Original | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

Earlier this month, leading DeFi protocol Pendle officially launched its long-awaited new product, Boros (see " Funding Rates Finally Become a Tradable Asset: How Does Pendle's Sub-Platform Boros Disrupt the Arbitrage Market? "). This product allows users to trade or hedge directly around funding rates, unlocking new gaming and revenue markets for the industry.

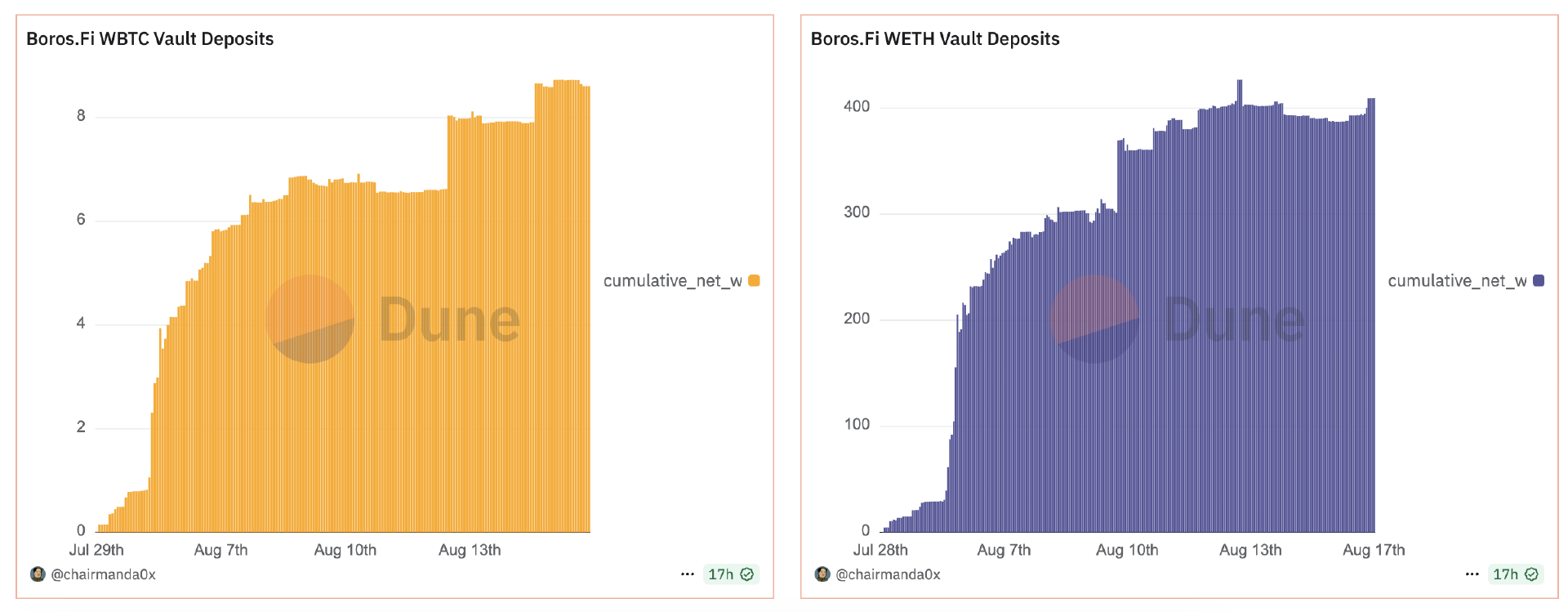

Since Boros went online, the platform's various data have achieved certain growth, and PENDLE's price has also been strongly boosted, breaking through $6 in the short term, becoming one of the most outstanding ETH Betas this month.

However, because the concept of fee-based trading is relatively new, most users remain confused about how to understand Boros and how to leverage it to generate returns. Below, we will address these questions in as much detail as possible.

Prerequisite: Understanding Funding Rates

Before understanding Boros, you need to first understand the concept of funding rate - the funding rate is a payment mechanism for periodic settlement in the perpetual contract market, which aims to keep the mark price of the perpetual contract continuously anchored to the spot price.

Funding rates can achieve price convergence by transferring funds between long and short positions. Simply put, when the rate is positive, long positions pay funding fees to short positions , and the larger the positive value, the higher the fee paid. Conversely, when the rate is negative, short positions pay funding fees to long positions, and the larger the negative value, the higher the fee paid .

For example, in the chart below, Binance's real-time funding rate is -0.0007%. This means that at this rate, BTC shorts will pay funding fees to longs at the next settlement. Since Binance settles funding every eight hours, this translates to a static APR of approximately 0.76% for longs receiving the fee.

Don't underestimate the funding rate just because it's 0.76%. The reason for this low figure is, firstly, the relatively quiet market on the day the screenshot was taken, and secondly, the inherently higher liquidity of BTC contracts. In the actual contract market, funding rates fluctuate with market sentiment, and the fluctuations can be quite significant. In particular, the funding rates of altcoins can sometimes fluctuate more dramatically than meme coins, so it's not surprising to see the corresponding static APR soar to over 100%.

Boros Basic Operations

Now that we understand the significance and utility of funding rates, let’s dive directly into Boros.

