Stock tokenization is becoming one of the strongest narratives in the convergence of traditional finance (TradFi) and Web3 by 2025.

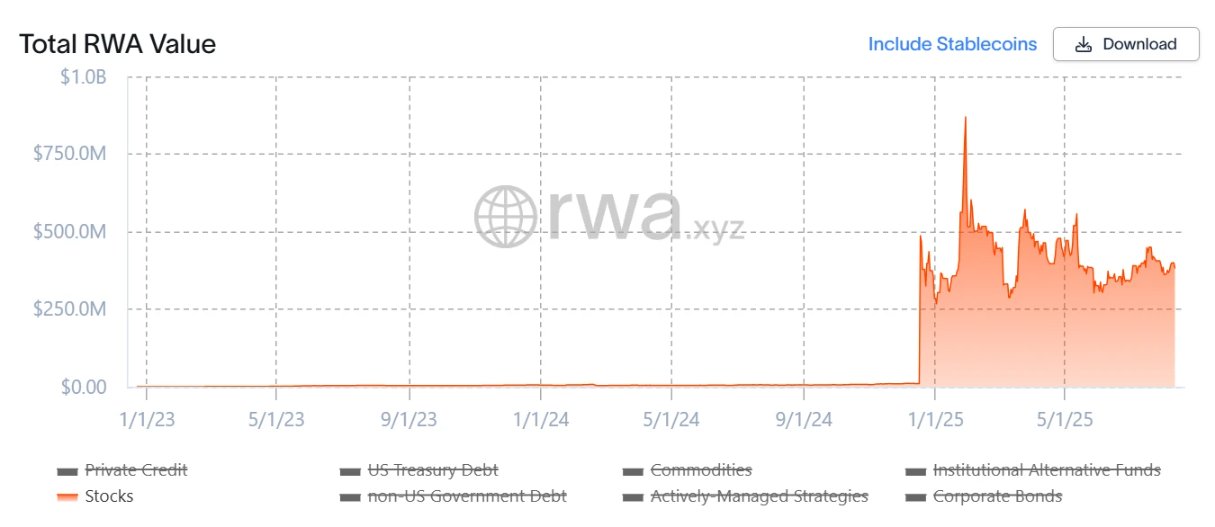

According to rwa.xyz, the market capitalization of tokenized stocks has grown from near zero to hundreds of millions of dollars this year, driven by a paradigm shift from early synthetic models to the custody of actual shares and increasingly to higher-end products such as derivatives.

This article will explain how the model has evolved, highlight the key players, and explore possible future developments—particularly the so-called “second growth curve” in derivatives and liquidity.

The Journey to Tokenizing U.S. Stocks

What is stock tokenization?

In short, traditional stocks are mapped onto the blockchain in the form of digital tokens, with each token representing one share of the underlying asset. These tokens can be traded on-chain 24/7, breaking the time zone and trading venue restrictions of traditional markets and opening up access to global investors.

Equity tokenization is nothing new. In the previous cycle, projects like Synthetix and Mirror built on-chain synthetic asset systems. Users could mint and trade equity tokens (e.g., TSLA, AAPL) by overcollateralizing their holdings (e.g., SNX, UST).

This model was later expanded to other assets, including fiat currencies, indices, gold, and oil, with settlement achieved through oracle pricing and on-chain matching. Because there is no actual counterparty (only price exposure), the system can theoretically provide deep liquidity and a low-slippage trading experience.

Limitations: Synthetic models don’t confer true ownership of the underlying stock—they merely provide price exposure. In the event of oracle failure or collateral depegging (as occurred in the UST incident), these systems can face liquidations, price deviations, and a loss of confidence.

What’s different in 2025?

The current growth driver comes from a model where real shares are held off-chain and tokens are issued on-chain at a 1:1 ratio. This leads to two main paths:

