Original title: @Trump, how does Wall Street tycoon Ackman use Twitter to "remotely control" the White House?

Original author: David, Yanz, TechFlow

Sunday, April 7, 2025.

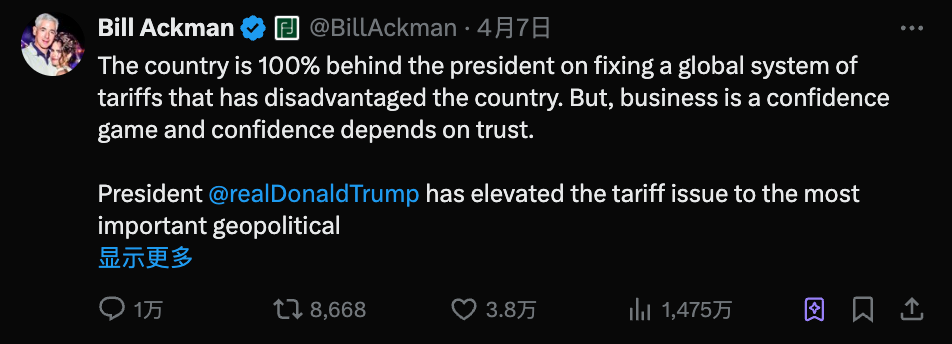

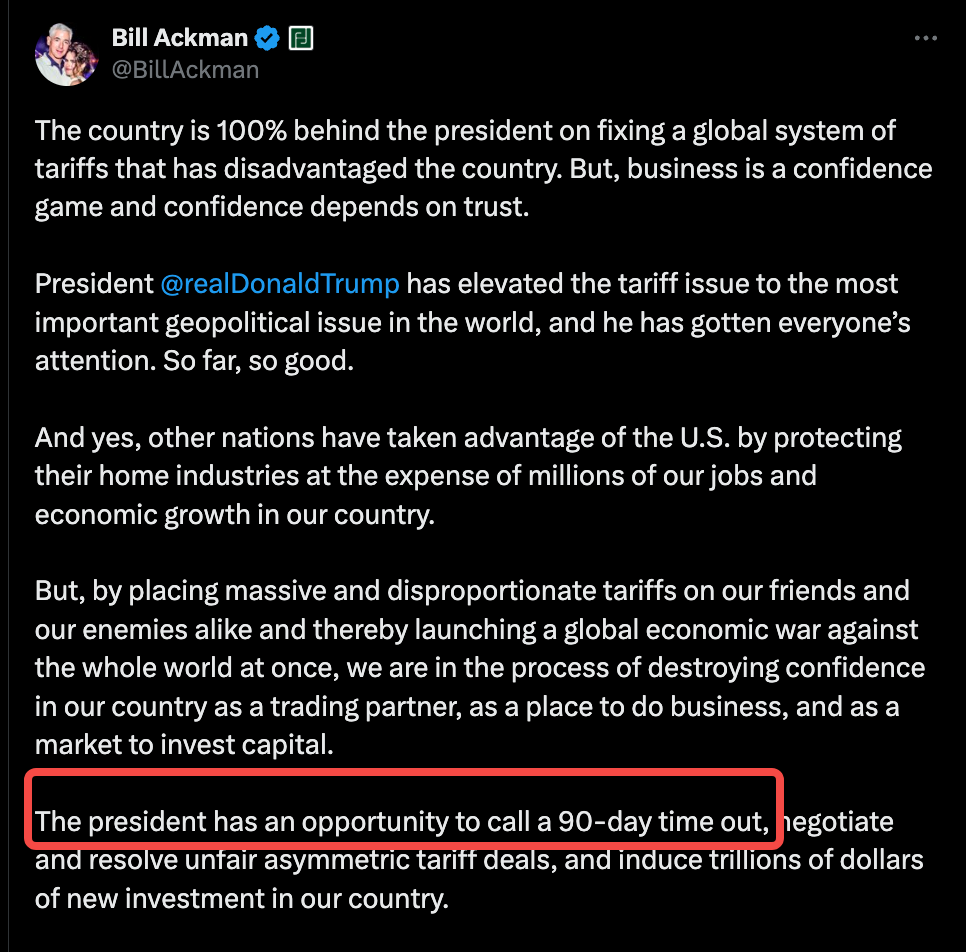

Bill Ackman tweeted a call for a 90-day pause in tariffs, @Trump. Naming the president directly is a no-no on Wall Street, but Ackman didn't care.

