Original author: BitMEX

Key Points

- Ethereum experienced its best-performing month yet, rising over 50% in July.

- Adjusted for market capitalization, ETH has attracted ~88% of BTC’s institutional demand (ETF + DAT corporate reserves), but still significantly underperforms Bitcoin since the ETF launch.

- July marked a fundamental reversal : record ETF net inflow momentum (20 consecutive days), and corporate reserve purchases absorbed over 2% of the total Ethereum supply in a single month.

- Although there has been a significant increase in July, the record demand is still at odds with Ethereum's long-term price trend and may continue to provide strong performance for ETH. This opportunity may be a gift for medium- and long-term traders.

Institutional demand for ETH is closer to BTC than media reports suggest

The US spot Bitcoin ETF began trading on January 11, 2024. At launch, Bitcoin was trading near $47,000 ; today, it's around $115,000 . Cumulative net inflows totaled $55.06 billion , with an average daily inflow of $142.2 million .

The US spot Ethereum ETF launched on July 23, 2024. ETH was trading near $3,500 at launch and is now around $3,700 —a gain of less than 10% . Cumulative net inflows have reached $9.62 billion , with an average daily inflow of $37.1 million .

On the surface, BTC appears to have far more success in traditional financial markets than ETH. However, if we adjust for market size, ETH's traditional financial demand quickly caught up and approached parity in July. Bitcoin's market capitalization is approximately $2.3 trillion, while ETH's is close to $440 billion—roughly one-fifth the former's size. If ETF flows are assessed as a percentage of the respective asset's market capitalization, BTC is approximately 2.4% and ETH is approximately 2.1%. In other words, after adjusting for market capitalization, ETH's ETF demand intensity is approximately 88% of BTC's. This is a stark contrast to the picture presented by raw totals, suggesting that Ethereum has attracted nearly comparable levels of institutional interest relative to its size.

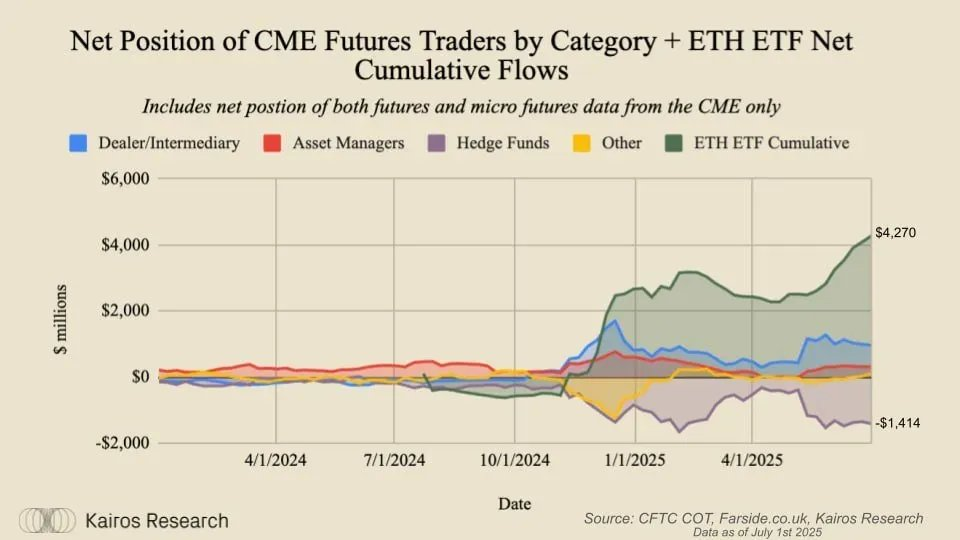

Net inflows into ETFs represent actual physical buying . According to Kairos Research, hedge fund hedging accounts for only about one-third of ETF trading volume. The majority of this is direct exposure, rather than synthetic or neutral positions, reinforcing the link between sustained inflows and eventual price discovery.

