Original article by Richard Chen

Compiled by Odaily Planet Daily Golem ( @web3_golem )

In 2025, cryptocurrency will see the dawn of mainstream adoption. With the US GENIUS Act signed into law, the crypto market finally has clear stablecoin regulation, and mainstream institutions are actively adopting cryptocurrencies. Compared to the past 10 years, it's a win!

As crypto crosses the chasm, early-stage venture capital is starting to see more crypto-adjacent projects , rather than just crypto-native ones . "Crypto-native" refers to projects built by "crypto experts" for "crypto experts," while "crypto-adjacent" refers to projects that use crypto within other, larger, traditional sectors. This is the first time I've witnessed this shift in my career, and this post will discuss the key differences when building the two approaches.

Projects built for crypto-native users

To date, the most successful crypto products have almost all been built for crypto-native users: Hyperliquid, Uniswap, Ethena, Aave, and so on. Like any subculture, crypto technology is so cutting-edge that those outside the crypto-native bubble can't "get" it or become enthusiastic, daily users . Only crypto-native developers, working on the front lines, have the risk tolerance and willingness to personally test every new product, enduring the rigors of hacking, online fraud, and so on.

Most traditional Silicon Valley venture capital firms previously passed on crypto-native projects because they believed the total addressable market (TAM) of crypto-native users was too small. This was true, as crypto technology was still in its very early stages of development. At the time, there were virtually no on-chain applications, and the term "DeFi" wasn't coined until October 2018 in a San Francisco group chat.

But entrepreneurs at the time had to cling to hope, hoping that macro tailwinds would eventually arrive and significantly increase the total addressable market (TAM) for crypto-native applications. Sure enough, the DeFi summer of 2020 arrived. Liquidity mining, coupled with the zero-interest rate era of 2021, rapidly expanded the market for crypto-native applications. Overnight, every venture capitalist in Silicon Valley, driven by FOMO, flocked to the cryptocurrency space and sought advice from crypto VCs, hoping they could make up for the missed opportunities of the previous four years.

Yet, both then and today, the total addressable market (TAM) for crypto-native apps remains quite small compared to the non-cryptocurrency market. The number of crypto users on X (a prominent social media platform in the crypto space) is likely only in the tens of thousands at most. Therefore, to reach nine figures in annual revenue (ARR), the average revenue per user (ARPU) must be extremely high. This leads to the following important fact:

The core of crypto-native applications is to be built for heavy crypto users.

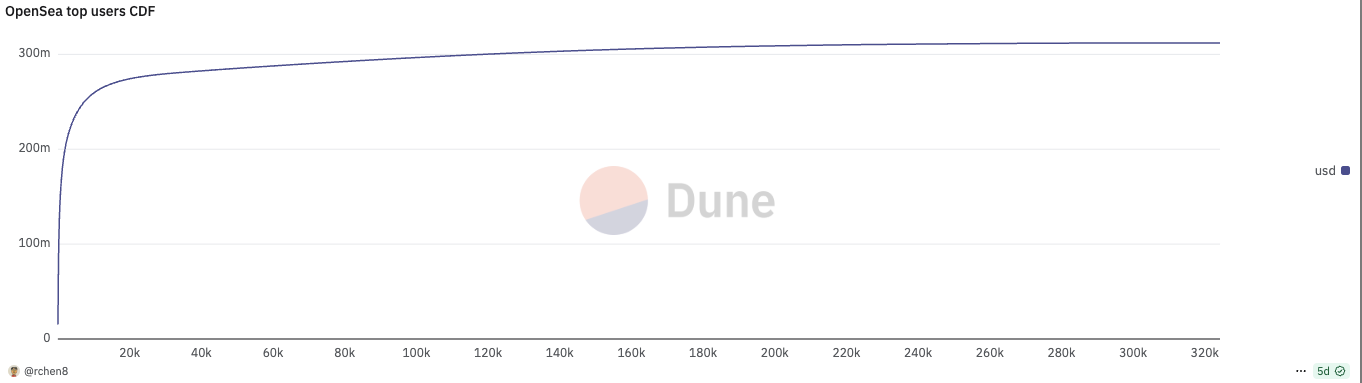

Every successful crypto-native product exhibits an extreme power-law distribution of user usage. Last month, the top 737 users (0.2% of total users) accounted for half of OpenSea’s trading volume ; the top 196 users (0.06% of total users) accounted for half of Polymarket’s trading volume .

As a founder of a crypto-native project, what should keep you awake at night is how to retain your core users, rather than attracting new ones . This goes against the traditional Silicon Valley mindset, which focuses on user growth, such as the number of daily active users (DAU).

But user retention in the crypto space has always been difficult. Core users are often profit-driven and respond well to incentives. This makes it easy for emerging competitors to emerge out of nowhere and erode your market share simply by poaching a few of your core users. Examples like Blur and OpenSea, Axiom and Photon, and LetsBonk and Pump.fun all illustrate this fact.

All of this suggests that crypto-native products are far less defensible than Web 2 , and everything is open source, making them easily copyable. Crypto-native projects come and go, rarely lasting more than a single cycle, or even a few months. Founders who become wealthy after a token offering (TGE) often quietly exit their projects and turn to angel investing as a post-retirement pursuit.

