Original author: Frank, PANews

Grayscale's pace of new product launches accelerated significantly in 2025. These products are no longer primarily focused on single crypto asset trusts, but rather on a structured matrix encompassing four product types: ETFs, publicly traded funds, private equity funds, and active strategies. As the most representative category of Grayscale's exploration of crypto market targets, single crypto trusts within private equity remain a topic of interest. PANews is revisiting this topic to examine whether the "Grayscale Effect" persists and what new insights it can offer. (Related reading: A Review of 21 Grayscale Crypto Trusts: Some Have Gone Tenfold, While Others Have Slumped. Are They Likely to Catch the Last Bull Market and Become a Market Counter-Indicator? )

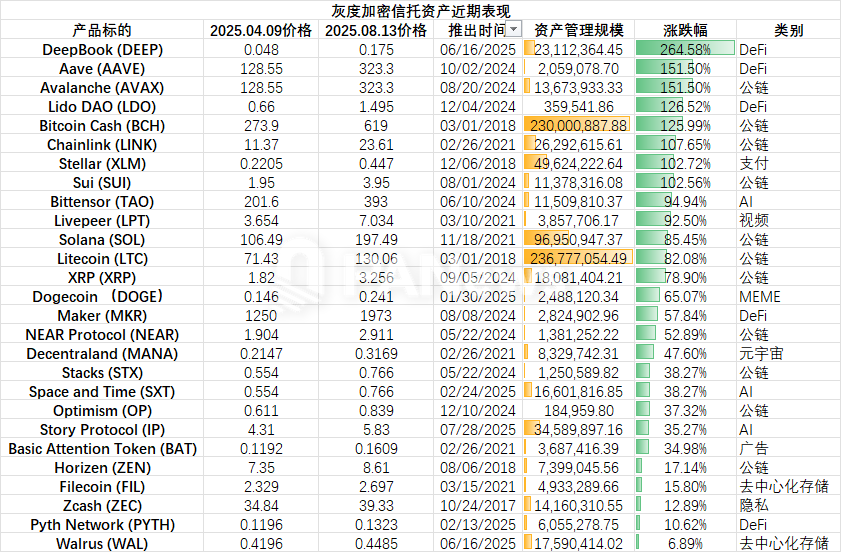

The price period selected for this survey is the closing price on April 9, 2025 (the low point of the market correction) to the closing price on August 13, 2025 (the recent high point of the market).

Grayscale Vision 2025: Deeply Cultivating AI, Sui Ecosystem, and Meme Culture

As of August 2025, Grayscale has launched six new single crypto trust products, involving the following crypto assets: Dogecoin (DOGE), Pyth Network (PYTH), Space and Time (SXT), Story Protocol (IP), DeepBook (DEEP), and Walrus (WAL).

From a narrative perspective, Grayscale's primary market narratives this year have focused on AI, DeFi, and Sui. Within the AI sector, Space and Time (SXT) and Story Protocol (IP) are two AI-related infrastructure products. Regarding the ecosystem, Grayscale's focus this year appears to be on the Sui ecosystem. Not only did it launch a private trust for the SUI token last August, but this August, it also launched trust products for DeepBook (DEEP) and Walrus (WAL), two key projects within the Sui ecosystem. It's also worth noting that Dogecoin (DOGE), Grayscale's first MEME-themed trust product, will also be listed in 2025.

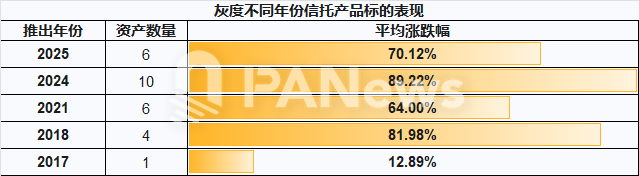

Judging from market performance, the projects launched in 2025 haven't been particularly impressive. In terms of price performance, these tokens have seen an average price increase of approximately 70% during this cycle. While outperforming BTC, this performance is still slightly lower than Grayscale's products launched in previous years. This may be because the products launched this year aren't essentially market leaders or track-leading assets, but rather represent Grayscale's investments in certain promising sectors.

Of course, from this change in choice, it can also be seen that Grayscale’s trust products are no longer simply pursuing the “barometer” of the hottest projects in the market, but have also begun to transform into a “reservoir” for exploring potential.

In terms of asset management scale, the average asset management scale of several single-asset trusts launched in 2025 is approximately US$16.73 million, which is far lower than the average of the overall data (the average scale is approximately US$32 million). On the one hand, this is because these products have been launched for a short time, and on the other hand, the market recognition of these emerging assets may not be high yet.

Grayscale Optimization Still Outperforms the Market

Recently, the overall market performance of Grayscale's trust products has been polarized. Both the best and worst performers came from the Sui ecosystem: DeepBook, with a 264.58% increase, and Walrus, with a 6.89% gain. Of the 27 trust funds surveyed, eight saw gains exceeding 100% during the statistical period, and 16 saw gains exceeding 50%, for an average gain of 75.47%. In comparison, BTC saw a 56.5% increase over the same period, making Grayscale's chosen assets significantly superior. Compared to the average for all tokens (Binance spot trading pairs during the same period), the average gain was approximately 59.8%, a clear advantage.

