Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web 3 )

On August 4th, in a quiet yet significant on-chain vote, the Cardano community approved a core proposal, the "IOE Roadmap," which will deploy 96,817,080 ADA (approximately $71 million at the time) from the treasury to fund technical upgrades to the Cardano core protocol. The proposal received a final approval rating of 74.01% , demonstrating that within a public blockchain known for its slow governance, Charles Hoskinson's radical reform initiative has garnered unexpected support.

According to the proposal document, the grant will be primarily used in three areas: scalability improvements , developer experience optimization , and cross-chain interoperability upgrades . The underlying goal is clear: to pave the technical path for Cardano into the final phase of the "Voltaire Era." In other words, this is a comprehensive battle centered around "on-chain governance, the DeFi ecosystem, and foundational protocol iteration."

This is no small sum. In the context of a DeFi project, it's enough to support a full Layer 1 development budget for a year; in the context of Cardano itself, it's even the most significant protocol-level funding allocation to date. Of particular note: this wasn't directly allocated by the Foundation, IOG, or EMURGO. Instead, it was initiated through an on-chain community proposal and approved by the governance mechanism—a clear sign that Cardano is moving towards its long-proclaimed goal of decentralization.

But the funding vote isn't just about consensus; it's also about numerous questions. Why spend this money when the market's attention isn't focused on it? Who will oversee the use of this money? Will the funding itself trigger fluctuations in ADA's liquidity? All of these questions point to a familiar name: Charles Hoskinson , the founder of Cardano.

Since 2023, Hoskinson's style of work seems to have undergone a fundamental shift: from a "philosophical technological idealist" to a "pragmatist who proactively promotes governance reform." This $71 million grant may be a footnote to his transformation.

Was all this an accidental result of path dependence, or was it foreshadowed long ago? Let’s first return to the starting point of the proposal.

Proposal Retrospect: From Criticizing Ethereum to Building Its Own Governance

If Ethereum defines the "universal computing logic of smart contracts," then Cardano's ambition, from the outset, has been more than just code-level "intelligence." Hoskinson has long described Cardano as a more complete "institutional experiment"—not just a decentralized execution tool, but also a self-updating and self-managing on-chain public governance system. To achieve this goal, he staked his bet on the patience to repeatedly build "institutional components" from scratch, and his unwavering belief that "slow is fast."

The passage of the funding proposal wasn't a sudden move; it was a natural progression of Cardano's governance trajectory. Back in April 2024, Cardano officially announced a hard fork upgrade, called Chang , which would advance network governance autonomy in two phases. The core of these phases involved restructuring the on-chain voting mechanism, the constitutional framework, and treasury allocation authority, ultimately leading to the final phase of its roadmap, the so-called "Voltaire Era."

On a technical level, Chang's upgrade, along with proposal CIP-1694, restructures the power structure among governance participants. ADA holders will be able to delegate their governance rights to "DReps" (representative voters), SPOs (staking pool operators), and the Interim Constitutional Committee (ICC), forming a governance structure that combines three-way consultation with on-chain execution . All of this will be automated on-chain through smart contracts and the CIP roadmap, independent of the foundation or Hoskinson himself.

Image source: What to Know About the Chang Hard Fork (Cardano)

This design sounds complex, but the core logic is simple: the distribution of governance rights should match the distribution of economic interests . This is also the "true decentralization" that Hoskinson has emphasized for years: a structure that no longer relies on leaders, but instead allows token holders to lead decision-making.

But to truly transform an ideal into reality, mechanism design alone is not enough; execution capabilities, technical architecture, and governance infrastructure must keep pace. Therefore, the "$71 million allocation" is no longer just a matter of fiscal allocation; it is practically a major test of the entire system design.

Crucially, this funding wasn't a personal decision from Charles Hoskinson, but rather a community proposal and on-chain vote. This, at least from an executive perspective, demonstrates that Cardano is transitioning from "founder rule" to "institutional drive." Even if the process is long and slow, it's in some way fulfilling Hoskinson's original promise.

In an AMA in April 2025, Hoskinson again criticized Ethereum's three major structural flaws : its faulty economic model, redundant VM design, and the "parasitic" nature of L2 that undermines the value of the main chain. He also noted, "Their governance model fails to address core scalability issues and instead detracts from the value of the main chain." Cardano's response is to build its own complete public governance stack. In this structure, funds are not a weapon controlled by the founding team, but a concrete manifestation of the governing will of ADA holders. $71 million is just the first step; the ultimate goal is whether Cardano can become the crypto world's first "truly autonomous" financial protocol ecosystem.

However, this path of autonomy is not without doubts and divisions.

