Original title: "Century-old company Fundamental Global claims to acquire 10% of total ETH, is it just empty talk or a real contender?"

Original author: Nancy, PANews

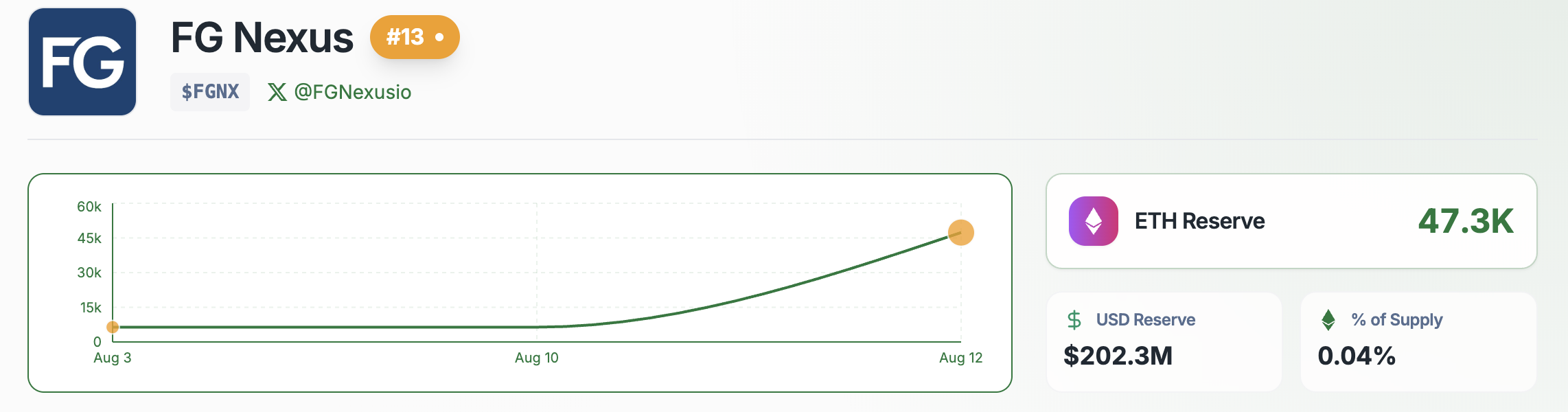

Ethereum's recent surge in price is undoubtedly driven primarily by the continued increase in ETH reserves held by various treasuries. Amidst this escalating market sentiment, a new, high-profile whale has entered the fray. Fundamental Global Inc., a US-listed company, recently announced its rebranding as FG Nexus and plans to acquire 10% of the total ETH supply through multiple rounds of funding. This target is far greater than BitMine, the current leader in Ethereum reserves.

Plans to acquire 10% of Ethereum's supply, but currently faces a huge funding gap

Founded in 1932, Fundamental Global Inc. is a comprehensive financial services company with nearly a century of history, encompassing reinsurance, asset management, and investment banking. However, in recent years, the company's revenue has remained in the tens of millions of dollars, experiencing significant fluctuations due to business restructuring and complex market conditions. Furthermore, since 2021, its stock price has continued to decline, currently trading at only 8.6% of its historical peak, while its average daily trading volume has also plummeted to tens of thousands of dollars.

Coinciding with the tenth anniversary of the Ethereum mainnet launch, this traditional financial institution officially announced the completion of a major strategic transformation, aiming to become one of the world's largest ETH holders. On July 30th, Fundamental Global announced plans to issue 40 million prepaid common stock warrants at a price of $5 each through a $200 million private placement. The company also changed its name to FG Nexus Inc., with the funds to be used to build its ETH reserve.

This private fundraising round, officially completed in early August, attracted participation from major crypto institutional investors, including Galaxy Digital, Kraken, Hivemind Capital, Syncracy Capital, Digital Currency Group (DCG), and Kenetic. Galaxy Digital , the operator behind several Ethereum treasury companies, has also been appointed as a strategic advisor to FG Nexus, responsible for managing its Ethereum treasury and providing asset management, revenue execution, and infrastructure support.

Subsequently, FG Nexus announced in early August that it had submitted an S-3 registration form to the US SEC, proposing a securities offering of up to $5 billion, with the goal of acquiring a 10% stake in the Ethereum network and becoming the largest corporate holder of the network. The document includes a flexible "at-the-market" (ATM) plan, allowing the company to issue up to $4 billion in common stock in tranches, tailored to market conditions and its own needs. These common shares may be issued and sold from time to time, ensuring flexibility in fundraising and market adaptability.

The company plans to use the majority of the proceeds to purchase Ethereum, with the remainder used to support operations. It plans to issue securities in phases, with the ability to flexibly adjust the size, pricing, and terms based on future circumstances. The company aims to achieve asset appreciation and generate income through staking, re-staking, and tokenizing assets.