From this perspective, although the "Grayscale effect" no longer exists, the targets selected for the Grayscale Crypto Trust as "Grayscale Preferred" seem to still be able to play a role.

From a yearly perspective, the strongest performing group is products launched in 2024, with an average increase of 89.22%. DeFi and Level 1 leaders such as AAVE, AVAX, and LDO performed exceptionally well during this cycle, representing the core drivers of the current cycle. Next in line is products launched in 2018, with an average increase of approximately 81.98%. This performance was primarily driven by the strong performance of established public chains such as BCH, LTC, and XLM during this rebound. 2017 performed the worst, with only one product launched that year (besides BTC and ETH): Zcash, which saw a mere 12.89% increase.

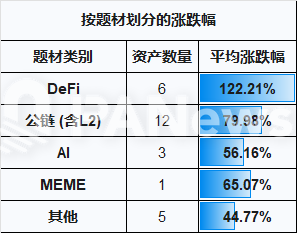

Looking at the performance of themes within the portfolio, Grayscale's selected DeFi and public chain assets outperformed the overall market on average. DeFi performed the best, with an average increase of 122%, primarily due to the fact that core DeFi infrastructure such as AAVE, LINK, and LDO led the market recovery.

Public chains also performed relatively well, but there was significant differentiation. High-growth ecosystems such as AVAX, SUI, and SOL performed well, while ZEN and OP performed relatively modestly, demonstrating that the market is becoming increasingly discerning about public chain selection.

In addition, AI, as one of Grayscale's current key focus areas, has an average increase of about 56%. Although it is not as popular as DeFi and public chain projects, it still has an overall increase of more than half.

From "Market Booster" to "Potential Discoverer"

Faced with fierce competition and an increasingly mature market environment in the post-ETF era, Grayscale Investments appears to be undergoing a transformation. Its product strategy and market positioning are also gradually shifting from a "market booster" to a "potential indicator."

Prior to 2021, due to the extreme scarcity of compliant investment channels, the "Grayscale Effect" was a powerful market booster. Any asset included in the Grayscale Trust gained a unique ticket to mainstream visibility, triggering a near-certain price increase. At this time, Grayscale was a crucial provider of market liquidity.

By 2025, with the widespread adoption of various ETFs and compliant products, market channels have greatly expanded. Grayscale's role has shifted to that of a "potential indicator." Its selection itself is no longer a sufficient condition for price increases, but its direction of choice is increasingly focused on finding the next success story in a specific sector or ecosystem.

Grayscale's deep investment in the Sui ecosystem and Python may illustrate this shift. No longer content with simply providing exposure to the SUI token, Grayscale is delving deeper into the ecosystem, launching both the core DeFi protocol DeepBook and a trust for the decentralized storage project Walrus. This signals a shift from investing in the macro narrative of public chains to a micro-investment approach that directly benefits from the ecosystem's prosperity. Furthermore, the investment in Python also aims to identify the most promising assets on Solana, the hottest public chain, to become the next AAVE or Chainlink.

In addition to exploring single-asset trust products, Grayscale is also developing portfolio trusts and diversified ETF/ETP products. In addition to launching several single-crypto asset trust products in 2025, Grayscale plans to expand its product offerings to include the Bitcoin Miners ETF (MNRS), the Bitcoin Adopters ETF (BCOR), and a range of options-based ETFs.

Notably, Grayscale recently launched the Grayscale Dynamic Income Fund (GDIF), a product dedicated to investing in staking returns on Proof-of-Stake (PoS) networks. This also demonstrates that as the market matures and speculative speculation subsides, "real yields" derived from real protocol revenue (such as transaction fees and staking rewards) are more stable and in line with the preferences of traditional institutional investors.

In summary, the performance of Grayscale's investment targets and the shift in its investment strategy may give us the following two considerations.

1. The "Grayscale Effect" is gone, but "Grayscale Preferred" still has value. Grayscale's launch of a trust fund for a specific crypto asset will no longer significantly stimulate the market, but in the long run, Grayscale's overall selection of assets remains a worthwhile research reference.

2. Infrastructure First: Grayscale's investment strategy repeatedly demonstrates a simple investment principle: in any emerging gold rush, businesses that sell "picks and shovels" offer the highest certainty. Whether it's oracles, DeFi liquidity layers, or data warehouses, investing in the core infrastructure that powers the entire ecosystem is key to navigating cycles.

3. Traditional capital’s enthusiasm for the crypto market is not only about pursuing high returns on a certain asset, but is more inclined to make layouts in the entire upstream and downstream of crypto, as well as multi-asset mixed investments to balance risks.

The above points may be the inspiration brought to us by Grayscale, the "crypto veteran".

- 核心观点:灰度转型为潜力发掘者,优选标的仍具价值。

- 关键要素:

- 2025年灰度新推6只信托,聚焦AI、Sui生态与Meme。

- 灰度优选标的平均涨幅75.47%,跑赢BTC(56.5%)。

- DeFi类表现最佳(122%涨幅),AI类次之(56%)。

- 市场影响:机构转向基础设施投资,市场偏好趋于理性。

- 时效性标注:中期影响。