Originally from Chilla

Compiled by Odaily Planet Daily Golem ( @web3_golem )

The crypto market is expanding at breakneck speed. After years of waiting on the sidelines, traditional institutional investors are finally changing their tune. Everyone wants a piece of the crypto pie, and the market is practically being carved up by them.

But we sometimes forget that this isn't the only piece of the pie. While traditional finance (TradFi) offers far less volatility than the crypto market, with lower risk and lower returns, it may seem less attractive. But let's not forget that there's a hidden area within traditional finance that's difficult for ordinary people to access: the private equity market. Now is the time for blockchain to break this taboo.

What is the private market?

In short, the private market, and private equity in particular, refers to companies that are not listed on a stock exchange. Examples include startups, growth companies, and established companies like Anthropic, SpaceX, or OpenAI.

Most companies in the world are actually private because staying private gives them greater control, less regulation, and protection from pressure from public shareholders. While private markets are riskier and less liquid, investors also like private equity because it offers the opportunity for good returns, especially if they invest early or help a company grow.

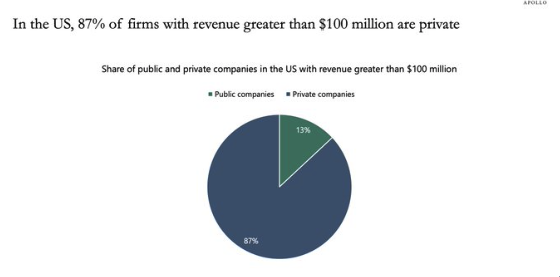

Source: S&P Capital IQ, Apollo Chief Economist. Note: Counts companies with revenue exceeding $100 million in the past 12 months.

As shown in the figure above, according to the latest data from Apollo, among US companies with revenue exceeding $100 million, approximately 87% are private companies, while only 13% are public companies.

Retail investors lack access to private markets, and even in public markets, it is increasingly difficult for them to obtain such information.

According to data from an EQT report, the number of publicly traded companies in the United States has declined dramatically over the past 30 years, from approximately 7,000 in 1996 to just over 4,000 in 2025. This decline isn't due to an overall decrease in the number of companies, but rather to a growing number of companies choosing to remain private. Meanwhile, venture capital and private equity funds have reaped high returns, investing in companies like Stripe, SpaceX, and OpenAI, which have delayed their IPOs for years or even decades.

Case Study: Amazon vs. Airbnb

Amazon was founded in 1994 and went public in 1997, just three years after its founding. At the time, it had just begun selling books online, had less than $20 million in revenue, and was not yet profitable. Its IPO valuation was approximately $438 million. However, another company, Airbnb, which remained private for over a decade, was valued at approximately $47 billion at the time of its 2020 IPO.

In this example, Airbnb’s early investors saw a 100x return on their capital, while retail investors were only able to enter after most of the value had been captured. Clearly, these markets carry higher risk, but the majority of value creation occurs in the private markets, leaving only a small portion of the growth potential for the public.

How venture capital firms manipulate IPOs to harm the public interest

The way these institutional investors maximize their profits in the public eye is simply ridiculous. Take the recent IPO of figma as an example. Figma's IPO was priced at $33 and opened at approximately $95 per share.

"Priced at $33" means the stock was sold to institutional investors at $33 before the market opened. "Opening at approximately $95" means the stock was already priced at $95 when it was publicly traded. This suggests that private investors who bought in at $33 immediately realized a near-tripling return, while retail investors who could only buy in at the opening found themselves forced to become institutional buyers.

Even Robinhood, a mainstream retail stock trading platform in the United States, only allowed a small number of users to purchase one share of Figma before its IPO. This is like giving ordinary people the opportunity to occasionally experience the benefits of "elite privilege" while maintaining restrictions on the public.

Figma's IPO price was $33, and it soared to $143 the next day, giving investors a 4.3x return in less than 24 hours. The real winners were Index Ventures, Sequoia Capital, Greylock, and other early investors.

