Original title: "The most popular candidate for the chairman of the Federal Reserve, why is it him?"

In early August, the already turbulent leadership changes at the Federal Reserve suddenly accelerated. Governor Adriana Kugler unexpectedly resigned, and the Director of the Bureau of Labor Statistics was dismissed by Trump himself on the day the non-farm payroll data was released. Before the market could fully digest the personnel shakeup, the White House made it clear that a decision on the Fed chair would be made this weekend. On August 7, sources familiar with the matter revealed that as Trump's advisers searched for Powell's successor, Federal Reserve Governor Christopher Waller was emerging as a leading candidate for Fed Chair. Trump's advisers were impressed by Waller's willingness to base policy on forecasts rather than current data, and his deep knowledge of the Federal Reserve system.

At a recent FOMC meeting, he and Governor Michelle Bowman jointly advocated for an immediate 25 basis point rate cut, becoming one of the first two members to dissent in 32 years. This stance aligns with Trump's interest rate cut advocacy and solidifies his position as a trusted ally of monetary easing in the political game between the White House and the Federal Reserve.

The race for the Fed chairman

It is reported that President Trump has officially launched the interview process for the next Federal Reserve Chairman. The three core candidates currently locked in are: Kevin Hassett, Kevin Warsh and current Federal Reserve Board member Christopher Waller.

Hassett, currently the director of the White House National Economic Council, served as chairman of the White House Council of Economic Advisers during Trump's first term and is a staunch supporter of his economic policy philosophy. Walsh is a former Federal Reserve governor who participated in responding to the financial crisis during his tenure from 2006 to 2011. Although he has a hawkish stance, he has long had a close relationship with Trump and is quite prestigious on Wall Street. Waller is currently the candidate with the highest market attention. As a current Federal Reserve governor, he voted in favor of a rate cut at the latest FOMC meeting, and his position is highly consistent with Trump's call for easing.

According to the Fed's appointment rules, the Chair must be a current member of the Board of Governors. Current Chair Powell's term as Chair expires in May 2026, while his term as a Governor runs until January 2028. If he chooses to remain on the Board after leaving office, Trump's pool of candidates for a future Chair would be limited. Therefore, the recent resignation of Governor Adriana Kugler is seen as a crucial window. Trump has already selected Stephen Miran, Chairman of the White House Council of Economic Advisers, who has also called for interest rate cuts, as a Fed Governor. This move not only affects the path of monetary policy but also could reshape the direction of macroeconomic governance for the remainder of his term.