The only secret to retaining core users is continuous product innovation, staying one step ahead of the competition. Seven years later, Uniswap remains competitive by consistently rolling out innovative features that delight its core users: V3 centralized liquidity, followed by UniswapX, Unichain, and V4 hooks. Despite building a decentralized exchange (DEX), one of the most crowded and competitive sectors in the crowded and competitive crypto industry, Uniswap continues to stand out.

Building Converged Encryption Applications

Past attempts to apply blockchain technology to larger, real-world markets, such as supply chain management or interbank payments, have failed due to premature adoption. Fortune 500 companies have experimented with blockchain in their innovation labs, but haven't been serious enough to truly deploy it at scale in production. Remember those popular slogans like "Blockchain is not Bitcoin" and "Distributed Ledger Technology"?

Today, we're seeing a 180-degree shift in incumbents' attitudes toward crypto. Major banks and corporations are launching their own stablecoins. The Trump administration's regulatory clarity has opened the "Overton Window" for mainstream cryptocurrency adoption. Cryptocurrency is no longer the unregulated Wild West of finance.

For the first time in our careers, we will see more crypto-integrated projects than crypto-native projects. And for good reason, the biggest wins in the coming years will likely come from crypto-integrated projects rather than crypto-native projects, as traditional financial markets have IPOs in the tens of billions of dollars, while crypto TGEs are in the hundreds of millions to billions of dollars .

Examples of such projects include :

- Fintech companies using stablecoins for cross-border payments;

- Robotics companies using DePIN incentives for data collection;

- A consumer goods company using zero-knowledge transport layer security (zkTLS) to verify private data;

- ......

What these projects have in common is that they treat encryption technology as a feature rather than a product .

In the crypto-integrated industry, heavy users are still important, but their influence is diminishing. When crypto becomes merely a function, the success of a project becomes less about crypto itself and more about whether the entrepreneur is a deep expert in the crypto-integrated industry and understands the key factors. Let's take fintech as an example.

Fintech is all about securing distribution channels with favorable unit economics (CAC/LTV). Emerging crypto fintech startups today constantly worry that a more established non-crypto fintech company with broader distribution channels will adopt crypto as a feature, crushing them or driving up their CACs, making them uncompetitive. Furthermore, unlike crypto-native projects, they can't save themselves by issuing a token that trades well based on narrative.

Ironically, crypto payments have long been a less attractive category, but the period leading up to 2023 is a prime time to start crypto fintech companies and seize distribution channels. After Stripe acquired Bridge, we saw founders of crypto-native companies pivot from DeFi to payments, but they were inevitably killed off by former Revolut employees who were well versed in fintech techniques.

What should crypto VC do?

What does crypto-integration mean for crypto VCs? It's important not to adversely select founders who would be passed over by non-crypto VCs, as crypto VCs are often fools who don't have a deep understanding of non-crypto native industries. This adverse selection largely manifests itself in selecting crypto-native founders who have recently turned to crypto-integration.

But the uncomfortable truth is that the cryptocurrency space, in general, tends to adversely select founders who are unable to succeed in Web 2.

Historically, a good way for crypto VC founders to capitalize on arbitrage is to seek out talent outside of Silicon Valley networks. These individuals lack stellar resumes (think Stanford, Stripe) and are not adept at pitching to VCs, but they possess a deep understanding of crypto-native culture and have built a passionate online community. Hayden left Siemens' mechanical engineering department to learn Vyper and create Uniswap. Stani founded Aave (formerly ETHLend) while completing law school in Finland.

But the founder archetype of a successful crypto-integrated project is very different from that of a crypto-native project. They aren't the Wild West financial cowboys who are deeply versed in the intricacies of the crypto-native industry and able to cultivate a cult of personality around themselves and their token networks. Instead, they are likely to be more mature, business-savvy founders who may come from traditional industries and have unique go-to-market strategies for acquiring users. As the crypto industry matures, so too will the next wave of successful founders.

Inspiration for entrepreneurs of fusion crypto projects

- The Telegram ICO in early 2018 perfectly exemplified the divergence in thinking between Silicon Valley venture capitalists and crypto-native venture capitalists. Firms like Kleiner Perkins, Benchmark, Sequoia, Lightspeed, and Redpoint invested in Telegram because they believed it had the users and distribution channels to become a dominant application platform. Meanwhile, nearly all crypto-native venture capitalists passed on the platform.

- The crypto industry currently has no shortage of consumer applications. However, the vast majority of these applications are not areas venture capital is willing to support due to a lack of sustainable revenue. For these types of businesses, founders should not seek venture capital but instead bootstrap and find a path to profitability. Then, in the months before the consumer trend shifts, they can continue to capitalize on the current spending spree and print money.

- Nubank, a digital banking platform based in Brazil, had an unfair advantage because they entered the fintech space before the term was even clearly defined. Similarly, they competed for users with Brazil's incumbent banks, not with other fintech startups. Brazilians were so fed up with their existing banks that they switched to Nubank immediately after its product launch, giving Nubank the rare combination of near-zero customer acquisition costs (CAC) and product-market fit.

- If you're building a stablecoin neobank for emerging markets, you shouldn't be based in San Francisco or New York. You need to be physically present in those countries, interacting with users. That's actually a good initial screening criterion.

- 核心观点:加密项目正从原生向融合转型。

- 关键要素:

- 加密原生用户规模小但ARPU高。

- 融合加密项目利用加密技术赋能传统领域。

- 成功取决于行业专长而非加密技术。

- 市场影响:加速加密技术主流化进程。

- 时效性标注:中期影响。