Original | Odaily Planet Daily ( @OdailyChina )

By Wenser ( @wenser 2010 )

In the early morning of August 6th, Sidekick, a livestreaming platform focused on the concept of "LiveFi" (translated by Odaily as "livestreaming with tokens"), announced the establishment of the Sidekick Foundation and the launch of its token, K, dedicated to supporting the development of the content creator ecosystem. Subsequently, Binance Alpha announced the initial launch of Sidekick (K) on August 8th. The news excited users who had previously participated in the project through various means, such as online livestreams and content sharing, hoping to win big. In this article, Odaily will provide a brief analysis of Sidekick's token launch and the LiveFi track.

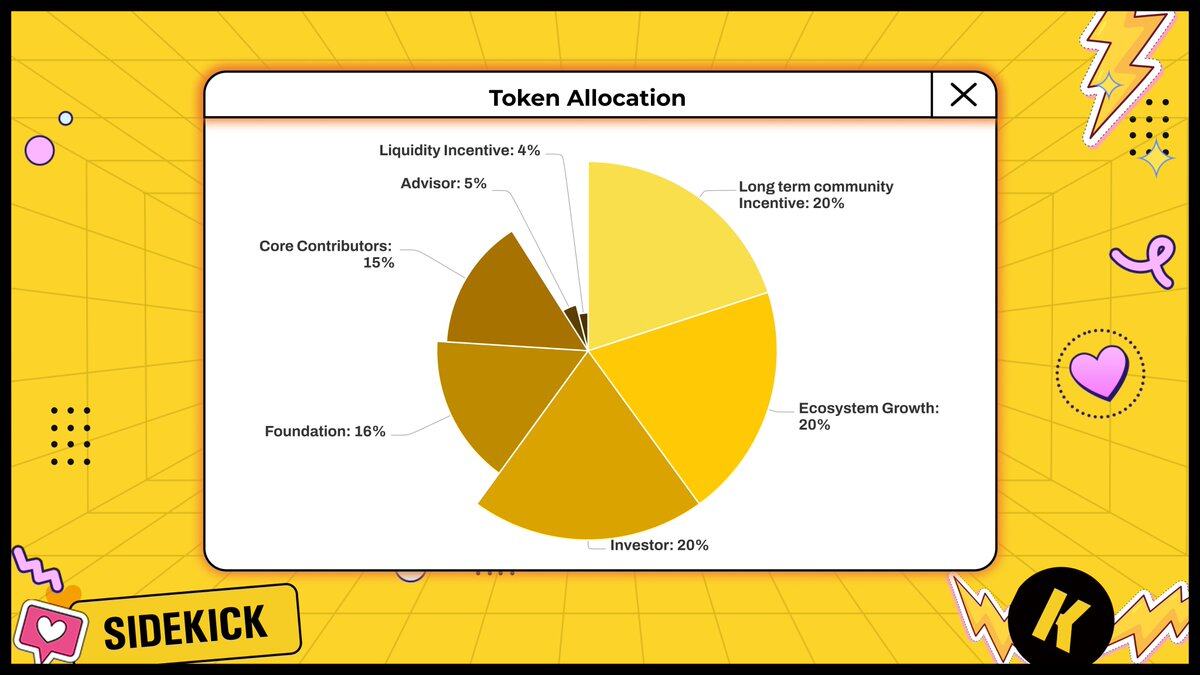

Sidekick Token Economics: Total supply: 1 billion, 20% allocated to community incentives, initial circulation: 11.13%

According to Sidekick's official announcement , the K token is the Sidekick platform's native utility and governance token, used for rewards, subscriptions, unlocking exclusive content, and participating in governance. The platform is dedicated to building an on-chain live streaming economic model centered around the concept of "attention as an asset." Specifically, the token's main functions include:

- Real-time gifting: Use K to instantly reward or send gifts to creators, and strengthen the interaction between creators and audiences based on on-chain operations.

- Premium Membership: Unlock exclusive live broadcasts, VIP chat rooms, and early token distribution; stake K tokens for more content access and privileges.

- Stake & Subscribe: Stake K tokens to boost visibility, unlock rewards, and join creator-curated loyalty programs.

- Creator monetization: Streamers can earn tokens K through tips, subscriptions, and rewards, and can initiate token threshold activities and exclusive airdrops.

- Proof of Creation Rewards: Active content creation and community growth will be rewarded with K tokens to drive the development of the creator economy.

- Governance: K token holders can propose and vote on platform upgrades, incentive models, and the future direction of Sidekick.

Overall, Sidekick's subsequent product development direction combines multiple attributes such as the paid community Onlyfans and the live streaming platform TikTok. The token K has certain consumption scenarios and also has the function of a governance token.