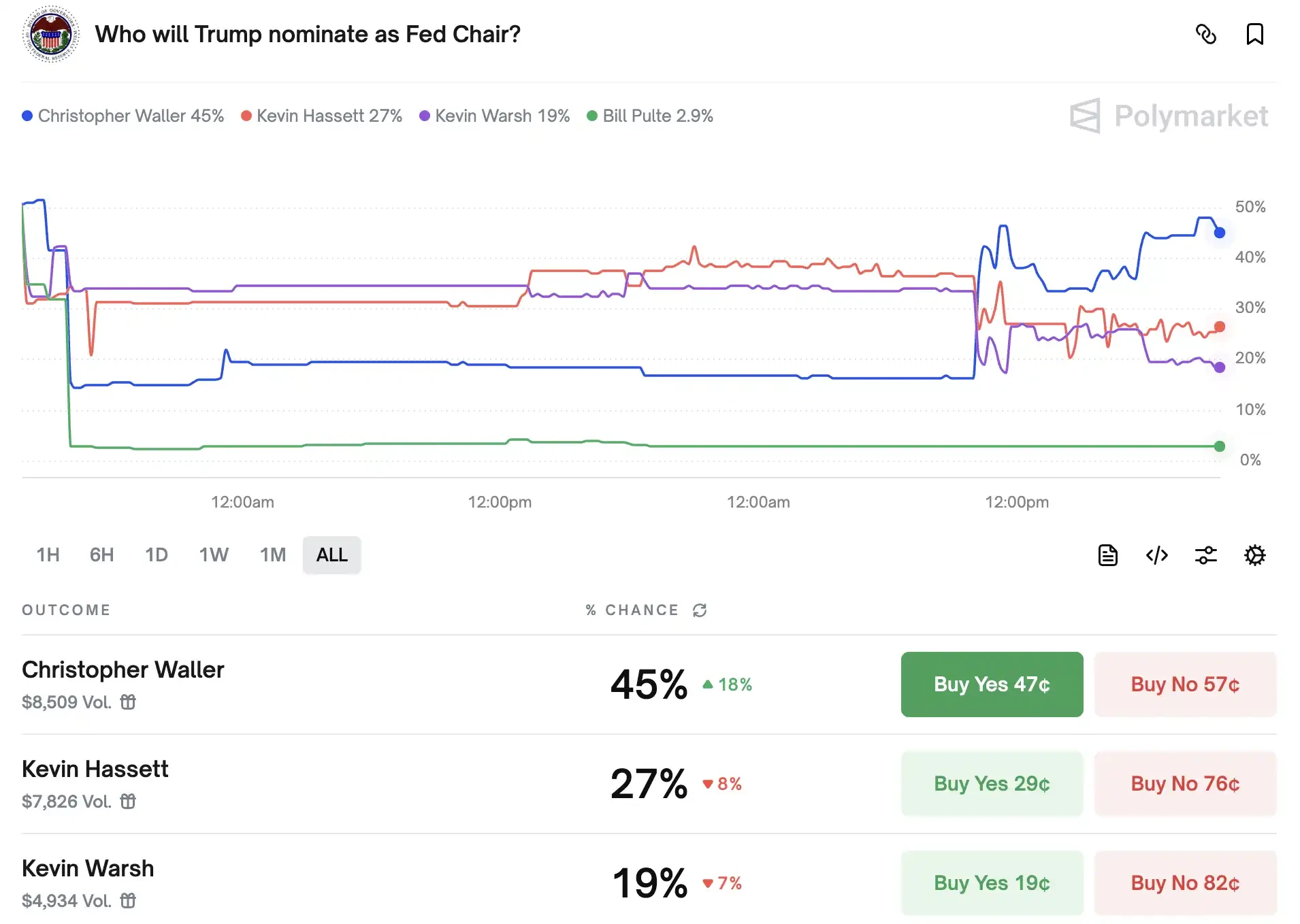

Currently, on the decentralized prediction market Polymarket, the odds between the three candidates are gradually widening: Waller's support has risen to 45%, ahead of Hassett (27%) and Walsh (19%). The market seems to be betting that this "rule-savvy, dovish" incumbent governor may be Trump's most reliable successor. It is also worth noting that newly nominated Federal Reserve Governor Milan has also praised Waller, believing him to be a suitable candidate for Fed Chairman after Powell.

Christopher Waller: A Crypto-Friendly Federal Reserve Governor

Born in Nebraska in 1959, Waller earned a bachelor's degree in economics from Bemidji State University, then pursued a doctorate at Washington State University. He subsequently taught at Indiana University, the University of Kentucky, and the University of Notre Dame, specializing in monetary theory, financial intermediation, and macroeconomic policy. He also studied European integration at the University of Bonn in Germany. In 2009, he joined the Federal Reserve Bank of St. Louis, where he led the research department for over a decade, transforming the renowned FRED database into a toolkit for the global economics community. At the end of 2020, he was nominated by President Trump to the Federal Reserve Board of Governors and a voting member of the Federal Reserve Committee, a term that lasts until 2030.

From the outset, Waller's scrutiny of crypto assets has been sober, almost harsh. He once compared most cryptocurrencies to "baseball cards"—without intrinsic value, their prices determined by a fragile balance of sentiment and confidence. Regarding such highly volatile speculative assets, he insisted that "the market bears its own profits and losses," and taxpayers should not be left footing the bill for failed investments.

However, Waller presented a different perspective on stablecoins—a forward-thinking, selective support. As early as 2021, he publicly stated that, with sound regulation and sufficient reserves, stablecoins could not only reduce payment costs and improve transaction efficiency, but could also become a tool for expanding the international use of the US dollar and consolidating its status as a reserve currency. At that time, stablecoins were still viewed by many as an adjunct to the crypto market, but Waller already saw their strategic value in the global payments system. In subsequent speeches in 2024 and 2025, he repeatedly urged Congress to legislate to prevent bank runs and payment system disruptions, ensuring that stablecoins could truly become secure "synthetic dollars."

