Original title: RWA Milestone: The first RWA token stock Figure is about to be listed

On August 5th, the US crypto capital market welcomed a newcomer: Figure Technology Solutions (FTS). Founded by Mike Cagney, co-founder and former CEO of SoFi, the fintech company has filed its S-1 filing with the US Securities and Exchange Commission (SEC), officially initiating its IPO process. Unlike traditional financial institutions, which follow the rules, Figure has been built on blockchain technology from the outset, leveraging it to reshape the financial paradigm for mortgages and crypto-backed loans.

Mike Cagney, who once led SoFi to a revolution in internet finance, now aims to leverage blockchain to disrupt the business models of established banks. He stated, "This funding validates our vision of redefining capital markets using blockchain technology, and we are reaping real benefits from adopting blockchain in our lending and capital markets businesses."

Starting with mortgages: The largest non-bank HELOC provider in the United States

In the mortgage market, Figure is directly addressing the weaknesses of traditional banks with its speed and transparency. In the past, applying for a HELOC loan could take weeks or even months. On Figure's platform, users can apply 100% online, with approvals in as little as five minutes and disbursements within five days.

To date, Figure has helped over 200,000 families unlock $16 billion in home equity, becoming one of the largest non-bank HELOC providers in the United States. Even more intriguing, this isn't achieved by "streamlining review processes" to achieve speed, but rather by leveraging Figure's proprietary Provenance blockchain. This public, proof-of-stake blockchain, built on the Cosmos SDK, supports instant finality, ensuring irreversible finality once confirmed, ensuring secure and transparent loan settlement.

Provenance not only establishes a standardized, immutable, on-chain record for each loan but also directly connects to Figure Connect, Figure's own on-chain private capital markets platform. Through it, loan originators and investors can complete matching, pricing, and settlement on-chain, reducing the entire process from months to days, virtually redefining the efficiency of private credit transactions.

Crypto Collateralized Loans: HODL and Liquidity

If HELOC allows Figure to gain a foothold in the traditional mortgage field, then cryptocurrency mortgages are its way of showing its sword in the digital asset track.

In this service, customers can use Bitcoin (BTC) or Ethereum (ETH) as collateral to borrow cash at up to 75% LTV (loan-to-value ratio), with interest rates as low as 8.91% (50% LTV), and no credit score is required.

All collateral assets are stored in a decentralized, isolated multi-party computation (MPC) custodial wallet. Clients can directly access on-chain addresses to ensure funds are never misappropriated. This means that even if you're currently using BTC or ETH as collateral for a loan, you can confidently continue to "hold on to your coins for appreciation." The cash you have can be used to pay off debts, buy a house, renovate, or even directly increase your crypto holdings.

This design is particularly popular in a bull market - investors can release liquidity without having to cut losses while retaining the potential for asset appreciation; in a bear market, they can obtain emergency funds through mortgage and avoid passive liquidation.

Actively integrating into the cryptocurrency circle: RWA and stablecoin dual-wheel drive

