Original | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

Trump Media & Technology Group (TMTG) recently released its Q2 2025 financial report, showing a net loss of $20 million, of which approximately $15 million was due to legal fees related to its merger with a special purpose acquisition company (SPAC). As a result, the company's stock price fell 3.8%.

However, behind this seemingly stressful financial report, there is actually a hidden secret: TMTG is quietly promoting a key strategic transformation - from a social media platform to a high-risk, high-leverage crypto-fintech company, and its core weapon is Bitcoin and crypto-financial business.

Starting from a social platform: TMTG's political genes and traffic starting point

Founded by US President Donald Trump in February 2021 and headquartered in Sarasota, Florida, TMTG positions itself as a "free expression" platform that counters content censorship by large tech companies. Its core product, Truth Social, emerged in the aftermath of the 2021 US Capitol attack, when Trump was banned from Facebook and Twitter. Targeting conservative users, the platform aims to create a platform for public opinion independent of mainstream platforms. Previously, Trump attempted to launch a personal website, but it was shut down after only a month.

In October 2021, TMTG went public through a merger with Digital World Acquisition Corp. (DWAC), a special purpose acquisition company (SPAC), under the ticker DJT. Trump, TMTG's largest shareholder, transferred approximately 115 million shares (valued at approximately $4 billion) to a trust controlled by his eldest son, Donald J. Trump Jr., in December 2024. This transfer, without selling any shares or receiving any consideration, was known as a "gift." This equity arrangement further strengthened TMTG's connection to the "Trump brand." Trump has previously stated that he will not leave Truth Social or sell his stake in Trump Media Group.

But TMTG isn't limited to social networking. Leveraging Trump's political capital and media influence, the company has gradually built a diverse ecosystem encompassing content, finance, and technology. From its streaming platform Truth+ (focusing on family-friendly and Christian content), to its planned crypto payments and utility tokens, to Truth.Fi's fintech and asset management efforts, this startup media company is attempting to blur the lines between "media" and "fintech," presenting a growth story with even higher multiples to the capital market.

TMTG's diversified strategy is inextricably linked to the political influence of its founder, Donald Trump. Truth Social is not only a social platform but also an extension of Trump's brand. However, its user base is relatively niche, its profit model is immature, and its growth strategy, which relies on Trump's personal popularity, faces uncertainty. Its investments in crypto and streaming media are intended to achieve breakthroughs in high-growth sectors.

Q2 Financial Report Interpretation: Bitcoin Strategy Drives Asset Surge

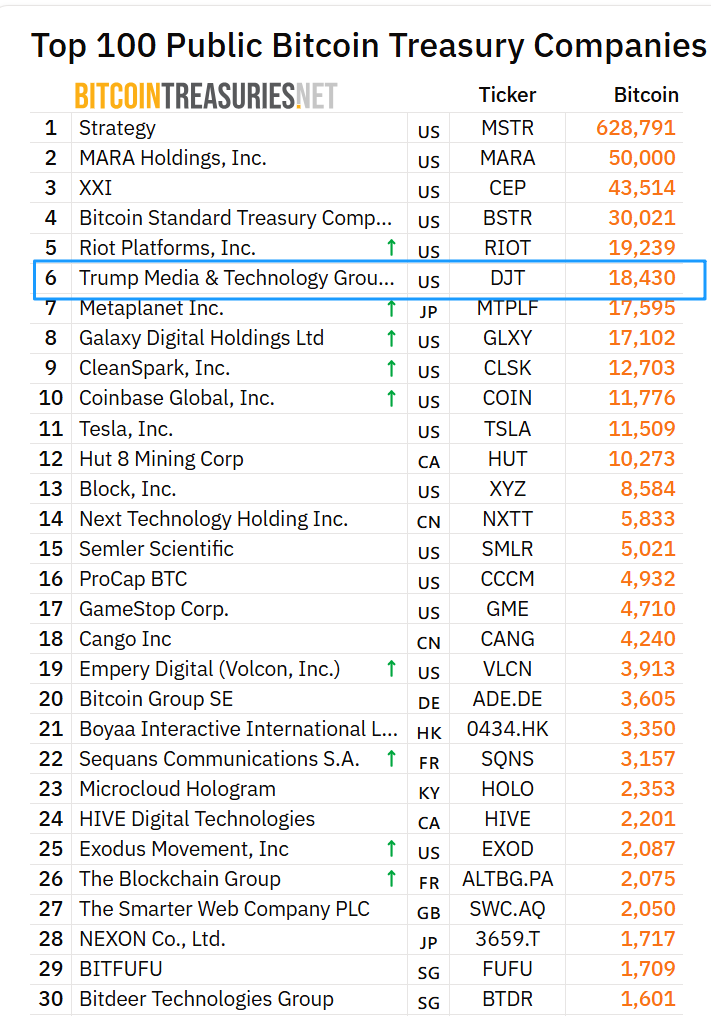

Despite significant losses, one statistic from the Q2 financial report stands out: as of June 30, 2025, TMTG's financial assets had climbed to $3.1 billion , a nearly 800% annual increase. This was primarily due to the full implementation of its Bitcoin strategy. The company raised $2.4 billion in dedicated funds for crypto asset allocation through financing, and in July held approximately $2 billion in Bitcoin assets, making it the sixth largest Bitcoin holder among publicly listed companies globally.