The tweet came 72 hours after Trump announced "reciprocal tariffs" on almost all of his trading partners; global stock markets plummeted and panic spread.

Then, a miracle happened.

On Wednesday morning, Trump made a surprising announcement: he would suspend the tariff plan for 90 days to allow for negotiations. The idea of a "90-day pause" came from Ackman's tweet three days earlier.

This coincidence also sparked speculation on social media: Did any White House aide see the tweet and present it to the president?

This isn't the first time Ackman has successfully controlled the White House remotely. In fact, in the Trump era, the hedge fund manager, who boasts 1.8 million Twitter followers, is practicing a completely new model for government-business relations— one that requires no formal position or secret meetings, but only sufficient followers and well-timed public outreach.

From a loyal donor to the Democratic Party's "Twitter strategist", this is a story about social media, money and power.

Tariff controversy: Financial backers "correct" famous scenes

Before it actually happened, no one could have imagined that a tweet could influence a shift in tariff policy.

When Ackman issued the warning that Trump's tariff policy might lead to an "economic nuclear winter," he was actually taking a dangerous gamble - as a financial backer who once publicly listed 33 reasons to support Trump, he now unexpectedly jumped out to oppose Trump's tariff policy.

Is this betrayal, or awakening?

Just three months ago, he was openly praising Trump's economic vision on Twitter. Now, he's openly dissenting, tweeting a request for a 90-day tariff freeze. The risk is clear: the goodwill he'd previously built up, along with his influence over the White House, could be wiped out.

But Ackman made the right bet.

He accurately grasped Trump's psychology, saying that the president cares more about the stock market and public opinion than anything else. But Trump needs a decent way to turn around and not appear to be succumbing to pressure.

The cleverness of the "90-day suspension period" plan lies in that it not only gives Trump a way out, as he can say this is for "better negotiations", but also reassures the market that there will be no tariff impact for at least three months.

On the same day, Trump announced a 90-day tariff suspension, and US stocks saw their biggest one-day gain in 16 years. The S&P 500 rose 4.2%, and the Dow Jones Industrial Average soared over 1,200 points.

Ackman downplayed his victory, tweeting simply: "Smart decision. America needs trade, but it must be fair trade."

The tariff drama lasted a full week, but the revelations it revealed will last much longer.

In the Trump era, financiers are no longer silent check-signers; they are vocal partners and, when necessary, even opponents. And when the opposition voices are loud enough and unified enough, even Trump must listen.

Governing the country through Twitter: A new relationship between politics and business

Bill Ackman is handling the relationship between politics and business in a simpler and more crude way: tweeting, @thepresident.

Traditionally, political and business relations take place in the shadows, with dinners at private clubs, deals on golf courses, and information passed through middlemen. The public never knows how policies are formulated, who influences whom, and at what cost.

Ackman's model was the exact opposite—no lobbyists, no private dinners, no formal requests for meetings. He simply tweeted and let his 1.8 million followers help him get his message to the White House.

This is not accidental, but inevitable because Ackman is well aware of Trump's media consumption habits.

According to multiple former White House officials, Trump's first thing every morning is to check Platform X to see who's talking about him and what they're saying. He pays special attention to accounts with large followings, especially those who have supported him. When these accounts publicly criticize a policy, Trump takes it seriously.

Ackman's Twitter strategy also appears to be carefully designed and operated - usually posting late at night and on weekends, with strong but not divisive language, and hashtags always related to the president.

Every lobbying was public, every one of his arguments subject to public scrutiny.

This is an unconventional kind of honesty, but it makes perfect sense:

Instead of hiding my interests, I use them as part of the argument - I have an interest in it, so I care about the consequences of this policy more than anyone else.

But when billionaires can amplify their voices through follower counts, what are the benefits of transparency?

A "radical" worth 9 billion

If you could define Bill Ackman in three numbers, they would be:

58 years old, worth $9 billion, 1.8 million followers on Facebook . These numbers paint a picture of a typical Wall Street success. But Ackman is anything but typical.

In a 2014 investor presentation about Herbalife, he made a fiery argument that the supplement company survived only because salespeople were forced to buy its mediocre nutritional shakes, which they often had trouble reselling to real customers.

