Original author: Zz, ChainCatcher

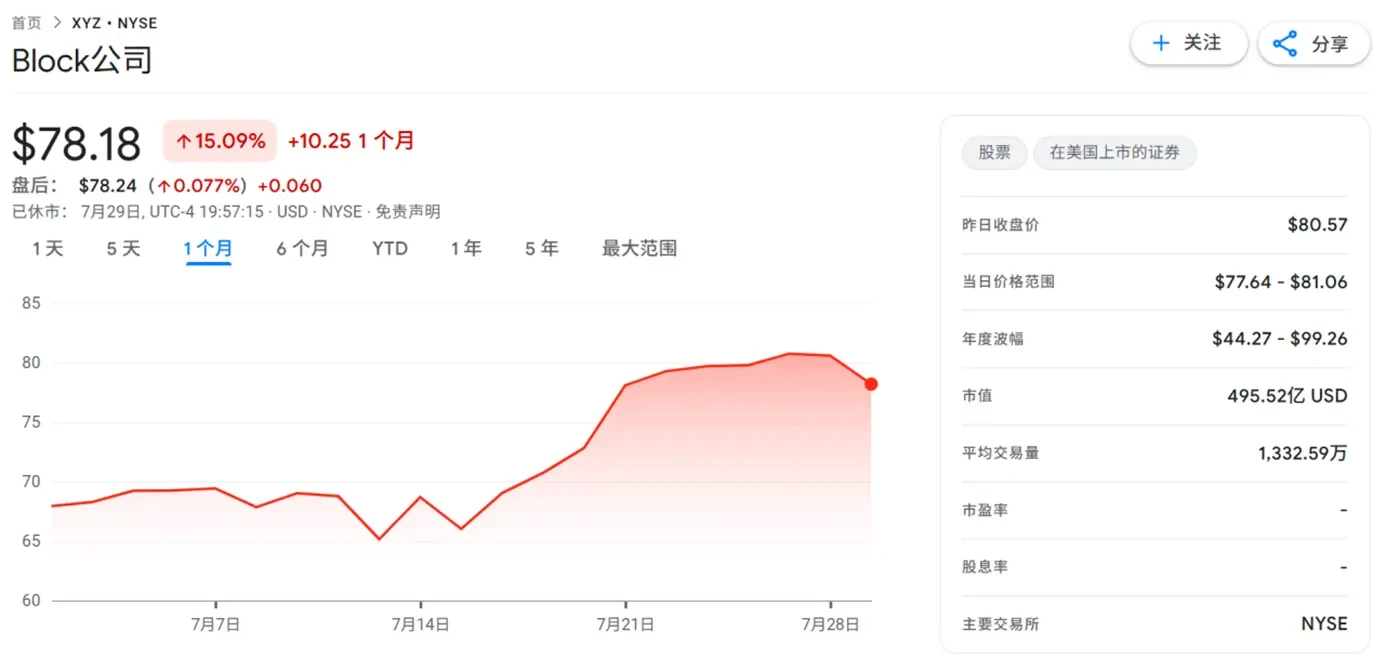

In July 2025, Jack Dorsey -led Blockchain was officially included in the S&P 500 index. The fintech company, which owns payments giant Square and mobile financial app Cash App, now ranks among the 500 most representative public companies in the United States. Its stock price subsequently surged 14% within days.

Being included in the S&P 500 means Blockchain will become a standard feature in mainstream global investment portfolios. According to incomplete statistics, the size of passive funds tracking the S&P 500 exceeds $5 trillion. Based on Blockchain's weighting in the index, it is estimated that over $10 billion of traditional capital will be indirectly allocated to Bitcoin through holding Blockchain stock.