K Token Economics Model

Specifically, the total supply of K tokens is 1 billion, with an initial circulating supply of 111 million (11.13% of the total supply). Token distribution includes: ecosystem growth (20%), long-term community incentives (20%), liquidity incentives (4%), foundation (16%), advisors (5%), core contributors (15%), and investors (20%). Investor, advisor, and core contributor shares will be locked for 12 months, followed by a linear vesting period of 24 months. The initial circulating supply of K tokens is 111.33 million (11.13% of the total token supply), consisting of:

- Ecosystem growth (6.883%);

- Long-term community incentives (1.5%);

- Liquidity incentives (2%);

- Foundation allocation (0.75%).

In addition, Sidekick officially disclosed that after nearly four months of operation and development, the platform has evolved from its original product prototype into the "world's first LiveFi platform" - a vibrant, creator-driven ecosystem, which includes:

- Total active users: 147,000+;

- Monthly active users: 57,000;

- Number of registered anchors: over 1,000;

- Average engagement time per active user: 37 minutes.

Judging solely by user size, the Sidekick platform is relatively small, and its overall economic system is inefficient. However, judging by the average duration of active user engagement, the platform's user stickiness is relatively high. (By comparison, the average duration of engagement in Douyin's livestreams is over 2 minutes, which is already considered a good figure. Of course, the scale of the platform's creators and user base is not comparable.)

So the question is, does LiveFi really have a viable track? And can its core concept of "attention as an asset" hold up?

Can Sidekick popularize the LiveFi concept? At present, it is doubtful.

In the cryptocurrency market where narratives are rotating and concepts are flying all over the place, the concept of "XX Fi" emerges in an endless stream, from the previous DeFi, GameFi, and SocialFi, to InfoFi, which became famous this year with Kaito, and PayFi, which became popular with stablecoin payments. Being in the circle, it is no exaggeration to say that, just like the previous NFT, "everything can be Fi."

However, the establishment and continuation of a track cannot be determined solely by a made-up term, but rather depends on three criteria:

1. What is the track capacity? Simply put, can it support multiple projects or even different vertical categories?

2. How durable is the wealth-creating effect of a track? Specifically, can a track attract more liquidity through its concepts and narratives, creating a sustained wealth effect for users and the platform?

3. Does the track have irreplaceable value? In other words, do projects in this track have essential value and can meet user needs? For example, PayFi's payment needs, InfoFi's margin trading and marketing needs, etc.

