Originally Posted by Prathik Desai

Original translation: Luffy, Foresight News

For the past few months, I've been tracking ARK Invest's daily trades in crypto companies. The US fund manages assets across several ETFs and a venture fund. Their buying and selling strategies reveal an interesting insight into how they precisely time the market in a seemingly difficult space.

One move might be coincidence, two might be intuition, but ARK's crypto trades display an uncanny sense of timing. It's deliberate, not reactive. The proof is that they raked in over $265 million in profits trading Coinbase and Circle stock in June and July alone.

A closer look reveals that ARK is withdrawing funds from exchanges and trading platforms and moving them into infrastructure, asset reserves, etc.

ARK's recent trading offers a glimpse into how one of the most closely watched institutional investors in crypto optimizes returns for its investors through rapid and often precise entry and exit timing. This is a stark contrast to the crypto world's "diamond hands" (long-term holding) narrative and is more complex and nuanced.

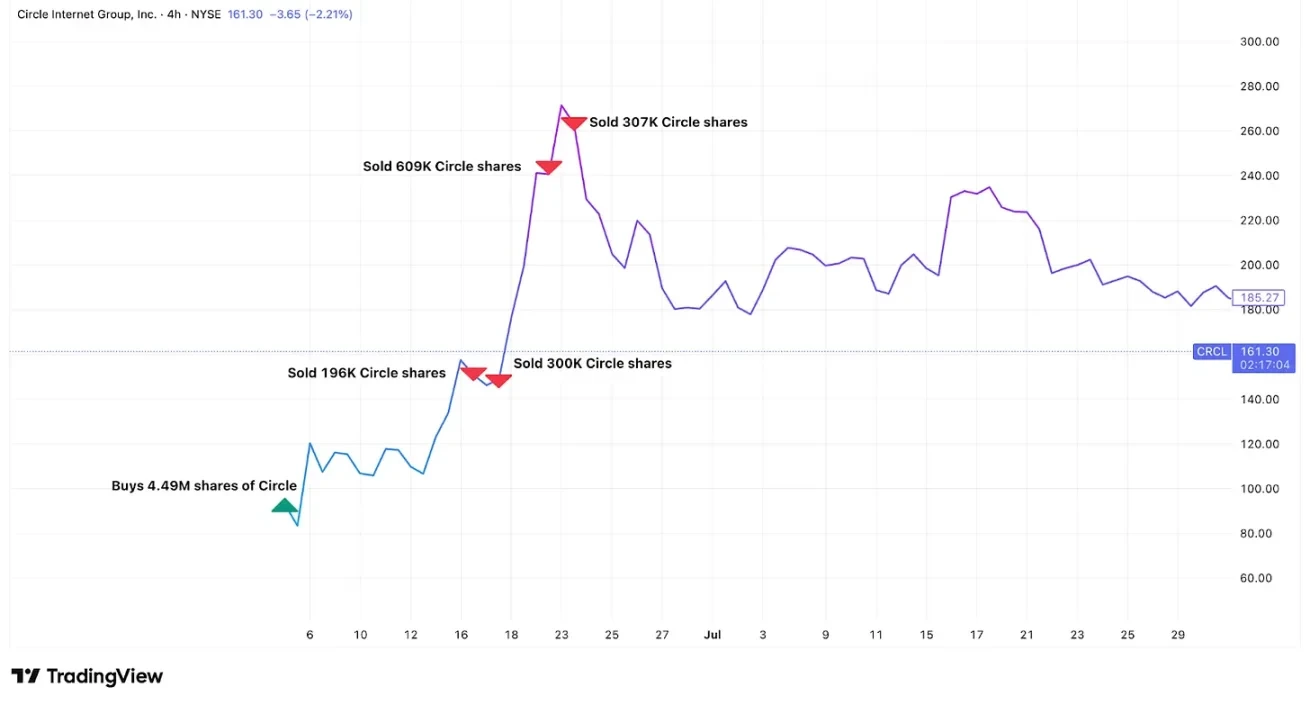

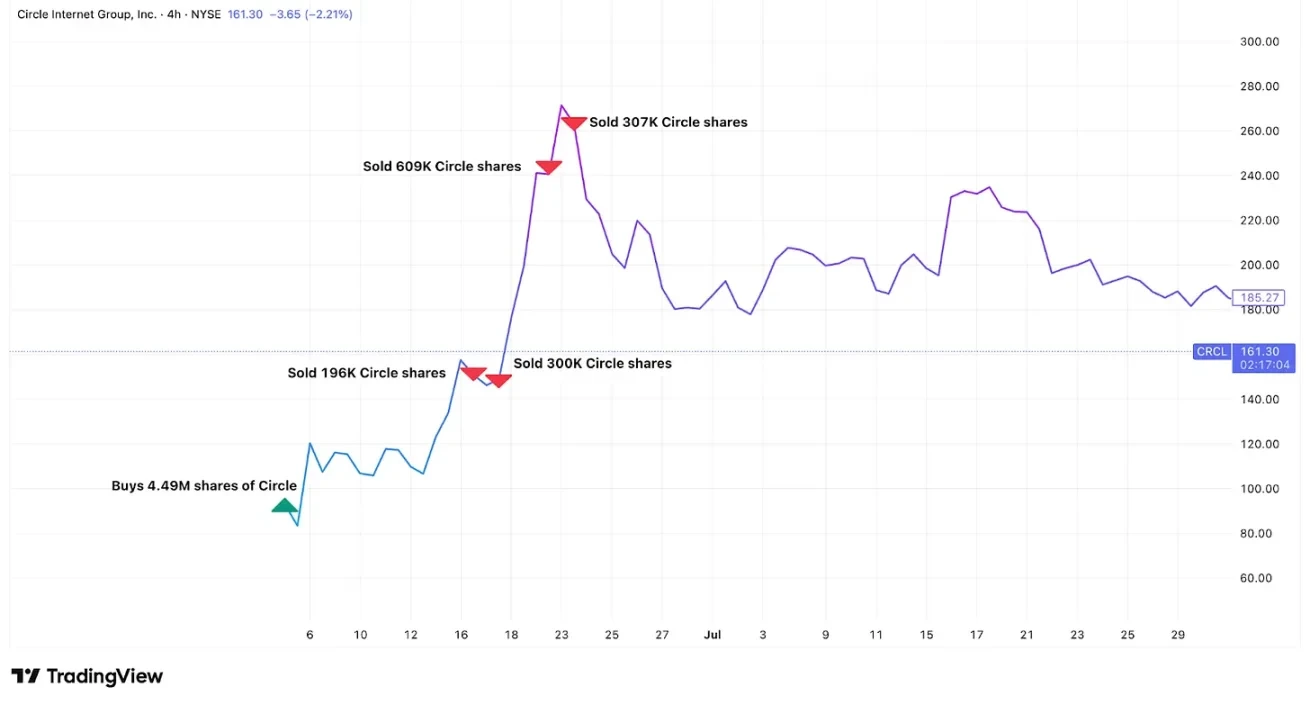

On June 5, 2025, Circle, the issuer of the largest regulated stablecoin USDC, was listed on the New York Stock Exchange at an issue price of $69. ARK, as a cornerstone investor, purchased 4.49 million shares through its fund, with a total value of approximately $373 million.