The trillion-dollar market is being leveraged by Blockchain

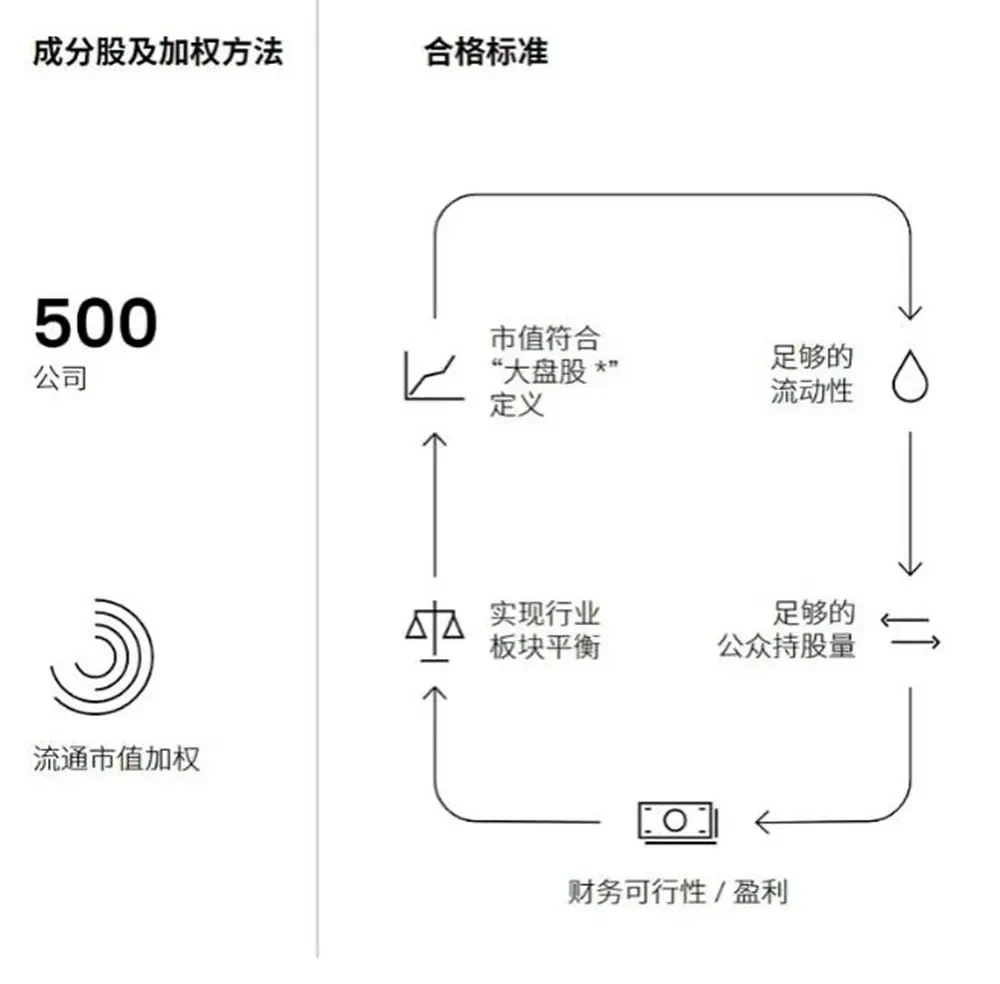

To understand how much leverage Block has pulled, you first need to understand the S&P 500 as a "protocol" for capital allocation, rather than a simple list of stocks.

The rules of this "protocol" are extremely simple, even "clumsy": all index funds that track it have the sole mission of accurately replicating the index's composition and weightings. They have no room for subjective judgment, as any deviation means tracking failure.

Block secured its entry into the protocol by passing its most stringent profitability review: the company must have achieved profitability in both the most recent quarter and the preceding year. This admission represented the traditional financial system's highest endorsement of the viability of a pro-Bitcoin business strategy.

So, Block’s selection is far more than just the story of another tech upstart joining an elite club.

The history of the S&P 500 is essentially a story of evolution, forced to absorb emerging industries and embrace new business models. Based on its landmark inclusion events, a clear trajectory emerges:

In 2006, Google (Alphabet) knocked on the door, forcing funds to buy into a company whose core assets were intangible algorithms and user data.

In 2013, the selection of Meta (formerly Facebook) marked that the vague Web 2 concept of "social graph" was officially digested by Wall Street's capital machine.

Tesla's inclusion in 2020 further demonstrated the mechanical power of this mechanism, triggering an estimated $80 billion in passive buying.

However, when these companies are included, what the fund ultimately buys is the equity of a company, and its value is closely linked to its specific business model and operating performance.

By contrast, when they are forced to buy Blockchain today, they are acquiring not only equity in a payments company but also direct exposure to the 8,363 bitcoins on its balance sheet.

This change immediately triggered a mechanical and irreversible capital flow. Given the core mission of the S&P 500 Index Fund, and assuming Block's market capitalization of approximately $50 billion and a weighting of approximately 0.1% in the index, this inclusion will trigger over $10 billion in "passive buying" in the short term.

