Original author: Lyn Alden

Original translation: AididiaoJP, Foresight News

While the cypherpunks and traditional institutions have different perspectives on Bitcoin stocks, both have their merits. Bitcoin must function as a free currency, but the massive influx of capital into Bitcoin is entirely reasonable.

Bitcoin’s rally over the past year or so has been largely driven by the rise of Bitcoin treasury strategies among publicly traded companies.

Although MicroStrategy set this precedent as early as 2020, other companies were slower to follow suit. However, after the Financial Accounting Standards Board (FASB) made a major update to the accounting treatment of Bitcoin on balance sheets in 2023, a new wave of Bitcoin treasury asset strategies was ushered in in 2024 and 2025.

This article explores this trend and analyzes its impact on the Bitcoin ecosystem as a whole. It also discusses Bitcoin as a medium of exchange and a store of value.

Why Bitcoin Stocks and Bonds?

Back in August 2024, when this trend was still in its infancy, I wrote an article titled " A New Look at Corporate Treasury Strategy ," explaining the utility of Bitcoin as a corporate treasury asset. At the time, only a handful of companies had adopted this strategy on a large scale, but since then, more and more new and existing companies have begun adopting it. Those early large-scale adopters, such as MicroStrategy and Metaplanet, have seen significant increases in their stock prices and market capitalizations.

The article explains why businesses should consider implementing this strategy. But what about investors? Why is this strategy so attractive to them? From an investor's perspective, why would one buy Bitcoin stocks instead of buying Bitcoin directly? Here are a few key reasons.

Bitcoin Stock, Reason 1: Restricted Capital

There are trillions of dollars of managed capital globally, a portion of which has strict investment restrictions.

For example, some equity funds can only be used to buy stocks and cannot buy bonds, ETFs, commodities, or other assets. Similarly, some bond funds can only buy bonds. Of course, there are more specific restrictions, such as fund managers can only buy healthcare stocks or non-investment grade bonds.

Some of these fund managers are optimistic about Bitcoin, and many even hold Bitcoin themselves. However, they cannot directly gain exposure to Bitcoin through their funds. However, if someone issues a stock with Bitcoin on its balance sheet (Bitcoin equity) or a convertible bond issued for a company with Bitcoin on its balance sheet, they can circumvent these restrictions and purchase it. This is a previously untapped market that is now being tapped into in the United States, Japan, the United Kingdom, South Korea, and other countries.

Since 2018, I have been creating a real money model portfolio so that readers can follow my holdings.

In early 2020, I strongly recommended Bitcoin as an investment and invested in it myself. I wanted to add some Bitcoin exposure to my model portfolio, but the brokerage account I used for that portfolio at the time couldn't buy Bitcoin or Bitcoin-related securities. I couldn't even buy the Grayscale Bitcoin Trust (GBTC) because it trades over-the-counter, not on a major exchange.

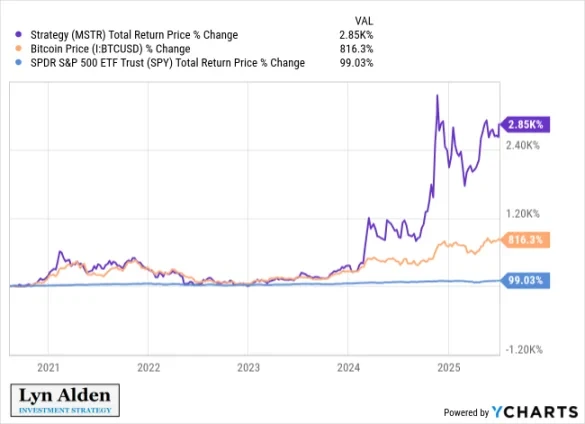

Fortunately, MicroStrategy added Bitcoin to its balance sheet in August 2020. The stock is listed on the Nasdaq and can be purchased directly from my Model Portfolio brokerage account. So, given the portfolio's limitations, I'm glad I bought into MSTR early on, a decision that has paid off handsomely over the past five years:

Later, I added GBTC, a security I could buy, to my brokerage account, and of course, the major spot Bitcoin ETF. Despite this, I still hold MSTR in the portfolio.

