In August 2020, a project called Sushiswap spread from everyone, attracting the attention of many liquidity miners.

Just one month later, it successfully "transferred" the "big brother" Uniswap exchange's over 1 billion US dollars of encrypted funds, accounting for nearly 80% of the total, to its own platform. First-line traffic Internet celebrity", this liquidity migration is also vividly called "vampire attack".

Sushiswap VS. Uniswap

"Later Wave" Sushiswap's Internet Celebrity Road

Before the story begins, let’s understand a small fact: We know that centralized exchanges are trading protocols based on order books, while decentralized trading AMMs are exchange pool transactions based on smart contracts deployed on the blockchain. That is to say, users deposit their own Token into the fund pool of an exchange, and then they can exchange for another Token according to the algorithm, which greatly enhances the immutability and autonomy of the transaction.

In the second half of 2020, the strong wind of DeFi decentralized finance will blow, and the fastest out of the circle is none other than Uniswap. Rising stars are also quietly upgrading, and various "Swap" such as Sushiswap, Mooniswap, and Airswap have emerged as the times require. They rob better data, including more users, trading volume, and liquidity, in order to obtain a higher market value ranking. There was smoke everywhere.

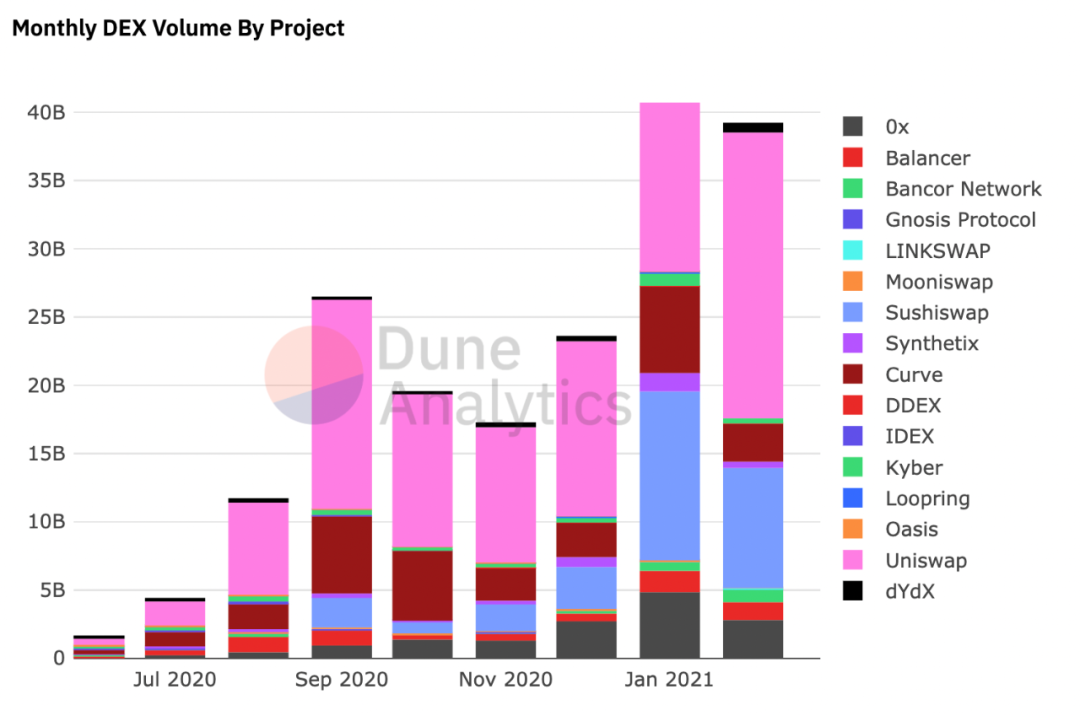

Since July 2020, various DEX projects have emerged to divide the market share. The picture shows the transaction volume indicator. Source: Dune AnalyticsThe relationship between Uniswap and Sushiswap is like a pair of twin brothers. Because of the open-source nature of the blockchain project code, its appearance comes from directly copying Uni’s code, or it is a fork of Uni, which is why Sushi has always been controversial. The place.However, the controversy cannot stop Sushiswap from keeping up with the rapid growth of Uniswap. It not only provides users with benefits similar to Uniswap, but also issues its own platform currency SUSHI and introduces token incentives, that is, allocating part of its transaction fees to tokens. Holders of SUSHI tokens. This model prolongs the timeliness of benefits. Even the early liquidity providers of the platform can benefit from the protocol and continuously obtain tokens from the SUSHI they mine. On the other hand, Uniswap was not “forced” to launch its own governance token UNI until a few weeks after it was attacked on September 18, and then backtracked 15% of Token quotation compensation to early liquidity providers through airdrops.Token incentives are like throwing out a lot of bait, and how to solve the large amount of liquidity on the platform? Sushiswap had an idea and proposed a method to attract liquidity providers (LP): if you have deposited money with Uniswap, then you can use the "passbook" to pledge the LP Token with me, and give you interest on schedule (earn SUSHI tokens), your "passbook" can also be taken away at any time.After hearing this good news, everyone went to Uniswap to create an asset pool, replace LP Token, and then pledge LP Token in Sushiswap to win "interest". Afterwards, the total TVL locked in Uniswap skyrocketed at a speed visible to the naked eye. In September last year It exceeded 1.6 billion US dollars on the 1st.

