Original author: angelilu, Foresight News

South Korea's crypto trading craze has quietly spilled over into the stock market. The "Kimchi Premium" was once a global phenomenon, a phenomenon widely discussed in the cryptocurrency market. This country, with a population of only 51 million, once saw Bitcoin trading volumes that shook the global market. While strict government regulation has made this premium a thing of the past, the adventurous spirit of South Koreans remains undiminished; it's simply seeking new outlets.

And the driving force behind this frenzy isn't South Korean institutional investors, but rather a generation of young retail investors who are betting on their future. In this country of 51 million, as many as 18 million people—over a third of the total population—are active in the digital asset market. Of these, nearly a quarter of those aged 20 to 39 see cryptocurrency trading as their only chance of turning their lives around.

BitMine is the latest trading target

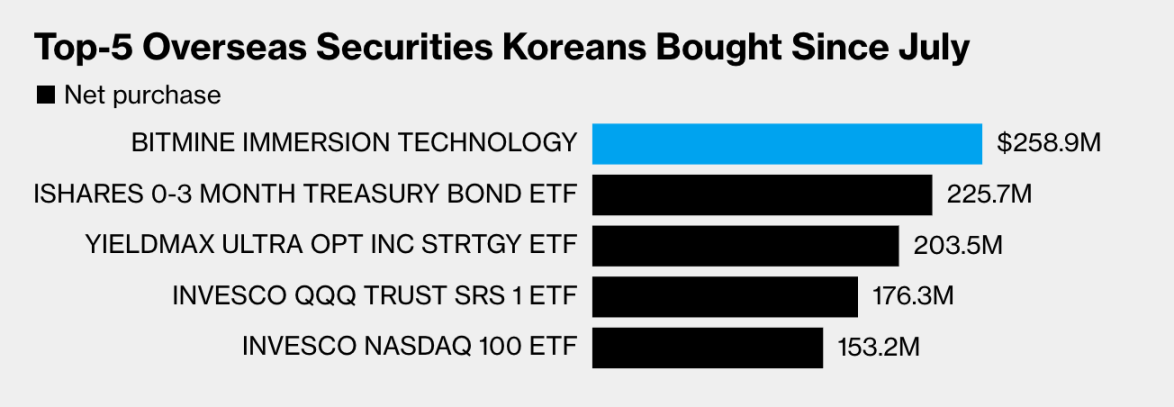

According to data from the Korea Securities Depository and Clearing Corporation, cited by Bloomberg, Korean investors have invested a net $259 million in BitMine shares since July, pushing BitMine to the top of South Korea's overseas stock purchase list.

BitMine, a US-based Bitcoin mining company backed by "King of Silicon Valley" Peter Thiel, recently transitioned from Bitcoin mining to Ethereum (ETH) as part of its financial strategy. It currently holds over 1.15 million ETH, valued at over $4.96 billion. This makes it a significant ETH holding hub on Wall Street. Even more coincidentally, Tom Lee, a key figure in bringing ETH to Wall Street, also serves on BitMine's board.

Tom Lee is a Korean-American. Despite the painful experience of the LUNA coin crash, Korean investors' enthusiasm for risky assets remains undimmed. The emergence of a highly successful "individual" from overseas undoubtedly garners significant trust and attention. For Korean retail investors, this isn't just the perspective of an industry expert; it's a powerful appeal woven with national sentiment. This subtle cultural connection further strengthens their confidence and enthusiasm for the crypto market.

Why not just buy ETH?

A key question then arises: Since you are optimistic about Ethereum, why don’t you just buy ETH directly, but go through a big detour to buy BitMine stock?

Volatility may be the answer. While cryptocurrencies are known for their extreme volatility, some retail investors may believe they can gain a different kind of exposure by participating in them through the stock market.

According to actual backtesting, the price of ETH rose from $2,500 to $3,800 in July, a 52% increase. During this period, the price of BitMine's stock BMNR rose from $46 on July 1 to a high of $135, a maximum increase of 193%.

However, as of this writing, ETH has risen to $4,300, its highest level since December 2021. Meanwhile, the price of BMNR has only rebounded slightly to $58.98. South Koreans with a higher risk appetite tend to choose more volatile investments, despite the roller-coaster ups and downs that can cause countless retail investors chasing high prices to fall from grace.

But in fact, the direct trading volume of ETH is not low. Upbit, the largest exchange in South Korea, had an ETH trading volume of US$111.1 billion in July, and the net inflow cannot be counted for the time being.

BitMine is just a microcosm of the "crypto-stock" craze

However, this is not the first time that Koreans have rushed into "crypto stocks". When the stablecoin company Circle went public, it attracted the attention of Korean investors. Their net purchases in Circle reached US$450 million in the month of its listing, pushing Circle's price-to-earnings ratio to 187 times, a figure far exceeding the reasonable valuation of any traditional fintech company.

This enthusiasm has also spread to the domestic South Korean market. The new South Korean government's crypto-friendly policies have fueled retail investor expectations, contributing in part to the rise of the Korea Composite Stock Price Index to a near four-year high. When the Bank of Korea announced its planned digital currency (CBDC), retail investors sensed an opportunity. The share prices of participating companies like Kakao Pay and LG CNS skyrocketed. Kakao Pay's stock price doubled in just one month, while LG CNS followed suit, surging nearly 70%.

When the craze finally subsides

South Korea's crypto-related stock craze is more a reflection of a deeper social phenomenon than a financial one. It reflects how young South Koreans are eagerly seeking unconventional, high-risk paths to success amidst the shrinking availability of traditional wealth accumulation channels.

As Dragonfly's Hadick warns, "When premiums disappear, investors quickly sell off stocks, and these phenomena are usually short-lived." The valuations of crypto-related stocks, driven high by sentiment and speculation, may actually be a massive bubble. When the hype finally subsides, perhaps the truth will become clear: who's been left swimming naked.

- 核心观点:韩国散户转向加密相关股票寻求高收益。

- 关键要素:

- 韩国投资者7月净买入BitMine股票2.59亿美元。

- BitMine持有115万枚ETH,价值49.6亿美元。

- 韩国年轻人视加密投资为改变命运机会。

- 市场影响:推高加密相关股票估值,或形成泡沫。

- 时效性标注:短期影响。