He accused the company of being a pyramid scheme that was preying on the American underprivileged. In the days following his speech, Herbalife's stock price rose 25%. He ultimately lost $1 billion on his short position.

Justice, or profit? This is the key question to understand Ackerman.

In March 2020, when the world was still debating whether the coronavirus would become a pandemic, Ackman used $27 million to buy credit protection to hedge against the risk of a market crash. A month later, this investment successfully turned into $2.6 billion.

During the same period, he tearfully called on CNBC to "shut down America for 30 days" and warned that hotel stocks would "go back to zero."

Critics say he's deliberately creating panic to profit from his short positions. Supporters say he's warning of risks and fulfilling his social responsibility. The truth? Probably a bit of both.

But there's no doubt he's smart. While other hedge fund managers are still working on their own, he's realized that the social media era requires new ways of playing.

He made himself an "Internet celebrity" in the financial world - not only did he tweet frequently, he also quarreled with netizens, and even participated in a professional tennis tournament at the age of 59 (although he was eliminated in the first round).

Some say he wants to be the "next Buffett." But Buffett never tweets @the president or publicly confronts Harvard's president over political positions. He seems more like someone who will do anything to win, but who firmly believes he's doing the right thing.

This contradiction is precisely his secret weapon that enables him to influence Trump.

A tortellini meal can change political stances

Before May 2024, Bill Ackman’s political resume read like a standard list of Wall Street liberals. He was a regular at Democratic fundraisers, at charity dinners on New York’s Upper East Side.

That same month, changes occurred in Los Angeles.

During the Milken Institute Global Conference, Ackman met Elon Musk, and the two billionaires, both active on the X platform, found common ground.

A few days later, back in New York, Ackman had dinner with Trump. Bloomberg News reported that the main course was ravioli. While the exact content of their conversation is unknown, the meal clearly left a lasting impression on Ackman.

Ackman had already endorsed several anti-Trump candidates in the 2024 presidential race; but everything changed after that ravioli dinner.

In October 2024, he posted a tweet on Platform X with an interview video, listing "33 reasons why I should support Trump over Harris."

There are many reasons, but insiders have noticed one detail: Ackman has held positions in Fannie Mae and Freddie Mac for over a decade. Trump had pushed for the privatization of the two during his first term, but simply ran out of time.

Ackman later tweeted, "I have faith that the Trump team will get the job done."

On July 14, Trump suffered a failed assassination attempt, and Ackman immediately publicly expressed his support. By January 2025, he even said that he "did not want to have anything to do with the Democratic Party anymore."

Ackman's transformation from Democratic Party donor to MAGA supporter may seem sudden, but there's actually a clear path. Just like Wall Street professionals prioritize profit, Ackman may have always been a trader. He simply made a political trade.

That tortellini meal may have been the starting point of the deal.

Privatization of the two housing agencies: a decade of reaping the rewards

Ackman's attempt to meddle in politics through Twitter can be traced back to his call for the privatization of the two housing agencies a year ago. Behind this lies a painstaking and ambitious gamble.

Fannie Mae and Freddie Mac, two government-sponsored enterprises, control nearly half of the U.S. mortgage market. They received government bailouts during the 2008 financial crisis and have been under federal oversight ever since.

To most, this is just a footnote in financial history. To Ackman, it is the biggest bet of his life.

Ackman's Pershing Square fund began building a position in Fannie Mae and Freddie Mac in 2013, when the stock price was less than $2. His logic was simple: the two companies were inherently profitable, government regulation was temporary, and they would eventually be privatized again. When that happened, the stock price would skyrocket.

He waited for this "one day" for ten years.

During this period, Fannie Mae and Freddie Mac's stock remained flat. While other investors exited, Ackman continued to increase his holdings. By 2024, he held over 115 million shares, making him one of the largest outside shareholders.

On December 30, 2024, Trump was elected but not yet inaugurated. Ackman launched his Twitter blitz.

He directly @ Trump in a tweet and wrote, "There is a credible path for Fannie and Freddie to end federal regulation over the next two years."

He carefully crafted his rhetoric, not talking about his own interests but only about the national interest: "This will bring more than $300 billion in additional profits to the federal government" and "remove $8 trillion in debt from the government balance sheet."

