Original author: Castle Labs

Compiled by Odaily Planet Daily ( @OdailyChina )

Translated by CryptoLeo ( @LeoAndCrypto )

Recently, the Pendle team announced the launch of a new platform, Boros, on Arbitrum, through which users can arbitrage and hedge funding rates. Boros will first be traded in the BTC and ETH markets of major exchanges. It uses Yield Units (YU) for trading. Each YU represents the income of 1 unit of collateralized assets (for example, 1 YU-ETH = 1 ETH nominal value income). Friends who often play Pendle should know that this is similar to its YT mechanism. Currently, the Boros market only offers contract transactions for Binance BTC and ETH. Users can obtain PENDLE rewards by trading limit order contracts on its platform. Castle Labs released an introduction and outlook on Boros, which Odaily Planet Daily compiled as follows:

The original text is as follows

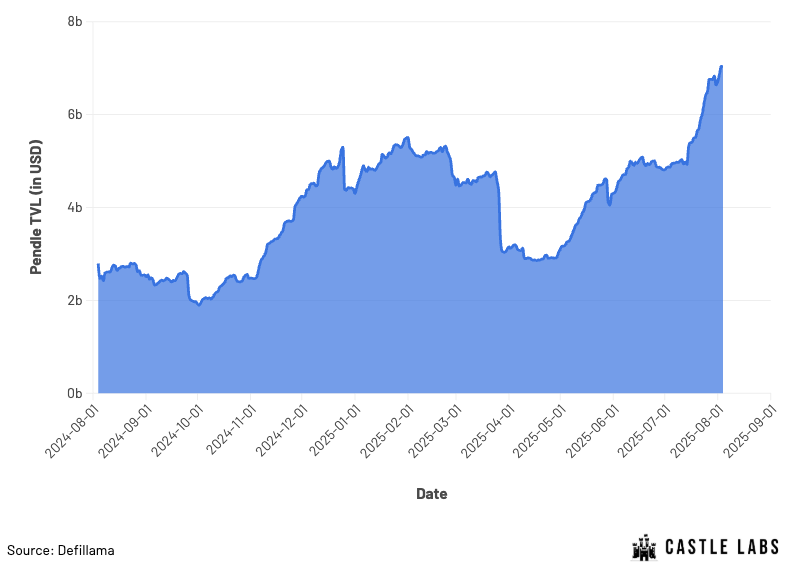

Pendle has been steadily making progress and has become a hub for on-chain yield farming. Its total TVL recently surpassed $7 billion, a record high.

To get closer to their vision of providing yield on any asset, they launched Boros, which is architected to support any form of yield, including yield from DeFi protocols, TradFi, and assets like bonds, stocks, and other RWAs.

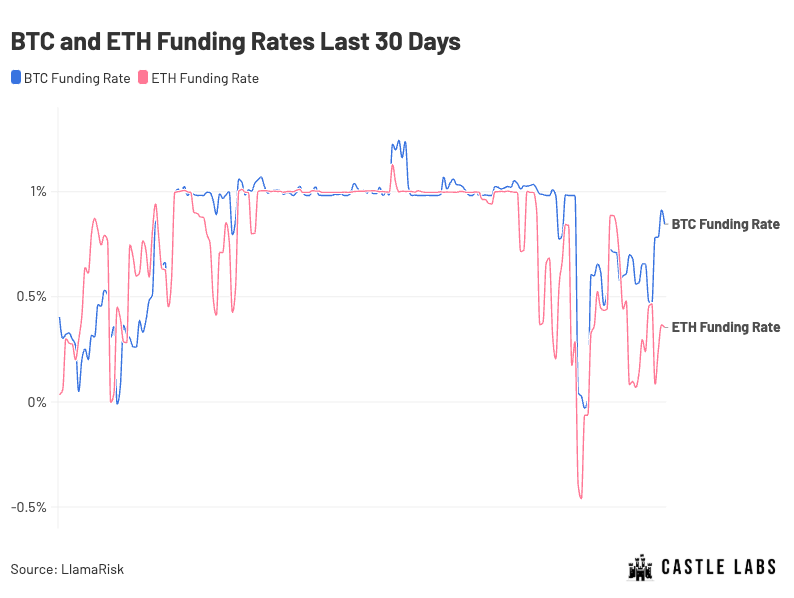

In its initial phase, it will focus on funding rate yields, a largely untapped on-chain market as the contracts space sees daily trading volume of $150-200 billion.

Boros is designed to hedge funding rate exposure or leveraged trading by shorting or longing Yield Units (YUs). YUs represent the yield on one unit of collateralized asset until maturity. For example, 1 YU ETH equals the yield on the notional value of 1 ETH until maturity, similar to how YT (yield tokens) work on Pendle.