A quick 'vampire attack' on Uniswap

Sushiswap then started the second step of migrating liquidity on the evening of September 9th, which is a step called "vampire attack": for users who just pledged LP Token, they will take everyone's "passbook" to exchange on Uniswap. The redemption of currency trading pairs directly "takes out" the token pool and transfers it from Uniswap to its own fund pool. During this process, the pledged users do not need to do any operations, and can continue to conduct token transactions on Sushiswap, and obtain 0.3% transaction fee income, of which 0.25% rewards are directly distributed, and the other 0.05% are converted into SUSHI tokens.This operation has greatly increased my liquidity, and the amount of locked positions reached as high as 1.27 billion US dollars when it was hot. At the same time, unexpected things also happened.During the process of users migrating liquidity, the founder Chef Nomi quietly cashed out the unlocked SUSHI with a total value of about 14 million USD in ETH. This operation immediately caused panic among the community and investors, and the price of SUSHI fell from $5 on September 5, 2020 to a minimum of $1.11 on September 6, a drop of nearly 80%. Everyone has vigorously condemned the founder's "fraud" behavior in the community and the media. In the end, he had to apologize and announced that he would hand over the platform private key to the CEO of the exchange FTX, Sam Bankman-Fried, and return the $14 million in ETH. Just calmed down a little.Sushiswap's growth path is both "genius" and "dog blood". Uniswap did not fail because of this migration. After the turmoil, it still occupies the first place in the decentralized exchange.

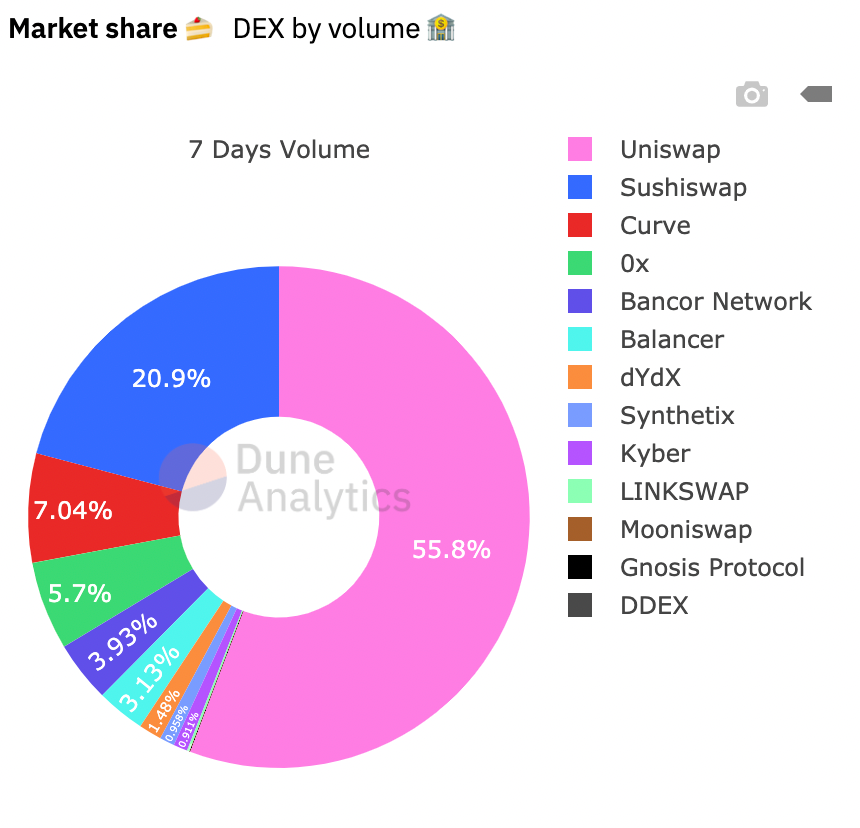

The transaction volume of each project in the past 7 days accounted for more than half of the total volume of Uniswap. Source: Dune Analytics

