Behind the Hainan Huatie Case: Opportunities and Challenges for the Compliance Implementation of RWA in the country

- 核心观点:RWA为中小企业提供链上融资新路径。

- 关键要素:

- 海南华铁通过NFT+RWA组合实现资产数字化。

- 合规设计规避证券化风险是关键。

- 中小企业需专业机构支持降低门槛。

- 市场影响:推动传统资产数字化进程加速。

- 时效性标注:中期影响。

1. The RWA window opens: How far can “on-chain financing” for SMEs go?

Against the backdrop of the continued deepening of the global digital economy, real-world assets (RWA) on-chain are becoming an important exploration direction for traditional industries to embrace blockchain technology and expand financing channels.

In recent years, several domestic industries have experimented with this approach. For example, the Shanghai-based Malu Grape Cooperative packaged agricultural products and related production data into underlying assets, listing them on digital asset trading platforms. Recently, the listed company Hainan Huatie's 10 million yuan non-financial RWA project sparked renewed discussion on whether companies can legally issue RWAs, providing valuable insights for small and medium-sized enterprises.

2. Hainan Huatie’s on-chain transformation: a combination of NFT+RWA

Hainan Huatie, a publicly listed company with state-owned assets in Hainan Province, primarily engages in equipment leasing, boasting a leading market share nationwide. The company's disclosed data indicates that its cumulative online equipment assets have reached 26 billion yuan. The company is exploring how to digitally map these assets and convert them into tradable equity products to optimize its asset structure and improve utilization efficiency.

In the direction of Web 3, Hainan Huatie is divided into two paths: NFT and RWA:

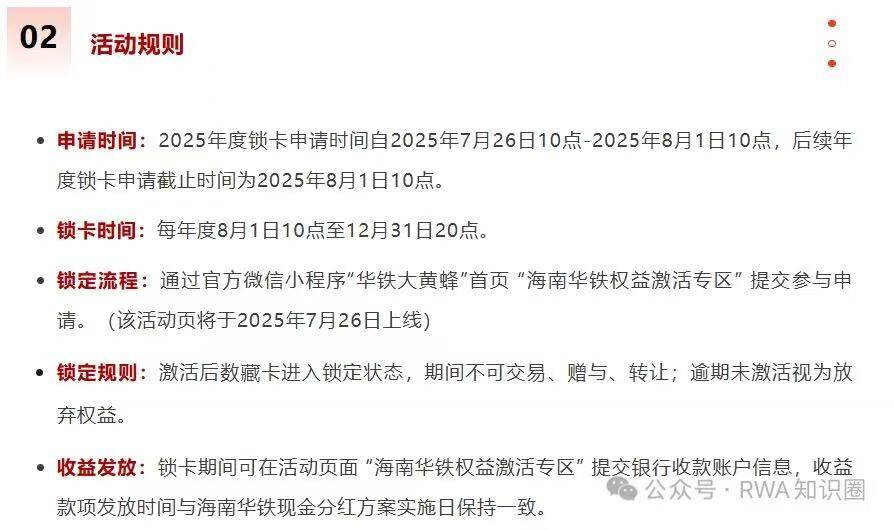

In the NFT sector, the company launched the "Hornet Brother" digital collectible, granting cardholders brand ambassador status and, through card lock-up, incentivizing participants to earn equity returns equivalent to stock dividends. While this novel model has sparked some discussion, such as whether user voice is restricted and whether the profit structure confuses financial products. However, from a compliance perspective, the current project process has not crossed regulatory red lines.

For most small and medium-sized enterprises, NFT projects inherently present technical barriers and challenges in promotion. Not only does this require familiarity with blockchain technology, but it also requires strong market organization and user engagement skills. This also means that it's difficult for an internal team to independently build an NFT incentive project.

(Pictures are taken from the Internet and are for case demonstration only. They do not constitute any investment advice.)

3. How to avoid pitfalls? Key design ideas for RWA compliance structures

Unlike NFTs, the core of RWAs lies in the direct link between on-chain tokens and the value of real-world assets. This also makes them more susceptible to crossing financial regulatory red lines. For example, if the right to use or ownership of an asset is directly divided and then sold, it may constitute a de facto securities issuance.

Hainan Huatie's RWA strategy is relatively conservative: rather than directly selling equipment ownership, the project design digitizes equipment usage and operating rights in the form of "membership cards," enabling transfer and circulation through on-chain mapping. This model preserves the asset's anchor value while avoiding high-risk operations that may violate securities laws.

Hainan Huatie has also partnered with licensed firm Weiyi Digital Technology, enabling membership cards to be consigned and transferred. The dual-track system of on-chain registration and offline redemption mitigates the risk of speculation associated with digital tokens, creating a relatively balanced combination of compliance, digitization, and market mechanisms.

This model, combining NFT incentive mechanisms, on-chain registration technology, and operational asset management experience, forms a unique structure for Hainan Huatie. However, it also reminds us that not all companies possess such resource integration and regulatory communication capabilities.

(Pictures are taken from the Internet and are for case demonstration only. They do not constitute any investment advice.)

4. It’s not that I don’t understand, it’s that I can’t do it: Breaking down the RWA threshold

Hainan Huatie’s attempt shows the potential of RWA, but it also once again confirms a reality: for small and medium-sized enterprises, the lack of resources, technology, and compliance capabilities is the real threshold.

- On the one hand, many companies do have assets that can be put on the blockchain: equipment, inventory, accounts receivable, etc. all have a basis for digital mapping;

- On the other hand, most companies lack compliance teams familiar with regulatory policies and are incapable of designing appropriate digital asset structures or user incentive models.

- Not to mention, each of the steps involved in completing on-chain deployment, verifying asset anchoring, conducting on-chain issuance, and establishing a market circulation mechanism poses a significant challenge to the team's capabilities.

Furthermore, regulatory risks remain significant. Since the 2017 joint release of the "Announcement on Preventing Risks in Token Issuance and Financing" by seven ministries and commissions, companies raising funds from the public using tokens without permission are highly susceptible to being deemed to be engaging in illegal fundraising. Therefore, issuing RWAs in compliance is not just a technical issue; it also involves systemic considerations regarding legal boundaries and market mechanisms.

5. It’s not that it can’t be done, but how to do it: A professional solution path for RWA implementation

In this case, for small and medium-sized enterprises that are interested in exploring RWA, instead of blindly "self-development", it is better to jointly complete the entire process from asset screening to on-chain mapping, from compliance design to market promotion. Find institutional partners with professional capabilities

Currently, experienced RWA accelerators have begun to provide full-process support for RWA exploration paths for small and medium-sized enterprises.

- Asset modeling and mapping solutions tailored to the company's business characteristics;

- Provide recommendations on issuance structure design that covers policy compliance;

- Complete on-chain deployment and cross-chain support services;

- Establishment of user incentive mechanism;

- Support for post-circulation strategies such as market-oriented issuance and community operations.

With the help of professional institutions, small and medium-sized enterprises can test the waters of RWA issuance in a phased and low-risk manner, avoid compliance risks and waste of resources, and strive for early dividends in the wave of digital assetization.

The digitization of real-world assets has never been the exclusive domain of a few large enterprises. The key lies in finding the right approach, mitigating risks, and taking the first step. Small and medium-sized enterprises (SMEs), which truly own assets and businesses, may be the most dynamic participants in this transformation.