In short, due to investment restrictions, many funds can only hold stocks or bonds with Bitcoin exposure, rather than ETFs or similar securities. Bitcoin Treasury Inc. ("Bitcoin Equity") provides them with an opportunity.

This does not conflict with Bitcoin as a bearer asset that individuals can self-custody, but rather complements it.

Bitcoin Stock, Reason 2: Businesses Have Ideal Leverage

The fundamental strategy for companies adopting Bitcoin as a treasury asset is to hold Bitcoin rather than cash equivalents. However, the first Bitcoin investors often have a high degree of confidence in this concept. Therefore, they not only purchase Bitcoin directly, but also purchase Bitcoin through leveraged means.

Public companies happen to have better leverage tools than hedge funds and most other capital, specifically the ability to issue corporate bonds.

Hedge funds and certain other assets often use margin loans. They borrow money to buy more assets, but if the value of the assets drops too much relative to the borrowed amount, they face a margin call. A margin call can force hedge funds to sell assets during a sharp price drop, even if they believe they will recover and reach new highs. Being forced to sell high-quality assets at a low point is a disaster.

In contrast, corporations can issue bonds, typically with maturities of many years. If they hold Bitcoin and its price falls, they aren't forced to sell. This makes them more resilient to volatility than entities relying on margin lending. While bearish scenarios could still force corporate liquidations, these scenarios require a more prolonged bear market and are therefore less likely.

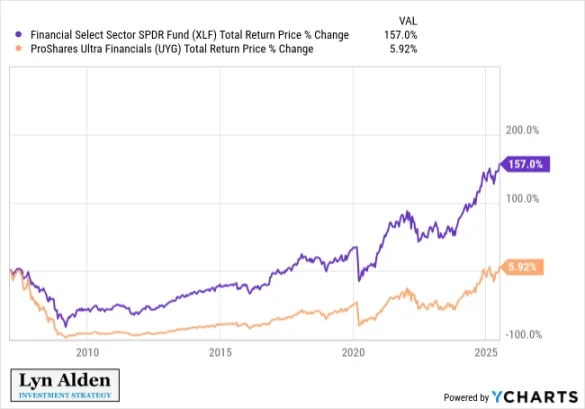

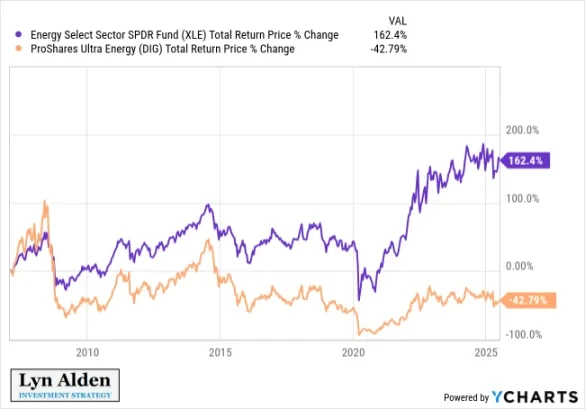

This long-term corporate leverage is generally better than leveraged ETFs. Because leveraged ETFs cannot use long-term debt and the leverage resets daily, volatility is often a disadvantage.

What happens to a 2x leveraged ETF if the underlying asset fluctuates between +10% and -10% during the trading day? Over time, the leveraged product will gradually deteriorate relative to the index it tracks:

In fact, the 2x leveraged Bitcoin ETF (BITU) hasn't actually outperformed Bitcoin since its inception, despite Bitcoin's price appreciation during that period. You might expect a 2x leveraged version to significantly outperform, but in reality, it primarily increases volatility without delivering higher returns. Here's a chart of BITU's performance since its inception:

The same thing happens with the long-term history of volatile stocks, such as 2x leveraged ETFs in the financial or energy sectors. During periods of volatility, they underperform significantly:

Therefore, unless you are a short-term trader, intraday leverage is generally not very effective. Volatility is very unfavorable to leverage.

However, attaching long-term debt to an asset generally doesn't present the same problem. An appreciating asset with multi-year debt is an attractive combination. Therefore, Bitcoin Treasury is an attractive security for high-conviction Bitcoin bulls looking to boost returns with reasonably safe leverage.