Controversial Views: Other Chain Criticism, Community Distrust, and the Rebuilding of Founders’ Credibility

For the Cardano community, this is not just a simple upgrade vote, but more like a test of trust in Charles Hoskinson himself - and the reason why it is tense is precisely because Hoskinson has always been the light of the project and the center of all controversy.

Back in June 2025, Hoskinson made a radical proposal during a livestream : to convert $100 million worth of Cardano (ADA) into Bitcoin and stablecoins to improve Cardano's stablecoin liquidity and boost the development of Cardinal, the Bitcoin DeFi ecosystem. He stated that Cardano's current TVL (TVL) and stablecoin size were significantly lagging behind, and that the conversion would "generate non-inflationary revenue" and build a healthier asset base.

The proposal immediately sparked controversy. Solana co-founder Anatoly Yakovenko publicly slammed the proposal as "idiotic," questioning why the project would hold Bitcoin for users instead of opting for "more rational short-term debt assets." The community was also caught in a panic over a potential sell-off in ADA, with one user bluntly asking on the forum, "Are you asking us to delegate our ADA voting so we can exchange it for something else?"

Although Hoskinson argued that the market was deep enough to absorb the selling pressure, this did little to allay concerns. Further fueling the fire, old allegations against Hoskinson were resurfaced. A transfer record of 318 million ADA from the 2021 Allegra hard fork was reexamined, raising questions about whether Hoskinson had misused the genesis key to secretly divert funds, totaling nearly $600 million. NFT artist Masato Alexander called the transfer "extremely unusual" and stated on social media that "on-chain records don't lie."

In response to the accusations, Hoskinson expressed "deep hurt" in mid-May, stating that most of the ADA had already been redeemed by the original buyers, with the remainder donated to Intersect, the Cardano governance organization. He stated, " We will release the full audit report in mid-August ," adding that he would consider having his social media handle managed by a professional team to avoid emotional responses that could cause harm.

Charles Hoskinson's previous live broadcast

This isn't the first time Hoskinson has faced public scrutiny . Back in 2022, Laura Shin, author of "The Cryptopians," accused Hoskinson of exaggerating his academic credentials and background , claiming he lacked a doctorate and had previously claimed to have collaborated with the CIA or DARPA. "It's a good work of fiction," Hoskinson responded, "but it doesn't surpass Tolkien."

These trust crises have cast the shadow of "founder intervention" on this funding event - although the funding itself was completed through on-chain governance, in the eyes of many onlookers, all decisions of Cardano still cannot avoid Charles's will.

This "binding of personality to protocol" is both the reason Cardano maintains its unity during its long-term development, and it can also become an obstacle to its true autonomy. As Hoskinson begins to experiment with delegating more authority to Intersect and on-chain voting mechanisms, he is also on the path of transitioning from "ruler" to "spiritual symbol."

Whether this transformation is thorough enough and whether Cardano can withstand the painful test of transitioning from “leadership charisma” to “institutional autonomy” will be gradually revealed in the subsequent market feedback and ecological evolution.

Market follow-up: On-chain ecological reconstruction and the formation of a pragmatic approach

Compared to controversy and emotion, on-chain data remains calm, even cold. It doesn't reflect sentiment; it simply records behavior. From a series of recent governance events and treasury allocations, we may be able to see a clear trend: Cardano is moving from conceptualization to practical execution.

This signal is first reflected in changes in asset structure. The Cardano Foundation disclosed that as of July, the total value of its crypto assets had increased to $659.1 million , with Bitcoin accounting for 15% and Cardano (ADA) decreasing to 77%. In other words, the foundation has begun to reduce its sole reliance on its native currency and shift towards a more robust asset allocation structure .

This to some extent echoes Hoskinson’s idea of “non-inflationary sources of income” and indirectly refutes the community’s concerns that the “coin swap proposal will damage ADA prices”: the reality is that they have already started doing this.

