Original title: "South Korea's Stablecoin Policy: Who Really Benefits?"

Author: MORBID-19

Compiled by: TechFlow

It’s all so obvious in hindsight!

It’s me again, complaining about the Korean won stablecoin.

But today I finally figured out why our "controllers" are so keen on promoting stablecoins.

I think I've discovered their real motive behind all this!

Let’s first look at the Financial Times report:

Ahn Do-geol, formerly the Second Vice Minister of Economy and Finance, recently formed a working group with the Ministry of Strategy and Finance, the Bank of Korea, the Financial Services Commission, the Korea Capital Market Institute, and other relevant agencies to draft a bill on won-denominated stablecoins.

(…)

Andojie's office plans to include in the bill not only the basic qualifications and licensing requirements for stablecoin issuers, but also provisions regarding collateral asset requirements, monetary policy management measures, foreign exchange transaction supervision, and user protection mechanisms.

Hwang Se-woon, a senior researcher at the Korea Capital Market Institute and a member of the Ahn Do-je’s task force on the Korean won stablecoin, stressed that only entities that meet strict eligibility criteria should be allowed to issue stablecoins , and that the qualifications of issuers should be granted through a licensing system.

TLDR: Issuing a Korean won stablecoin will likely require government approval

So who is most likely to secure government approval? Someone close to the government, perhaps? Or perhaps established businesses that have already hinted they are preparing for it?

