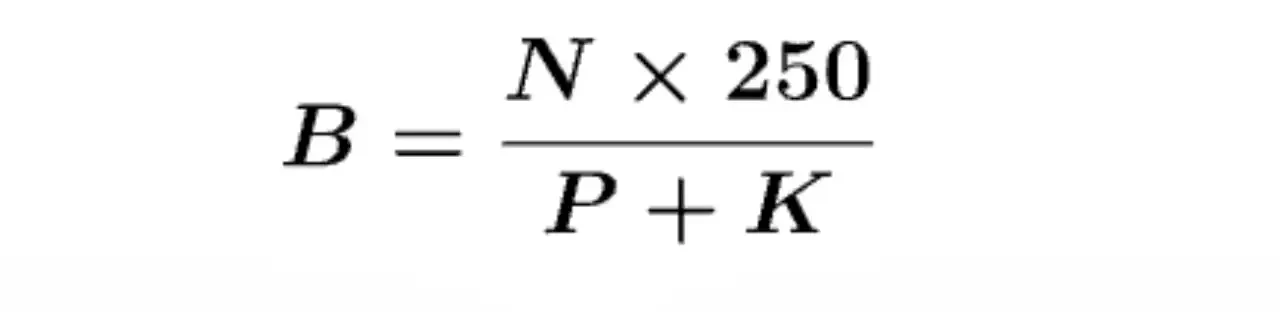

Automatic Burn Mechanism: BNB's original burn method was based on BNB trading volume on the Binance exchange. Starting in Q4 2021, a new automatic burn algorithm was introduced, dynamically adjusting based on BNB prices and the number of blocks produced by the BNB Chain. For example, in the just-completed 32nd BNB quarterly burn, a total of 1,595,599.78 BNB were destroyed, valued at approximately $1.024 billion at the price at the time of execution.

The figure below shows the formula for the automatic burn mechanism. B represents the amount of BNB to be burned during the quarter, N represents the total number of BNB Chain blocks produced during the quarter (the number is determined by the fixed block time), P represents the average price of BNB, and K is a constant (currently set to 250 after the hard fork upgrade). As can be seen from the formula, when the price is higher, the amount burned decreases, and vice versa. The essence of this mechanism is to increase deflationary intensity during market downturns, maintaining BNB's value anchor by reducing circulation; while automatically reducing the intensity of burns during market booms to avoid excessive supply tightening.

Real-time Burn Mechanism: In addition to quarterly centralized burns, BNB Chain introduced the BEP-95 protocol in 2021 to enable real-time burns on-chain. A fixed percentage of gas fees paid on each BNB Chain transaction is directly burned. The more prosperous BNB becomes, the more BNB is burned. Over the long term, increased on-chain activity will drive higher transaction volume, triggering more real-time burns.

For retail investors, BNB's deflationary nature means increased scarcity. Assuming stable or growing demand, a reduced supply will drive up the intrinsic value of each token. This is similar to a publicly traded company continually repurchasing shares, boosting earnings per share and net assets, which in turn benefits the stock price. It's worth noting that BNB's supply is committed to approximately 100 million and will not be reduced indefinitely to avoid compromising network security. Therefore, as the supply approaches 100 million, it's important to monitor whether policy adjustments, such as a shift to a constant inflation rate, are warranted. However, for at least the next few years, the deflationary trend is clear.

6. BNB Revaluation and Future Outlook

With the entry of institutions, traditional financial institutions are also changing their assessment of the value of BNB. For example, Standard Chartered Bank pointed out in a report in May this year that it expects the price of BNB to double to approximately US$1,275 by the end of 2025, and is expected to rise further to around US$2,775 by the end of 2028.

Source: Standard Chartered Bank (for reference only)

Furthermore, BNB's development in the payment sector will provide additional support for its value, further driving the market's upward revision of its valuation model. Binance's payment application, Binance Pay, has been rolled out globally, using BNB as one of its key settlement currencies. Data shows that Binance Pay has processed 300 million transactions with a total transaction volume of $230 billion, a significant portion of which was conducted using BNB. For example, in the French Riviera, Binance has partnered with fintech company Lyzi to enable over 80 local merchants to accept crypto payments, including BNB and other currencies. If this trend continues, demand for BNB will not only come from investment and trading, but also from real commercial circulation.

Overall, as of mid-2025, BNB is on an upward trajectory of revaluation. Institutional accumulation has given it the narrative of a "digital gold reserve," a thriving ecosystem has given it the narrative of a "leading public chain," and the expansion of payment systems has given it the narrative of a "practical currency." These multiple narratives have given BNB the potential to further increase its market capitalization. However, we must remain rational. Ultimately, BNB's long-term value depends on the continued development of its ecosystem, maintaining innovation and robust operations in an ever-changing market.

VII. Conclusion

From its initial origins as a platform coin and a popular public chain token to its current status as a popular crypto asset for traditional institutional investors, BNB's transformation reflects the maturity of the crypto industry. Amidst the wave of institutional investors building positions, retail investors can share in BNB's value growth through various channels, including deep on-chain participation, investing in related concept stocks, participating in trading platform events, and holding BNB. True to its slogan, "Build and Build," BNB's value will be shaped and shaped by everyone's participation. Looking ahead, driven by the combined efforts of institutional and retail investors, can BNB usher in a new golden age of innovation? Let's wait and see.

- 核心观点:BNB正从平台币向机构储备资产转型。

- 关键要素:

- 多家美股公司大举购入BNB作为储备。

- VanEck提交BNB ETF申请。

- BNB价格突破历史新高。

- 市场影响:推动BNB价值重估和需求增长。

- 时效性标注:中期影响。