The key line: "Trump loves big deals, and this would be the biggest deal in history. I'm sure he'll get it done." This tweet has been viewed nearly 3 million times. Wall Street analysts are beginning to reassess Fannie Mae and Freddie Mac's stocks.

In February 2025, the signal appeared.

During his confirmation hearing, Scott Turner, the new Secretary of Housing and Urban Development, said that privatizing Fannie Mae and Freddie Mac was a "priority" for him; the news sent Fannie Mae and Freddie Mac's stocks soaring. Over the past 12 months, both companies' shares have risen more than sixfold.

Ackerman believes his decade-long wait is about to end.

"You don't need to be old to be right," he wrote in a recent tweet . "This is the most inspiring thing I've ever heard, and I was 25."

The Trump era has changed the rules of the game of patronage politics. In this new game, Bill Ackman has won two victories and is patiently waiting for more.

I also care about encryption

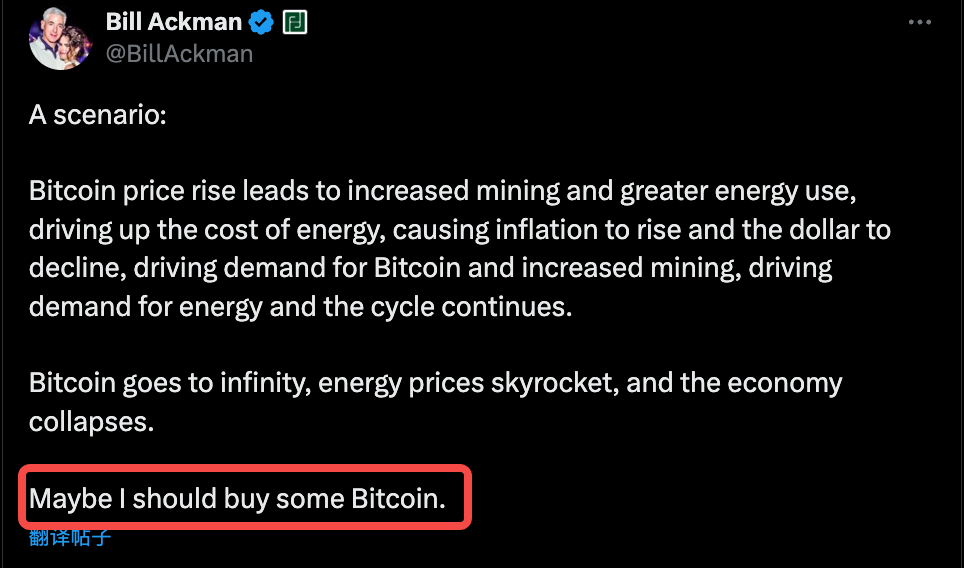

On March 9, 2024, Bitcoin was hitting a record high, approaching the $70,000 mark; Ackman tweeted: Maybe I should buy some.

In fact, Ackman's attitude towards cryptocurrencies has always been subtle. In 2022, after the FTX collapse, he revealed that he had "small investments" in several crypto projects and seven crypto venture funds, accounting for less than 2% of his assets. He said these investments were "more like a hobby, a way to learn."

Even more noteworthy is the timing.

Ackman's Bitcoin tweet comes after Trump explicitly voiced his support for cryptocurrencies. Trump has pledged to make the United States the "cryptocurrency capital of the world" and opposes central bank digital currencies, positions that align with Ackman's free-market philosophies.

Besides Bitcoin, Ackman has recently been talking a lot about artificial intelligence. He has invested in several AI-related startups, though the exact names remain confidential. Interestingly, these emerging fields also happen to be priorities for the Trump administration—Vice President Vance is a well-known tech supporter, and several Silicon Valley elites have joined the administration.

Ackman's layout seems to be both a business judgment and a political stance.

Looking back, he always finds the intersection of money and power. Where will the next battlefield be? Perhaps cryptocurrency regulation, or perhaps AI.

But what is certain is that when that battlefield appears, Bill Ackman will be wearing a suit and tie, waiting there early, and say to everyone: Hey, you are here.

- 核心观点:阿克曼通过推特影响特朗普政策。

- 关键要素:

- 推特喊话促成关税暂停90天。

- 180万粉丝放大其政治影响力。

- 精准把握特朗普媒体消费习惯。

- 市场影响:政商关系转向公开化博弈。

- 时效性标注:长期影响。