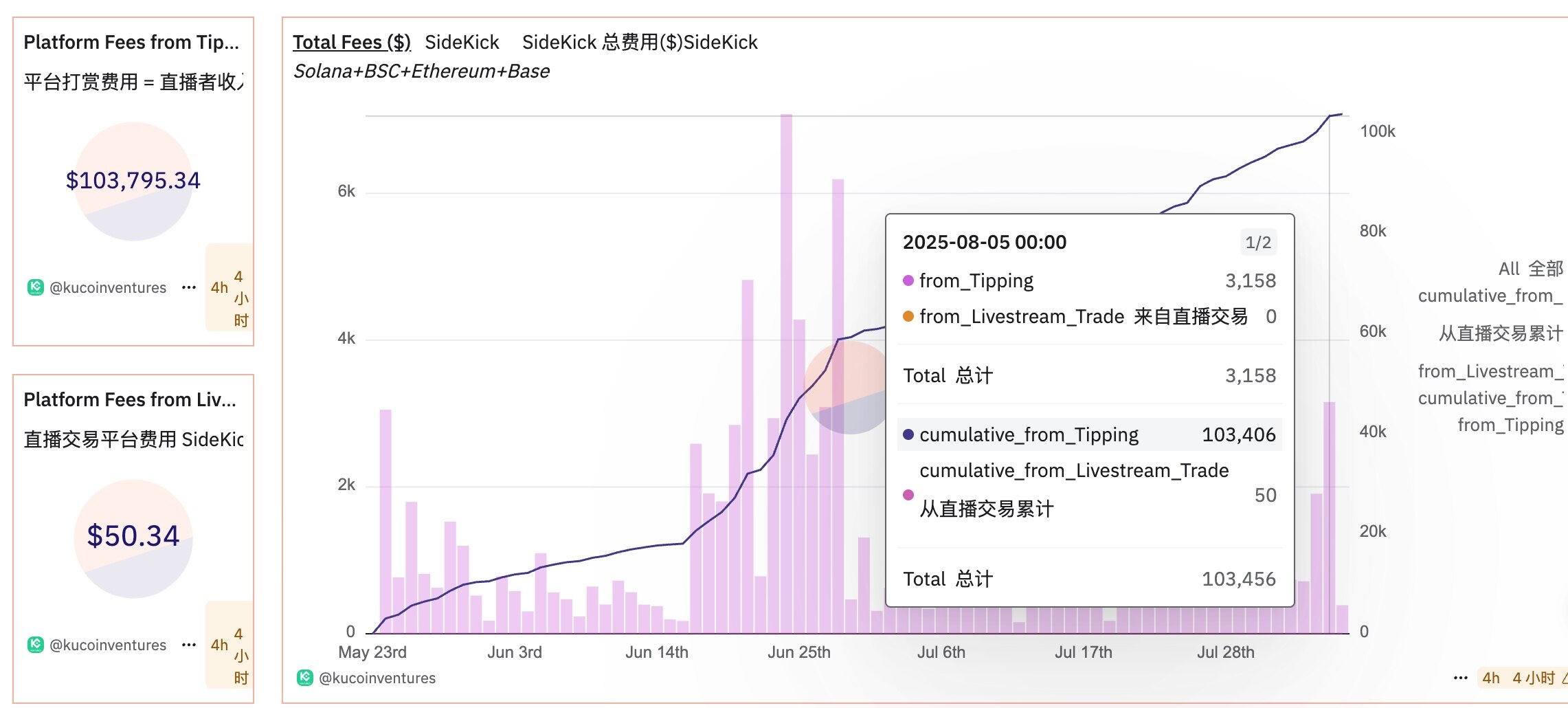

Judging from the Dune data panel , Sidekick is still in its early stages of development and can hardly serve as evidence of the continued existence of the LiveFi track.

As of August 6, the live broadcast reward fees on the Sidekick platform (live broadcaster income) were only US$103,700; on August 5, the live broadcast reward fees on the Sidekick platform were only about US$3,100.

Platform revenue chart

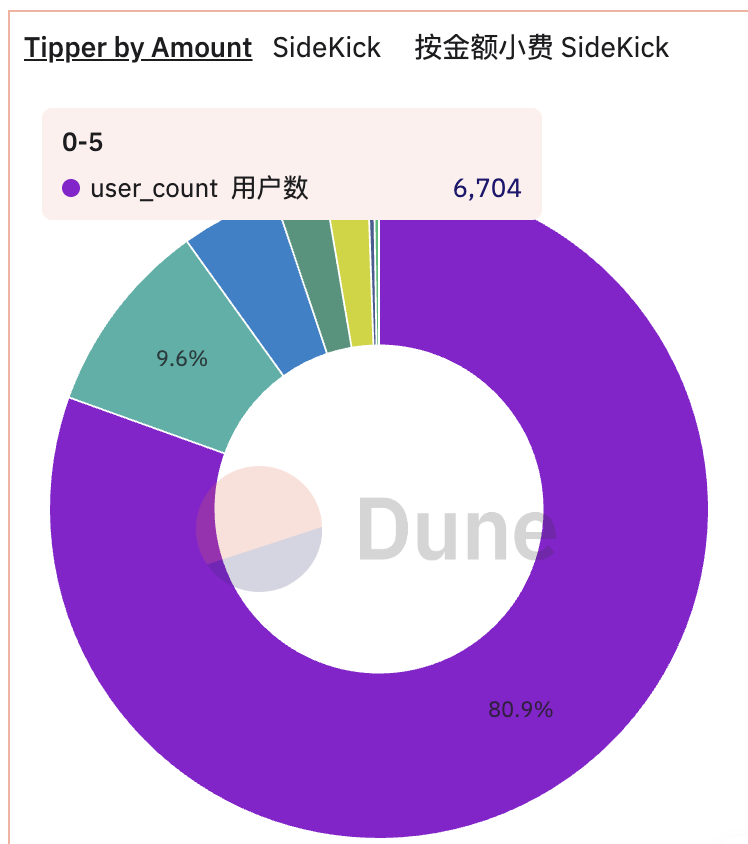

Looking specifically at the on-chain tipping user stratification model, of the approximately 8,200 tipping users, 80.9% spent less than $5. In other words, if you've tipped more than $5 on the Sidekick platform, congratulations! You've already surpassed 80% of users!

Statistics on tipping users and amounts

Furthermore, from the perspective of livestream creators, according to statistics compiled in May by X platform user Rita ( @Mimoo 1201 ), the livestream content of the top five Sidekick platform livestreamers focused primarily on interactive activities like chain scanning and trading, while lacking the true backbone of the livestreaming platform—the high-paying players at the top of the rewarding user rankings and the low-paying players who create the best atmosphere in their livestreams.

To sum up, Sidekick’s LiveFi concept is more of a hype for crypto projects rather than a new direction for the crypto track.

Of course, judging from the current information, there is often no necessary connection between project development and token price performance. Whether K token can repeat the same upward trend as B token and C token on exchanges such as Binance still depends on the willingness of the project party and market makers, as well as the market's recognition of its subsequent development path.

At that time, Odaily Planet Daily will pay attention to its specific market performance together with market users.

- 核心观点:Sidekick推出LiveFi代币K,但赛道存疑。

- 关键要素:

- 代币K总量10亿,初始流通11.13%。

- 平台活跃用户5.7万,互动时长37分钟。

- 直播打赏收入仅10.37万美元,用户付费意愿低。

- 市场影响:短期或炒作,长期需验证价值。

- 时效性标注:短期影响。