Not everyone should use leverage, but those who do will naturally want to do so in an optimized manner. There are now a wide variety of Bitcoin treasury companies with varying risk profiles, sizes, industries, and jurisdictions, and a genuine market need is being met.

Some of the securities issued by these same companies, such as convertible bonds or preferred stock, can provide exposure to the Bitcoin price while reducing volatility. A diverse range of securities provides investors with the specific type of exposure they need.

What is the impact of Bitcoin Treasury on Bitcoin?

Now that we understand why Bitcoin treasuries exist and the market gap they fill for investors, the next question is: are they beneficial to the Bitcoin network as a whole? Does their existence undermine Bitcoin’s value as a free currency?

First, we must clarify the theoretical path for a successful decentralized currency. What steps would be required, and in what general order?

This section will therefore be divided into two parts. The first is an economic analysis of how a new form of money might become popular—that is, an analysis of what the path to success might look like. The second part is an analysis of whether businesses facilitate or hinder that path.

Part 1: What would success look like?

“If a global, digital, robust, open-source, programmable currency were to circulate from scratch, what would it look like?”

Ludwig Wittgenstein once asked a friend, “Tell me, why do people think it’s more natural for the sun to revolve around the Earth than for the Earth to revolve around itself?” The friend replied, “Well, obviously, because the sun appears to revolve around the Earth.” Ludwig responded, “Well, what would it look like if the Earth appeared to revolve around itself?”

—Wittgenstein’s Currency, Alan Farrington, 2020

Bitcoin was created in early 2009, and throughout 2009 and 2010, a group of enthusiasts mined, collected, tested, traded, and investigated whether they could contribute to or improve it in some way. They were fascinated by the idea of Bitcoin.

In 2010, Satoshi Nakamoto himself described on the Bitcoin forum how to give Bitcoin initial value from scratch:

As a thought experiment, imagine there is a precious metal that is as scarce as gold, but has the following properties:

- Monotonous and dull color

- Poor conductivity

- Low strength, ductility or malleability

- No practical or decorative use

And a special, magical property:

- Can be transmitted via communication channels

If it for some reason acquired any value, then anyone who wanted to transfer wealth over a long distance could buy some and transmit it, and the recipient could sell it.”

After its initial success, Bitcoin faced the challenge of spawning numerous competitors as a payment network. Numerous altcoins emerged, offering similar functionality: they could be purchased, transferred, and sold by the recipient. Stablecoins, introduced in 2014, eliminated token volatility by using USD collateral.

In fact, the rise of competitors was the biggest reason I didn't buy Bitcoin in early 2010. It wasn't that I was against the concept, but I believed the industry was full of speculative bubbles and could be replicated endlessly. In other words, Bitcoin's supply may be finite, but its concept is infinite.

But in the second half of 2010, I noticed something: Bitcoin's network effects were growing. Like any communications protocol, Bitcoin benefits greatly from network effects. The more people use it, the more useful it becomes to everyone else, a self-reinforcing cycle. And that's the real point of holding Bitcoin. The network effects must continue to grow to move beyond this niche, crowded phase.

We can divide currencies into two categories:

The first category is "contextual currency," which refers to currencies that solve a specific problem but are not widely used otherwise. An asset that can be purchased with local currency, transferred with high slippage (due to capital controls, payment platform blockages, etc.), and sold or redeemed for local currency by the recipient. It has value, but success in this area does not necessarily lead to broader success.

The second category is "universal money," which refers to money that is widely accepted in a specific region or industry. It's important that recipients don't sell or redeem it immediately upon receipt; they hold it as a cash balance and potentially re-use it elsewhere.

For a currency to become universal, spenders must hold it for the long term, and recipients must be willing to hold it. If a new universal currency were to emerge, most people would likely view it first as an investment, believing its purchasing power would increase, and then be willing to accept it as a means of payment. They wouldn't need to be convinced to accept it as a means of payment; they already recognize the asset.

Bitcoin's simple and secure design (proof-of-work, fixed supply, limited script complexity, moderate node requirements, and decentralization after the founder disappears) and first-mover network effects give it optimal liquidity and security, leading many people to want to buy and hold Bitcoin. So far, Bitcoin has been a resounding success in this regard: as a secure and portable store of value that users can freely spend or redeem as they choose.