However, FG Nexus's ambitions face a severe test. Based on current Ethereum prices, FG Nexus's goal of maintaining a reserve of 12 million ETH would require over $50 billion in funding, far exceeding its current total funding. Even with the planned $5 billion in follow-on funding, a significant funding gap remains. Market concerns also exist about FG Nexus's ability to execute. While its stock price briefly surged after the announcement of its Ethereum reserve strategy, it quickly fell back to its original level.

As of now, FG Nexus has held 47,331 ETH with an average holding cost of US$4,228.4, ranking it the 13th largest Ethereum corporate reserve holder.

It’s worth noting that despite FG Nexus’s less-than-optimistic revenue, its stock is held by a number of well-known institutional investors, including Everstar Asset Management, Vanguard Group, Renaissance Technologies, BlackRock, Tower Research Capital, and JP Morgan Chase & Co.

Multiple institutions have attracted nearly $15 billion in ETH. How competitive is FG Nexus?

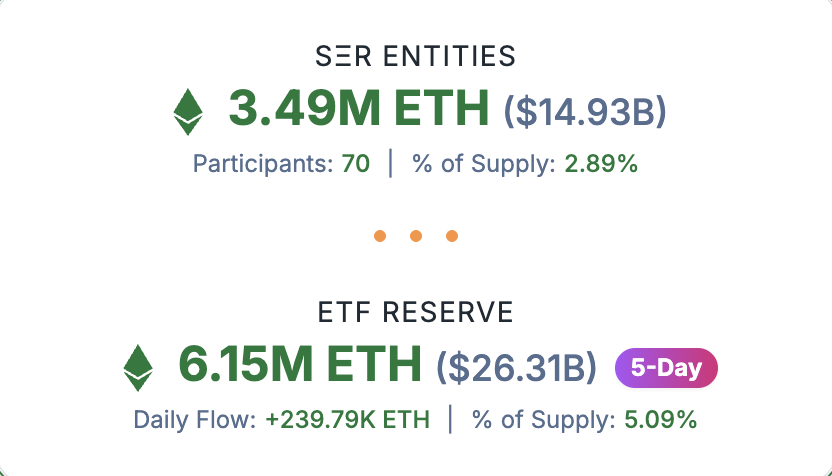

Currently, a growing number of institutions are incorporating Ethereum into their core strategies. According to the latest data from strategythreserve.xyz , as of August 12th, 70 companies had accumulated approximately 3.49 million ETH, valued at nearly $15 billion, representing 2.89% of the total Ethereum supply.

As a new entrant in this new narrative war for Ethereum, FG Nexus is planning to build a differentiated competitive advantage through the experience of a senior team, diversified revenue value-added strategies, and exploration of real-world applications.