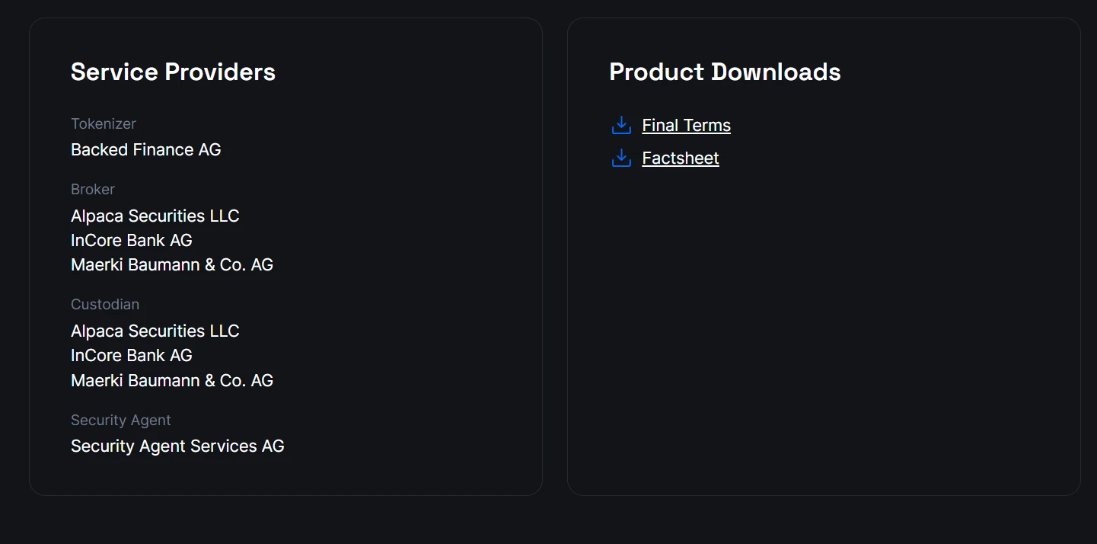

- Third-party compliant issuance and support for multi-platform access (such as Backed Finance/xStocks): xStocks purchases and holds stocks through partners such as Alpaca Securities LLC.

- Broker-led closed-loop model (Robinhood-style): Licensed brokers purchase stocks and issue tokens on their own, covering the entire process from purchase to on-chain issuance.

The core upgrade lies in the support of verifiable real assets. This improves security and compliance, making the model more easily accepted by traditional institutions.

Project overview: from issuance to trading

A complete stock tokenization ecosystem typically includes:

- Infrastructure: underlying blockchain, oracle, and settlement channels

- Issuer: regulated or compliant issuer

- Trading: Centralized exchanges/decentralized exchanges, and DeFi (lending and other derivatives platforms)

The infrastructure is gradually maturing, and the areas where competition is most intense and ultimately determines user experience and liquidity are mainly concentrated in issuance and trading.

The following are some representative projects.

Ondo Finance – Expanding from RWA bonds to stocks

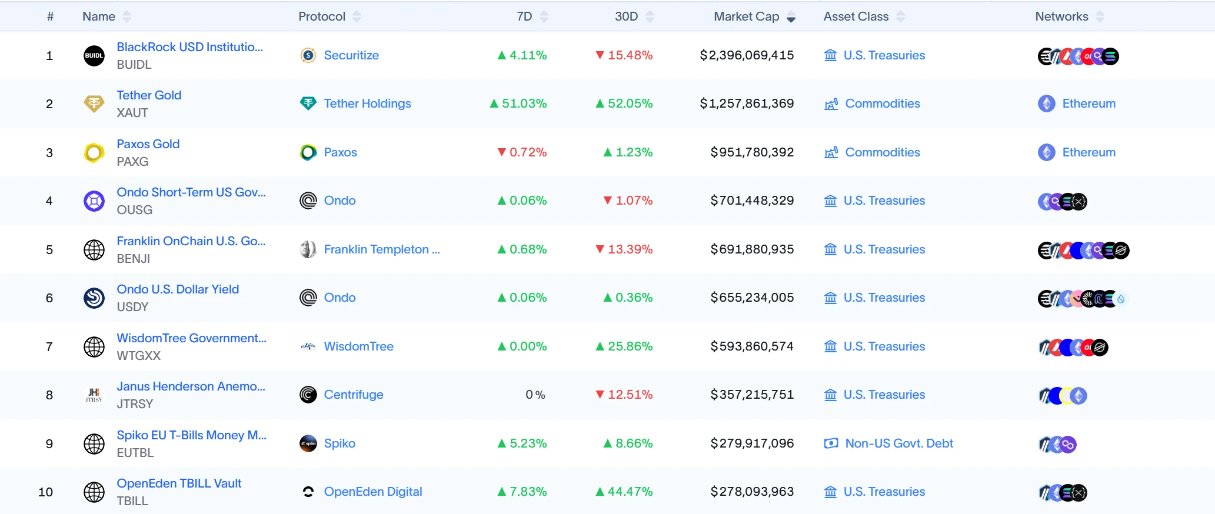

Ondo initially gained recognition for tokenizing treasury bonds and bond exposures (e.g., USDY, OUSG) and remains one of the largest RWA platforms to date.

Ondo recently expanded into the equity sector, partnering with regulated custodians and clearing houses like Anchorage Digital to hold real US stocks and issue corresponding on-chain tokens. This model provides regulatory compliance assurance for institutions and enables the creation of cross-asset liquidity pools, allowing tokenized stocks to interact with stablecoins and RWA debt assets. Ondo and Pantera Capital also announced plans to establish a $250 million fund to support RWA projects.

Injective — A blockchain for real-world financial assets

Injective positions itself as a high-performance financial blockchain, with native modules like order book matching and derivatives built in. Its ecosystem encompasses over 200 projects, including decentralized exchanges (Helix, DojoSwap), lending platforms (Neptune), RWA participants (Ondo, Mountain Protocol), and NFT marketplaces (Talis, Dagora).

Two major advantages in the RWA field:

- Wide asset coverage: Applications such as Helix have launched tokenized US technology stocks, gold, foreign exchange and other asset classes.