As a retail investor, do you feel protected from participating in the private equity market?

Pre-IPO platform landscape

Given the growing interest, the number of platforms offering access to pre-IPO companies has also increased significantly. Although some traditional financial companies already offer such services, such as Hiive , EquityZen , and Forge , the mainstream trend in the future is tokenization.

Therefore, we will focus on companies that are embracing tokenization technology:

At the intersection of traditional finance and cryptocurrency, there are platforms such as:

- Republic allows accredited investors, and in some regions even retail investors, to buy shares in private companies like SpaceX or Anthropic on its Solana-based secondary market after going through a KYC process.

- Robinhood has launched trading of US stock tokens on Arbitrum and is conducting preliminary tests of pre-IPO token trading for European users only, requiring KYC.

In the crypto-native space, there are some emerging projects, such as:

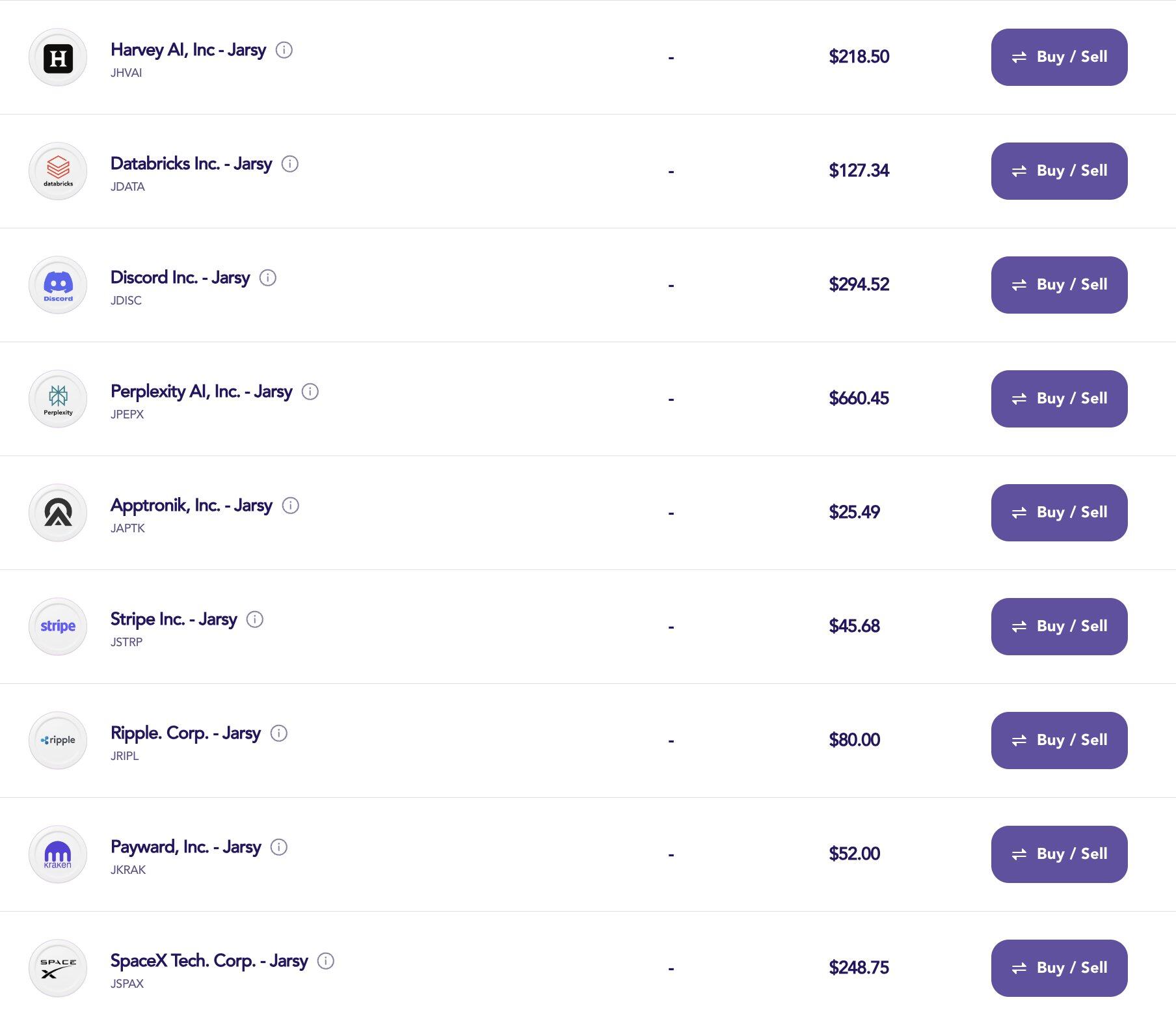

- Jarsy , which offers 1:1 collateralized tokens, replicates private equity on-chain, allowing KYC-verified investors to invest as little as $10 while always legally holding the underlying equity.

- PreStocks : After failing to find a PMF that allows users to trade pre-IPO perpetual products without holding the underlying equity, they recently turned to Solana, allowing users to trade tokens directly on Jupiter. They use an SPV (Special Purpose Vehicle) to hold shares, but this is not fully compliant (no KYC required). However, the product has not yet launched.

- Ventuals : Built on the Hyperliquid ecosystem, this project allows for pre-IPO token trading via a non-custodial order book with up to 10x leverage. No KYC verification is required, and since no one actually holds the underlying equity and only trades synthetic assets, compliance is lower.

Jarsy In-Depth Analysis

The Jarsy platform is simple to use: users deposit USD (or USDC) and convert it into JUSD, the internal currency for investing. The platform is divided into three sections: Private Equity (1:1 token collateralization), Presale (early distribution without actual ownership), and Public Equity. The Private Equity section includes companies such as Stripe, Kraken, xAI, and Perplexity.