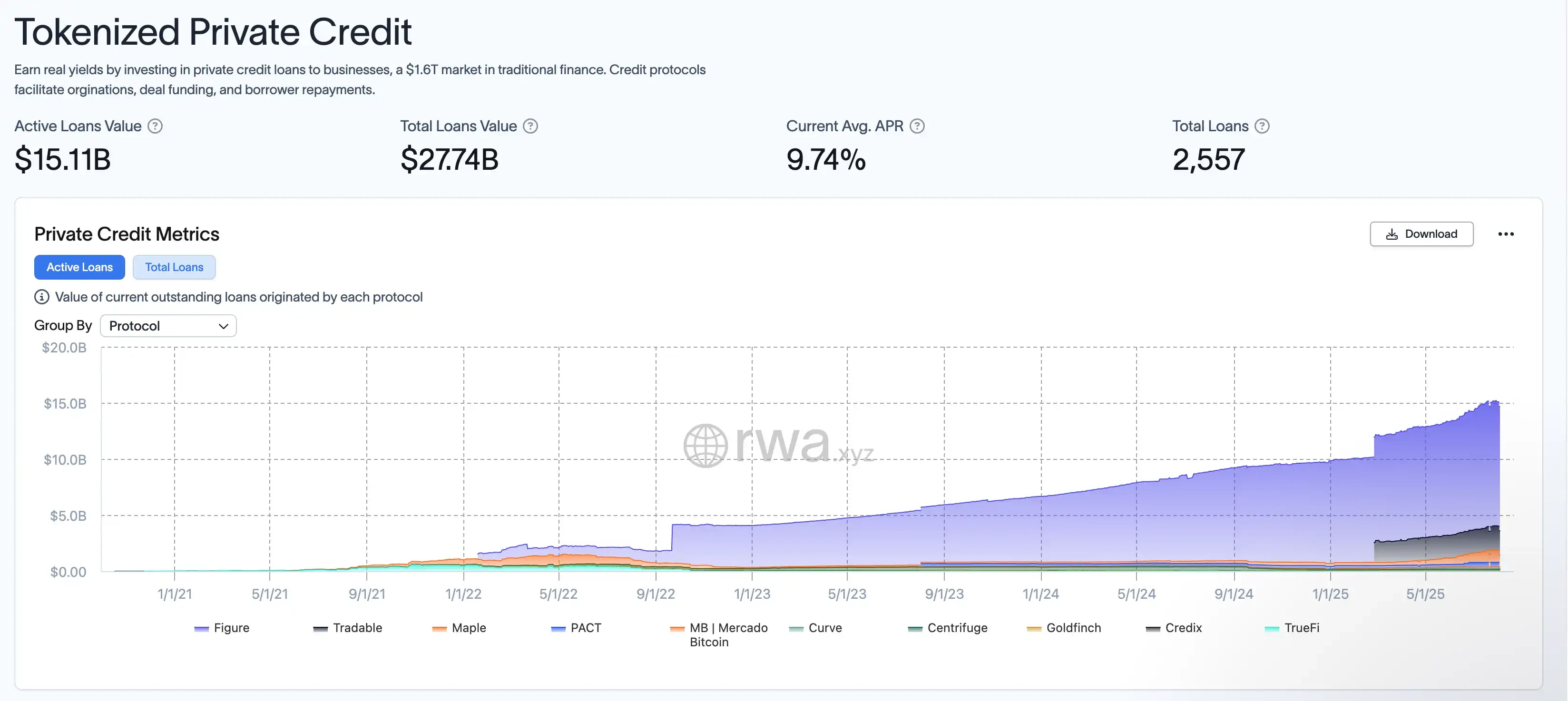

Figure's ambitions extend far beyond mortgages and crypto loans. Leveraging the underlying technology of the Provenance blockchain, Figure has issued $13 billion in cumulative loans in the $27.74 billion tokenized private credit market, with $11 billion in active loans and an utilization rate exceeding 84%. As seen on the rwa.xyz website, Figure holds a top position in the private credit category. Whether it's mortgage assets or private credit, Figure digitizes and programmably enables standardized issuance and trading on-chain. These on-chain assets are naturally compatible with decentralized finance (DeFi) protocols, enabling the global circulation, collateralization, and reuse of funds previously locked in the traditional financial system, blurring the lines between TradFi and DeFi.

Meanwhile, Figure Markets' YLDS stablecoin has become the world's first SEC-approved interest-bearing stablecoin. It's pegged 1:1 to the US dollar and calculates interest at SOFR minus 50 basis points, yielding an annualized yield of approximately 3.79%. YLDS not only boasts impeccable regulatory compliance but also provides users with stable returns. It can be used in a variety of scenarios, including payments, cross-border settlement, and mortgage financing. This "RWA + stablecoin" combination not only secures growth in both the real asset and digital asset markets for Figure, but also positions it at the gateway to the next trillion-dollar market.