Waller also holds a positive view on decentralized finance (Defi). At the 2024 Vienna Macroeconomic Symposium, he traced the reasons for the existence of financial intermediaries from the perspective of economics: to facilitate transactions, reduce costs, and manage risk. He then turned to DeFi—a model that utilizes blockchain, smart contracts, and distributed ledger technology to eliminate the need for traditional intermediaries. He believes that DeFi technologies can indeed bring efficiency improvements, such as 24/7 instant settlement, automated contract execution, and asset tokenization, but its core value is more of a supplement to traditional finance than a replacement. Stablecoins, distributed ledger technology (DLT), and smart contracts—tools originating from the crypto world—can fully benefit centralized systems and improve the efficiency and security of traditional markets.

Waller has consistently insisted that innovation should be led by the private sector, with the government's role being to "build the highway"—clearing infrastructure like FedNow being the lanes, and the vehicles driven by market competition. However, he also warned that the lack of regulation of non-bank payment institutions and decentralized platforms could lead to the accumulation of leverage, the creation of bubbles, and ultimately, a threat to financial stability.

He is both a crypto skeptic and an early discoverer of the potential of stablecoins; he can analyze the technical and economic logic of DeFi while also adhering to the Federal Reserve's bottom line of systemic security. On the balance between innovation and risk, Waller doesn't try to let one completely overwhelm the other, but rather insists on drawing a clear and enforceable line between the two—leaving a path for progress while also maintaining the responsibility of defending the dam.

Waller takes over? The Fed's next move

If Waller ultimately succeeds Powell as Fed Chair, the market may experience a distinctly different rhythm from that of Powell. While Waller's approach to monetary policy is data-driven, he tends to quickly shift to a pro-growth stance once inflationary pressures ease. He has repeatedly opposed excessive tightening on the FOMC and has readily supported rate cuts when economic data weakened. This flexibility not only helps align with the White House's fiscal stimulus and economic expansion goals, but also allows the capital market to sense the potential for a liquidity recovery during an economic slowdown.

In the areas of crypto and payment innovation, Waller's appointment is likely to bring a clearer and more predictable regulatory path. He will actively support the advancement of stablecoin legislation, allowing its safe and compliant integration into payment and financial markets. His endorsement of DeFi technology means that Wall Street and crypto platforms may gain more policy space in tokenization, smart contracts, and 24/7 settlement. In other words, a Fed led by Waller could maintain the dollar's dominance in the global financial system while leaving room for the growth of a compliant crypto ecosystem.

In the eyes of investors, such a combination not only reduces policy uncertainty, but also releases potential benefits on two tracks: one is the asset price boost brought about by monetary easing, and the other is the new market opportunities that may be brought about by the integration of encryption and traditional finance.

Summarize

However, Waller's close coordination with the White House on policy has also sparked concerns among some market participants about the Fed's independence. Critics argue that if monetary policy becomes increasingly influenced by political rhythms at critical moments, the Fed may struggle to maintain an absolute neutral position between inflationary pressures and the election cycle. This concern is echoed not only on Wall Street but also in the comments of some academics and former officials. They warn that if the market begins to doubt the Fed's independence, its credibility could escalate rapidly, further impacting the pricing of US dollar assets and international capital flows.

According to procedure, even if the president approves the nomination, Waller's appointment will still require further Senate review and confirmation. This step will not only test his congressional support but also serve as a barometer for market assessment of policy direction. Before the final announcement, investors can only price in rumors and interpretations, awaiting the next steps from the White House and Congress.

- 核心观点:沃勒或成美联储主席热门人选。

- 关键要素:

- 沃勒支持降息,与特朗普政策契合。

- 对稳定币和DeFi持开放态度。

- 市场预测其支持率领先其他候选人。

- 市场影响:或推动宽松政策与加密监管。

- 时效性标注:中期影响。