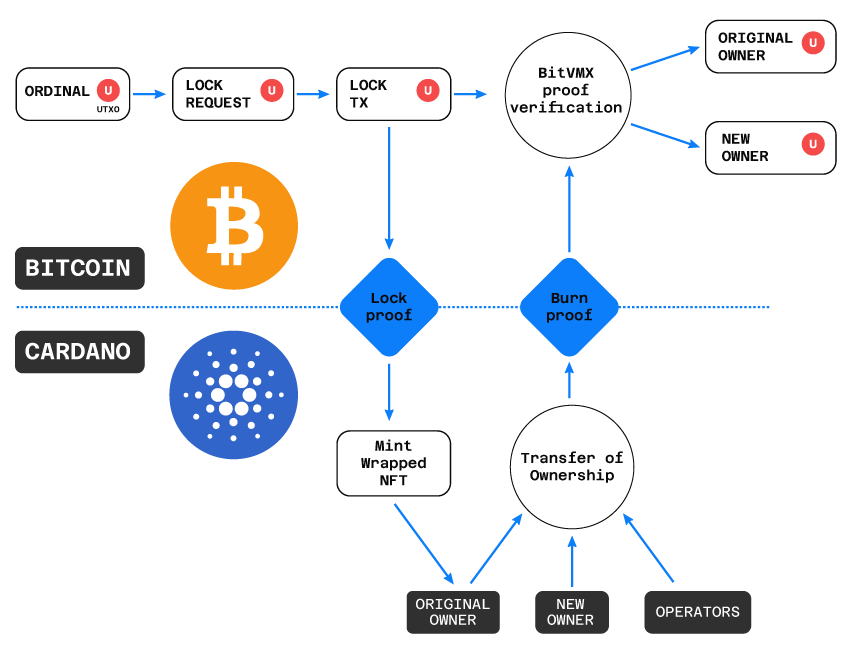

Meanwhile, Cardano's DeFi landscape is quietly evolving. In June 2025, Hoskinson announced the launch of Cardinal , a Bitcoin DeFi protocol. Based on MuSig 2 multi-signatures, Cardinal will enable cross-chain, non-custodial support, enabling BTC to participate in staking, lending, and trading operations on the Cardano chain and supporting Ordinals as collateral. The protocol will also integrate a zero-knowledge proof system to enhance liquidity and interoperability.

This marks Cardano's first technical breakthrough in providing access to Bitcoin liquidity , and also signifies a shift in its ecosystem strategy from "building a closed, academic public chain" to "embracing cross-chain compatibility with mainstream assets." In other words, Cardano is no longer attempting to carve out a niche, but is instead seeking to participate in the DeFi world dominated by Bitcoin and stablecoins.

Regarding governance, the first phase of the Chang hard fork has been largely completed, with the DRep registration channel open, the SanchoNet testnet operating stably, and Intersect implementing a member-based development collaboration mechanism . This marks the transition of Cardano's on-chain governance from framework design to implementation. Governance authority is also gradually transitioning from core development teams like the IOG to community governance and a treasury proposal system.

Across multiple metrics, Cardano demonstrates consistent adjustments from top to bottom: a more robust asset structure, a more open technological ecosystem, and a more autonomous governance mechanism. The underlying logic behind all of this is its attempt to establish an institutionally driven, long-term incentive model , truly freeing on-chain governance from the "founder's will" and moving toward institutionalized, sustainable operation.

Ultimately, the effectiveness of this transformation still needs to be observed by two key indicators: first, whether the stablecoin TVL can be increased from the current 10% to 30%-40% ; second, whether the community can continue to produce DRep governance decisions with consensus and quality.

Conclusion: Cardano’s Second Chance to Define Itself

In a sense, this is not the first time Cardano has "defined itself", but it may be the most critical one.

Back in 2017, Charles Hoskinson founded Cardano, choosing to bypass Silicon Valley, reject venture capital, and build upon academic norms to create the consensus model Ouroboros. He envisioned Cardano as a rational system that didn't rely on personalities or cycles. That was his initial self-definition: not to follow the path of Ethereum, not to cater to the DeFi craze, but to take a slow and steady approach.

Now, after the transfer of governance authority, the allocation of treasury funds, and the update of ecological planning, Cardano has entered its second stage of self-definition: no longer a "project led by Hoskinson", but as a governance structure itself, it has begun to operate independently of personal will.

From asset restructuring and integrating DeFi with mainstream assets to the advancement of CIP-1694 and Intersect's autonomous mechanisms, Cardano is shedding external labels like "symbolic chain" and "zombie chain" through a series of technological and institutional implementations. It no longer emphasizes crypto ideals, but instead chooses a slow but clear path—replacing emotions with institutions and responding to criticism with practice.

Charles Hoskinson himself has also gradually retreated behind the scenes: from CEO to system designer, he has now turned to ranching, medical care, and extraterrestrial exploration. What he left behind is an autonomous system that can be driven by representative voting and operated through treasury governance.

Funding is not the end, but rather a validation of the system's self-sustaining nature. When Cardano can one day continue to evolve without human leadership, Hoskinson's name will fade from "executor" to remain within the logic of the system itself.

This might be the "Voltaire moment" he's truly been waiting for.

- 核心观点:Cardano通过社区投票拨款7100万美元升级协议。

- 关键要素:

- 74.01%支持率通过链上治理提案。

- 资金用于可扩展性、开发者体验和跨链升级。

- 创始人Hoskinson转向实用主义治理。

- 市场影响:推动Cardano去中心化治理进程。

- 时效性标注:中期影响。