Capital layout and listing preparation

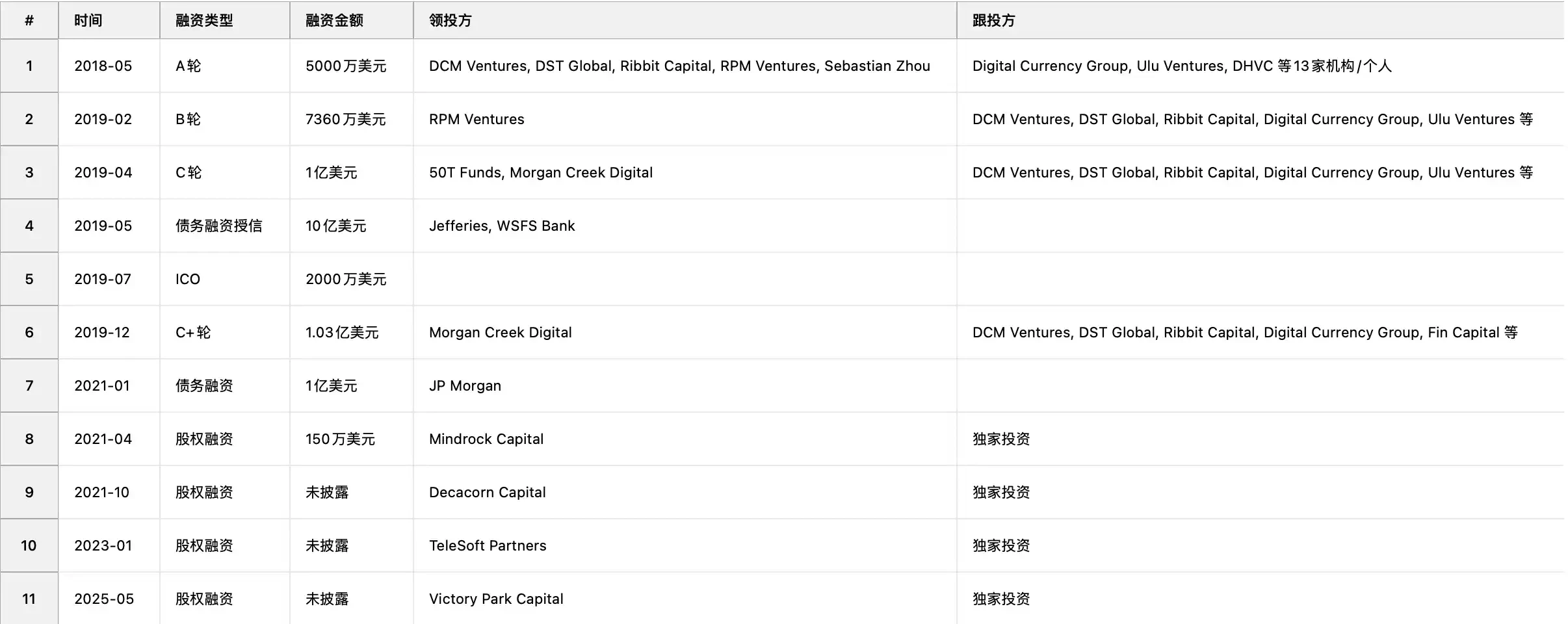

In just a few years, Figure has completed multiple rounds of financing from renowned investors including DCM Ventures, DST Global, Ribbit Capital, and Morgan Creek Digital. It has also secured billions of dollars in debt lines from Jefferies and JPMorgan Chase. According to market sources, top Wall Street investment banks such as Goldman Sachs and JPMorgan Chase are also among the underwriters for this IPO.

Prior to this, Figure had reorganized its internal structure, incorporating the lending entity Figure Lending LLC into the Figure Technology Solutions brand system, and introduced an executive team with extensive regulatory and corporate governance experience to pave the way for listing.

Summarize

2025 may be remembered as the year of the cryptocurrency-stock market. From the sudden emergence of various "altcoin versions of MicroStrategy," to CRCL's incredible 10x return a month after its IPO, to top crypto companies like Kraken gearing up for action, the convergence of capital markets and on-chain markets is entering a new era.

Today, everyone is waiting for the true RWA whale—one that can bring trillions of real-world assets onto the blockchain and redefine the market landscape like Bitcoin and Ethereum. Figure is sprinting towards this position, and its next step may become part of history.

- 核心观点:Figure 通过区块链技术革新传统金融业务。

- 关键要素:

- 5分钟获批HELOC贷款,效率远超传统银行。

- 加密货币抵押贷款支持BTC/ETH抵押,LTV达75%。

- Provenance区块链实现资产数字化与DeFi兼容。

- 市场影响:推动RWA与DeFi深度融合,加速传统金融链上化。

- 时效性标注:中期影响。