Boros will initially support BTC and ETH contract funding rates on Binance, with support for more assets such as SOL and BNB to follow. It will also integrate with Hyperliquid and Bybit. To ensure a smooth launch, Boros will set a $10 million contract position cap and a maximum leverage of 1.2x to allow the team to monitor risks in the early stages.

Products like Delta-neutral stablecoins can benefit from this as they can hedge against negative funding rate exposure, opening up new strategies and risk management tools for institutional investors and DeFi-native traders.

Boros Beyond Retail

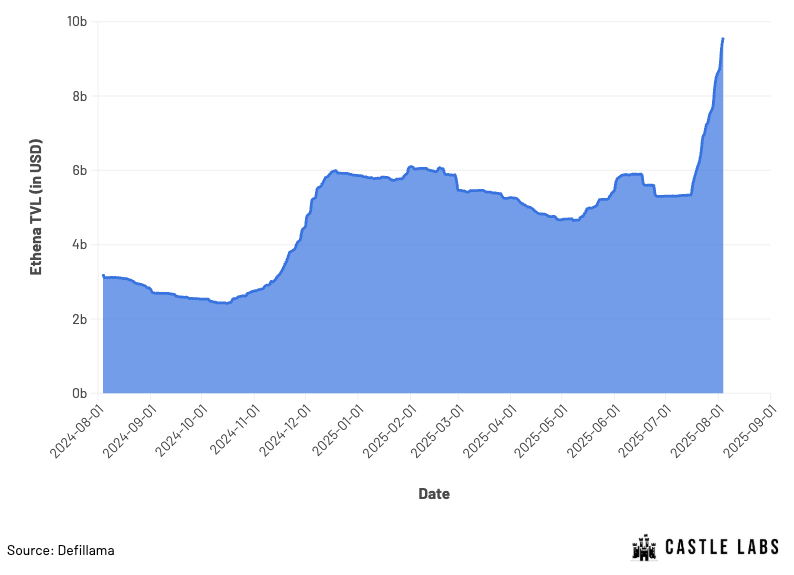

While Boros complements the suite of yield puzzle pieces Pendle offers, its greatest value-add lies in the value it provides to protocols that leverage funding rate exposure in their products. Protocols like Ethena, which currently has $9.71 billion in TVL, benefit significantly from this, as their delta-neutral strategies have funding rate exposure, which helps boost their stablecoin yields.

Ethena's stablecoin, USDe, is backed by volatile assets such as BTC, ETH, and LST. To operate in a delta-neutral environment, Ethena hedges these volatile assets as spot positions and uses them as margin by subsequently opening short contract positions.

While Ethena's positions maintain a neutral delta, it still has to pay the funding rate charged by exchanges, which is one of Ethena's revenue sources. When the funding rate is positive (long open interest > short open interest), Ethena is profitable because long positions pay the funding rate to short positions.

However, Ethena loses money when funding rates are negative (short positions > long positions) and can benefit from the additional hedging of these funding rates to ensure stable returns during market downturns, which is exactly what Boros can provide.

For example, Ethena allocates 50% of its collateral to different CEXs, including BTC and ETH (the assets initially supported by Boros), with a total collateral deposit of more than $4 billion, and its funding rate may be hedged through Boros.

Boros can bring to the protocol:

The protocol can take a directional view on funding rates;

The agreement can effectively hedge its funding interest rate risk exposure;

Protocols can ensure greater predictability, consistency, and lower output risk.

in conclusion

The emergence of Boros represents a shift in on-chain yield opportunities, providing retail and institutional investors with more ways to gain exposure to diverse assets and instruments across DeFi and TradFi. It is also the next step in Pendle's vision to provide access to multiple, and ultimately all, on-chain yield mediums.

Pendle introduced tokenized fixed-income products to the DeFi space, while Boros expands its offerings by leveraging hedging and leverage based on the same foundation of funding rates and returns. Together, these two offerings will expand the reach of returns and propel DeFi forward, enabling anyone to trade and hedge any yield, on or off-chain.

Boros has begun unlocking more funding rate yield strategies by providing a platform to use YU to go long, short, or hedge funding rate exposure.

In the future, Boros will grow and provide benefits that are currently unattainable on the chain.

- 核心观点:Boros 提供链上资金费率套利和对冲工具。

- 关键要素:

- 支持 BTC/ETH 资金费率交易,未来扩展至 SOL/BNB。

- 采用收益单位(YU)机制,类似 Pendle 的 YT。

- Ethena 等协议可对冲负资金费率风险。

- 市场影响:增强 DeFi 收益策略多样性。

- 时效性标注:中期影响。