On June 23rd, Circle's stock price peaked at $263.45, implying a market capitalization of approximately $60 billion, equivalent to 100% of its assets under management (AUM). This may be due to market optimism about the future of stablecoins, leading to an attempt to estimate Circle's future revenue at 10 times its current assets under management (AUM). However, this appears exaggerated compared to the valuations of traditional asset managers. For reference: BlackRock manages $12.5 trillion in assets, yet its market capitalization is just over $180 billion, approximately 1.4% of its AUM. This is a signal for ARK.

Daily trading filings show that as Circle's stock price premium soared, ARK systematically sold its shares through multiple funds.

ARK began selling Circle shares a week before the stock peaked, selling approximately 1.5 million shares (33% of its total holdings) and cashing out approximately $333 million during the stock's parabolic rise. This represents a profit of over $200 million and a return of 160% compared to when ARK first entered the position.

ARK's interest in hot IPOs doesn't stop there.

Last week, they bought 60,000 shares of Figma on its first day of trading. The San Francisco-based design software company disclosed in an SEC filing that it holds $70 million in a Bitcoin ETF and has approval to buy an additional $30 million.

Figma's stock price soared more than 200% on its first day of trading, closing at $115.50, a 250% increase. The next day, Figma's stock price rose another 5.8%.

ARK’s recent trades against Coinbase further reveal its systematic profit-taking pattern.

As of April 30, 2025, ARK held 2.88 million shares of the largest U.S. crypto exchange. They subsequently systematically took profits by the end of July.