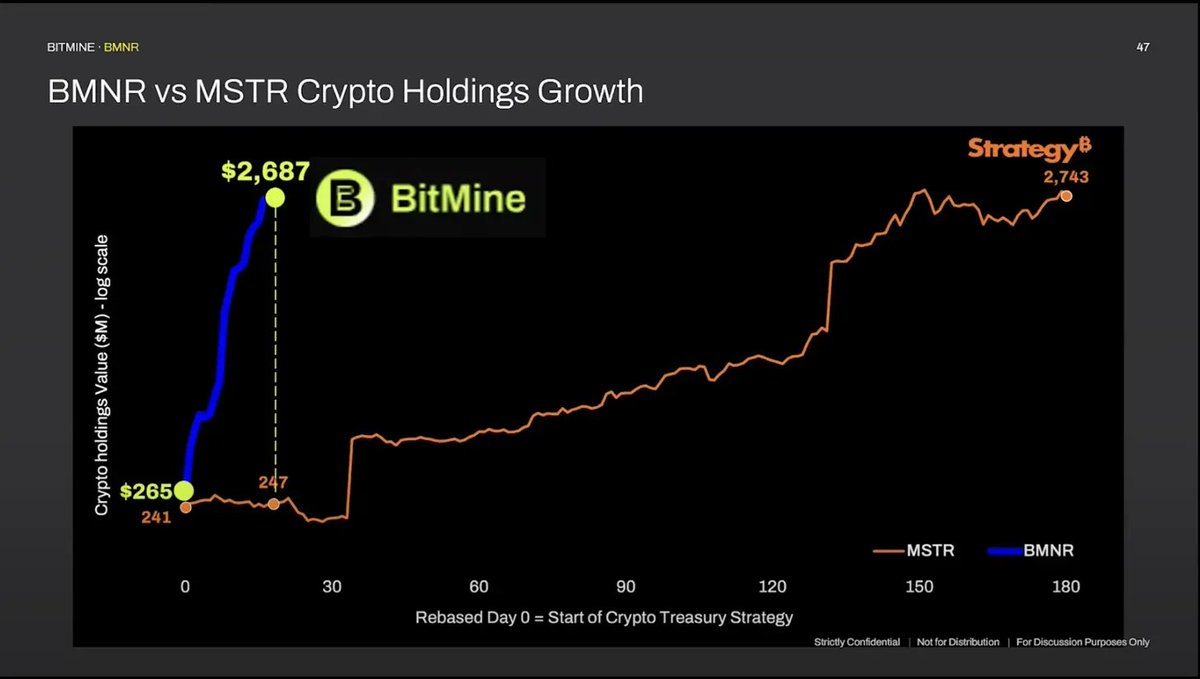

Beyond ETFs, ETH's digital asset reserve narrative has also accelerated faster than BTC's. ETH reserves now hold approximately $9.7 billion in ETH, representing ~2.1% of the supply (compared to $83.7 billion in BTC, representing ~3.5% of the supply). Two companies are leading the charge: SharpLink (SBET) and BitMine Immersion (BMNR), which have been actively purchasing ETH using at-the-market (ATM) equity financing, without leverage. Notably, BMNR has accumulated an amount in a single month equivalent to what MicroStrategy purchased in the early six months of its Bitcoin program. This pace reflects the high risk appetite of traditional financial investors and the growing confidence of institutions in ETH as a reserve asset.

Can the rally continue? Drivers and risks

Driving factors:

- Fund flows remain positive—but price gains are far less impressive than BTC's performance under similar fund flows. Since the launch of the Bitcoin spot ETF on January 11, 2024, BTC has more than doubled (2x+). In contrast, since the launch of the Ethereum spot ETF on July 23, 2024, ETH has risen less than 10%, despite a 50% gain in July, its best month yet. This divergence suggests significant upside potential if fund inflows continue. July's combined ETF and corporate reserve demand (approximately $11 billion, or over 2% of supply) effectively shifted leverage from short-term retail crypto investors to more stable traditional financial institutions, significantly compressing the market's circulating supply. As more tokens are locked up in ETFs and corporate reserves, the impact of this increased demand on prices will become more pronounced; the July supply shock is likely to continue to push prices higher for months to come.

- Corporate reserve stocks like SBET and SBET and BMNR still have room to expand - if they migrate from pure ATM equity to convertible bonds - the same evolution as the early BTC reserve strategy.

- ETH's narrative may resonate more with traditional finance than BTC. Ethereum can be framed as a productive asset: it pays native staking yield, and its fee-burning mechanism reduces net issuance as on-chain activity increases. The network also supports real economic use cases—stablecoin settlement, DeFi, Layer 2, and a growing number of tokenized/RWA applications like on-chain stocks. For traditional investors, this combination of cash flow-like characteristics and utility-driven demand (transactions requiring ETH as gas) makes it easier to underwrite than purely non-yielding, monetary assets. In effect, ETH can be analyzed more like a toll road or payment network—value is supported by increased throughput and usage—while BTC remains closer to digital gold. This provides a clearer fundamental story for traditional finance frameworks focused on returns, operating leverage, and usage-based valuations.

risk:

- The fragility of Ethereum reserve shares — The compression of the mNAV premium of shares after PIPE unlocking ($SBET and $BMNR have already unlocked) may cause the scale of ATM financing to shrink rapidly. If the premium cannot be sustained, the buying demand for Ethereum is likely to drop significantly, causing the price to fall.

- ETF Inflow Bottleneck — If multiple weeks of inflows give way to lackluster or negative data, price momentum could stall and fall back into a range. With Trump’s imminent signing of a bill allowing US residents to use their 401(k)s to purchase crypto assets, we believe this possibility only exists at the macro level.

- Macro and Technicals — ETH remains a high-beta, liquidity-sensitive asset. The $4,000 region represents multi-year resistance; a failed breakout could yield a significant retracement.

- 核心观点:以太坊机构需求接近比特币,但价格涨幅滞后。

- 关键要素:

- ETH ETF需求达BTC的88%(市值调整后)。

- 企业储备月购2% ETH供应量,速度超BTC早期。

- ETH质押收益和链上应用增强传统金融吸引力。

- 市场影响:ETH或迎补涨行情,但需警惕短期回调风险。

- 时效性标注:中期影响。