Original | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

This column aims to cover the current low-risk return strategies based on stablecoins (and their derivative tokens) in the market (Odaily Note: code risks can never be ruled out), to help users who hope to gradually expand their capital scale through U-based financial management to find more ideal interest-earning opportunities.

Previous records

New opportunities

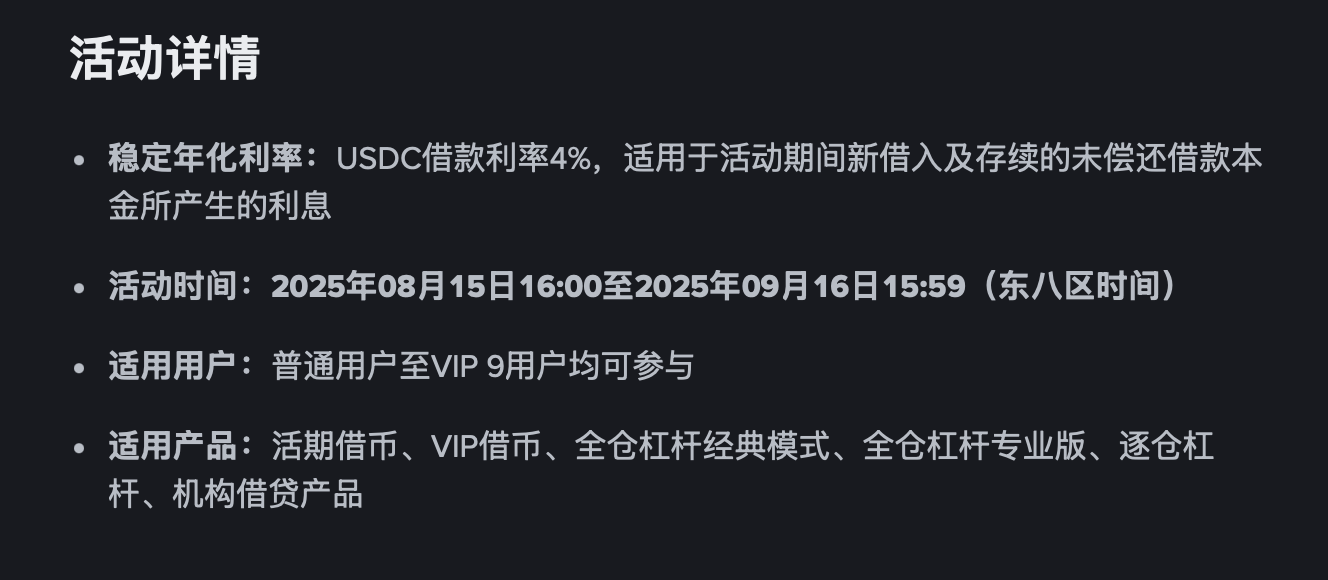

Binance Increases USDC Subsidies — Launches Loan Promotion

Following the announcement of a one-month USDC deposit subsidy campaign last week (see the article on August 12 for details), Binance announced another limited-time USDC loan promotion last week.

Specifically, during the event period (16:00 on August 15, 2025 to 15:59 on September 16, 2025 UTC time), newly borrowed or held USDC loan balances through Binance Leverage or Binance Pledge will enjoy a fixed annualized interest rate of 4%. Since the current subsidized annualized interest rate for USDC deposits is approximately 12%, this means that users can arbitrage a yield of approximately 8% by pledging other assets and borrowing USDC, and then depositing it into a current account.

OpenEden confirms airdrop ratio

On August 14, the RWA tokenization platform OpenEden announced that it will launch the token EDEN.

According to the official announcement, 7.50% of EDEN will be distributed to participants of the Bills Campaign through airdrops . The airdrop shares will be fully unlocked upon claiming, but OpenEden will introduce a lock-up reward mechanism to incentivize long-term holders. More details are expected to be announced on September 15.

At present, OpenEden's points activity is still in progress. Users can check the specific yields and points rates of various plans such as deposits and LP on the official website (portal: https://portal.openeden.com ). I personally recommend plans such as cUSDO LP (5 times points) in Pendle, cUSDO-USDC LP (10 times points) in Curve, and cUSDO deposits in Upshift (12 times points).