It is worth noting that despite the rapid growth of assets, TMTG's core revenue has remained weak. According to public data:

- In 2023, the company's revenue was $4.1 million and its losses were $325 million;

- In 2024, annual revenue fell to $3.6 million and losses widened to $400.9 million.

The massive losses in the past two years reflect significant challenges facing TMTG in its business model, user growth, and monetization capabilities. While leveraging Trump's brand recognition to attract traffic, TMTG lags far behind established social platforms like X (formerly Twitter) in terms of advertising revenue, making it difficult to attract stable advertisers and long-term investors.

To some extent, TMTG is trying to make up for the sluggish growth of its core business through the highly volatile "financial engine" of crypto assets.

In June 2025, TMTG submitted a registration application to the U.S. Securities and Exchange Commission (SEC), planning to issue over 84.65 million shares of common stock at a valuation of $12 billion, demonstrating its strong capital investment ambitions. According to the Financial Times, TMTG had previously planned to raise $3 billion through the issuance of shares and convertible bonds to increase its crypto investment. Although this was officially denied, the $2.44 billion financing and ETF registration completed at the end of May provide a realistic footnote to this strategy.

At present, TMTG has submitted registration documents for multiple ETF products to the SEC, including Truth Social Crypto Blue Chip ETF, Truth Social Bitcoin and Ethereum ETF, and Truth Social Bitcoin ETF. A financial productization offensive led by politicians is ready to take off.

Market valuation: cautious premium and market differentiation

As the valuation logic of "Bitcoin treasury companies" like MicroStrategy and Semler Scientific gradually gains market acceptance, TMTG's valuation as a "political-crypto hybrid" has also drawn attention. In a June 6th report, Greg Cipolaro, head of global research at NYDIG, noted that TMTG (DJT) and Semler Scientific (SMLR) had the lowest "equity premium to net asset value (NAV)" at -16% and -10%, respectively. When Bitcoin's price rose to $108,500 in June, MicroStrategy's stock price rose nearly 5%, while TMTG and SMLR's stock prices barely budged.

The market clearly hasn't yet fully developed confidence in TMTG's crypto strategy. This is driven by both concerns about the uncertainty surrounding its early stages of exploration and aversion to its exposure to political risk. In today's highly financialized crypto market, it remains questionable whether a highly politicized player like TMTG can escape the shadow of a "Trump concept stock" and earn recognition based on financial and asset valuations.

The offensive and defensive sides of the crypto space: From ETFs to M&A penetration

Beyond its Bitcoin treasury strategy, TMTG is expanding its presence in the crypto ecosystem on multiple fronts. The company recently signed a non-binding agreement with Crypto.com to launch a series of ETFs in the United States covering digital assets and securities. The initial products are expected to include mainstream assets such as BTC, ETH, SOL, and XRP. The company plans to expand into European and Asian markets in the future, with Crypto.com providing the underlying infrastructure and custody services.

Meanwhile, TMTG is in acquisition talks with crypto trading platform Bakkt. Bakkt, incubated by Intercontinental Exchange, and its former CEO, Kelly Loeffler, currently serves as co-chair of Trump's inaugural committee, give the potential deal a strong political dimension. Following the announcement of the deal, Bakkt's stock price soared over 162% in a single day, and TMTG's stock price also surged significantly.

Separately, TMTG's executive team has formed a new SPAC, Renatus Tactical Acquisition Corp I, aiming to raise $179 million through an IPO and private placement to acquire companies in the cryptocurrency, blockchain, secure computing, and dual-use technology sectors. Its CEO is Eric Swider, a current TMTG board member, while current TMTG CEO Devin Nunes serves as Chairman. COO Alexander Cano also has TMTG background. Renatus Tactical's leadership overlaps significantly with TMTG, potentially creating strategic synergies. It's worth noting that the Trump administration's appointments to regulatory bodies, such as the SEC and the Department of Justice, could impact the review of such mergers and acquisitions.

Currently, TMTG is attempting to break away from the singular trajectory of traditional media companies, no longer content with relying solely on monetization from social media platforms. Instead, it seeks to leverage the political momentum embodied by the "Trump" brand into capital leverage in the crypto-financial market. By increasing its Bitcoin holdings, developing ETF products, and venturing into blockchain and asset management, TMTG is deeply embedded in the high-volatility intersection of technology and finance. As the crypto narrative becomes increasingly institutionalized, this highly politicized hybrid is seizing its own niche.

- 核心观点:TMTG转型加密金融科技公司。

- 关键要素:

- Q2比特币资产激增至20亿美元。

- 计划发行多款加密ETF产品。

- 洽谈收购加密交易平台Bakkt。

- 市场影响:或推动加密市场政治化。

- 时效性标注:中期影响。