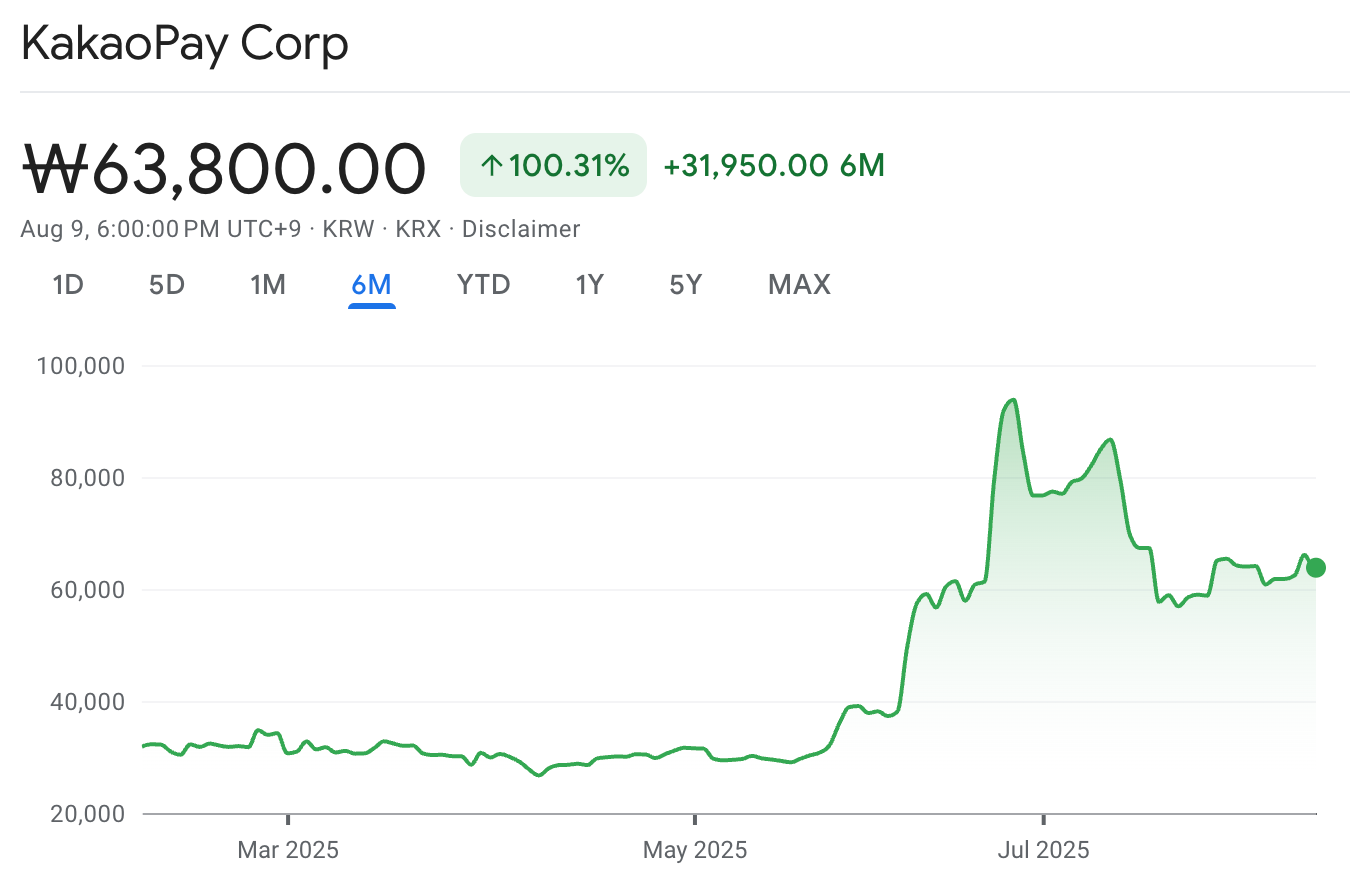

No one really knows yet who the ultimate winners will be from this hasty policy, but the market seems to have already bet very aggressively on certain names.

KakaoPay is one of the obvious candidates as a potential beneficiary of a won-based stablecoin, as it is one of the largest payment apps in South Korea.

With KakaoPay at the forefront, Kakao Group is planning to deploy its own bank, KakaoBank , to further promote its stablecoin dream.

It seems that South Korea’s crypto players are about to “eat their fill” again, and the “invisible hand” seems to be working silently.

But is this hand truly invisible, or is it actually “visible” to some people?

Thanks to 4K cameras, the "invisible hand" becomes clearly visible

Expose elected officials who claim they own no securities but may be engaging in insider trading.

Photo: Lee Chun-seok, a member of the Democratic Party of South Korea, traded stocks in the name of another person in the National Assembly.

Lee Chun-seok, a member of the Democratic Party of South Korea, was photographed trading stocks, including Naver shares, using a mobile phone securities trading app during the plenary session of the National Assembly. The problem is that the account name in the photo was not "Lee Chun-seok," but his assistant, Mr. Cha.

(…)

Despite two similar photos taken within the past 10 months, Councilman Lee's asset disclosure statement indicated that neither he nor his family members held any stocks or securities as of December 31st of last year. Under the Financial Transaction Real-Name System Act, all financial transactions must be conducted under one's real name. Anyone who conducts transactions under another person's name for illegal purposes, such as concealing assets, may face up to five years in prison or a fine of up to 50 million won.

This classic "I don't care about the 125x zoom camera on the back, let me see how these stocks perform and vote for them" really left me speechless.

Although it is still unclear whether he was actually involved in insider trading, the mere fact that he used his assistant's account to trade already exudes the whiff of a crime.

When it comes to crime, a lot of things are being done under the guise of “educational content.”

Original video link: Click here

At the 17:06 mark of the aforementioned video, the narrator claims that K-Pop and Korean culture could be a good use case for a Korean won stablecoin, repeating the arguments of politicians who have attempted to push for related legislation.

However, what’s truly shocking about this video isn’t the content itself, but the sheer amount of disappointment viewers express towards the channel owner when you check out the comments section:

- "What's wrong with you? Are you trying to run for election?"

- "It seems I've always overestimated Hyoseok..."

- "What's going on? Did the government threaten you to post this video? Haha... Yeah."

However, seeing the voices expressing dissatisfaction with this attempt at "brainwashing" in the comment section made me feel a little scared, because I suddenly realized that those who raised questions may only be an absolute minority in this country.

Most people don’t even care what stablecoins are or how they work. Only those with a certain level of financial knowledge are able to pay attention to and solve these problems.

The current government's approval rating is a whopping 65%. Of course, this has absolutely nothing to do with that free $100 voucher !

As long as they keep throwing money around, maybe they can eventually achieve their goals.

We will all succeed.

- 核心观点:韩国政府推动韩元稳定币政策或存在利益输送。

- 关键要素:

- 政府工作组起草韩元稳定币法案,需许可发行。

- KakaoPay等关联企业或成主要受益者。

- 议员涉嫌用他人账户进行股票内幕交易。

- 市场影响:加剧市场对政策公平性质疑。

- 时效性标注:中期影响。