A secure, liquid, convertible, and portable store of value lies somewhere between contextual and universal currencies. Unlike contextual currencies, universal currencies are considered an asset to be held long-term, rather than simply sold or redeemed immediately upon receipt. However, unlike universal currencies, they are not yet widely accepted in most regions, as only a minority of people have taken the time to research them.

This phase will take a long time to complete due to volatility and the scale of the existing network effects Bitcoin faces as people's spending and liabilities are denominated in existing currencies.

If a new monetary network with independent units (i.e., not pegged to the fiat rails of existing currencies, but operating entirely parallel to a central bank) were to grow from scratch to scale, it would require upward volatility. Any appreciating asset with upward volatility would attract speculators, which would inevitably lead to periods of downward volatility. In other words, it would look something like this:

In its adoption phase, it's a form of money with short-term flaws. If you receive some Bitcoin and want to use it to pay your rent at the end of the month, neither you nor your landlord can afford to see its value drop 20% in a single month. The landlord's payouts rely on the network effects of existing fiat currencies; she needs to know the value of the rent she receives from her tenants. And you, as a tenant, need to be sure you can pay your rent at the end of the month in a currency that won't depreciate rapidly.

Therefore, Bitcoin is primarily viewed as an investment in this era. Believers are more likely to use it for payments. Those with specific payment challenges (such as capital controls or payment platform closures) are also more likely to use it, though they are increasingly opting for stablecoins with similar liquidity. If you're only using stablecoins for a short period, their centralized nature isn't crucial.

Early Bitcoin supporters tried to convince Bitcoin holders to use more of their currency. I don't believe this is a sustainable approach. Bitcoin will not become popular as a charitable tool. To achieve widespread and sustained adoption, it must address a payment gap in the market for both spenders and recipients. This is not easy at this stage of adoption, especially since every transaction is subject to capital gains tax. Options like stablecoins can address short-term spending needs.

Owning a robust, liquid, fungible, and portable store of value offers holders advantages during its adoption phase that other assets don't. They can take Bitcoin anywhere in the world without relying on central counterparties or credit structures. It also allows holders to avoid significant capital losses by making cross-border payments, including to recipients blocked by the platform. They may not be able to pay with Bitcoin everywhere, but in most cases, they can find ways to convert it into local currency, and in some cases, they can pay directly with it.

Imagine you're traveling to a random country. What currency can you bring with you to ensure you have enough purchasing power without relying on the global credit network? In other words, even if all your credit cards are deactivated, how can you ensure you can still make transactions, even if it means incurring some wear and tear on your funds?

The best answer right now is usually physical US dollars. If you bring US dollars, while you may not be able to use them directly, it is easy to find someone willing to exchange them for local currency at a reasonable exchange rate and with sufficient liquidity.

Other possible answers would be gold and silver, as well as the Euro. Again, it's not difficult to find a broker in most countries who will accept gold, silver, or Euros and exchange them at a fair local value.

The Chinese yuan, Japanese yen, British pound, and some other currencies might also be options, but they often come with more wear and tear. I'd put Bitcoin somewhere in the top ten, somewhere between 5th and 10th, especially if you're traveling to a city center. Most cities have numerous exchange options, allowing you to seek help if needed. This is quite impressive considering Bitcoin is only 16 years old.

The next 160 or so fiat currencies are very bad currencies outside of their own countries, the vast majority of them.

The US dollar is the most liquid currency in the world today. Smaller, less liquid assets are almost always denominated in terms of larger, more liquid assets. People use larger, more liquid currencies as their units of account and denominate their primary liabilities in them.

The US dollar was once defined by a certain amount of gold. Eventually, the US dollar network became larger and more ubiquitous than gold, and the situation reversed: gold is now primarily denominated in US dollars. Over time, Bitcoin may surpass the dollar in this way, but it is far from that level yet. It doesn't matter what Bitcoin is denominated in during this process; it is a bearer asset that can be denominated in the largest and most liquid currency. If it ever becomes the largest and most liquid currency, then other things will naturally follow suit.