Even more ingenious is that most of these funds come from pension funds and sovereign wealth funds that previously would not actively touch crypto assets. This mechanical capital inflow bypasses the psychological defenses of traditional investors towards crypto assets.

If the inclusion of Google and Meta signifies that Wall Street is forced to accept new business models, and the inclusion of Tesla demonstrates Wall Street's enormous power to mobilize capital, then the inclusion of Blockchain means that for the first time, driven by rules, Wall Street is forced to embrace decentralized, non-sovereign currency assets.

Block's love affair with Bitcoin

To understand why Blockchain is so committed to Bitcoin, we must first understand the evolving values of its founder, Jack Dorsey. His career isn't about chasing trends, but rather about solving a core problem: breaking down the restrictions on individual rights imposed by centralized institutions.

The story begins with a dramatic story. His co-founder, Jim McKelvey , a glass artist, lost out on $2,000 in business because he couldn't accept credit cards. This experience deeply stung the two founders—why, in the 21st century, were small merchants still excluded from modern payment systems?

It was this pain point that gave rise to Square (the predecessor of Block), a company that revolutionized the payments industry with its tiny white card reader. While traditional banks imposed numerous barriers to entry for small and micro businesses, Square enabled anyone to accept credit card payments with a smartphone. This was Dorsey's first successful shift of power from the center to the periphery, achieving what he called the "democratization of payments."

However, it was his experience with Twitter that truly fueled his obsession with decentralization. The platform he co-founded initially carried a utopian vision of information democratization—giving everyone a free and equal voice. But as the platform's influence grew, the pull of reality began to take hold. Business models demanded advertising revenue, governments pressured content censorship, and the public demanded accountability. Twitter was forced into the role Dorsey least wanted: content arbiter.

"The power of a single company to determine who can speak and what content can be disseminated is too great and too dangerous," Dorsey later reflected. He attempted to build Twitter on a decentralized protocol through the "BlueSky" project, but it was too late. This failure made him realize: true decentralization is not based on well-intentioned "articles of association" but on the cold, cold "code agreements."

It was in this disillusionment that Bitcoin came into his sight. In this permissionless, censorship-resistant, global financial protocol not owned by any single entity, he saw the ideal that Twitter had failed to achieve.

Blockchain's embrace of Bitcoin began with its products. In 2018, its Cash App began supporting Bitcoin transactions, allowing millions of ordinary Americans to purchase Bitcoin as easily as they would stocks. This decision was controversial at the time—traditional finance viewed cryptocurrencies as speculative bubbles, but Dorsey saw it as an extension of financial inclusion.

The turning point came in October 2020. With Bitcoin's price hovering around $10,000, Block suddenly announced it had used company funds to purchase 4,709 Bitcoins, a $50 million investment. Wall Street analysts were baffled, wondering, "Why would a payments company hold such a speculative asset?"

Dorsey's message is clear: "Bitcoin represents the native currency the internet needs."

In February 2021, Block made another move, spending $170 million to purchase 3,318 bitcoins. The two purchases totaled $220 million, bringing his holdings to 8,027 bitcoins. The market began to realize that this wasn't a spur-of-the-moment financial move, but an expression of faith.

Subsequently, the Bitcoin strategy was further deepened after 2023. Block launched the "Bitcoin Blueprint" plan, announcing that 10% of the gross profit of its Bitcoin-related businesses would be used to purchase Bitcoin every month.

What does this mean? Bitcoin is no longer a static investment sitting on a balance sheet, but a dynamic engine deeply tied to a company's business growth. Every Bitcoin transaction on Cash App contributes to Blockchain's Bitcoin reserves.

This programmatic and predictable accumulation strategy sends a clear signal to the market: Block's commitment to Bitcoin is algorithmic, not emotion-driven.

Furthermore, Blockchain's ambitions extend far beyond simply holding Bitcoin. Over the past few years, the company has launched a movement to build infrastructure around Bitcoin. Cash App integrates the Lightning Network, making small Bitcoin payments as easy as sending a text message. The TBD division focuses on developing decentralized protocols, attempting to build financial infrastructure independent of any centralized entity. Open-source hardware wallet projects empower ordinary users to truly control their Bitcoin. The company has even invested in mining chips in an effort to further decentralize the Bitcoin network.

"We're not betting that Bitcoin will rise, we're betting that Bitcoin will become part of the global financial system."