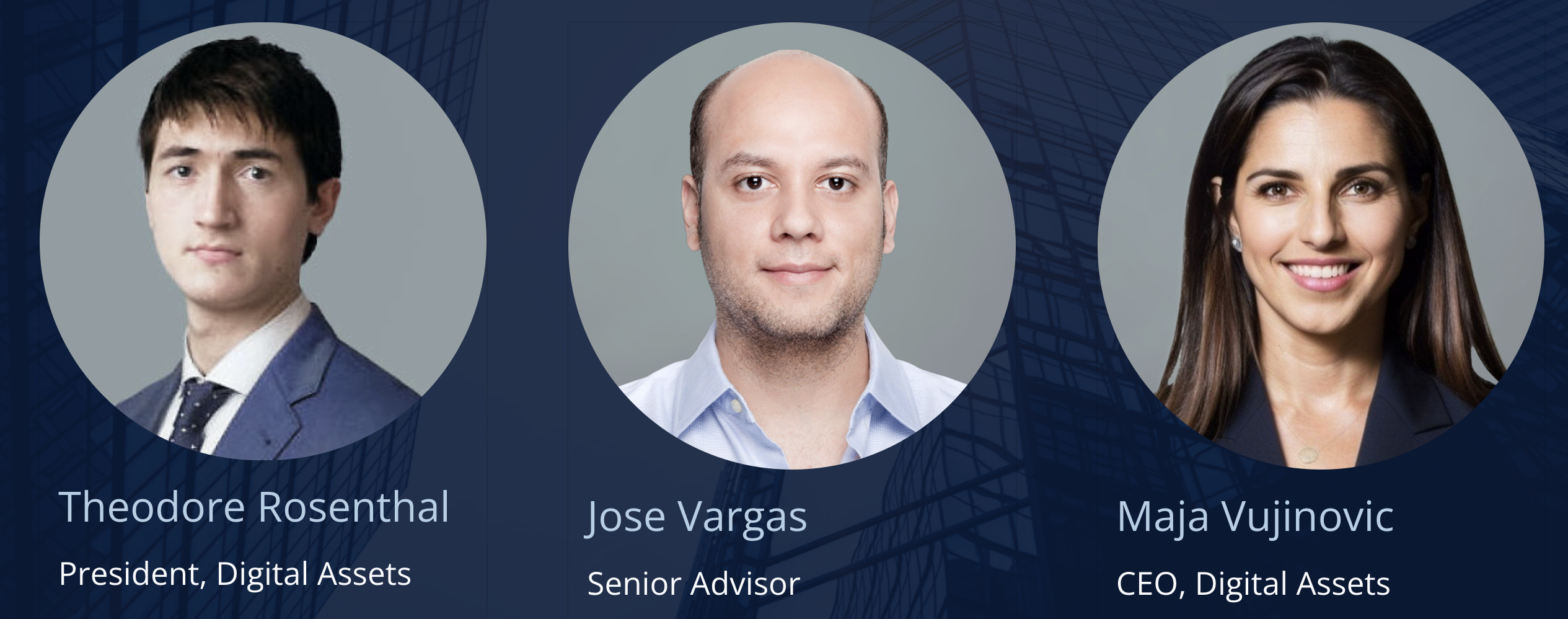

In terms of team background, FG Nexus is composed of senior executives from crypto assets and Wall Street, and its members have accumulated decades of experience in financial technology, cryptocurrency and capital markets.

Maja Vujinovicd, CEO of the Crypto Assets division, has over a decade of experience in crypto investment and operations. She is the founder and managing partner of OGroup, a firm involved in various crypto sectors, including stablecoins, blockchain gaming, carbon credits, and DeFi, and manages over 40 innovative crypto companies. An early investor in Bitcoin in 2009, Vujinovicd has facilitated blockchain pilot projects with leading global financial institutions such as JPMorgan Chase and State Street, led Tether's first bank acquisition, and guided family offices in investing over $4 billion in AI and blockchain strategies.

"Ethereum is not only infrastructure, but also a personal belief. As GE CIO, I worked with Ethereum co-founder Joseph Lubin to promote the application of smart contracts in one of the world's largest companies. This belief has never changed. At FG Nexus, we are building an institutional-grade Ethereum treasury channel that is secure, transparent and yield-driven," said Vujinovicd.

Theodore Rosenthal, President of the Crypto Assets Division, is the founder of the hedge fund TMR Capital, which manages over $2 billion. He is a proponent of Warren Buffett's investment philosophy and has reportedly achieved a 28.8% annualized return with no annual losses since the fund's inception in 2019. He is also an early investor in several crypto projects, including Monero, Aave, Hyperliquid, and MakerDAO.

Jose Vargas, Head of Crypto Asset Business Development, is an experienced serial entrepreneur and seed investor. He co-founded Healthcare.com, Osigu, and PeopleFund, and has successfully founded and exited five companies, including AutoWeb, BlueKite (acquired by PayPal), and BrokersWeb. Vargas has also participated in several early-stage crypto-related investments, including seed rounds for Japan's MicroStrategy Metaplanet and Akash Network.

At the same time, FG Nexus also plans to increase returns on its Ethereum holdings through staking, re-staking, and participating in DeFi protocols. "Ethereum is rapidly becoming the foundation of global digital finance. We plan to continue promoting the global adoption of Ethereum as a treasury reserve asset, with the goal of becoming a significant participant in the Ethereum network, focusing not only on accumulating Ethereum assets," said Maja Vujinovicd.

In addition to its Ethereum treasury and staking strategies, FG Nexus will also explore tokenization opportunities. "This is a pivotal moment in our journey. FG Nexus will leverage its deep expertise in commercial banking, reinsurance, and capital markets to unlock the full potential of Ethereum as a reserve asset," said Kyle Cerminara, CEO and Chairman of FG Nexus.

FG Nexus's aggressive deployment is a microcosm of the current surge in Ethereum reserve investments. For Ethereum, the entry of these institutions not only brings increased capital attention and market influence, but also drives the entire ecosystem towards greater maturity and institutionalization. Ethereum founder Vitalik Buterin recently publicly supported the Ethereum Reserve Company, arguing that it would allow more investors to access ETH and provide more options for people of varying financial circumstances. However, Vitalik also warned the market against the risks of excessive leverage. A significant price correction could trigger a chain reaction of forced liquidations, further depressing prices and damaging the credibility of the entire ecosystem.

Regardless of whether FG Nexus’ goals can be achieved, ETH will be a beneficiary.

- 核心观点:FG Nexus计划收购10%的ETH供应量。

- 关键要素:

- 融资目标50亿美元,资金缺口巨大。

- 已获Galaxy Digital等机构支持。

- 当前持有4.7万枚ETH,成本4228美元。

- 市场影响:推高ETH需求,增强机构化趋势。

- 时效性标注:中期影响。