At the same time, as Bitcoin hit a record high of over $112,000, Coinbase's stock price also rose in tandem, briefly exceeding $440, its own all-time high. On July 1st, ARK sold $43.8 million worth of shares; on July 21st (the day Coinbase's stock price peaked), ARK reduced its holdings by $93.1 million through three funds. Between June 27th and July 31st, ARK sold a total of 528,779 shares (approximately 20% of its total holdings), valued at over $200 million, at an average price of $385 per share. By comparison, ARK's weighted average cost of Coinbase shares over the four-year period was approximately $260, and these transactions generated profits exceeding $66 million.

In the past two months, Coinbase is no longer the top holding in ARK's fund portfolio.

After the market closed on July 31st, Coinbase announced disappointing second-quarter results, sending its stock price plummeting 17% the following day, from approximately $379 to $314. On August 1st, the day of the crash, ARK bought $30.7 million worth of Coinbase stock.

These trades aren’t isolated incidents, but part of a strategic shift, moving capital away from the overheated crypto exchange ecosystem and toward sectors that are just beginning to attract widespread attention.

While selling Coinbase shares, ARK also reduced its holdings in competitor Robinhood. Both reductions coincided with ARK's significant investment in BitMine Immersion Technologies , known as the "MicroStrategy of Ethereum." BitMine, led by Wall Street veteran Tom Lee, is building an Ethereum reserve with the goal of holding and staking 5% of all Ethereum.

On July 22, ARK invested $182 million in BitMine through a block trade. However, they did not stop there, but systematically bought every significant pullback, accumulating over $235 million in just two weeks.

These transactions indicate ARK's shift from crypto exchanges and payment companies to the so-called crypto infrastructure sector. While Coinbase and Robinhood profit from people's crypto trading, BitMine profits from directly holding cryptocurrencies. Both approaches capitalize on the growing popularity of cryptocurrencies, but with different risk profiles.

Exchanges benefit from market volatility and speculation. When cryptocurrency prices fluctuate wildly, trading activity increases, boosting exchange revenue. However, this is cyclical. Reserve-based companies like BitMine directly benefit from rising cryptocurrency prices. If Ethereum rises 50%, BitMine's assets will also rise 50%, independent of trading volume or user behavior. Even without significant capital appreciation, staking Ethereum on the network can generate a stable income.

But high returns come with high risks: reserve companies also face direct downside risk. When the price of Ethereum falls, the value of BitMine’s assets also shrinks proportionally, making the reserve strategy’s beta (risk factor) higher.

ARK's trading reflects its belief that cryptocurrencies are maturing from speculative trading markets and becoming more permanent financial infrastructure, a world where owning the underlying assets can be more valuable than owning the platforms that trade them.

What’s interesting about these trades is the precise timing. They sold Circle’s fantastic rally all the way to its peak; they caught the 250% surge in Figma’s IPO; they sold Coinbase at its peak and then added to it after it plummeted after missing earnings expectations; and they bought BitMine during its multiple pullbacks.

ARK's methodology blends traditional value investing principles with precise timing: when Circle's market capitalization reaches 100% of its assets under management, it's likely overvalued; when Coinbase plummets 17% in a single day due to earnings misses, it's likely undervalued. ARK also appears to time its trades around predictable events (earnings releases, regulatory decisions, market fluctuations).

A more crucial question arises: Why do these stocks trade at such a significant premium to their underlying assets? Circle's market capitalization once matched its assets under management, and BitMine's stock price traded at a multiple of the value of its Ethereum holdings. This premium exists largely because most investors can't easily buy cryptocurrency directly; even if they can, the deposit and withdrawal platforms are often not seamless for retail investors. If you want to allocate Ethereum to your retirement savings to capture its appreciation, buying shares in companies that hold Ethereum is far easier than purchasing it directly.

This creates a structural advantage for companies holding crypto assets, and ARK’s trading shows they understand this: buying when premiums are reasonable and selling when they are excessive.

ARK's strategy demonstrates that investing in crypto stocks isn't as simple as buying and holding, especially when optimizing for returns. For anyone trying to track ARK's crypto trades, it's not enough to simply know what they bought; you also need to understand why they bought, when they might sell, and what they might move into next.

- 核心观点:ARK精准择时加密交易获利。

- 关键要素:

- Circle上市套现160%回报。

- Coinbase高位抛售获利6600万。

- 转向以太坊基础设施BitMine。

- 市场影响:引导资金从交易所转向基础设施。

- 时效性标注:中期影响。