While people are free to price their money in any currency, most will quickly price it in Bitcoin. Critics describe this as a flaw in Bitcoin: a new decentralized monetary asset that has no other path to grow than being denominated in existing currencies.

Part 2: How Businesses and Bitcoin Stocks Fit In

Back in 2014, Pierre Rochard wrote a prescient article titled “Speculative Attack.”

Speculative attacks in the foreign exchange market involve borrowing money in a weak currency to buy more of a stronger currency or other high-quality assets. This is one reason central banks raise interest rates, and some countries resort to outright capital controls to prevent entities from arbitrage trading against their poorly managed currencies.

Wikipedia provides a working definition:

“In economics, a speculative attack occurs when previously inactive speculators suddenly sell off unreliable assets and acquire some valuable asset (currency, gold) in response.”

Due to the appreciating nature of Bitcoin, various entities would eventually borrow currency to purchase more Bitcoin. At the time, the price of Bitcoin was just over $600, with a market capitalization of just over $8 billion.

Initially, borrowing money to buy Bitcoin was a rare phenomenon. But now the Bitcoin network is highly liquid, with a market capitalization exceeding $2 trillion, and billions of dollars in corporate bonds from mainstream capital markets have been specifically used to buy Bitcoin.

Now, 11 years later, this phenomenon has become commonplace. Is this good or bad for the Bitcoin network?

From what I’ve observed, there are two main types of critics who believe this is bad for the Bitcoin network.

The first group of critics are Bitcoin users themselves. Many of them fall into the cypherpunk or sovereigntist camps. From their perspective, entrusting Bitcoin to custodians seems dangerous, or at least contrary to the very idea of a decentralized network. Some of them refer to corporate Bitcoin treasury supporters as "suit Bitcoiners," which I think is a good term. This group of Bitcoiners prefers that people hold their own private keys. Some of them further suggest that rehypothecation by major custodians could suppress prices or otherwise undermine Bitcoin's value as free money. While I like the values of this camp, some of them seem to harbor utopian dreams, wishing everyone shared their interest in full control of their own currency.

The second group of critics are typically those who have historically held negative views on Bitcoin. They've been questioning Bitcoin for years. As Bitcoin has become a top-performing asset, consistently hitting new highs over multiple years and cycles, some of them have shifted their views, arguing that "Bitcoin's price may be rising, but its value is already captured." I take this group less seriously than the first. This is similar to perma-bears in the stock market who, when their bearish thesis fails to materialize after a decade, will shift to saying, "The market is only rising because the Fed printed too much money." My response is, "Well, yes, that's why you shouldn't be bearish."

My message to both camps is this: the fact that some big money chooses to hold Bitcoin doesn't mean "libertarian" Bitcoin is harmed in any way. It can be self-custodied and transferred peer-to-peer as usual. Furthermore, as more entities hold Bitcoin, the network becomes larger and less volatile, which also helps enhance its utility as a peer-to-peer payment currency. It may also provide political cover, helping policymakers mainstream it. If Bitcoin reaches this scale, the emergence of Bitcoin stocks and the phenomenon of big money buying into Bitcoin are inevitable.

One of the skills of perma-bears is to constantly adjust their narratives as needed, ensuring they're right no matter what happens. Bitcoin, by their definition, has no plausible path to success. What if Bitcoin remains a niche asset? Then its price growth and liquidity will be compromised, and voila, it's a failure! What if it's adopted by large entities and governments and continues to grow massively? Then its value has been captured and lost.

But if it’s going to become big, widely accepted, and somehow change the world, how could that path not go through businesses and governments?

Bitcoin's price moves through several major phases.

In the first phase, people mine Bitcoins with their computers, send money to Mt Gox to buy Bitcoins, and other early adopter behaviors that incur costs. This is the early user phase.

In the second phase, particularly after the collapse of Mt Gox, buying and using Bitcoin became much easier. Domestic exchanges in many countries made it easier than ever to buy Bitcoin. The first hardware wallets became available in 2014, making self-custody more secure. This was the retail buyer phase, and while slippage still existed, it was decreasing.