If this bet holds true, companies that build the relevant infrastructure will have a huge advantage.

This comprehensive investment ultimately paid off. When the S&P Dow Jones Index Committee evaluated Blockchain, they saw not just a company that simply held Bitcoin, but a "Bitcoin native enterprise" that had deeply integrated Bitcoin into its business model and was committed to promoting its adoption.

For Jack Dorsey, Block's inclusion in the S&P 500 is more like a means to achieve his ultimate vision - using Wall Street's money to build a future that ultimately does not belong to Wall Street.

From Square allowing small merchants to accept credit cards, to Twitter trying to give everyone a voice, to Block all-in on Bitcoin, his journey has never changed: to disperse power from the center to the edges.

In the world of Bitcoin, he found the utopia he had been pursuing, which would not be kidnapped by commercial interests.

However, to realize this utopia, we need not only ideals, but also real resources and execution capabilities.

Jack Dorsey's ultimate goal: using Wall Street's money to build a decentralized path

Block's business structure clearly serves Jack Dorsey's vision.

The two traditional businesses are the engines of this revenue stream. Square provides payment and financial services to millions of merchants, contributing to a sustained cash flow. Cash App, a high-growth financial application targeting consumers, launched Bitcoin trading as early as 2018 and has accumulated a large and loyal user base.

These profits and users are continuously transferred to future departments within Block:

At the software level, Spiral and TBD are focused on building Bitcoin's underlying infrastructure. They develop the Lightning Development Kit (LDK), allowing developers to easily integrate Bitcoin micropayments into any application. They also build decentralized identities (DIDs) and the tbDEX protocol, aiming to enable seamless, peer-to-peer fiat-to-Bitcoin conversions, bypassing centralized exchanges.

At the hardware level, the Bitkey wallet is dedicated to solving the challenges of Bitcoin self-custody, striking a balance between security and ease of use through technologies like "2 of 3 multi-signature." Furthermore, the Proto department is developing an open-source Bitcoin mining system, aiming to challenge the monopoly of existing mining machine giants and maintain the decentralized nature of the Bitcoin network.

This isn't just wishful thinking, as Bitcoin itself is a powerful engine for user and revenue growth. At the peak of the bull market, Bitcoin transactions alone generated $10.02 billion in revenue for Cash App, representing a staggering 81.5% of the company's revenue. This demonstrates that leveraging Bitcoin to attract users and generate revenue provides strong financial support for investments in these "future sectors."

This forms a perfect closed loop: using profits from traditional financial business to invest in and build Bitcoin infrastructure; then using the appeal of Bitcoin to acquire new users and feed back into the growth of traditional business.

Block also has fatal injuries

There are hidden concerns behind Block’s grand narrative.

First, its technological dependence is a primary risk. Its deep integration with the Bitcoin protocol means any protocol-level black swan event could have devastating consequences. Technologies like the Lightning Network, which its payment services rely on, are still in their early stages of development, and their stability remains to be tested.

Secondly, execution risk should not be underestimated. Projects like TBD, Proto, and Bitkey have high technical barriers to entry, and their commercialization prospects remain uncertain. Morningstar, a ratings agency, maintained its "very high" uncertainty rating for Blockchain, bluntly stating that inclusion in the index "does not change the company's fundamentals."

Meanwhile, Blockchain's financial performance has also drawn scrutiny. According to The Economic Times, Blockchain's revenue growth has slowed, and its operating profit margin is below the S&P 500 average. Analysts believe the company needs to translate its "Bitcoin is the future" vision into tangible shareholder returns.

Final Thoughts

For the crypto world, Blockchain represents a possibility: to push Bitcoin from the margins to the center, not through confrontation, but through construction and integration. This "Trojan Horse"-style infiltration may be more effective than any radical revolution.

But when trillions of dollars of passive funds are "forced" to embrace Bitcoin, there is always a soul-searching question that cannot be avoided: Is this the beginning of Bitcoin conquering Wall Street, or the prelude to Wall Street taming Bitcoin?

- 核心观点:Block入选标普500推动传统资本被动配置比特币。

- 关键要素:

- Block入选标普500触发100亿美元被动买盘。

- 公司持有8,363枚比特币,提供直接敞口。

- 比特币业务贡献Cash App 81.5%收入。

- 市场影响:加速比特币主流化进程。

- 时效性标注:中期影响。