- Strong connectivity with traditional finance: Collaborating with Coinbase, Circle, Fireblocks, WisdomTree, Galaxy, etc. to deeply integrate off-chain custody and clearing with on-chain issuance and trading.

The result is a low-latency, low-cost execution environment that supports staking, composability, and the subsequent development of richer equity-linked products.

Backed Finance — Compliance-first, multi-market coverage

Backed Finance operates under the Swiss legal framework and is aligned with Europe's MiCA regulations. The company issues fully collateralized tokenized securities and partners with institutions such as Alpaca Securities LLC for stock acquisition and custody, maintaining a 1:1 mapping between off-chain assets and on-chain tokens. Backed's coverage includes US stocks, ETFs, European securities, and selected international indices. This enables investors to gain multi-market and multi-currency exposure on a single on-chain platform—for example, combining US tech stocks with European blue-chip stocks and global commodity ETFs—without the constraints of traditional market trading venues and hours.

Block Street — Unlocking Liquidity for Tokenized Stocks

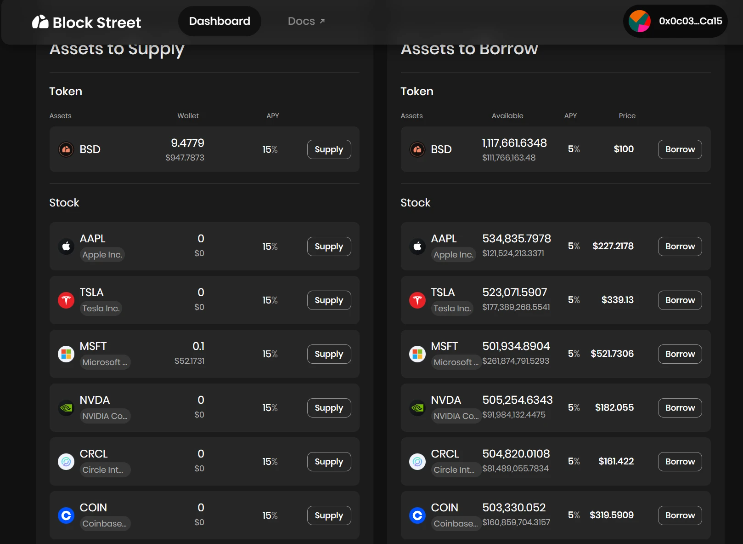

Block Street specializes in tokenized stock lending. Holders can use assets like TSLA.M or CRCL.M as collateral to borrow stablecoins or other tokens, unlocking liquidity without selling their assets. A beta version recently launched, enabling tokenized stocks as collateral, filling a significant gap in DeFi lending. If features like lending, perpetual contracts, and options mature on the platform, they could trigger a "second wave" of growth for the tokenized stock sector.

The biggest advancement in this wave is the integration of real stock custody with low-barrier participation. With just a wallet and a stablecoin, anyone can gain price exposure to US stocks on a decentralized exchange (DEX)—no brokerage account required, no time zone restrictions, and fewer regional barriers. However, most current products remain at the "voucher stage": they merely issue and trade tokens, but haven't fully transformed them into financial infrastructure for trading, hedging, and fund management. This presents a significant challenge if the goal is to attract professional capital flows, high-frequency liquidity, and institutional participation.

DeFi went through a similar phase before the "DeFi Summer." Ether wasn't widely used for lending or composability until lending protocols emerged. Once ETH became an acceptable collateral, liquidity grew rapidly. Tokenized stocks will likely need to undergo a similar transformation: becoming collateralized, tradable, and composable assets.

If the first growth curve represents spot trading volume, then the second growth curve will be driven by capital efficiency and market activity stimulated by financial instruments.

Expected development directions include:

- Lending and credit based on tokenized stocks (e.g., Block Street)

- Short selling and hedging tools (inverse tokens, perpetual contracts, options, etc.)

- Structural strategies and

- Basket/portfolio products that interoperate across DeFi platforms

Platforms that can offer an integrated on-chain experience—covering spot trading, shorting, leverage, and hedging, and making tokenized shares available in protocols like lending, options, and stablecoins—will have a competitive advantage.

in conclusion

Tokenizing US stocks and ETFs isn't just about moving Wall Street onto the blockchain; it's about bridging the gap between traditional capital markets and blockchain. From issuance (Ondo), multi-market access (Backed Finance), to unlocking liquidity (Block Street), the full-stack ecosystem for tokenized stocks is steadily taking shape. With growing institutional participation and maturing trading infrastructure, composable, tradable, and collateralized tokenized stocks are poised to become one of the most influential and sustainable asset classes in the RWA market.

- 核心观点:股票代币化加速TradFi与Web3融合。

- 关键要素:

- 代币化股票市值从零增至数亿美元。

- 模式转向真实股票托管,衍生品扩展。

- Ondo等平台推动合规与流动性创新。

- 市场影响:提升全球资本流动性与参与度。

- 时效性标注:中期影响。