It’s worth noting that the equity in these tradable pre-IPO companies has actually been acquired by Jarsy. Therefore, even if users are only buying the tokenized version, they are actually trading the underlying asset, which also provides economic rights similar to shareholders: for example, if the company distributes dividends, users who buy tokens will be entitled to receive the distribution.

Additionally, if the company actually goes public, Jarsy will receive shares and convert them into tradable equity tokens; if it receives cash, the proceeds will be distributed to users.

In terms of security, these shares are held by a regulated special purpose vehicle (SPV) that is separate from Jarsy, ensuring that users' assets remain safe even if Jarsy goes bankrupt. Furthermore, a reserve certificate is published on-chain for each asset.

However, given Jarsy's focus on retail adoption, the wallet uses a custodial model, and the tokens are not yet usable in DeFi. Currently, Jarsy is invitation-only, and while KYC isn't part of the cryptocurrency ethos, it's still mandatory for compliance. However, non-US users are free to invest, while US users must be accredited investors.

The focus of Jarsy’s future roadmap is to become a fully integrated DeFi platform with a non-custodial wallet and the ability to rely on combinations with other applications to acquire liquidity and users.

Summarize

We are witnessing the emergence of a whole new market segment with a huge potential market, one that is unfamiliar to most cryptocurrency users due to historically limited market accessibility.

But what is important is how this field will integrate with the DeFi field in the future, just like the situation of RWA in recent years. Sufficient liquidity is crucial, and volatility will be higher, and the risks and returns will be higher.

While there is market competition in this space, the solutions they are building all share the same goal: opening up private markets to the public.

- 核心观点:区块链将打破私募市场准入壁垒。

- 关键要素:

- 87%高营收企业为私营,散户难参与。

- Pre-IPO代币化平台涌现(如Jarsy)。

- 机构通过IPO价差收割散户收益。

- 市场影响:推动私募资产流动性民主化。

- 时效性标注:中期影响。