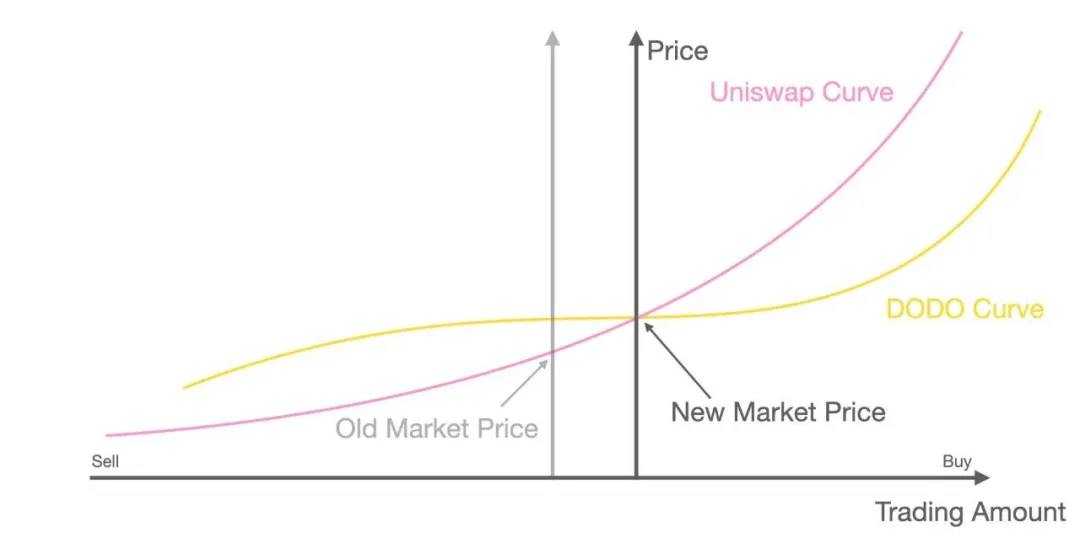

The PMM algorithm that goes a step further

Speaking of liquidity, it is one of the most important characteristics used to measure whether a market is good or bad, and there is still a big gap between the liquidity of decentralized exchanges and centralized exchanges. One of the reasons is that the smallest unit of time on the blockchain is not seconds or minutes, but blocks, which means that the fastest response to price changes is a block, so the speed of distributed transactions on the chain is almost It will be faster than centralized exchanges.In addition to the slow speed, in the AMM mode, funds are evenly distributed on the price curve, and only funds allocated near the market price can be effectively utilized. The resulting high slippage, low capital utilization and uncompensated losses are also very troublesome, and innovative algorithms are urgently needed to solve them.At this time, a "smarter" liquidity solution PMM (Proactive Market Maker) on the chain was developed by a newly established Chinese team to provide traders with a painkiller in a timely manner. It is like an "active market maker" that caters to market opportunities, allowing users to deposit a single asset and use Chainlink oracles for decentralized price feeds (to learn about oracles, please click:Oracles: An Inspiring Journey From Oracles to Smart Contracts), focusing on solving the problems of AMM’s slippage and impermanent losses. Once it appeared, it was enthusiastically welcomed by the capital in the circle, and there are countless investment institutions. Comparison of DODO's PMM function curve and Uniswap's AMM function curve

Comparison of DODO's PMM function curve and Uniswap's AMM function curve

The algorithm of PMM is no longer the constant model such as X*Y=K we mentioned in the last article, but more complex and dynamic: it no longer passively waits for the appearance of arbitrageurs, but uses price predictions Machines are used to imitate the behavior of human market makers, and by directly changing the price curve, the funds are gathered around the market price for transactions, so that the price curve is always smooth around the market. Under certain conditions, AMM becomes a subset of PMM, and the low slippage of "stronger" PMM provides the same high-quality liquidity as centralized exchanges.DODO's performance soared rapidly. According to the latest data from Debank, its 24-hour transaction volume has exceeded 100 million US dollars, and it has risen to the fifth place in the DEX transaction volume list, with more than 1,000 users. DODO was once considered a strong opponent of Uniswap. Judging from the current trading volume, its strength is still quite different (Uniswap’s 24-hour trading volume reached 1.1 billion US dollars). foreseeable risk.According to the latest news, DODO announced that it will launch the Beta version of V2 on February 22, and launch Ethereum and Binance Smart Chain. The overall ecological layout of Binance Smart Chain BSC is strong. Since its launch in September 2020, it has covered nearly 26 different fields such as wallets, infrastructure, derivatives, and stable coins. Among the DeFi products, BakerSwap and PancakeSwap are the AMM pools on their chains, which provide incentive mechanisms for users to participate in DeFi mining.Various projects in the DeFi world are rapidly established and changed, and all imaginations and attempts are given a lot of space to realize. Whether it is the next step of Sushiswap's development away from Uniswap, or DODO's improvement of the AMM model, simple "plagiarism" and copying have been abandoned by the market, and innovations based on democracy and community opinions can often stand firm.Comparison of DODO's PMM function curve and Uniswap's AMM function curve