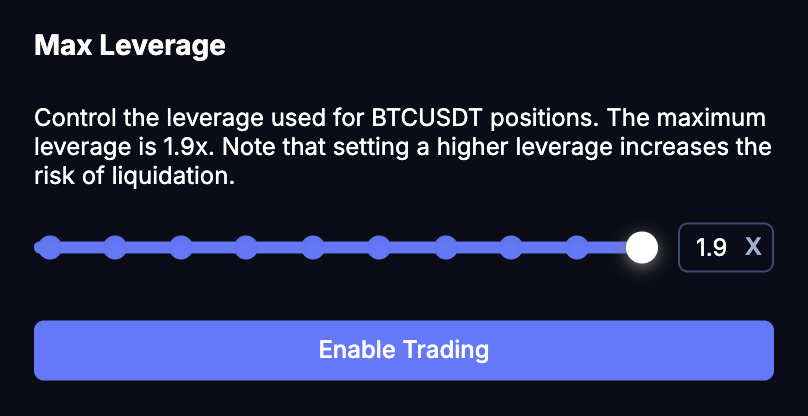

Due to the relatively early stage of the product, Boros currently only supports BTC funding rate and ETH funding rate transactions in the Binance Futures market, and the current leverage ratio is also limited, currently only supporting a maximum leverage of 1.9x.

When trading on Boros, the most important thing to pay attention to are two core concepts - Implied APR and Underlying APR.

- Implied APR refers to the APR level corresponding to the funding rate locked in at the moment you execute a transaction .

- The so-called Underlying APR refers to the APR level corresponding to the current market real-time funding rate ;

- Like the Funding Rate, both the Implied APR and Underlying APR can be positive or negative.

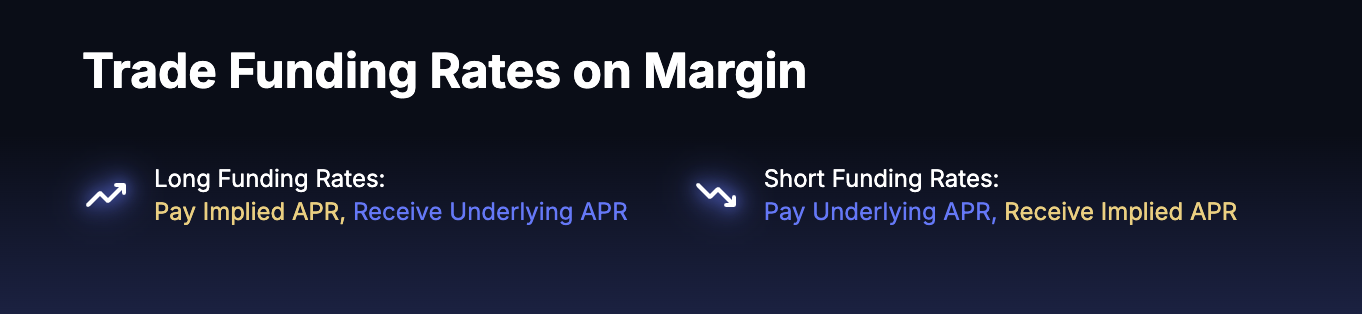

As explained on the official website below, when you go long on Boros Funding, you're actually paying the Implied APR and receiving the Underlying APR . If the Underlying APR is greater than the Implied APR, you'll achieve a positive profit. Conversely, when you go short on Funding, you're actually paying the Underlying APR and receiving the Implied APR . The Underlying APR must be greater than the Implied APR to achieve a profit.

It may sound complicated, but you can understand it in a simpler way - simply think of Implied APR as the "invoice price", Underlying APR as the "real-time price", and payment and receipt as "selling" and "buying".

In actual trading, the size of our long or short positions will be measured in YU. One unit of YU corresponds to the future returns of one underlying asset before expiration . Simply put, when you own YU, you are entitled to the returns generated by that asset before settlement. For example, 1 YU-ETHUSDT-Binance represents the funding rate income of one ETH position at expiration on the Binance ETH/USDT futures market.

Potential applications: trading, hedging, arbitrage

After understanding the basic operations of Boros, we can further explore the actual application scenarios of Boros. We roughly classify them into three directions: trading, hedging, and arbitrage.

First, let's talk about trading. This scenario is the easiest to understand. Users who are sensitive to market sentiment and funding rate fluctuations can directly go long or short on Boros . This is essentially the same as our daily trading logic, except that the trading object is the funding rate.

Hedging, which involves adjusting the funding balance of existing contract positions through flexible long or short positions , is primarily designed for institutional users who are sensitive to fees due to large positions or who require more stable bookkeeping. For example, if an institution holds a large BTC long position on Binance but incurs high funding fees at each settlement due to high fees, it can hedge a portion of these fees by going long on Boros when the fee fluctuates to a relatively low point.

Finally, let’s talk about arbitrage. This scenario can be subdivided into spot-futures arbitrage, cross-contract arbitrage, cross-platform arbitrage, etc. But to put it simply, it is to first look for potential price differences or rate differences, and then achieve "Delta neutrality" through more balanced hedging, so as to stabilize the currency and earn differential profits without being affected by the price fluctuations of the underlying assets.

Exploiting funding rates for arbitrage is nothing new. The simplest example is "buying spot (with continued staking) and shorting an equivalent contract." Because funding rates tend to be positive over time, extending the timeframe allows for positive returns from collecting funding fees. However, this strategy still suffers from unstable rates. When the rate declines or even turns negative, returns also decline, or even turn to losses. With Boros, users can short when the rate is relatively high, thereby locking in higher funding fee income.

Fees fluctuate greatly, so please be aware of leverage risks.

Since Boros is still in its early stages, there are not many actual trading options on the platform. However, because it is still in its early stages, it is more likely that Boros will have some relatively deviated quotes due to insufficient liquidity, which actually gives early users greater operation opportunities.

Finally, I would like to emphasize again that the fluctuation of funding rates may be more drastic than you think. Please be aware of the risks when intentionally using leverage.

- 核心观点:Pendle新推Boros解锁资金费率交易市场。

- 关键要素:

- Boros支持BTC/ETH资金费率交易。

- 资金费率波动大,套利机会显著。

- 杠杆风险高,需谨慎操作。

- 市场影响:拓展DeFi衍生品创新空间。

- 时效性标注:中期影响。