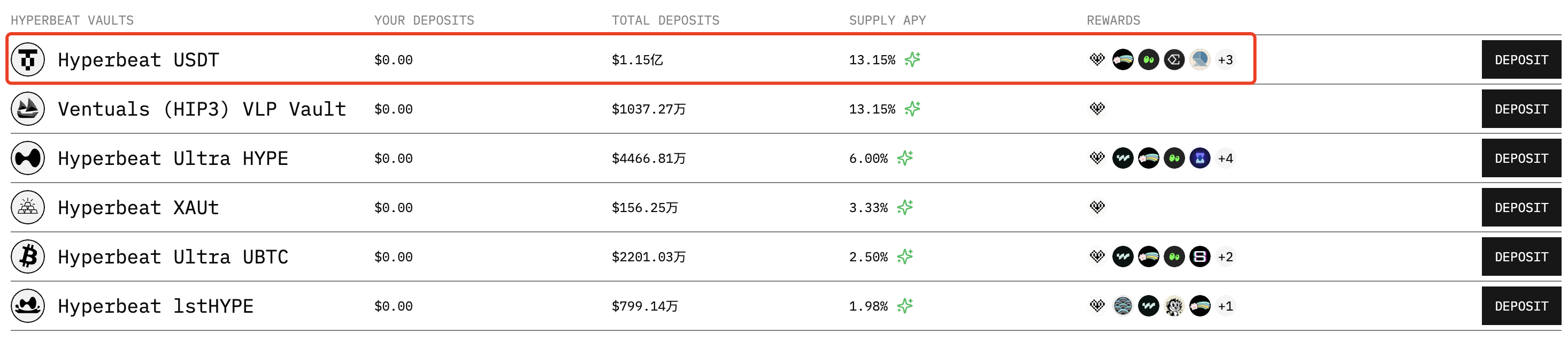

Hyperbeat raises $5.2 million

On August 15, Hyperbeat, the Hyperliquid ecosystem’s native yield protocol, completed an oversubscribed seed round of financing of US$5.2 million. Ether.fi Ventures and Electric Capital co-led the investment, with participation from Coinbase Ventures, Chapter One, Selini, Maelstrom, Anchorage Digital, and HyperCollective community supporters.

Currently, Hyperbeat has launched multiple income pools. I personally recommend depositing directly into the Hyperbeat USDT pool (portal: https://app.hyperbeat.org ). While earning 13.15% APY, you can also obtain points from projects such as Hyperbeat, Hypurrfi, Hyperswap, Ethena, Resolv, Felix, Hyperlend, and Theo.

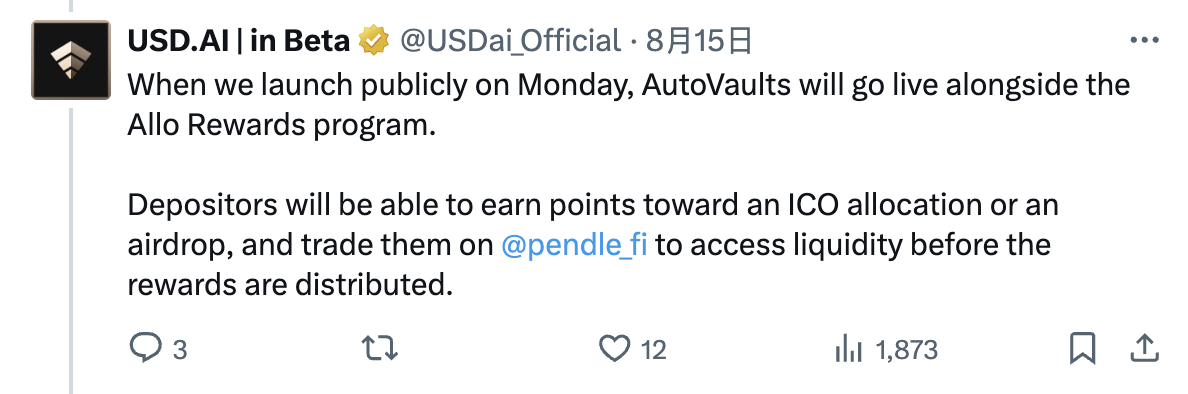

AI-powered stablecoin USD.AI raises $13 million

On August 14th, USD.AI, a stablecoin protocol providing credit for AI, completed a $13 million Series A funding round led by Framework Ventures, with participation from Bullish, Dragonfly, and Arbitrum. Developed by Permian Labs, USD.AI provides loans to AI companies using graphics processing unit (GPU) hardware as collateral. The on-chain system consists of USDai, a dollar-pegged token, and sUSDai, a yield-generating token backed by revenue-generating computing assets.

According to USD.AI’s official announcement, the project’s AutoVaults deposit pool will be launched on Arbitrum on Monday, and Pendle will also provide support. In addition to obtaining returns, deposit users can also obtain points, which will be used for IC0 quotas or airdrops.

I know that "AI stablecoin" sounds a bit abstract, but considering the good background of the investors and the early stage of the project, I still recommend controlling the funds to participate after the pool is opened.

- 核心观点:稳定币理财策略持续更新,套利机会涌现。

- 关键要素:

- 币安USDC借币利率4%,存款利率12%,套利空间8%。

- OpenEden确认7.5%代币空投,锁仓奖励待公布。

- Hyperbeat融资520万,USDT池APY达13.15%。

- 市场影响:吸引资金流入稳定币理财市场。

- 时效性标注:短期影响。