In the third phase, Bitcoin became widespread, liquid, and had a long enough track record to attract more institutions. Some entities established institutional-grade custody services, public companies began purchasing Bitcoin, and various ETFs and other financial products emerged, allowing various funds and managed capital to gain exposure. Some countries, such as Bhutan, El Salvador, and the United Arab Emirates, mined or purchased and held Bitcoin at the sovereign level. Others, such as the United States, chose to hold confiscated Bitcoin rather than sell it outright.

Fortunately, while businesses are currently the primary buyers, retail investors can still freely purchase Bitcoin in a frictionless manner.

I’ve heard people say, “I thought Bitcoin was for the people, peer-to-peer cash, but now it’s all owned by giant corporations.” Bitcoin is indeed for the people; anyone with an internet connection can buy, hold, or transfer it.

This is why I agree with both the cypherpunks and the suited Bitcoin enthusiasts. I want Bitcoin to function as a free currency, which is a key reason why I'm a general partner at Ego Death Capital. We fund startups building solutions for the Bitcoin network and its users. It's also why I support the Human Rights Foundation and other nonprofits that fund developers and educators focused on providing financial tools to people in inflationary environments. However, once businesses, investment funds, and even sovereign entities understand Bitcoin, it makes sense for them to buy it, and now it's on their radar.

It's important to remember that most people aren't active investors. They don't buy stocks or deeply analyze how Bitcoin differs from other cryptocurrencies. If they speculate on an asset as a trader, they're likely to buy at the top and get washed out at the bottom. Their investments are typically passively allocated, rather than selected by themselves. In the past, pension funds often made allocations. Today, financial advisors often make investments.

In my opinion, it is unreasonable to expect billions of people to actively buy Bitcoin. However, it is reasonable to work hard to lower the barriers to entry through technological solutions and educational resources so that anyone can choose to get involved in Bitcoin.

The best way I’ve seen it put it is: “Bitcoin is for anyone, not everyone.” In practice, this means that everyone should be educated about Bitcoin, but only some will choose to adopt it.

Summary

The development of Bitcoin monetization is roughly as follows:

Bitcoin began as a collectible for enthusiasts and those with revolutionary dreams, a new technology that might offer some value to people.

Bitcoin is beginning to become a situational medium of exchange, even among pragmatists who might not have previously considered it. For example, when sending funds to a country with capital controls, Bitcoin can facilitate transfers when other payment methods fail. When receiving payments or donations but being blocked by major online payment platforms (like WikiLeaks), Bitcoin can be a good solution.

High volatility, numerous competitors, and various acquisition costs like capital gains taxes hinder Bitcoin's continued growth as a common medium of exchange. If you pay a merchant with Bitcoin who doesn't hold Bitcoin and they automatically convert it to fiat, the full benefits of Bitcoin are not realized.

Bitcoin is widely viewed as the ideal portable, appreciating asset. Unlike other cryptocurrencies, it achieves decentralization, security, simplicity, scarcity, and scalability, making it a valuable long-term asset. While it's not always easy to buy coffee with it, it has begun to rank among the top ten bearer assets that can be carried internationally and readily converted to local value, surpassing most fiat currencies.

The Bitcoin network has sufficient liquidity, scale, and durability to attract active interest from businesses and governments. Significant amounts of managed capital are invested in the asset, with businesses and funds providing indirect exposure to Bitcoin. Meanwhile, Bitcoin's continued existence as an open and permissionless network means individuals continue to use and build on it.

If the Bitcoin network continues to scale, they may achieve:

As the Bitcoin network grows larger, more liquid, and less volatile, its appeal to large sovereign entities will also increase. Initially a small sovereign fund investment asset, Bitcoin could eventually become a large-scale foreign exchange reserve or international settlement method. Countries have been attempting to build closed-source alternative payment methods, but adoption has been slow and consensus has been lacking. However, open-source settlement networks with a limited supply of independent units are gradually gaining global traction.

Overall, I still believe that Bitcoin is in good shape technically and economically, and its adoption path is expanding as expected.

- 核心观点:企业比特币国库策略推动比特币采用。

- 关键要素:

- FASB会计规则更新加速企业配置。

- 受限资本通过股票/债券间接投资比特币。

- 企业杠杆优势提升比特币持有量。

- 市场影响:机构入场增强比特币流动性。

- 时效性标注:中期影响。